The market is giving enough face to Bank of America.

After visiting the Austin factory on site, BofA gave Tesla a target price of $400.

BofA analyst John Murph expressed confidence in Tesla's growth prospects for 2025 and beyond, with autonomous driving and robotics businesses leading the growth. FSD is making significant progress, adoption rates are increasing, and Optimus development is expected to accelerate. New models next year will expand the total addressable market (TAM).

Tesla hit a two-year high overnight, with multiple brokerages raising their target price for the company. After visiting Tesla's Texas Gigafactory, a BofA analyst even increased the target stock price by $50 to $400.Tesla's target stock price was raised by $50 to $400 after visiting the Tesla factory in Texas by a BofA analyst.

Bank of America analyst John Murph said in Thursday's report:

After visiting the super factory located in Austin, Texas, USA by Musk, including meeting with the investor relations department, factory tour, and test drive experience, there is confidence in its growth prospects for 2025 and beyond, because it is believed that autonomous driving and robot business will lead the growth.

Murph further stated:

Tesla is expected to continue to improve its profit margin, currently mainly driven by hardware, but with the growth of Full Self-Driving (FSD) software and charging services, it will shift more towards value-added software.

It is expected that Tesla's sales will reach $123.171 billion in 2026, with an improvement in operating margin. Net income and free cash flow are expected to grow significantly in 2025 and 2026. We reiterate a buy rating and raise the target price from $350 to $400, based on a multiple of 60 times enterprise value/earnings before interest, taxes, depreciation, and amortization (EV/EBITDA).

FSD has made significant progress, with Optimus development expected to accelerate.

Murph pointed out in the report:Tesla demonstrated significant progress in FSD technology and is expected to launch autonomous ride-hailing services in the future.:

Tesla的FSD技术在异常路况下表现出色,预计干预频率将降至每0.01 million英里一次,这接近安全推出自动驾驶出租车业务的要求。

As a reference, Waymo's siasun robot&automation taxi service has been in operation before reaching the milestone of intervening once every 17,000 miles. Tesla believes that with the growth of its Artificial Intelligence computation capability (with 50,000 H100 chips installed and activated as of the end of October), it will soon reach this milestone.

展望明年,Murph预计,新车型将扩大可获取市场总规模(TAM),全自动驾驶(FSD)的采用率正在增加:

Tesla计划在2025年上半年推出一款成本更低的车型,这将增加可获取市场总规模,预计这款车的成本将低于0.03 million美元,包括目前在美国可获得的7500美元电动汽车税收抵免。Tesla还确认,低成本车型不会是其2025年唯一的新车型。

此外,FSD的采用率正在上升,截至2023年第一季度,Tesla在1.8 million辆符合条件的车辆上有0.4 million订阅用户,在2024年第二季度和第三季度,订阅用户的数量增长速度超过了符合条件的车辆数量。Tesla之前曾为FSD收取几千美元的预付费用,但自从改为订阅模式后,FSD的采用率增长得更快。

In addition, the development of Optimus may be accelerated, as Murph stated:

Currently, Optimus is used for sorting 4680 battery cells inside the factory and is being tested in multiple scenarios. Tesla plans to deploy 1000 Optimus robots in its factories by the end of 2025. Optimus currently accounts for only a single-digit percentage of Tesla's computing resources. With the maturity of robotaxi technology, this will accelerate the development of robot technology and improve production efficiency in 2026 and beyond.

