Nvidia Investor Eyes Max Pain Prices as Optimism Revives Ahead of Key Shareholder Meeting

$NVIDIA (NVDA.US)$ is gearing up for its annual shareholder meeting on Wednesday, where investors will vote on executive compensation, board re-elections, and the ratification of an accounting firm. This pivotal event presents a chance for the chipmaker to highlight its leadership and strengths in the rapidly evolving artificial intelligence (AI) sector. Concurrently, the options market is signaling a potential halt to Nvidia's recent stock decline, with increased activity suggesting investor confidence in a rebound this week.

On Monday, Nvidia's stock closed at $118.11, a significant drop from its recent highs. This decline has put pressure on the upcoming shareholder meeting, scheduled for Wednesday, June 26. Investors are eagerly awaiting reassurances from Nvidia's management regarding the company's future, particularly its AI initiatives which have been a cornerstone of its recent success.

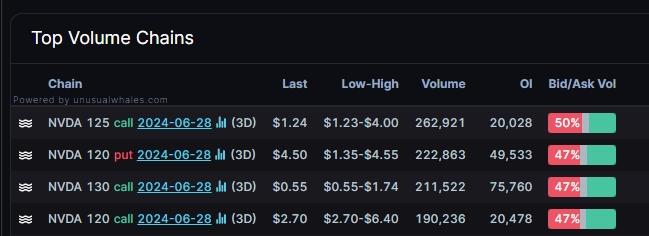

The options market reflects this anticipation, with significant activity in call options. Volume in call options expiring on Friday with strike prices at $125, $130, and 120 saw the most active trading, with 262,921 211,522 and 190,236 contracts changing hands, respectively. While put options expiring this Friday, with strike prices at $120, saw the highest trading volume at 222,863.

The jump in activity caused the ratio of put options to call options in the Nvidia to lowered to 0.67, compared with 0.70 on last Friday, Barchart data show.

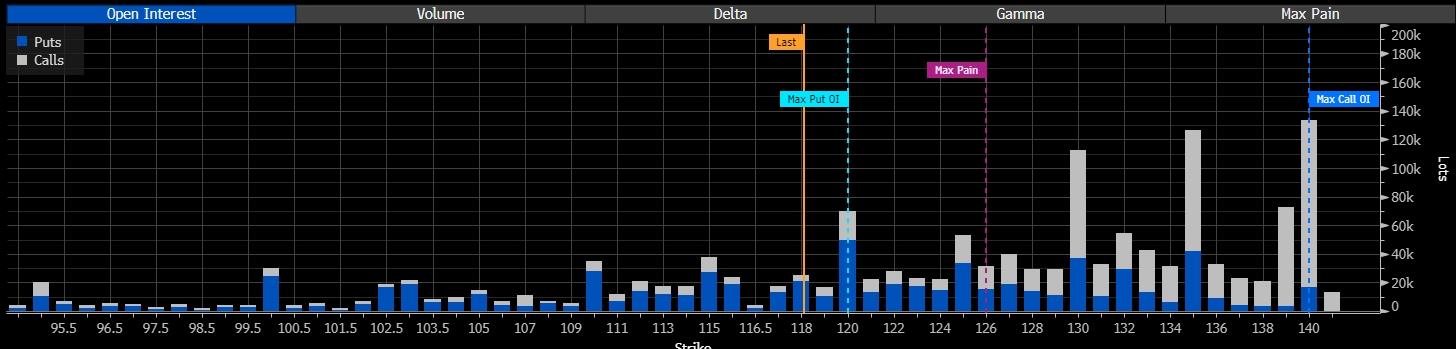

The options market reveals key levels for expiration of this Friday that are drawing attention: Max Pain at $126. The concept of Max Pain, where the stock price causes the maximum loss for option holders at expiration, is at $126. In the scenario that the current stock price is below the max pain level, market makers might have an incentive to push the stock price up towards 126 to benefit from the maximum number of options expiring worthless.

The heavy open interest in calls, particularly around the $130 to $140 range, suggests bullish sentiment from the previous rally remains.

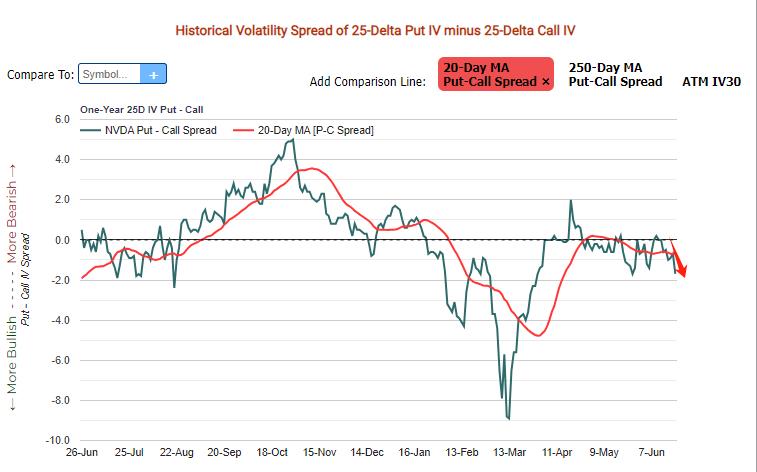

Recent data on the put/call skew shows a slight decrease, indicating a mild increase in demand for call options.

Shareholder Meeting: A Catalyst for Recovery?

Nvidia stockholders are expecting the upcoming shareholder meeting to be a pivotal event. Among the key items on the agenda, investors will vote on the compensation packages for Nvidia executives, including CEO Jensen Huang and CFO Colette Kress. This annual “say-on-pay” vote, while non-binding, could signal the perceived value of Nvidia's leaders as the company's valuation soars in the AI era.

Nvidia's executive compensation structure is largely performance-based, with around 78% of CEO Jensen Huang's compensation through stock awards. The stock's meteoric rise has significantly boosted his compensation, with Huang earning $34.2 million in total compensation for fiscal year 2024, up nearly 60% from fiscal 2023. Recently, Huang sold 120,000 shares valued at around $15.25 million, highlighting the financial gains tied to Nvidia's stock performance.

In addition to the compensation vote, shareholders will also vote to re-elect 12 existing directors to the company's board, including Huang, and to ratify PwC as the company's independent registered public accounting firm for fiscal 2025. The firm has audited Nvidia's financial statements annually since 2004.

While the shareholder meeting may not feature groundbreaking announcements, it presents an opportunity for Huang and other company leaders to highlight Nvidia's gains amid the AI boom and showcase long-term growth prospects.

Harvest Portfolio Management Co-CIO and Nvidia shareholder Paul Meeks expects Wednesday's shareholder meeting to "make investors feel comfortable that there is a long runway" as the company touts its AI initiatives. He believes CEO Jensen Huang's remarks will cause the stock to rebound from its period of decline.

"I think you must believe that the company will continue to upside numbers. I mean, they have scorched the quarterly numbers for about a year and a half ever since the advent in November of '22 of ChatGPT, and I think you can probably expect more of the same," Meeks adds. He expects Nvidia to continue to push the narrative that the AI chip boom will last longer than expected, allowing them to continue to beat earnings estimates.

Source: MarketWatch, Barchart, Market Chameleon

Disclaimer: Options trading entails significant risk and is not appropriate for all customers. It is important that investors read Characteristics and Risks of Standardized Options before engaging in any options trading strategies. Opening new options positions close to or on their expiration date comes with substantial risk of losses for reasons that include potential volatility of the underlying security and limited time to expiration. Options transactions are often complex and may involve the potential of losing the entire investment in a relatively short period of time. Certain complex options strategies carry additional risk, including the potential for losses that may exceed the original investment amount. Supporting documentation for any claims, if applicable, will be furnished upon request.This presentation is for informational and educational use only and is not a recommendation or endorsement of any particular investment or investment strategy. Investment information provided in this content is general in nature, strictly for illustrative purposes, and may not be appropriate for all investors. It is provided without respect to individual investors' financial sophistication, financial situation, investment objectives, investing time horizon, or risk tolerance. You should consider the appropriateness of this information having regard to your relevant personal circumstances before making any investment decisions. Past investment performance does not indicate or guarantee future success. Returns will vary, and all investments carry risks, including loss of principal. Moomoo makes no representation or warranty as to its adequacy, completeness, accuracy or timeliness for any particular purpose of the above content.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

104371487 On Paris : Good morning