November FOMC Meeting Preview | Impending Rate Cut Thrusts Fed into Unwanted Political Arena

Due to the impact of the U.S. elections, the Federal Reserve will announce its interest rate decision at 2:00 p.m. ET on November 7.

Most analysts expect the FOMC to cut the federal funds rate at the meeting by 25bp, lowering the target range to 4.50-4.75 percent. Market participants are also pricing in another 25bp cut in December. Although the U.S. elections have limited impact on the extent of rate cuts at this year's interest rate meetings, they will affect the interest rate outlook for 2025 and beyond.

▶ The Fed faces several economic scenarios as U.S. elections bring uncertainty

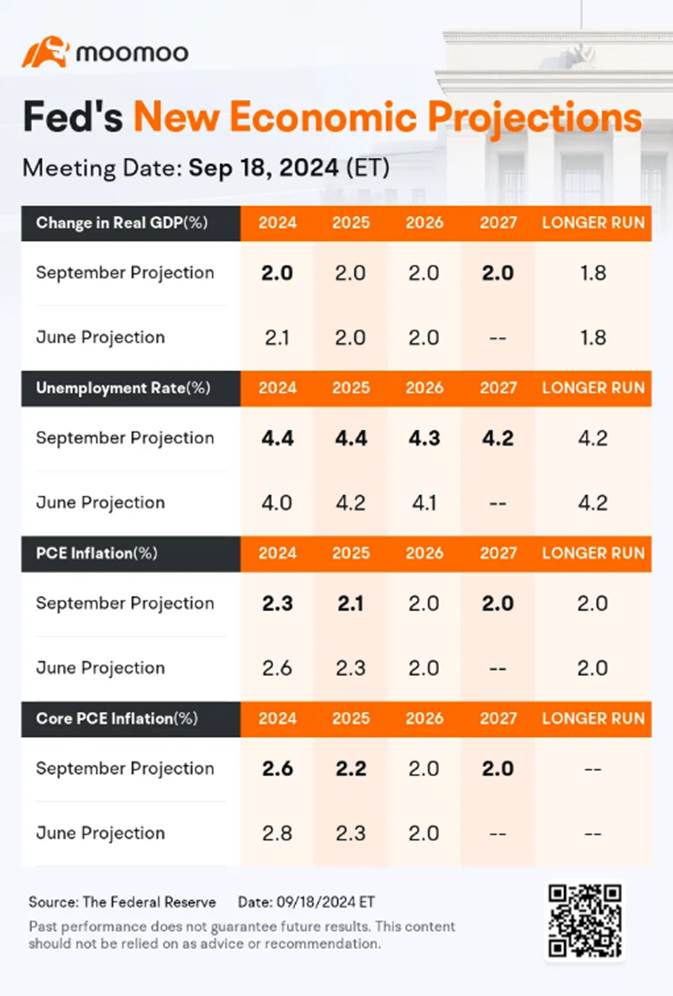

Since the last economic projections were issued, economic growth has exceeded expectations;the unemployment rate has been below anticipated levels, and inflation has been somewhat lower than expected, although there may be "base effects" that could elevate PCE inflation in the fourth quarter.

The BEA's second estimate for the third quarter GDP indicated an annualized real growth of 2.8%, following a 3.0% growth in the second quarter and 1.6% in the first quarter. Current forecasts suggest that the fourth quarter GDP will be around 2.6%. This would result in a year-over-year real growth of 2.5% for the fourth quarter of 2024, significantly surpassing the upper range of the September FOMC projections.

In October, the unemployment rate was 4.1%, which is below the September projections of 4.3%-4.4%. As of September 2024, year-over-year PCE inflation was at 2.1%, which is also below the projected range of 2.2%-2.4% set in September.

Overall, the current economic situation will not significantly alter the Federal Reserve's rate-cutting path, as the current interest rates remain restrictive.

However, the upcoming rate cut will inevitably place Fed officials in a political spotlight they usually try to avoid, especially since it occurs just a few days after Americans decide whether to elect former President Donald Trump or Vice President Kamala Harris as their next president.

Contributing to the uncertainty, economists point out that each candidate could lead to different economic outcomes.

James Knightley, the economist from ING Group, posits that a Trump victory would ensure a lower tax environment, potentially boosting sentiment and spending initially. However, his proposed tariffs, immigration controls, and higher borrowing costs might present increasing challenges throughout his term. On the other hand, a Harris victory would likely represent policy continuity. Yet, with a possibly divided Congress, her capability to fulfill her agenda remains uncertain. The Treasury market might view slightly higher taxes and modest spending increases as the most favorable election outcome, placing additional pressure on the Fed to implement rate cuts to sustain growth.

