Meta Q4 Earnings Preview: Will It Beat Estimates Again?

CEO Mark Zuckerberg dubbed 2023 as the "year of efficiency" for $Meta Platforms (META.US)$, which led to a nearly 200% surge in the company's stock value. As the world's second-largest digital-ad corporation, just behind $Alphabet-A (GOOGL.US)$, Meta is poised to announce its fourth-quarter earnings after the close of trading on Thursday.

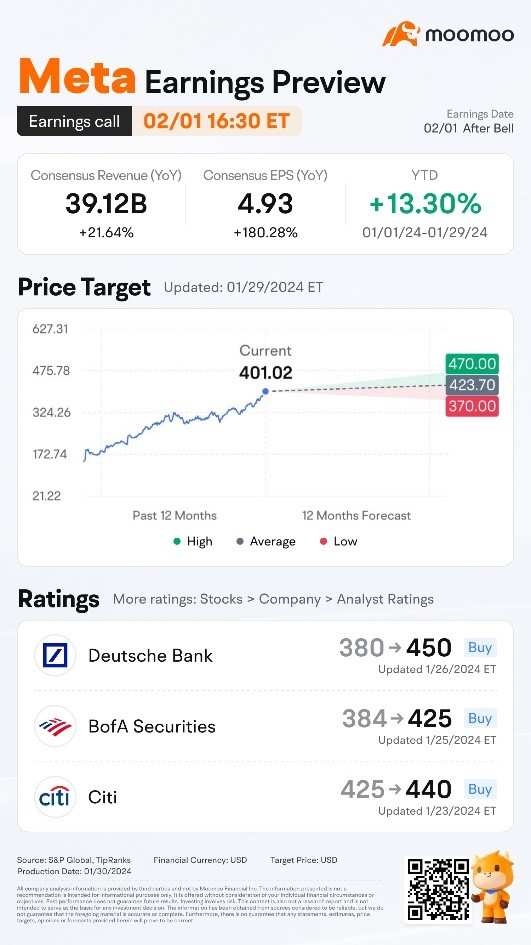

● Wall Street sees revenue at $39.12 billion in the fourth-quarter of 2024, suggesting slower sales growth of 22% after three quarters of acceleration.

● Analysts expect earnings of $4.93 a share compared with $1.76 for the year-earlier quarter, marking a 180% leap.

● The average price target for Meta is $423.7, which implies 5.66% upside from Monday's closing price. BofA raised the firm's price target on Meta Platforms to $425 from $405 and keeps a Buy rating on the shares. With a favorable macro backdrop for advertising, Reels contribution turning positive in 2024, a large messaging revenue ramp in progress, and "still plenty of costs to cut if needed," said BofA.

Historically, Meta has outperformed earnings expectations, including a 20.94% surprise in the last reported quarter.

Robust Online Advertising Industry

The upcoming 2024 Paris Olympics and US Presidential election provide a favorable backdrop for advertising, with analysts predicting a boost in online ad growth for the year.

Morgan Stanley saw an acceleration in online ad growth in 2024 over 2023. The analysts said they model U.S. online advertising growth to accelerate to about 12.5% in 2024 from around 8% in 2023.

Monetizing Reels and Expanding Ad Load

Reels monetization will be on focus when the company reports financial results. Citi analyst Ronald Josey writes that Reels likely became "revenue accretive" in the fourth quarter, with ad load on Reels gradually increasing.

Reels has driven a 40% increase in time spent on Instagram since launch, and that daily plays have been running above 200 billion, he says. Josey estimates that Reels revenue reached $18 billion this year, or about 12% of overall Meta revenue, compared with the $10 billion run-rate that Meta disclosed for the 2023 second quarter.

Potential Revenue Streams from AI-Powered Ads

Summarizing Zuckerberg's statement, Meta will have around 600,000 GPUs up and running. The total would establish one of the largest AI systems in the world.

Meta has already proven that its work in AI can produce results for its advertisers. According to Bernstein analysts, a survey revealed that advertisers who tested Meta's AI-driven creative tools—capable of crafting images and ad backgrounds—reported potential time savings of at least five hours weekly.

A suite of AI tools that automatically finds potential customers and tests which ads will perform best is earning $10 billion on an annualized basis, Meta has said.

Further, with the potential rollout of paid ads within its recently launched AI assistants on platforms like WhatsApp, Messenger, and Instagram, Meta could generate $6.7 billion in ad revenue in 2025, New Street Research estimated.

Despite the remarkable performance in 2023, analysts believe Meta's stock remains attractive. But for Meta's stock to work in 2024, revenue growth needs to once again outpace the digital ad market and consensus, Bernstein argues.

Source: Zacks, Seeking Alpha, Reuters, the Fly

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

104381746 : ok

70922367 : 0x84fbEc5a0c9939B9e3fA49248B5B518a15561D75

Walter_Del_Sol : It's gonna jump!