🏮Hong Kong stocks slip ahead of Powell’s speech tonight

• The Hang Seng Index (HSI) futures fell 0.3% to 17,601 as at lunch break today ahead of Jerome Powell’s much-anticipated speech at Jackson Hole tonight.

• Investors’ views were mixed as they took positions on both the call and put warrants over the HSI with HSI-CVT clocking in 8.1m units net bought out of the 38M units traded while HSI-HWJ saw up to 4.6m units net bought. Meanwhile the focus call warrant HSI-CVC also saw as much as 27.8M units exchanged hands.

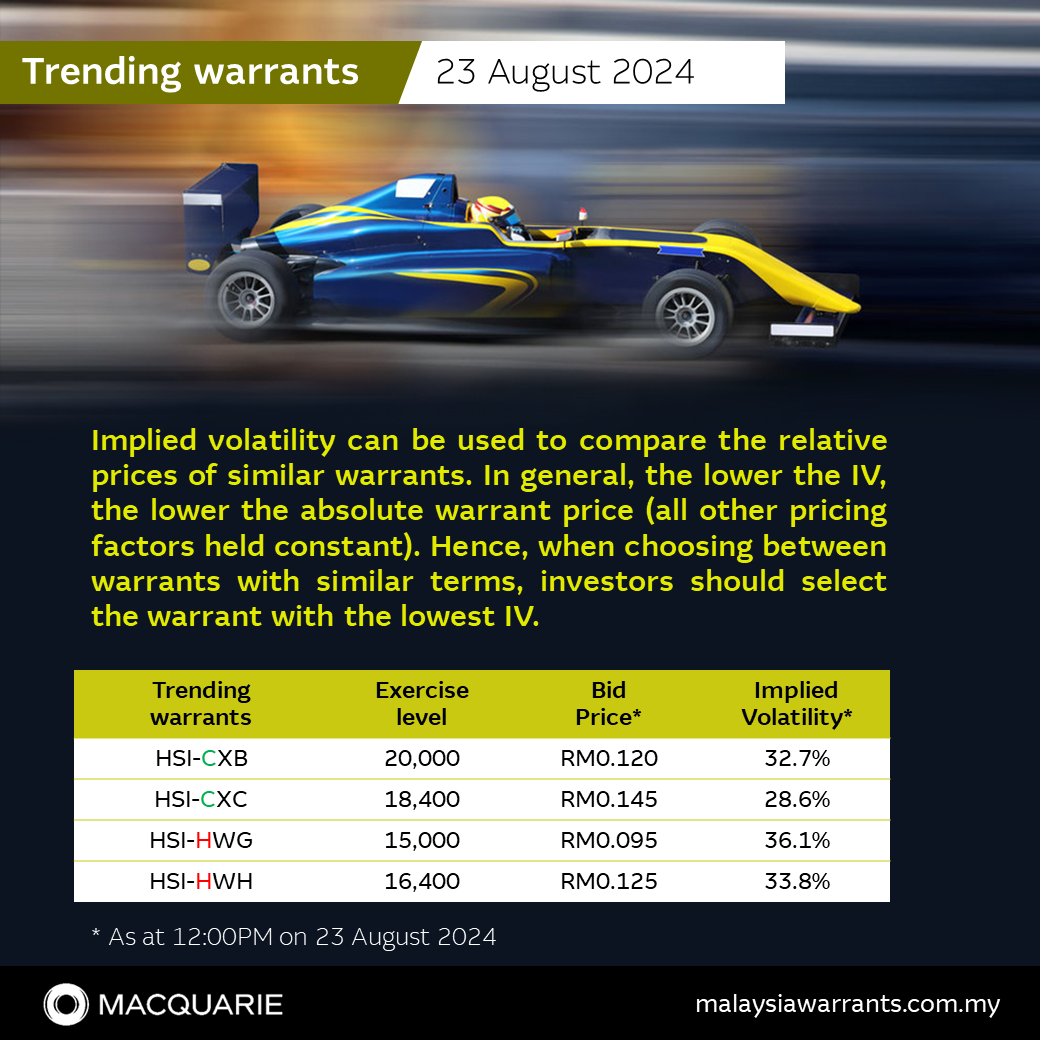

• Our focus call warrant HSI-CXB (Exercise price: 20,000) and put warrant HSI-HWG (Exercise price: 15,000) which are expiring on 30th October 2024, have implied volatility* (IV) levels of 32.7% and 36.1%, respectively as of the time of writing, one of the lowest among all call and put warrants over the HSI with similar exercise levels and expiry dates.

* Warrant tip: IV can be used to compare the relative prices of similar warrants. In general, the lower the IV, the lower the absolute warrant price (all other pricing factors held constant). Hence, when choosing between warrants with similar terms, investors should select the warrant with the lowest IV.

Investors net bought:

HSI-CVT (-23.8%) 8.1M units

HSI-HWJ (+3.2%) 4.6M units

HSI-CXK (-5.4%) 2.1M units

Investors sold back:

HSI-HW5 (0.0%) 475K units

🗽U.S. index put warrants also see position taking

• In addition, as of the lunch break, investors are net buying the put warrants over the US index warrants (DJIA-HH, NDX-HH and SP500-H47) leading up to tonight's Jackson Hole speech by Fed Chair Jerome Powell.

• Call warrants track the relevant US index futures, increasing in price as the underlying increases, and vice versa. Put warrants move in an opposite direction to the relevant US index futures, increasing in price when the underlying falls, and vice versa. Put warrants may be suited for those who think that the US indices may pull back in the short-term.

• As the warrants trade during the Malaysian trading hours, ahead of US trading hours, they give investors the opportunity to position their short-term views on the US market ahead of tonight's US market open.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment