How do Wall Street's top financial institutions make strategic investment decisions?

Wall Street's top financial institutions have different ideas about choosing and locking in large strategic investment targets, and sometimes even quite a bit different. For example, Berkshire Hathaway (Berkshire Hathaway) has no interest in high-tech growth stocks other than stock god Warren Edward Buffett, who very rarely followed the advice of young people under his command and invested in Apple. Whether Tesla turned a loss into profit and began to rise violently, or Nvidia rose to prominence with the Artificial Intelligence revolution, they were unmoved.

However, once Wall Street's top financial institutions make decisions, their departments responsible for implementing strategic decisions all have one characteristic in common. That is, they attach great importance to the in-depth development and application of chip theory, and strictly implement it when making strategic investment decisions. It is definitely not the world's standard for measuring the success or failure of investment in the short term. It is not easy to continue to fully apply chip theory and implement chip theory, and also to suppress the huge psychological impact of floating profits and losses caused by short-term stock price fluctuations. Large institutions hold huge positions, and small fluctuations in stock prices can cause huge changes in profit and loss. The core issue is, on the one hand, the layout of opening positions in gradients and batches. On the other hand, it is also necessary to prevent the cost increase caused by the continued sharp rise in stock prices and the impact of the continuous decline in stock prices on existing positions. This requires calculating and arranging the corresponding protective options contract strategy.

What are the top financial institutions on Wall Street? Simply put, there are the three main groups, the Three Titans, and the Seven Daggers. They form Wall Street's top 10 major lineups, that is, the top ten consortiums in the US today. They have replaced the top ten consortiums in the traditional sense of the US, namely the Rockefeller Foundation, the Morgan Foundation, the First Citibank Foundation, the DuPont Foundation, the Boston Foundation, the Mellon Foundation, the Cleveland Foundation, the Chicago Foundation, the California Foundation, and the Texas Foundation. They are the ruling class in the true sense of the United States. Faces and the whole world They all have significant effects and effects. Each of them is very powerful. They have ten kings and one from all over the world. Overpressure for more than 300 miles and quarantine for the day. They fight for each other's circumstances. I don't know how many tens of millions stand in the water vortex in the hive. Nagahashi wandering waves, no clouds, what dragon? If the road returns to nowhere, why not? I'm lost in high and low, and I don't know the west or the east. The song stand was warm, and the spring light was melting. The dance hall is cold sleeved, and the wind and rain are terrible. Within a day, between Ichinomiya, the climate was uneven.

Don't you see that Tesla's individual stock is being fought by JP Morgan (Xiaomo) and Morgan Stanley (Damo) using market power (including seizing many negative factors such as declining Tesla sales and declining profit margins) against the three major setbacks. They spearheaded bearish short sales for over a year, and the biggest drop was over 60%, with countless duvet agencies and retail investors. As a result, Tesla's three most important shareholders had to buy large numbers of put options in the options market to protect their long positions. After completing a bearish short sale and arbitrage, JP Morgan and Morgan Stanley have now achieved a spectacular transformation and have become Tesla's big bulls.

Wall Street's three guiding principles:

That is The Vanguard Group (Pioneer Pilot Group)

A US registered investment advisor headquartered in Malvern, Pennsylvania, with assets under global management of approximately $7.7 trillion as of April 2023. It is the world's largest mutual funds provider and the second-largest exchange-traded fund (ETF) provider after BlackRock's iShares. In addition to mutual funds and ETFs, Pioneer also provides brokerage services, educational account services, financial planning, asset management, and trust services. Many mutual funds managed by Pioneer are at the top of the US mutual funds asset management scale ranking. Along with BlackRock and State Street Bank, Pioneer is considered one of the three leading index fund managers in the US corporate world.

BlackRock Inc (BlackRock Group)

An American investment management company headquartered in Midtown Manhattan (Midtown Manhattan) in New York City, USA, and has established 70 offices in 30 countries around the world, with clients in 100 countries. The main business is to provide investment management, risk management and financial consulting services for corporate and retail channels. Its well-known funds include BlackRock Global Asset Allocation Fund, BlackRock World Mining Fund, BlackRock Latin America Fund, BlackRock Emerging Europe Fund, BlackRock World Energy Fund, and BlackRock New Energy Fund.

Currently, BlackRock employs 18,400 employees, and the total assets under management in the fields of stocks, fixed income, cash management, alternative investments, and real estate consulting strategies are $8.59 trillion ($1 trillion).

State Street Global Advisors (State Street Global Investors)

State Street Global Investment Management (SSGA) is the investment management division of the State Street Group and the fourth largest asset management company in the world. As of December 31, 2021, it managed nearly $4.14 trillion in assets. The company serves financial clients by developing and managing investment strategies for governments, corporations, endowments, non-profit foundations, corporate treasurers and chief financial officers, asset managers, financial advisors, and other intermediaries around the world. SSGA has 2,500 employees in 28 countries.

Wall Street's Seven Donkeys:

That is JP Morgan (Komo)

JPMorgan Chase & Co. (commonly known as “Komo”) is an American financial institution headquartered in New York City. It has 5,100 branches under its commercial banking department. In 2011/10, J.P. Morgan's assets surpassed Bank of America to become the largest financial services institution in the US. J.P. Morgan's business covers more than 50 countries, including investment banking, securities trading and services, investment management, commercial financial services, private banking services, etc. Today's J.P. Morgan Chase was formed by merging Chase Manhattan Bank and J.P. Morgan in 2000, and acquired Chicago First Bank, Washington Mutual Bank, and Bearsden, a famous American investment bank in 2004 and 2008, respectively.

Morgan Stanley (Big Mo)

Morgan Stanley (NYSE: MS; commonly known as “Damo”) is an international financial services company founded in New York, USA, providing financial services including securities, asset management, corporate mergers and restructuring, and credit cards. Morgan Stanley currently has representative offices in more than 1,300 cities in 42 countries around the world, with a total of more than 60,000 employees. The company's customers include companies, governments, institutions and individuals. Morgan Stanley changed the company's registered status to a “bank holding company” in September 2008. Old Morgan Stanley was founded on September 16, 1935, and was first founded by J. P. Morgan's partner Henry Sturgis Morgan (grandson of John Pierpont Morgan) and Harold Stanley were founded. The new company was established in response to the Glass-Steagall Act — the mandatory separation of commercial banking and investment banking businesses. In the first year of establishment, Old Morgan Stanley was responsible for trading 24% of the total market value (1.1 billion US dollars). New Morgan Stanley was founded in 1997 as a result of the merger of the old Morgan Stanley and Tianhui Discovery Company. Pei Xiliang, the chairman and CEO of Tianhui, became the chairman and CEO of the new company. The new company was named “Morgan Stanley Dean Witter Discover & Co. (Morgan Stanley Dean Witter Discover & Co.)” In 2001, the new company finally changed its name to “Morgan Stanley (Morgan Stanley)”. New Morgan Stanley's main business areas are securities management, wealth management, and investment management.

Citadel LLC (commonly known as Castle Company, Castle Investment Company)

A multinational hedge fund financial services company headquartered in the United States, founded by Kenneth C. Griffin in 1990. The company has two main businesses. One is Citadel, which operates as an asset management capital of more than 35 billion US dollars, and Citadel Securities, which provides products such as stocks and options as a market maker. The company has more than 1,400 employees, is headquartered in Chicago, and has an operations center in Manhattan, New York, and branches in many cities in North America, Europe, and Asia. In January 2021, Citadel+Point72 Asset Management invested $2.75 billion in Melvin Capital, which previously lost 30% of its value due to GameStop's short squeeze. Meanwhile, Citadel denied rumors that it ordered the Robin Hood trading platform to close the relevant stock trading rights.

The Goldman Sachs Group, Inc. (Goldman Sachs Group Inc.)

An American multinational investment banking and financial services company with its head office in Manhattan, New York City. Goldman Sachs Group provides services such as investment management, securities, asset management, primary brokerage and securities underwriting. Goldman Sachs Group is one of the largest investment institutions in the world; it is also a first-class treasury bond dealer for US Treasury Securities, and is also a well-known market maker in the general sense of the word. Goldman Sachs Group also owns a direct sales bank, Goldman Sachs Bank USA (Goldman Sachs Bank USA). Goldman Sachs Group was founded in 1869, and its head office is located at 200 West Street in Lower Manhattan (Lower Manhattan); it also has offices in major financial centers around the world. Goldman Sachs Group suffered losses during the 2007-2008 global financial crisis due to its participation in asset securitization during the subprime mortgage crisis. Goldman Sachs Group received an investment of $10 billion from the US Treasury as part of the troubled asset rescue plan; the financial relief plan stemmed from the Economic Stability Emergency Act. The investment began in November 2008 and began to be repaid in June 2009. Many former Goldman Sachs employees will be transferred to government positions. The most famous ones include former US Treasury Secretary Robert Rubin, Henry Paulson, and Stephen Mnuchin; former chief economic adviser Gary Cohen, European Central Bank President Mario Draghi; former Bank of Canada President Mark Carney; and former Australian Prime Minister Mackan Tembo. In addition, former Goldman Sachs Group employees have managed the New York Stock Exchange, the World Bank, and competitors such as Citigroup and Merrill Lynch. Goldman Sachs Group is ranked 70th in Fortune Magazine's list of the 500 largest companies in the U.S., according to total revenue.

Bank of America (Bank of America)

It is the second-largest commercial bank in the US in terms of assets, after J.P. Morgan. Bank of America has approximately 5,600 branches and 16,200 ATM locations in more than 150 countries around the world. Bank of America was the third-largest company in the US based on total revenue rankings in 2010. In 2014, it was the 13th largest company in the world according to Forbes Global Top 2000 listed companies. The bank's establishment dates back to the Bank of Massachusetts in 1784 and is the second-oldest bank in the United States.

Renaissance Technologies LLC (Renaissance Technologies LLC) is famous for its high-precision investment transactions. After James Harris Simons returned to heaven, it seemed to disappear and no longer exist? low-key?)

Renaissance Technologies LLC, also known as RenTech or RenTec, is an American hedge fund headquartered in East Setucket, Long Island, NY, that specializes in systematic trading using quantitative models derived from mathematical and statistical analysis. Their iconic Medallion fund is known for the best record in investment history. Renaissance was founded in 1982 by James Simmons, a mathematician who worked as a code-breaker during the Cold War.

In 1988, the company established its most profitable investment portfolio—the Medallion Fund (Medallion Fund). The fund uses Leonard Baum's mathematical model, refined and extended by algebraist James Ax (James Ax), to explore the correlations that can be profitable from it. Elwyn Berlekamp (Elwyn Berlekamp) played an important role in developing transactions into short-term, purely system-driven decisions. The hedge fund was named the Medal Fund after Simmons and Axe's math awards.

Medallion, the flagship fund of the Renaissance, is mainly managed by fund employees and is known for its best performance record on Wall Street. In the 30 years from 1988 to 2018, the annualized return before deducting fees was over 66%, and the annualized return after deducting fees was 39%. Renaissance offers two portfolios to external investors — Renaissance Institutional Equity Fund (RIEF) and Renaissance Institutional Diversified Alpha Fund (RIDA).

Due to the success of Renaissance Corporation and Medallion Fund, Simmons is known as “the best fund manager on the planet.”

Simmons ran the Renaissance Company until his retirement at the end of 2009. He continued as the company's non-executive chairman, stepped down in 2021, and continued to invest in its funds, particularly the Medallion Fund, until his death in 2024. The company is now run by Peter Brown (after Robert Mercer's resignation). Both are computer scientists who specialize in computational linguistics and joined Renaissance from IBM Research in 1993. As of April 2021, the fund managed discretionary assets (including leverage) of $165 billion.

Berkshire Hathaway (Berkshire Hathaway)

Stock god Warren Edward Buffett is in charge, believes in the so-called “value investment law,” and is known as the most successful investor in the world. In 2010, Buffett claimed that the acquisition of Berkshire Hathaway was his biggest investment mistake ever, and claimed that the investment cost him approximately $200 billion in return on investment. Buffett claims that if he directly invested this money in the insurance business instead of buying out Berkshire Hathaway. Because he feels he has been offended by others, these investments will pay back hundreds of times.

Long-term portfolios:

5.89% of Apple's shares

Occidental Petroleum Corporation 27.13% equity

26.55% equity in Kraft Heinz

9.25% stake in Coca-Cola

Chevron shares 5.89%

American Express has a 20.8% stake

Bank of America 13.05% equity

2.89% of Citigroup's shares

Moody's shares are 13.48%

Kroger's 6.95% equity

Liberty SiriusXM's 19.42% equity

9.61% equity in Allied Financial Corporation

39.51% equity interest in Davita Healthcare

Verisign 12.55% equity

4.49% shareholding in Floor & Decor

8.75% share in STORE CAPITAL

Itochu 8.17% equity

Marubeni 8.39% equity

8.65% equity in Mitsubishi Corporation

Mitsui & Co., Ltd. shares 8.32%

(6.732% shareholding in Sumitomo Corporation)

Occidental Petroleum Corporation 27.13% equity

26.55% equity in Kraft Heinz

9.25% stake in Coca-Cola

Chevron shares 5.89%

American Express has a 20.8% stake

Bank of America 13.05% equity

2.89% of Citigroup's shares

Moody's shares are 13.48%

Kroger's 6.95% equity

Liberty SiriusXM's 19.42% equity

9.61% equity in Allied Financial Corporation

39.51% equity interest in Davita Healthcare

Verisign 12.55% equity

4.49% shareholding in Floor & Decor

8.75% share in STORE CAPITAL

Itochu 8.17% equity

Marubeni 8.39% equity

8.65% equity in Mitsubishi Corporation

Mitsui & Co., Ltd. shares 8.32%

(6.732% shareholding in Sumitomo Corporation)

Earning money is always added value. If you have an idea and enhance your value, it will naturally be easier to make money. Be honest, take the lead, be intelligent, and have good skills.

Alcohol, don't drink, don't get drunk. People, never get tired, never sleep. My heart is unbroken and unbroken. Love, if you don't learn it, you won't. Life is a grand encounter. If you understand it, please cherish it! The Bible is also a complete path to life's practice. It tells us that it is necessary to live a sea of love and hate, to fight through the world, to cut short interests, to overcome desire and obsession, and to reach the end of life in peace and light.

Once a person enters the stock market, it is like a missile that tracks heat sources with infrared characteristics. Seemingly smart and powerful, it is actually easy to be deceived by other heat sources with infrared characteristics deliberately set by opponents in the surrounding environment, and cannot achieve the intended arbitrage goals.

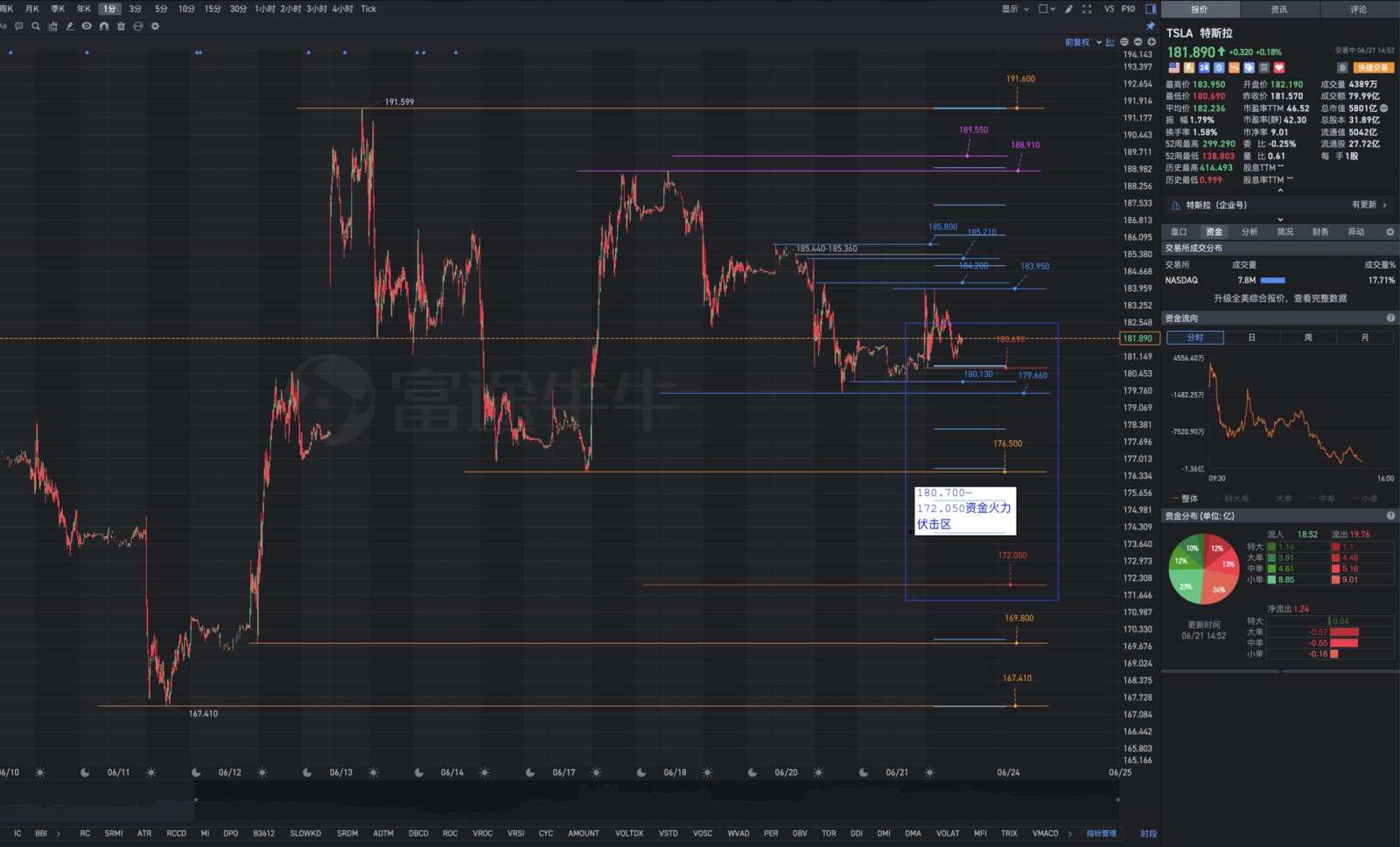

The general framework blueprint for Tesla's trend: Tesla's stock price first crossed the 182.800-187.420 region. The prudent side set up positions in this region. The so-called “not seeing rabbits” does not throw eagles. In the second step, Tesla's stock price crossed 187.420-191.300 and continued to rise. Step 3: Tesla's stock price rises👆It floated out of the strong resistance zone of 198.870-205.600, opening the prelude to Tesla's spectacular gains. The stock price effectively standing at 220.800 will start the main upward trend.

Due to the vastness of these three regions, the rise in stock prices depends more on the gold pits made up of relatively low chips that appeared after the decline, so Tesla's strategic investors are willing to build up their overall positions.

It is not until there is a major breakthrough in Tesla's fundamentals and signs of financial profit bookkeeping, that the situation of long-time stock price swings back and forth will evolve into a pattern of continuous rise. Tesla's position layout: upper limit 180.450 (the watershed between strength and weakness); median value of 176.500 (ideal impact point); lower limit 172.050 (the lower the greater the grace).

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment