Netflix Q2 Earnings Preview: Subscriber Growth Remains Market's Focus

$Netflix (NFLX.US)$ is set to release its second-quarter earnings report on July 18 after the close of trading in the US. Investors want to know if the popular streaming service can keep attracting lots of new subscribers, make the most of its ad-supported plans, and remain the top streaming platform.

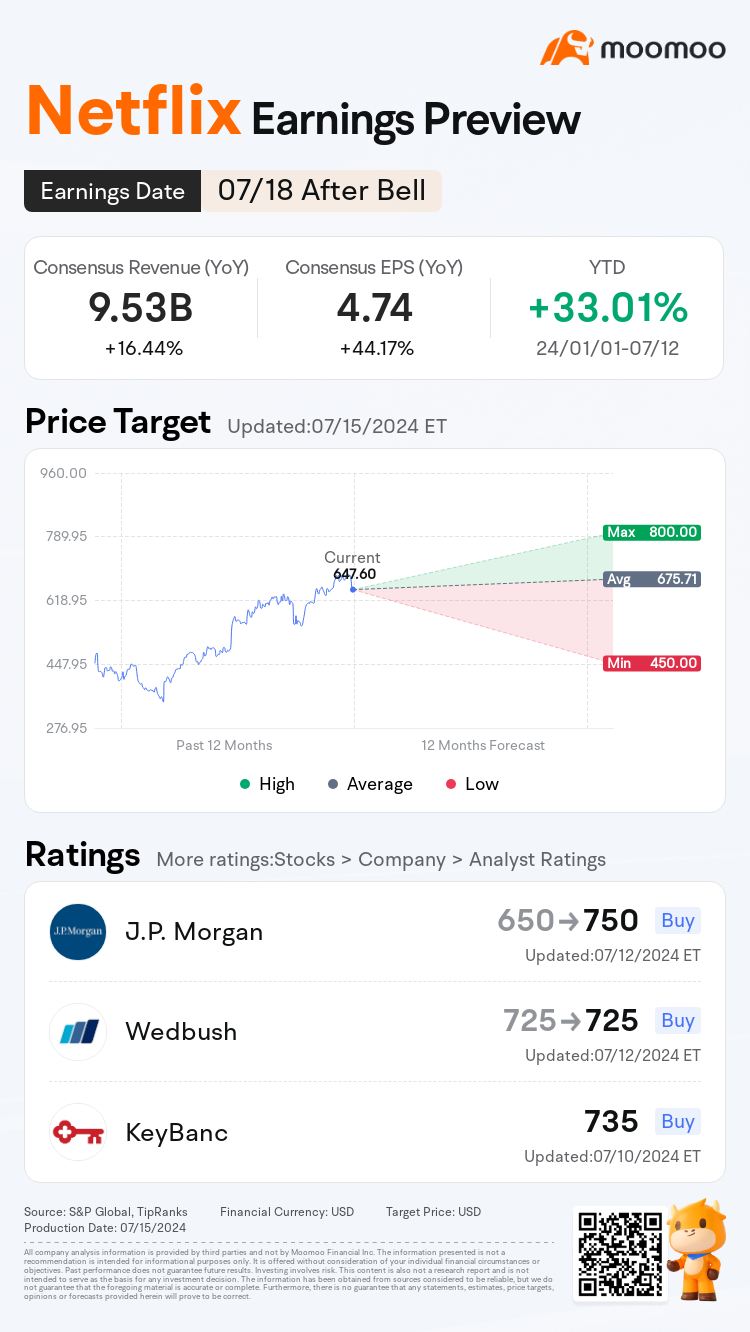

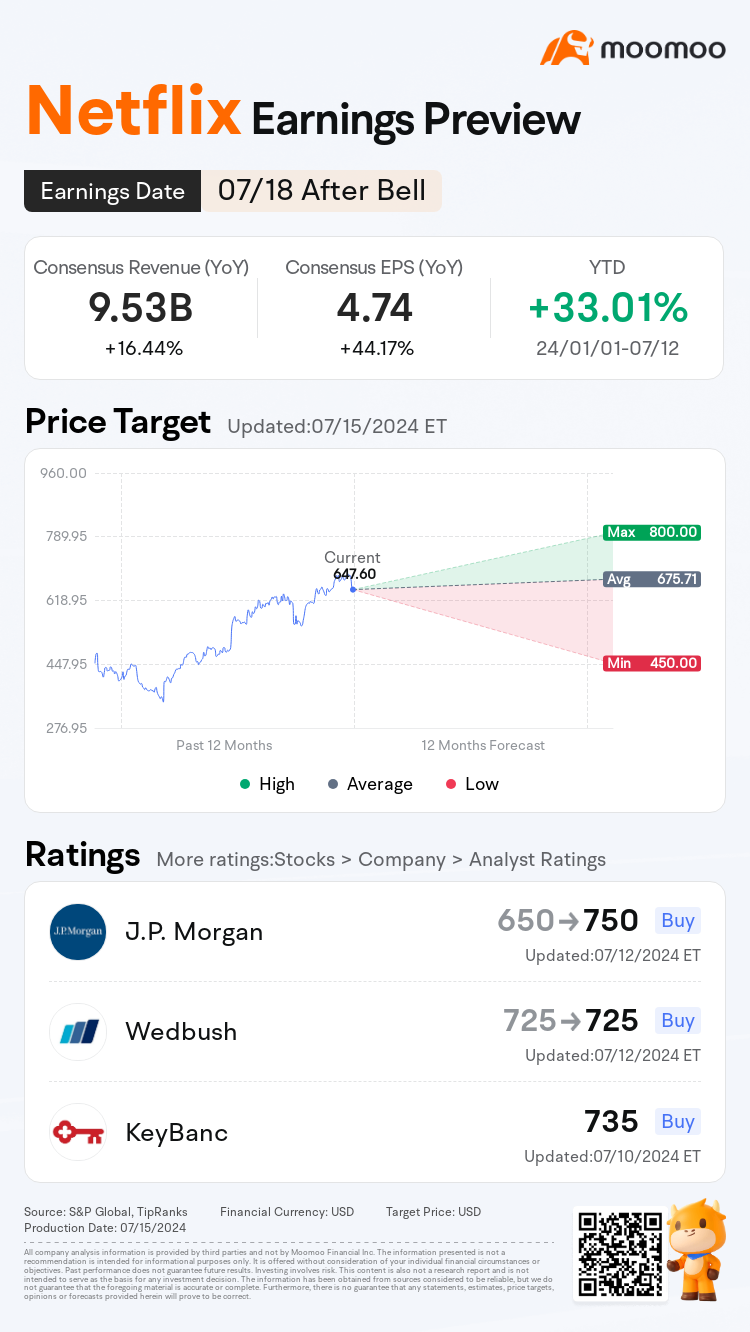

Consensus Estimates

● Netflix expects its revenue to increase 16% year-over-year (YoY) to $9.49 billion in the second quarter of 2024 but analysts predict Netflix's Q2 revenue will be slightly higher at $9.53 billion.

● Regarding earnings, Netflix forecasts net income of $2.06 billion, or $4.68 per share, for the second quarter of 2024 whereas analysts estimate Netflix's Q2 earnings per share will reach $4.74.

Subscriber growth and ad-supported tier

Netflix has had a pretty good start to 2024, with shares rising around 33%, well outperforming rival Disney. In the second quarter, it is likely to see the company continue to expand its customer base led by its ad-supported plans and crack down on password sharing.

Netflix added 9.3 million new net subscribers in Q1, whilst revenues climbed 15% year-over-year to USD$9.4 billion. Although revenue is forecasted higher in Q2 at US$9.5 billion, subscriber additions look set to be more modest at 4.8 million on account of typical seasonality.

However, the company should continue to benefit from its ad-supported tier which is enabling it to attract more price-sensitive customers with a price of just $7 per month in the U.S. This tier had a total of 40 million users as of mid-May 2024, up from about 23 million in January and Netflix has indicated that the ad-supported services represented about 40% of all its signups in the last quarter in markets where they are offered.

Moreover, the ad-supported plan is expected to generate more revenue per user than some of Netflix’s ad-free plans as incremental ad revenue more than offsets the discount offered on the ad tier.

Analysts raises Netflix stock price target ahead of earnings

JPMorgan raised the firm's price target on Netflix to $750 from $650 and affirmed an overweight rating on the shares, according to The Fly.The firm raised its second-quarter estimate of net subscriber additions to 6 million from 5 million.

Citi analysts maintained a neutral rating and $660 price target on Netflix. Investors will likely remain focused on the company's advertising tier, sports content strategy and capital allocation, Citi said.

KeyBanc raised the firm's price target on Netflix to $735 from $707 and affirmed an overweight rating on the shares.

The firm said the upcoming report will reinforce that net additions remain strong into a robust content slate and monetization initiatives.

Recent price increases by competitors and ongoing low rates of churn support Netflix price increases over coming quarters, and Netflix has ample room to sustain more than 10% annual revenue growth with 2% to 3% annual operating margin expansion as pricing returns to a more normal cadence, KeyBanc said.

Source: Bloomberg, Yahoo Finance, Proactive

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

Paul Anthony : very helpful thanks