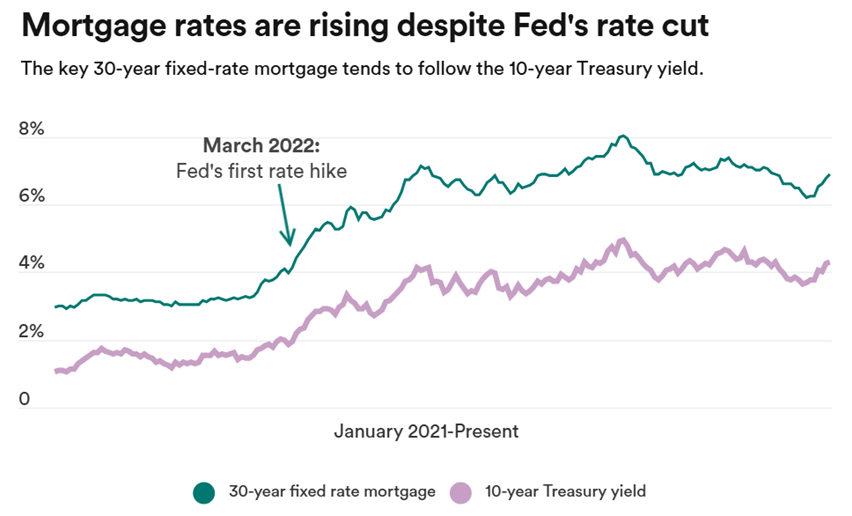

▶ Mortgage rates are rising despite Fed's rate cut

Since the Federal Reserve's rate cut in September, credit cards, auto loans, and home equity lines of credit have seen reductions in interest rates across the market, as per data tracked by Bankrate. However, other borrowing costs have unexpectedly risen. Notably, the 30-year fixed-rate mortgage spiked by 68 basis points following the Fed's half-point cut, reaching 6.88 percent in the week ending October 30, according to Bankrate’s weekly national rate survey.

This increase is linked to subsequent rises in the 10-year and 2-year Treasury yields, which more directly influence the long-term interest rates paid by consumers than the Fed's rates do. The 10-year Treasury yield has climbed to its highest level since July, and the 2-year yield has reached its peak since August.

Greg McBride, chief financial analyst at Bankrate, suggests that the Fed's significant half-point cut played a role in this dynamic. "That larger half-point cut reduced the odds of a sharper economic slowdown and increased the likelihood that the economy continues to grow. This poses a threat to slowing the progress on inflation," says McBride.

▶ The Federal Reserve will dynamically adjust the interest rate target in 2025

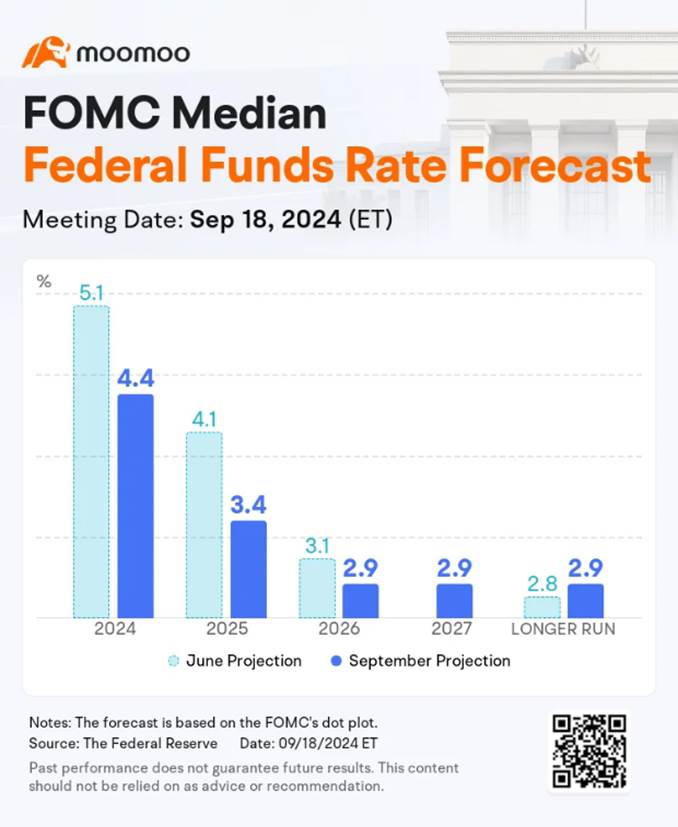

The Fed’s Summary of Economic Projections suggests that the "neutral" policy rates are around 3%, but Knightley believes they are more likely near 3.5% amid a loose fiscal policy context.

With the deficit expected to hover around 7% of GDP in the coming years, the Fed might contend that interest rates should remain somewhat elevated to balance the fiscal stimulus and achieve the 2% inflation target. In this context, The ING Group anticipates that the Fed funds rate could reach 3.5% by summer if Trump is elected. However, under a Harris presidency, the rate might be reduced further to 3% in the latter half of 2025.

At the end of October, several Federal Reserve officials also expressed similar views of "cautious" rate cuts or a "slowing down" of rate cuts before the quiet period.

Lorie Logan, President of the Dallas Federal Reserve, stated that officials should act prudently in the face of high economic uncertainty, and she supports a "gradual" approach to rate cuts.

Jeffrey Schmid, President of the Kansas City Federal Reserve, expressed his desire for a more normalized policy cycle, where the Fed could make moderate adjustments to maintain economic growth, price stability, and full employment. Slowing down the pace of rate cuts would also allow the Fed to find a so-called neutral level—where policy neither pressures nor stimulates the economy.

Neel Kashkari, President of the Minneapolis Federal Reserve, said he favored the Fed's significant rate cut in September but reiterated his support for slower rate cuts over the next few quarters. "At present, I expect some more moderate cuts over the next few quarters to bring rates to a neutral level, although this will depend on the data."

Source: ING, Bankrate

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

103613928 : Noted

Jancy rani : noted

Alen Kok : o

103827296 : what is I I don't know I know understand

TracyC : Wrong date!

TracyC TracyC : Isn’t FOMC 11/6-11/7?

Laine Ford : noted

NiceOne : good stuff