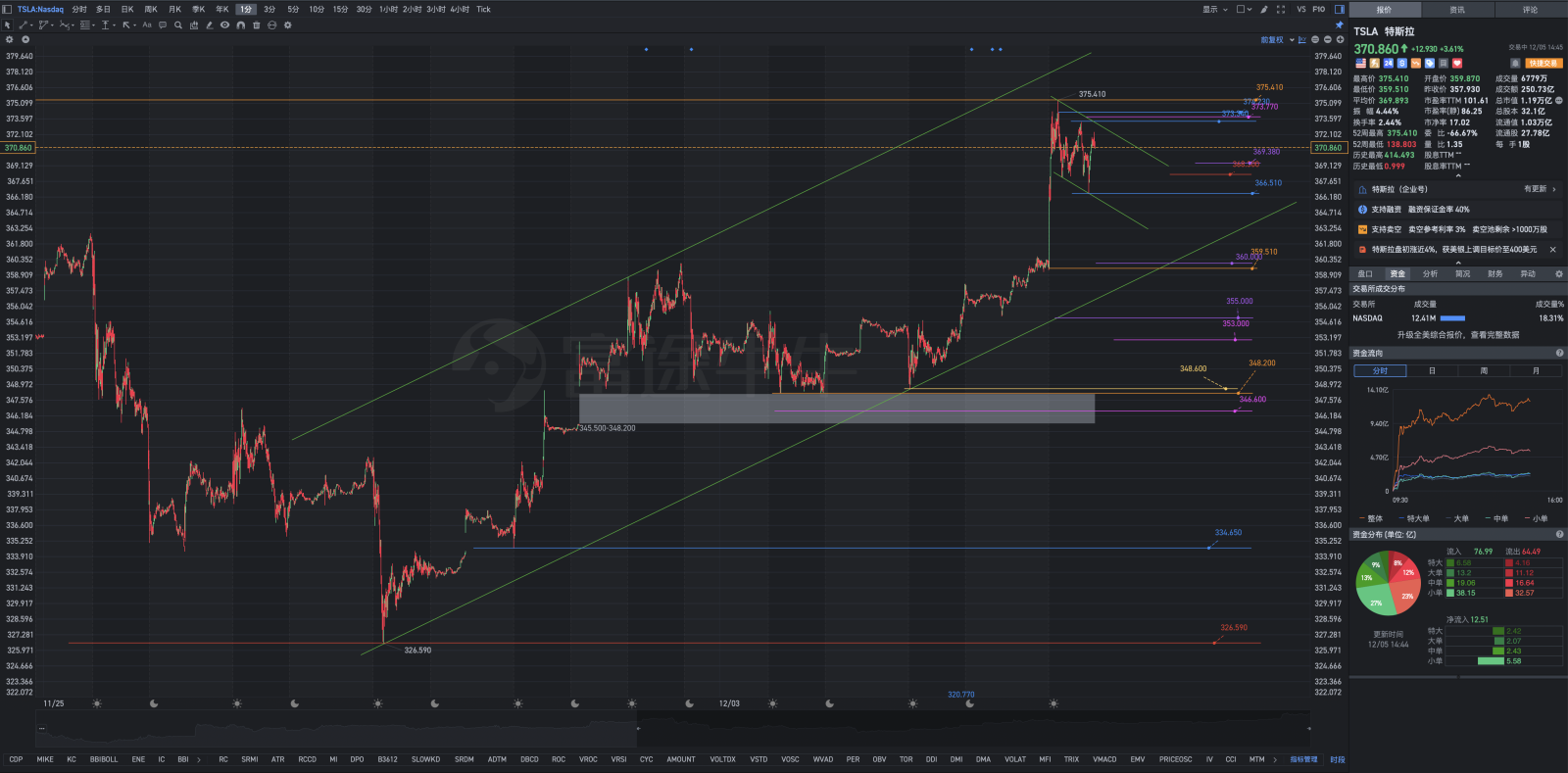

Consider establishing a new long position when it falls below 368.300.

Bank of America, BOA (Bank of America) ranks second in the United States in terms of assets among commercial banks, second only to Chase Bank (JP Morgan Chase). Bank of America has approximately 5,600 branches and 16,200 ATMs in more than 150 countries worldwide. In 2010, based on total revenue rankings, Bank of America was the third largest company in the United States. In 2014, according to the Forbes Global 2000, it ranked as the 13th largest company in the world. The bank can be traced back to the Massachusetts Bank established in 1784, making it the second oldest bank in the United States. Bank of America provides multilingual phone interpretation services, with a better reputation than Chase Bank (JP Morgan Chase), making it more international.

Amadeo Giannini is the founder of today's Bank of America NT&SA. After the Great San Francisco Earthquake in 1906, Giannini quickly took out all the money and customer information from the small Italian bank, escaping the subsequent fire disaster. While other major banks were still recovering from the fire losses, he became the leader of the San Francisco banking industry through local lending for rebuilding the city's infrastructure.

In the late 1920s, Giannini proposed a merger with Orra E. Monnette, the founder of the Los Angeles branch of Bank of America. The Los Angeles branch experienced strong growth in the 1920s due to the successful establishment of an advanced branch system. In early 1929, the merger was completed and officially named Bank of America. Giannini served as chairman with Monnette as vice chairman.

In 1958, the bank invented the bank credit card, known as the BankAmericard, which was renamed Visa card in 1976. Some other banks in California jointly issued the Mastercard to compete with the Bank of America card.

In December 2002, Bank of America spent $1.6 billion to acquire a 25% stake in Grupo Financiero Scamander Serfin, the third largest bank in Mexico.

On June 17, 2005, Bank of America and China Construction Bank jointly announced in Beijing that they had signed a final agreement on strategic investment and cooperation. According to the agreement, Bank of America would invest in China Construction Bank in stages, eventually holding up to 19.9% of the equity. Bank of America's BofA Asia earlier announced the sale of its Hong Kong operations to China Construction Bank for approximately 9.7 billion Hong Kong dollars and withdrew from the Chinese market, with the former Shanghai and Guangzhou offices being operated by China Construction Bank.

On July 2, 2007, Bank of America acquired wealth management company U.S. Trust Corporation for $3.3 billion.

On September 14, 2007, Bank of America spent $21 billion to acquire LaSalle Bank, a subsidiary of a Dutch bank.

In September 2008, due to the financial tsunami, Bank of America reached an agreement with Merrill Lynch to acquire what would become the largest global financial services institution for $44 billion.

In January 2009, the U.S. government reinfused Bank of America with $20 billion and provided guarantees for the bank's assets not exceeding $118 billion.

In March 2009, Temasek Holdings sold all of its 3.8% stake in Bank of America.

In September 2009, Bank of America sold long-term asset management operations of Colombia Management Group to Metlife for approximately $1 billion.

In December 2009, Bank of America repaid a total of $45 billion in relief funds to the U.S. government as part of the Troubled Asset Relief Program. Bank of America used $26.2 billion in cash and proceeds from the sale of securities, including trust certificates and warrants convertible into one share of common stock; a total of 1.286 billion shares were sold for a total of $19.3 billion.

In August 2011, Bank of America signed a final agreement to sell its credit card business in Spain to Apollo Global Management.

In August 2011, Bank of America sold its $8.6 billion asset portfolio and certain other assets and debts related to the Canadian credit card business MBNA to the Toronto-Dominion Bank Financial Group.

In August 2011, Berkshire Hathaway reached an agreement with Bank of America to purchase 0.05 million shares of Bank of America preferred stock, totaling $5 billion. In addition, Berkshire Hathaway also acquired 0.7 billion Bank of America warrants, exercisable over a 10-year period, representing up to $10 billion that Berkshire Hathaway can inject into BofA.

When Bank of America listed on China Construction Bank in June 2005, it purchased 19.133 billion shares of China Construction Bank for $3 billion, reaching a maximum stake of 19.14%. Since 2009, it has reduced its holdings in China Construction Bank's listed companies four times.

In August 2011, Bank of America sold approximately 13.1 billion shares of China Construction Bank H shares, representing a stake of about 5.12%, to an investment consortium for $8.3 billion. This sale brought Bank of America a post-tax profit of $3.3 billion.

In November 2011, Bank of America sold 10.4 billion shares of China Construction Bank in a private transaction, equivalent to 4.14% of the bank's issued share capital. With a total investment of $6.6 billion, the shares were priced at $4.93 per share. Since 2009, Bank of America has reduced its holdings in China Construction Bank four times, realizing approximately 194.6 billion yuan and expecting to generate $1.8 billion in after-tax profits for Bank of America. The shareholding will decrease from 5.12% to 0.84%, with around 2.1 billion shares remaining.

On August 14, 2012, BSI Bank Switzerland agreed to acquire Merrill Lynch's non-U.S. wealth management business for 0.86 billion Swiss francs (about $0.882 billion). BSI will finance the transaction through cash, issuing hybrid bonds, and new shares. Bank of America will receive a 3% stake in BSI.

On September 3, 2013, Bank of America sold 2 billion shares of China Construction Bank's H shares through block trading, completely divesting its remaining holdings. The subscription price was HK$5.70 (equivalent to $0.74) per share, realizing $1.47 billion. Including this offering, Bank of America has divested over 20 billion yuan.

On March 26, 2014, the Federal Housing Finance Agency announced an agreement with Bank of America to pay $9.5 billion to settle four lawsuits related to the sale of mortgage-backed securities by Fannie Mae and Freddie Mac against Bank of America and its subsidiaries.

In October 2016, at the Money20/20 conference, Retail Banking President Thong Nguyen introduced a digital assistant named Erica. Starting in 2017, clients will be able to communicate with Erica using voice or text to receive advice, check balances, and pay bills.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

105334506 : can tell something about coinbase?

Elias Chen OP 105334506 : The leader of cryptocurrencies, Bitcoin, is bullish because of its own scarcity, but it is difficult for it to replace the hard currency of the US dollar and the standard gold bar that can be used for physical delivery in precious metal exchanges. Without the official public endorsement of the US government, Bitcoin cannot function as a legal currency in the true sense. The wide fluctuation of its own value is also a natural obstacle that is difficult to overcome.