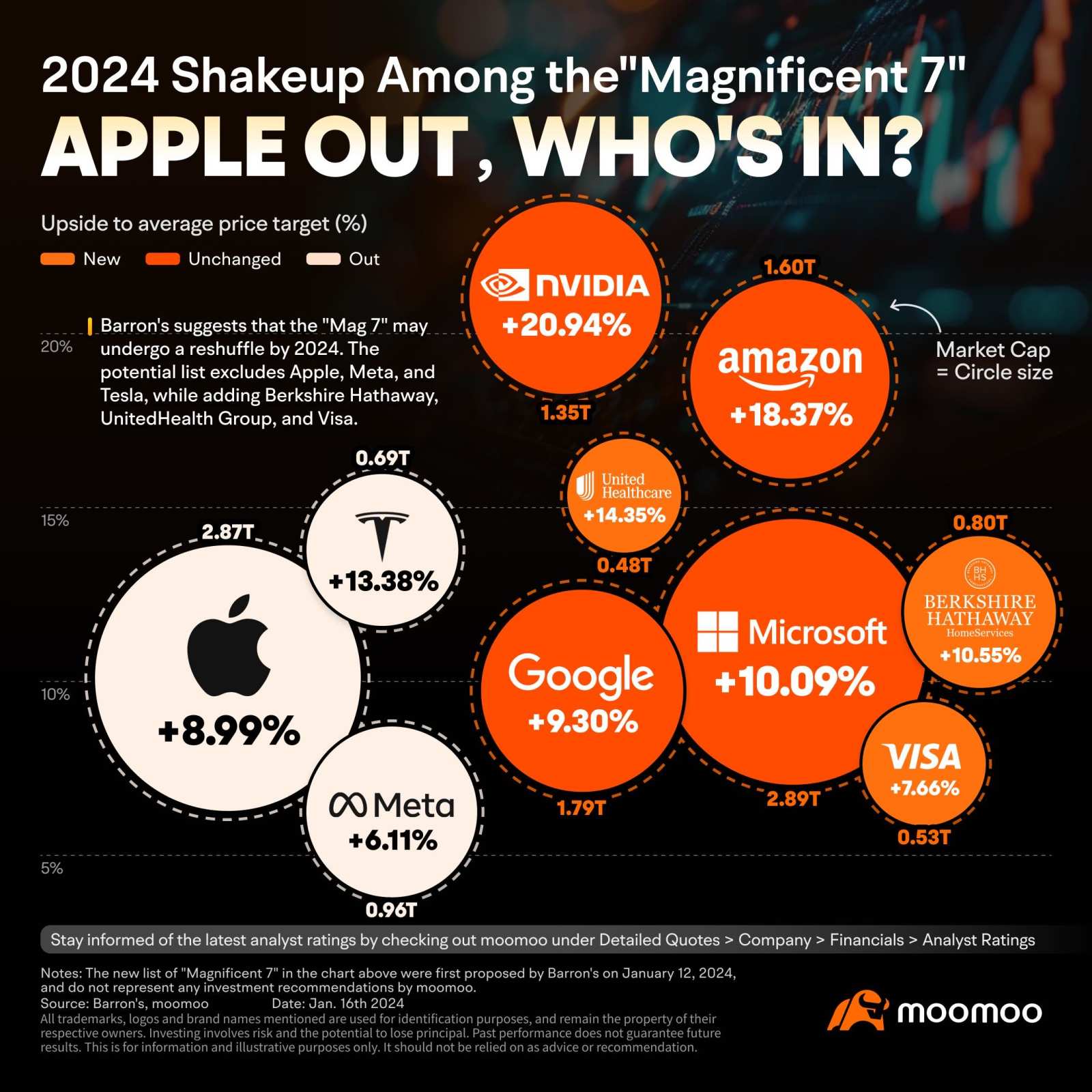

Here's a Potential List of the New "Magnificent 7" for 2024: Who's In and Who's Out?

The "Magnificent 7" made an impressive showing in 2023. However, as 2024 begins, there has been a significant divergence in the fundamentals, analyst opinions, and stock performance of the seven companies.The increasing sentiment is that a shakeup is needed in the "Magnificent 7" this year to include companies with greater potential. Barron's senior writer and member of the stock-picking team, Nicholas Jasinski, has compiled a new list of the "Magnificent 7" based on various criteria such as portfolio diversification, fundamentals, and valuation. Here are the details:

1. It's unlikely for the "Magnificent 7" to repeat the myth of 2023 in 2024

In 2023, the "Magnificent 7" demonstrated an astonishing return rate, with $NVIDIA (NVDA.US)$delivering the best performance by surging 239%, while even the worst-performing stock, $Apple (AAPL.US)$, still managed to accumulate a 49% increase for the year, vastly outperforming the $S&P 500 Index (.SPX.US)$'s 24%. According to Nicholas Jasinski, achieving a similar high return rate for these seven stocks in 2024 seems unlikely.

“For one thing, this is the first time the seven largest stocks have posted such returns since at least 1999, suggesting a reversion to the mean may lie ahead. What's more, just once in that time span have the same seven stocks remained the largest in the index over consecutive years.”

2. A more diversified investment portfolio is necessary

From the perspective of investment diversification, the previous "Magnificent 7" was highly concentrated in the information technology, communications services, and consumer discretionary sectors. The new list includes finance and healthcare sectors, which may bring more stable profits, to achieve industry diversification and increase defensive exposure.

3.Partial companies' earnings may not be sufficient to support high valuations

The surge in stock prices of certain "Magnificent 7" members in 2023 was not grounded in fundamental factors. Moreover, some firms that were delisted from the group encountered substantial hurdles in their core operations, potentially impeding their performance in 2024 and beyond. Uncertain performance and unclear growth prospects are unlikely to continue supporting such high valuations.

1. Apple, Meta Platforms, and Tesla have been Removed

● Apple:

Since the start of this year, $Apple (AAPL.US)$'s stock price has declined by over 3%, and its status as the most valuable company has been temporarily surpassed by Microsoft on several occasions.

In terms of revenue stability, Apple's sales have experienced year-on-year declines for four consecutive quarters, marking the longest such streak in over 20 years.Analysts note that growth prospects for its flagship products, the iPhone and Mac, are also gradually fading, with the smartphone's market share slipping for four consecutive quarters. The delivery volume of the costly new product, Apple Vision Pro, and its contribution to Apple's performance remain uncertain. Moreover, ongoing negative news such as patent disputes over the Apple Watch and antitrust battles may pose additional challenges.

● Meta Platforms:

While analysts are optimistic about the potential revenue growth in 2024 from the significant election year and $Meta Platforms (META.US)$'s AI-enhanced advertising product, the looming cost pressures, CEO stock sell-off behavior, and slight upside potential above the current price may diminish Meta's advantage.

● Tesla:

The 2023 rally in $Tesla (TSLA.US)$'s stock price was not driven by fundamental factors, with the company even losing its position as the world's largest EV maker to Chinese competitor BYD in the fourth quarter. Analysts project that its earnings per share in 2023 may decline by around 25%, but its valuation remains quite high, with the current trading price at 62 times the estimated earnings for 2024.

2. Berkshire Hathaway, UnitedHealth Group, and Visa have joined the ranks as new members

● Berkshire Hathaway:

According to Nicholas Jasinski, the sustained turnaround in its insurance business and growing operating earnings elsewhere in the portfolio are expected to support the performance of the market giant $Berkshire Hathaway-A (BRK.A.US)$ in 2024. Moreover, its reasonable valuation and ample book value provide good support for potential deals and stock buybacks.

● Visa and UnitedHealth:

$Visa (V.US)$ and $UnitedHealth (UNH.US)$ were included due to their respective leading positions in their industries and outstanding defensive attributes. Nicholas Jasinski predicts that both companies will see earnings per share growth of over 10% in 2024.

Nicholas Jasinski included both in the "More Magnificent Seven" not only because of their low forward P/E of as low as 11x, but also due to their ample cash reserves available for buybacks.

Source: moomoo, Barron's

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

DreamyLucid : The list is highly opinionated and pointless. With the exception of Tesla which is set to be out of magnificent 7 after Q4 earnings

ZEK : An interesting thought towards the “Magnificent 7”— the 3 out (and the possible 3 in) seems very opinionated. Visa & United Healthcare might be a nice add to a portfolio with “health scares” in an election year and Visa with inflation still high causing more families to lean on credit to “survive”. In the end, I believe the new list is an inaccurate “Magnificent 7”.

102086369 : It should have been replaced

cychin37 : APPL and META will stay

BelleWeather : I hope TSLA remains based on other projects under that umbrella (though EM’s recent comments vis a vis his voting rights are a concern.) BYD will clearly be the largest automaker in the world in a few years - that comparison is apples to oranges. The valuation of TSLA is fair if it can continue with all current projects, which I for one would like to see.

I’d sooner invest in for-profit prisons or nicotine then UNH or any US health care player (biotech and pharma not withstanding.)

Mastercard is more appealing for growth and value than Visa (but it’s close.)

Meta isn’t going anywhere and I think XOM is a steal. Also agree on Microsoft.

Actually stopped buying Apple in favor of BrKB in 2022 - it’s Apple+ (not counting out Apple’s balance sheet nor Munger/Buffet wisdom re: that holding overall though.)

Nvidia is obvious - it will keep winning big time for a while.

It’s silly to throw several defensive plays (though XOM is positioned for growth too) in with most of the so called Mag7 - defeats the point, no?

honest NyanCat_9198 : amd will be in at the end of 2024, just like nvidia one year ago, mark my words

151345481 : BYD is a new energy company supported by the government. One common characteristic of such enterprises is that once policies change, they will rapidly decline. In addition, Exxon and J.P. Morgan have strong cash flow, which is enough to support their share repurchases. The author seems to have forgotten that Apple's cash flow is unrivaled?

彬彬傻 : The US cut interest rates this year, and the stock market is a bit difficult to understand.