$GOOGL reported a solid qtr. Great assets at a good price.

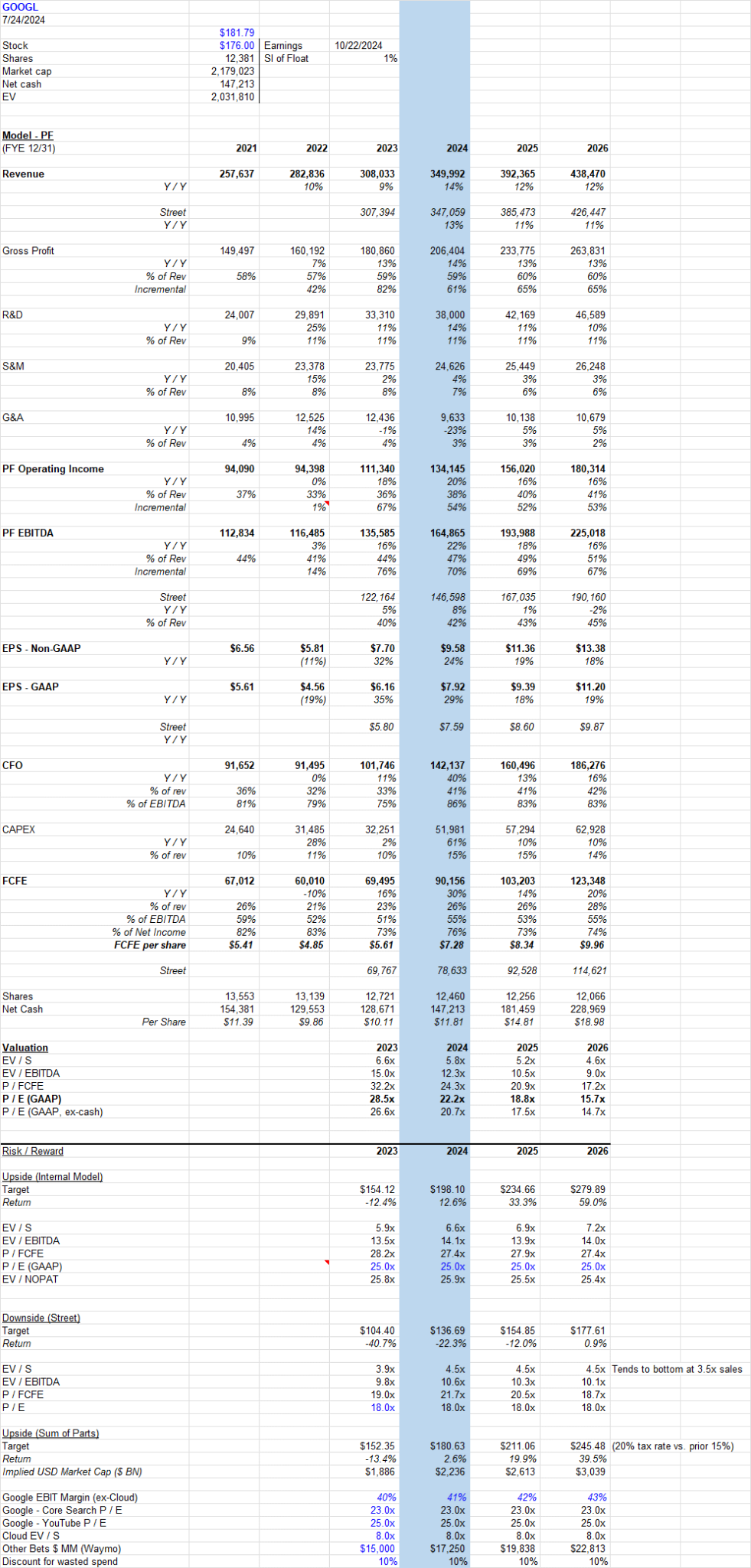

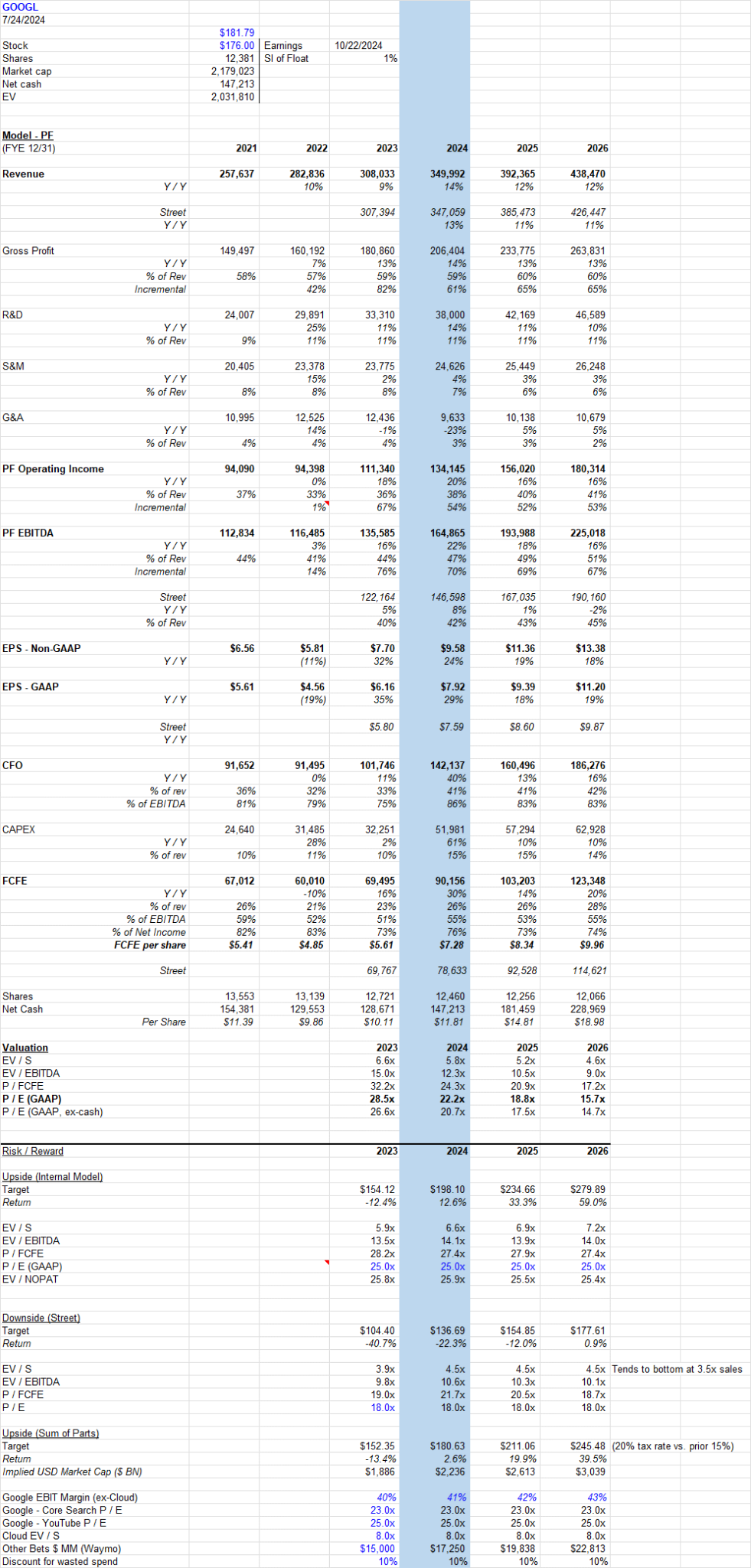

My numbers are ahead of the street and risk / reward still attractive. 33% upside to 25x my 2025 GAAP EPS (trading at 25x 2024 today), 59% upside on 2026 EPS. -12% downside to 18x street 2025 GAAP EPS.

Search revs of 48.5b grew 13.8% yy. AI results seem to be doing just fine as users continue to click on ads above and below. They plan to launch integrated shopping ads soon, and meanwhile doubled model size while keeping cost / query flat (so higher quality results at same price). Thus far, seems like $GOOGL is incorporating AI while not seeing any impact from ChatGPT / Perplexity. PerformanceMax is also increasing conversion by 25% at same cost for advertisers!

Cloud revs of 10.4b slightly accelerated to 28.8% w/ net delta of 773m vs 577m last Q2. Lots of focus on AI which is being used by majority of their top 100 customers and has generated billions ytd which implies it is at least 10% of cloud revs.

YouTube revs of 8.7b grew 13.0% yy which was a meaningful slowdown from 20.9% last year – due to lapping the ramp of a large APAC retailer starting Q2 of last year. So growth will likely be subdued for the next 3 qtrs.

Waymo is delivering over 50k paid rides a week across SF / PHX. They committed another 5b to expansion and will keep annual burn at the same rate (implies faster expansion as now turning on monetization).

The company continues to manage costs very effectively. Employee count decreased 1.2% yy. GAAP OM of 32.4% vs 31.6% in Q1 and 29.3% last Q2. They intend to show continued operating margin expansion including absorption of higher D&A from the AI-related capex. My numbers show this can be easily absorbed as well (unless AI related capex is going to depreciate rapidly – say 3 years).

Notes

Search

-See higher engagement w/ AI from users 18-24

-Ads above / below AI results continue to receive clicks

-Will soon be able to ask questions via asking questions in videos

-Doubled core model size for SGE while keeping cost / query flat – also matching right model w/ query to keep latency / cost appropriate

-AI tool helps advertisers upload product image and easily create media collateral

-Tiffany using AI / Demand Gen and saw 2.5% brand uplift and 5.6x more efficient CAC than social

-Pmax increasing conversions by 25% at same cost

-Will soon launch search / shopping ads in AI results

Search

-See higher engagement w/ AI from users 18-24

-Ads above / below AI results continue to receive clicks

-Will soon be able to ask questions via asking questions in videos

-Doubled core model size for SGE while keeping cost / query flat – also matching right model w/ query to keep latency / cost appropriate

-AI tool helps advertisers upload product image and easily create media collateral

-Tiffany using AI / Demand Gen and saw 2.5% brand uplift and 5.6x more efficient CAC than social

-Pmax increasing conversions by 25% at same cost

-Will soon launch search / shopping ads in AI results

Gemini

-Over 1.5m devs have used this

-Comes in 4 sizes so can run on server through end-device

-Longest context window for now

-Over 1.5m devs have used this

-Comes in 4 sizes so can run on server through end-device

-Longest context window for now

Cloud

-AI has generated billions of dollars YTD and has 2m developers, majority of top 100 customers using it.

-Over 1.5m devs have used Gemini which has 4 sizes

-TPU v6.0 has 5x peak compute perf / 67% more energy efficiency compared to v5e

-Enterprise AI platform, Vertex, helps companies build agents. DB, KingFisher and US Air Force using for this.

-Also support third-party models like Anthropic, Gemma 2, Llama 2, and Mistral

-Conversational AI being used by Best Buy and Gordon Food Services

-AI has generated billions of dollars YTD and has 2m developers, majority of top 100 customers using it.

-Over 1.5m devs have used Gemini which has 4 sizes

-TPU v6.0 has 5x peak compute perf / 67% more energy efficiency compared to v5e

-Enterprise AI platform, Vertex, helps companies build agents. DB, KingFisher and US Air Force using for this.

-Also support third-party models like Anthropic, Gemma 2, Llama 2, and Mistral

-Conversational AI being used by Best Buy and Gordon Food Services

YT

-Nielsen says number 1 in US streaming on TVs for past 17 months

-YT Sports viewership on connected TVs up 30% yy

-Large brands partnering w/ creators [seems like a slower sales / ad creation cycle than standard ads though]

-YT Shorts on Connected TVs doubled yy – making it easier for content to be converted to this format

-Brand advertising on Shorts launched in Q4 – good progress

-Last year had 30b hours of shopping content up 25% yy

-Decel due to APAC-retailer that started in Q2 of last year, and Q1 had leap year

-Nielsen says number 1 in US streaming on TVs for past 17 months

-YT Sports viewership on connected TVs up 30% yy

-Large brands partnering w/ creators [seems like a slower sales / ad creation cycle than standard ads though]

-YT Shorts on Connected TVs doubled yy – making it easier for content to be converted to this format

-Brand advertising on Shorts launched in Q4 – good progress

-Last year had 30b hours of shopping content up 25% yy

-Decel due to APAC-retailer that started in Q2 of last year, and Q1 had leap year

Android

-Pixel 8a powered by Tensor G3 chip and has AI functionality like circle-to-search, and Gemini assistant

-Pixel 8a powered by Tensor G3 chip and has AI functionality like circle-to-search, and Gemini assistant

Waymo

-2m trips to date and 20m miles

-Delivering over 50k rides in SF / PHX

-2m trips to date and 20m miles

-Delivering over 50k rides in SF / PHX

Qtr

-Subscriptions growth slowed as lapped YT price increase

-Other cost of rev up due to content costs and retroactive impact of Canadian digital tax applied retroactively [no mention of increased depreciation from increased CAPEX]

-FCF growth impacted by cash taxes deferred in Q2 and Q3 of last year to Q4 – so Q3 will have hw and Q4 will have tw

-Subscriptions growth slowed as lapped YT price increase

-Other cost of rev up due to content costs and retroactive impact of Canadian digital tax applied retroactively [no mention of increased depreciation from increased CAPEX]

-FCF growth impacted by cash taxes deferred in Q2 and Q3 of last year to Q4 – so Q3 will have hw and Q4 will have tw

Guidance

-“Our leadership team remains focused on our efforts to moderate the pace of expense growth in order to create capacity for the increases in depreciation and expenses associated with the higher levels of investment in our technical infrastructure”

-2024 margin will expand but Q3 margins will be impacted by higher D&A and hardware cost of revenue as product launches pulled forward

-Q3 / Q4 Capex will be at or roughly above 12b

-Waymo will invest 5b in expansion – in-line w/ recent annual investment levels

-“Risk of underinvesting way greater than overinvesting here [AI]”

-“Our leadership team remains focused on our efforts to moderate the pace of expense growth in order to create capacity for the increases in depreciation and expenses associated with the higher levels of investment in our technical infrastructure”

-2024 margin will expand but Q3 margins will be impacted by higher D&A and hardware cost of revenue as product launches pulled forward

-Q3 / Q4 Capex will be at or roughly above 12b

-Waymo will invest 5b in expansion – in-line w/ recent annual investment levels

-“Risk of underinvesting way greater than overinvesting here [AI]”

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment