November FOMC Preview: The Fed May Suspend Further Rate Hikes Due to Higher Bond Yields

At 2 p.m. EDT on November 1st, the Federal Reserve will make the interest rate decision at the FOMC meeting. The Fed is widely expected to leave interest rates unchanged. Fed officials appear content to let higher long-term yields serve as a substitute for further rate hikes.

■ Developments since the September FOMC meeting

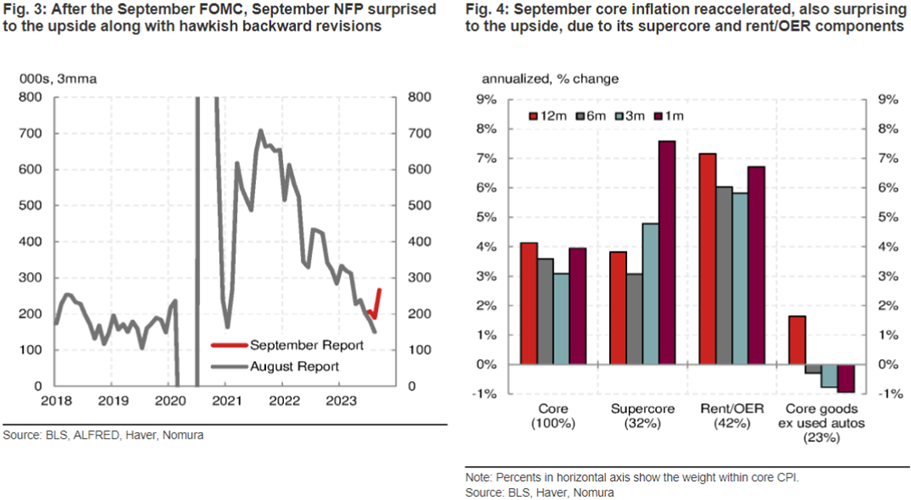

Data since the September meeting shows surprising strength in growth and inflation. Job gains accelerated in the September employment report, and positive backward revisions showed a more resilient underlying trend. JOLTS job openings also surged higher in the latest report, partly reversing a three-month decline. Headline and core CPI were slightly stronger than expectations. The underlying details contain signs of persistent inflation pressure. In particular, the recent upward trend of supercore CPI inflation raised inflation risks.

Q3 GDP is backward-looking, but 4.9% headline growth and a 3.5% rise in domestic final sales effectively summarize the recent surprising strength in growth and spending.

■ A deceleration of the economy in Q4 should reduce pressure to hike in response to above-trend growth.

Goldman Sachs expected a deceleration to 1.6% GDP growth in Q4 as the effects of the resumption of student loan payments and the recent tightening of financial conditions kick in and weigh in particular on consumer spending and housing activity.

Besides, the encouraging decline in the underlying inflation trend has kept core PCE inflation on track to undershoot the FOMC's 3.7% Q4/Q4 projection by 0.3%.

■ Interest rates may have reached restrictive levels.

Goldman Sachs' analyst Jan Hatzius estimates that the recent tightening has roughly the same impact on the economy as four 25bp hikes. The rise in interest rates has been driven by a reassessment of the neutral rate and an increase in the term premium, and for that reason, it looks unlikely to reverse anytime soon.

WSJ's correspondent Nick Timiraos suggests that borrowing costs for US businesses and households are rising in ways that could allow the Fed to suspend its historic run of interest-rate increases in his latest article.

He notes that, at the Fed's July 2013 policy meeting, staff economists told officials that a sustained 0.75-percentage-point increase in 10-year Treasury yield could allow officials to lower the path for the Fed's benchmark federal funds rate by around 0.6 percentage point relative to their baseline forecast over the following 2 1/2 years. The situation at that time might foreshadow a similar policy path for this year.

■ What message will Powell deliver at the press conference?

Nomura analyst Aichi Amemiya expects Powell to emphasize the cumulative tightening in policy rates and broader financial conditions, noting that this will allow the Fed to be patient regarding future policy decisions, though keeping options open for additional tightening. He is likely to repeat his recent comments that policy is in restrictive territory, which should help to push growth below trend and bring inflation back towards target.

Aichi expects Powell to acknowledge recent hawkish data surprises, but he will likely point to signs of progress in the underlying trend, with the three-month average of inflation data continuing to ease. He could also suggest that survey data and anecdotes point to growth weakness, raising some doubts about the recent acceleration in labor indicators and spending data.

Powell will likely be asked about his interpretation of the recent surge in longer-term yields. Bloomberg estimates Powell will say that a sustained increase in long-term bond yields would, on the margin, substitute for one or two rate hikes.

■ What's the next move?

CME FedWatch shows that the probability of the Fed raising interest rates in December is also low, only 24.4%. Goldman Sachs pointed out that if the FOMC does not hike in December either, attention will likely turn to rate cuts. GS's baseline forecast puts the first cut in 2024 Q4, when core PCE inflation will have fallen below 2.5% year-on-year, according to GS's estimate. Recent comments by President Bostic, who suggested the first cut could come in “late 2024,” and by Governor Waller, who said a 2.5% inflation threshold, show that Fed officials are on the same page.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment