An Emergency Rate Cut? Key Points for Investors to Consider After Monday's Slump

US equities faced a three-day rout driven by concerns over a potential US recession, a pullback from AI excitement, and a rising yen disrupting carry trades.

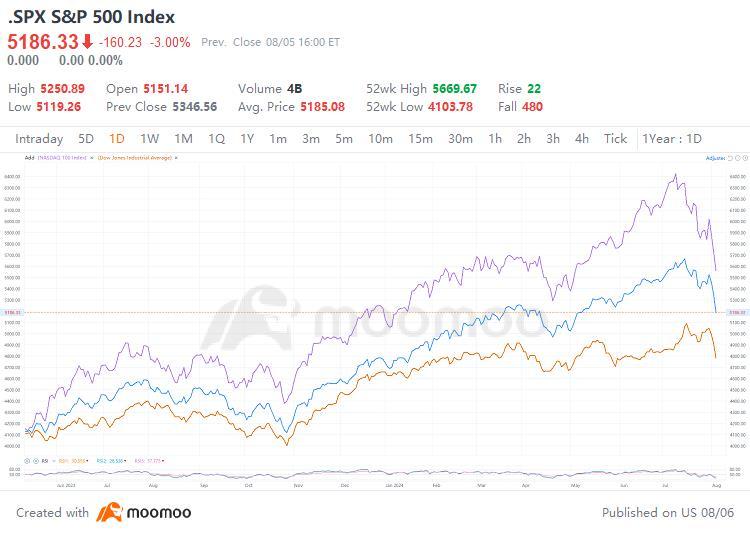

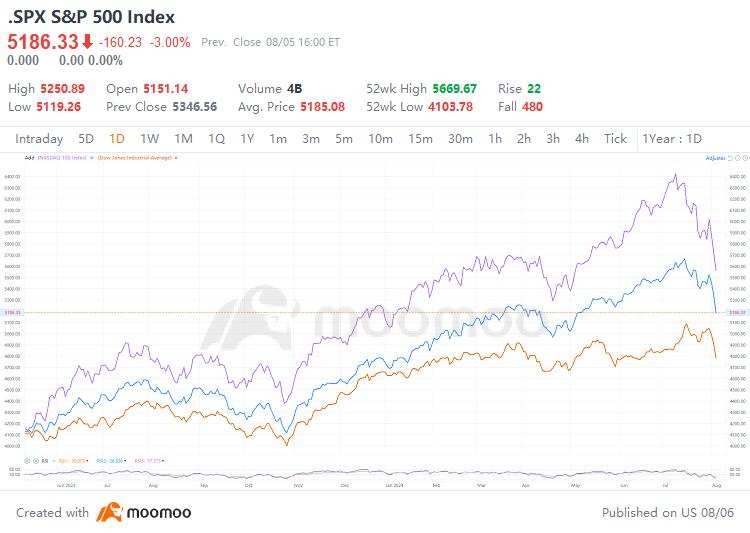

Significant sell-offs hit theUS and Japanese markets on Monday. The $Dow Jones Industrial Average (.DJI.US)$ tumbled by 2.6%, recording one of its steepest single-session declines, while the $S&P 500 Index (.SPX.US)$ and $Nasdaq Composite Index (.IXIC.US)$ also endured notable losses. The $Nikkei 225 (.N225.JP)$ index in Japan witnessed its worst fall since 1987, plunging over 12%.

Economic Data & Fed Talks Lift Asia-Pacific Mood

Recent economic data and comments from Fed officials on Mondayseemlyprovided a lift to market confidence. The ISM's latest figures outperformed forecasts, indicating the U.S. ISM Services Index for July has emerged from its worst shrinkage in four years, seen in June, back into expansion territory. "The hotter-than-expected ISM services report slowed the bleeding on Wall Street," noted Matt Simpson, Senior Market Analyst at City Index Inc. "So we're not seeing a risk on rally as such, but a healthy correction after an unhealthy selloff, triggered by investors stampeding for a tiny exit.”

Chicago Federal Reserve President Austan Goolsbee stated Monday on CNBC that the central bank would respond to signs of weakness in the economy and indicated that interest rates could be too restrictive now. San Francisco Federal Reserve President Mary Daly also remarked on Monday her anticipation of rate cuts later in the year, yet declined to disclose a timeline or the extent of the anticipated easing by the central bank.

Japanese stocks opened higher on Tuesday, with The Nikkei Stock Average closing up 10% at 34675.46, marking its largest daily percentage increase since October 2008. The cryptocurrency market rebounded, with Bitcoin surging over 7% in the past 24 hours, nearing the $56,000 mark, while Ethereum crossed the $2,500 threshold. Gold prices fell 1.4% on Monday.

Is the U.S. Economy Truly in a Recession?

Investors in the stock market have been toasting to a "Goldilocks" economy throughout most of 2024, one that is balanced and not exhibiting extremes of overheating or undercooling. However, a series of disappointing U.S. economic indicators at the start of August has ignited concerns that a bearish trend may be setting in. Following the release of the July jobs report, Ian Lyngen, a rates strategist at BMO Capital Markets, shared his insights in a note on Friday.

Even if one is not convinced the Fed will cut by 50 basis points in September, or by 25 bp at each of this year's three remaining meetings, one development is clear - Goldilocks has left the building.

Some investors suspect that the market's reaction has been overblown. They argue that the economy is not in dire straits but merely decelerating, and what was once a red-hot labor market is returning to a state of normalcy.

Claudia Sahm, the economist who devised the Sahm Rule, has disputed assertions that the U.S. economy is in a recession. She has pointed out that the current economic cycle is atypical, and traditional metrics might not be providing an accurate read of the actual conditions.

According to Angelo Kourkafas, a senior investment strategist at Edward Jones, the market is unmistakably experiencing a "growth scare." However, investors should recall that the so-called soft landing involves a deceleration in both growth and employment. He noted that this doesn't necessarily signal the termination of the bull market, but it does set the stage for a more turbulent trading atmosphere.

Will the Fed Opt for an Emergency Rate Cut?

Persistent panic in the markets creates various risks, both significant and minor. One of the most critical risks is that if the selloff continues unchecked for an extended period, it could disrupt the workings of the financial system.

Economists are now forecasting the Federal Reserve to implement aggressive half-point reductions or to take inter-meeting measures typically seen in crises. Wharton's Jeremey Siegel urged the Fed on Monday for an urgent 75 basis-point reduction in the federal funds rate, following Friday's lackluster employment data.

The fed funds rate right now should be somewhere between 3.5% and 4%.

Emergency rate cuts are exceedingly rare. Over the past 30 years, there have only been eight such cuts. The last instance of such a move by the Fed was in March 2020 amidst the onset of the COVID-19 outbreak. However, the stock market still plummeted that day, leaving investors shocked rather than reassured.

Below is a chart showing the S&P 500's performance on the day of and one month following the past 30 years of emergency Fed rate cuts:

Although speculation about an emergency Fed rate cut grows, some experts warn it might trigger further alarm. Gina Bolvin, president of Bolvin Wealth Management Group in Boston, cautions investors to stay focused on the bigger picture. "Investors should remember that fundamentals haven't changed much, and Friday's job report was one data point."

Marc Chandler, chief market strategist at Bannockburn Global Forex, suggests that an emergency cut is unlikely as the bar is too high.

I can't think of a time they've done such a thing when there wasn't some sort of stability issue at hand. Even with the slide in U.S. stocks, we're still higher on the year. And an emergency rate cut aimed at calming the market could cause more panic, considering the Fed's need to restore market confidence.

Source: Bloomberg, MarketWatch

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

103364653 : What's the problem for global traders? What has happened so that all investment companies and assets around the world, plummeted out of control. We should never carry out the withdrawal of investment proceeds at once with My main backend, which is Bitcoin Bhutan, whose value is greatest, can not be removed all Bitcoin gold before, we have to return it to the original, ,70 percent of the currency, do not bother. Sometimes it hurts or even takes crypto money where it was originally stored. The global economy is expected to fall bankrupt, and all the investment company's fee suffered a terrible loss. It's like a god in 'to fix and a

103364653 : I never made a statement to withdraw all the Money from those investments, let alone with the currency that I have loved for decades, issuing the Bitcoin Sya digital Fund Just like destroying an irreversible. foreign currency other than daripad a rsaysa Bitcoin, can be removed. put it back in place QSMMMANmoney de

103364653 : I already made Bitcoin Goldk crypto points, I already have over ten QR mall t

103364653 : I made myself the King of all currencies in the world, I've started to run Bitcoin traders since, 20 years ago on' on a massive scale, this heart swhitks, I don't l pernllllllll0

my own Pum KK BB

103364653 : I myself have never produced the results of this 2g hi.

PAUL BIN ANTHONY : very nice and your family tq