Healthcare, AI and More: What to Expect When Goldilocks Hopes Return to Wall Street

A benign U.S. inflation report for October is bolstering hopes that the Federal Reserve can bring down consumer prices without negatively impacting the economy, a so-called Goldilocks environment that investors believe will benefit stocks and bonds.

Both asset classes have ripped higher in November, fueled by hopes that the Fed was unlikely to increase interest rates any further.

Goldilocks hopes return to Wall Street

The latest inflation data supported the view that a turning point is near: consumer prices were unchanged on a monthly basis for October, the first such reading in more than a year and a softer figure than analysts were expecting.

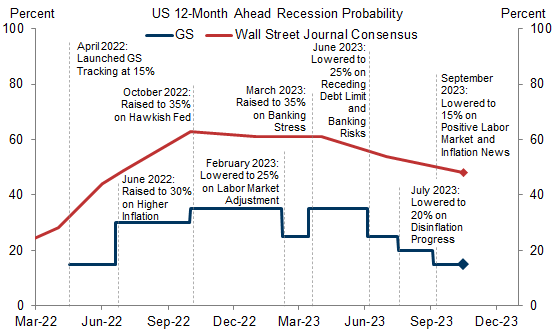

At the same time, there have been few indications that tighter monetary policy is severely hurting the economy. The probability of recession continues to recede in the U.S. as the banking turmoil subsides and strong labor market resilience and rising real incomes support consumer demand.

In the latest quarterly survey by The Wall Street Journal, economists lowered the probability of a recession within the next year, from 54% on average in July to a more optimistic 48%. That is the first time they have put the probability below 50% since the middle of last year.

The broader market has been challenged with this consensus negative view about both a recession and inflation," said Eric Kuby, chief investment officer at North Star Investment Management Corp. "Reality is telling a different story. This does feel like a Goldilocks moment for the entire market."

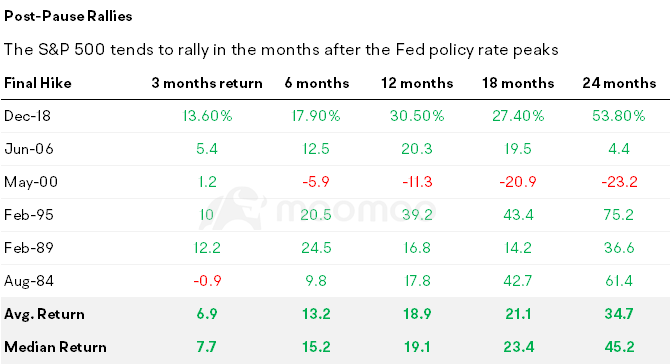

History says to buy the Fed pause

According to BofA Global Research's monthly survey out Tuesday, 76% of fund managers were convinced the Fed had finished its rate hike cycle, up from 60% in October and the highest level since the survey began tracking the topic in May.

History shows that monetary policy pauses mark great buying opportunities for U.S. stocks. In post-pause data going back to the early 1980s, the $S&P 500 Index (.SPX.US)$ has posted an average return of 6.9% after three months; 18.9% after a year; and 34.7% after two years. That's much better than the index's 11.1% compound annual return over the past four decades and indicates why investors may be inclined to maintain equity exposure.

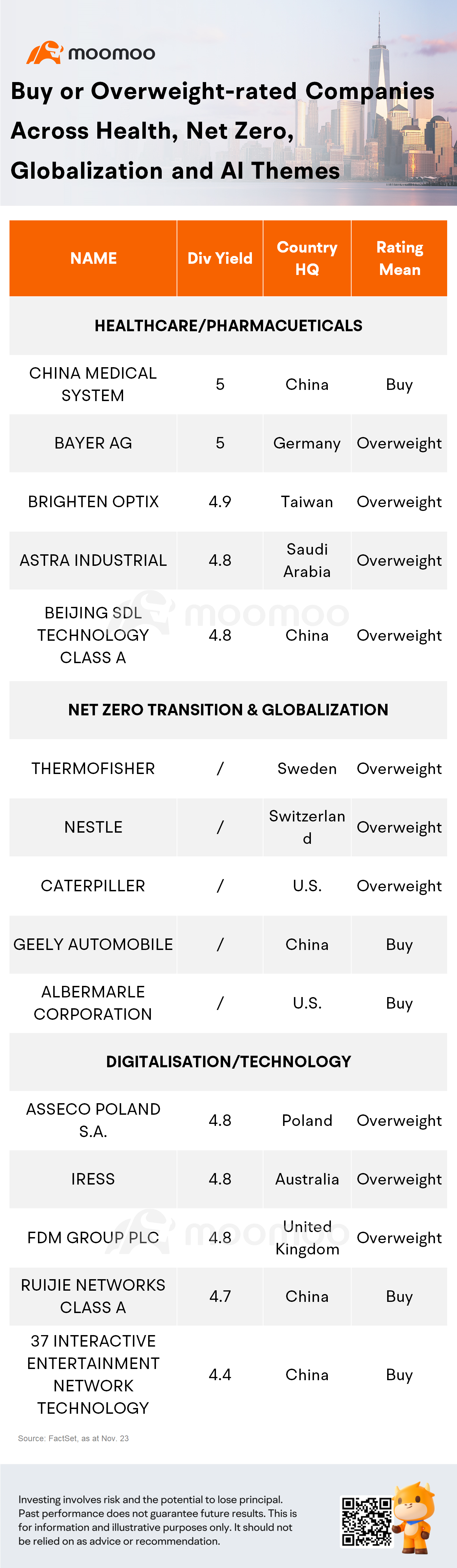

How one pro is investing for a Goldilocks economy

Andy Budden, investment director at Capital Group saw this classic "Goldilocks" environment as historically favorable for equity investments.

Here are the top dividend stocks in each of the four themes. All of the stocks have buy ratings from over 70% of analysts, according to FactSet.

Source: CNBC, WSJ, Bloomberg, Reuters

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment