Nvidia stock split: What you need to know about the impact

Following Nvidia's surge in Q1 2024 after its earnings report, the company completed its sixth stock split on June 10, following a market holiday on June 7. If you're wondering about the impact of a stock split, this article will provide answers. The article covers the following topics:

1. The impact of a stock split on the underlying stock

2. The impact of a stock split on options

3. The impact of a stock split on ETFs

The impact of a stock split on the underlying stock

1. Trading times and position changes before and after the split

The stock split plan for Nvidia became effective after the after-hours trading session on June 7th.

Nvidia did not have after-hours trading on June 7th, 10th, and 11th.

On June 10th, after the opening of the pre-market trading session, trading began at the post-split price, and your position was automatically adjusted before market open.

2. Impact on stock liquidity

Nvidia has undergone five previous stock splits. Looking back at the dates, plans, and post-split stock prices:

A stock split does not change the company's total market value; only the number of shares held by shareholders changes, and the price per share drops significantly. The company believes that a stock split will make it easier for employees and investors to buy shares.

The market generally believes that although the fundamentals of the company have not changed, investors tend to respond positively to a stock split and consider the stock price "cheaper." A stock split can increase liquidity and attract more buyers. Looking at the post-adjustment results, if Nvidia had not undergone five rounds of stock splits, the current stock price would be approximately $55,000, which would be a price that ordinary investors would be intimidated by.

A Bank of America analysis report shows that historically, stock splits have been viewed by the market as a bullish signal. According to data from Bank of America since 1980, S&P 500 index component stocks that announced stock splits outperformed the index in the 3, 6, and 12 months after the announcement, with an average increase in stock price of 25.4%, while the S&P 500 index rose by an average of 11.9% over the same period.

3. Easier inclusion in the Dow Jones Index

The Dow Jones Index is composed of the stock prices of 30 well-known companies in representative industries in the United States. As the semiconductor industry's total leader, Nvidia should be selected, but because Nvidia's stock price is too high, including it in the Dow Jones would cause the index to deviate significantly.

Therefore, some market analysts believe that unlike the two-month period between the announcement and actual stock split in 2021, this round of stock split only took two weeks and involved a large-scale split to catch up with a possible adjustment of the Dow Jones Index components on June 14th.

However, looking back at the last two times the "Big 7" announced a stock split, it took 1 to 2 years to be included in the Dow Jones Index. Will Nvidia be included in the Dow Jones Index quickly this time?

Amazon announced a 1-for-20 stock split on March 9, 2022, and was included in the Dow Jones Index on February 20, 2024, taking two years.

Apple announced a 1-for-7 stock split on April 23, 2014, and was included in the Dow Jones Index on March 6, 2015, taking one year.

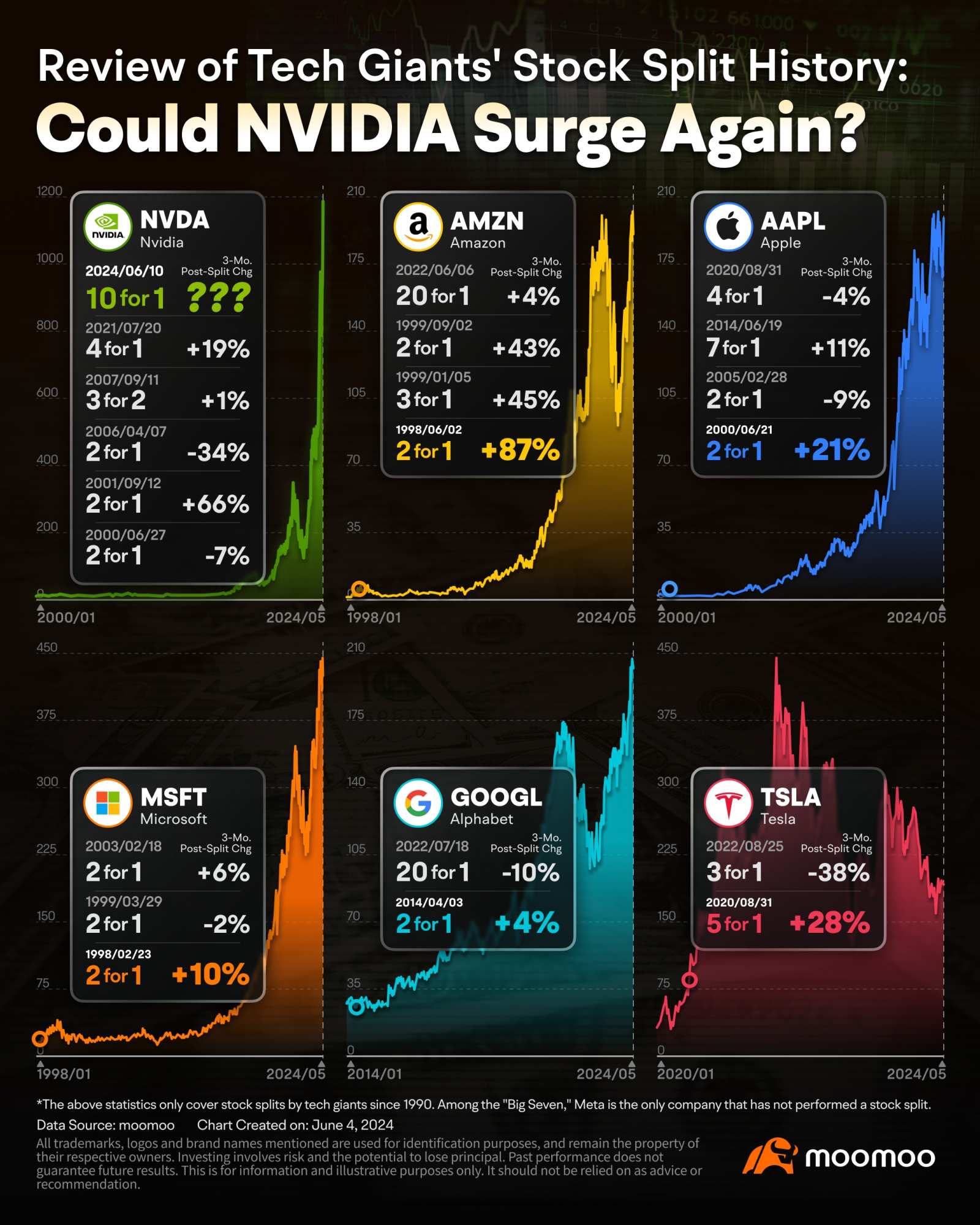

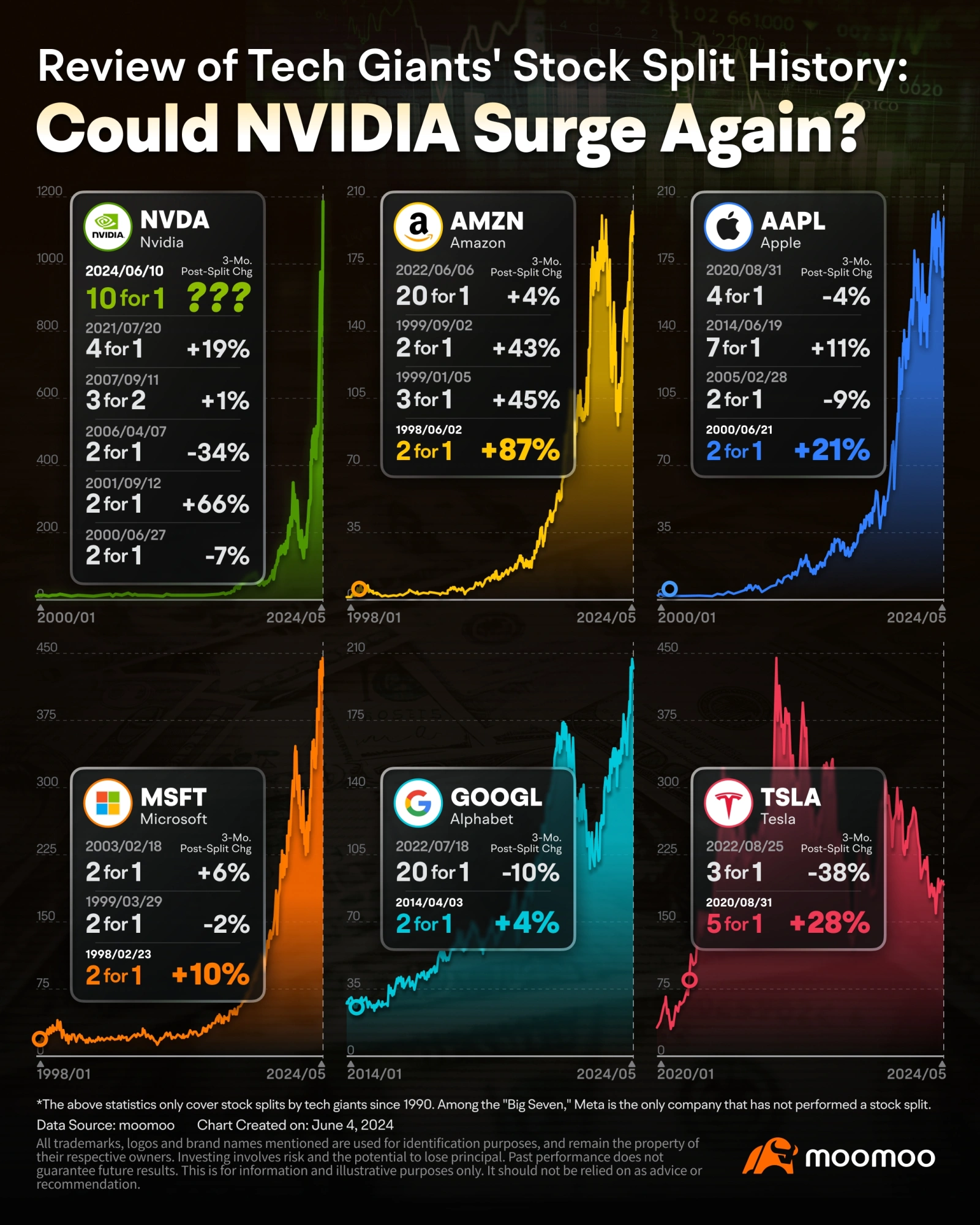

4. Recent stock price trends after the "Big 7" stock split

* Note: Meta has no stock split history

The impact of a stock split on options

1. Nvidia's option split plan

According to the settlement company OCC's announcement on the adjustment of NVDA option contracts, after the stock split takes effect on June 10th, the number of option contracts held by investors will be adjusted to ten times the number held before the split.

2. Option position adjustment schedule

According to the above option split plan, if you hold an Nvidia option contract that has not yet expired after the close of trading on June 7th, and you hold one contract, your position will be adjusted before the start of trading on June 10th during the US market trading hours: the exercise price will be reduced to 1/10, and the number of contracts held will increase to ten.

3. Impact on option liquidity

Some analysts believe that a stock split will increase investors' enthusiasm for trading options, which will increase the liquidity of new option contracts:

The impact of a stock split on ETFs

1. Inverse ETFs

The following inverse ETFs* will not make any adjustments to Nvidia's stock split:

2x long ETF: $GraniteShares 2x Long NVDA Daily ETF.US

1x short ETF: $Direxion Daily NVDA Bear 1X Shares ETF.US

1.25x short ETF: $AXS 1.25X NVDA Bear Daily ETF.US

2x short ETF: $GraniteShares 2x Short NVDA Daily ETF.US

* These are just some of the related ETFs and are for reference only.

2. ETFs related to Nvidia's underlying stock

ETFs that hedge options: $YieldMax NVDA Option Income Strategy ETF.US, and index ETFs that include Nvidia are not affected by the stock split.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment