Option Volatility | Market Sees Big Move in Wells Fargo and Delta Airlines Shares After Earnings

Stock prices may see larger-than-normal moves during earnings season, making it a potentially attractive time for options traders. For investors looking to trade against these moves, you should always keep track of how the options might shift after their earnings.

The $Nasdaq Composite Index (.IXIC.US)$ and $S&P 500 Index (.SPX.US)$ keep reaching new highs. However, the strength of the stock market's current advance now hinges on the results of the second quarter's earnings and the upcoming inflation data.

This coming week marks the beginning of the earnings season. On July 11, $PepsiCo (PEP.US)$ and $Delta Air Lines (DAL.US)$ will report, and on July 12, JPMorgan Chase, Wells Fargo, Citigroup, and $Bank of New York Mellon (BK.US)$ will release their results.

Estimates from FactSet indicate that analysts anticipate the S&P 500 to see 8.8% growth in earnings in the second quarter; however, the financials are only projected to show a 4.3% increase.

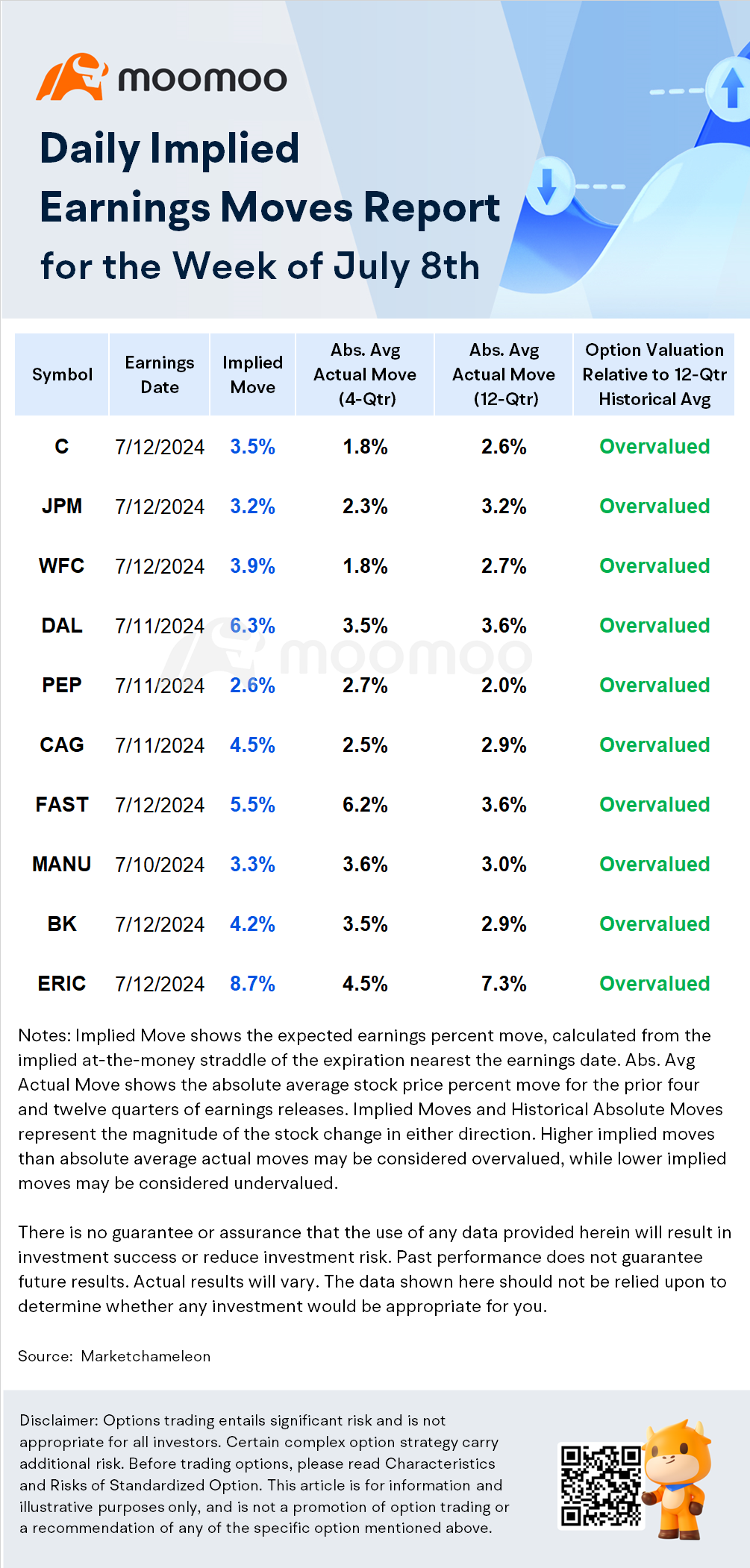

Here are the top earnings and volatility for the week:

-Earnings Release Date: Pre-market on July 12

-Earnings Forecast: 2024 Q2 revenue of $20.09 billion, up 3.35% year-over-year; EPS of $1.41, up 5.71% year-over-year

- Citi's current option implied move is ±3.5%, indicating the options market is expecting a post-earnings one-day move of 3.5%, with current option prices slightly overvalued.

Prior to C earnings releases, the average expected earnings move was ±3.4%. The actual move averaged ±2.6%, which is 0.8% below the average predicted move. The opening gaps averaged ±1.9% while the stock drift after the open tended to move ±2.0%.

During regular trading hours after the earnings was released, the biggest move to the high price was +14.7%, and the largest move to the low price was -7.8%.

C shares have moved higher after 7 out of 12 previous reports. On average the stock moved up 1.3% in the first day of trading after the company reported earnings.

Analysts are predicting a more than 40% increase in earnings for the financial sector in the fourth quarter, with continued robust growth expected in the first half of 2025, according to Paul R. La Monica of Barron's. Michael Cuggino, president of the Permanent Portfolio Family of Funds, says financial stocks are becoming more appealing. However, he advises investors to be cautious and prioritize companies that derive a significant portion of their revenue from fee-based businesses rather than relying solely on spread income from loans.

"Financials are interesting, but you have to be a little careful," he says. "I like companies with a more diversified portfolio of businesses, " noting that he owns Morgan Stanley, Charles Schwab, Visa, and State Street.

Regional banks, which have been adversely affected by concerns over the sharp decline in the value of commercial real estate loans, could also be attractive. Despite several regional bank failures in 2023 and the near collapse of New York Community Bancorp earlier this year, large regional banks still maintain healthy balance sheets.

Citi Financial Chief Mark Mason last month reported a pickup in investment-banking activity compared to year-ago levels, due partly to a rise in mergers-and-acquisitions activity, as well as capital raising.

-Earnings Release Date: Pre-market on July 12th

-Earnings Forecast: 2024 Q2 revenue of $39.69 billion, down 3.91% year-over-year; earnings per share of $3.97, down 16.40% year-over-year.

- JPMorgan Chase's current implied move is ±3.2%, indicating the options market is expecting a post-earnings one-day move of 3.2%, with current option prices fairly valued compared to the past 12 earnings actual moves.

Prior to JPM earnings releases, the average expected earnings move was ±2.9%. The actual move averaged ±2.2%, which is 0.7% below the average predicted move. The opening gaps averaged ±1.9% while the stock drift after the open tended to move ±1.5%.

During regular trading hours after the earnings was released, the biggest move to the high price was +7.9%, and the largest move to the low price was -6.7%.

JPM shares have moved lower after 7 out of 12 previous earnings reports. On average the stock moved down -0.9% in the first day of trading after the company reported earnings.

- Earnings Release Date: Pre-market on July 12th

- Earnings Forecast: 2024 Q2 revenue of $20.22 billion, down 1.53% year-over-year; earnings per share of $1.28, up 2.22% year-over-year.

- Wells Fargo's current implied move is ±3.9%, indicating the options market is expecting a post-earnings one-day move of 3.9%, with current option prices overvalued compared to the past 12 earnings actual moves.

Prior to WFC earnings releases, the average expected earnings move was ±3.4%. The actual move averaged ±2.5%, which is 0.9% below the average predicted move. The opening gaps averaged ±1.8% while the stock drift after the open tended to move ±1.8%.

During regular trading hours after the earnings was released, the biggest move to the high price was +7.9%, and the largest move to the low price was -8.4%.

WFC shares have moved higher after 6 out of 12 previous reports. On average the stock moved up 1.0% in the first day of trading after the company reported earnings.

The bank has completed the Federal Reserve's stress test, similar to JP Morgan. However, the bank remains constrained by a six-year-old Fed-imposed limit of $1.95 billion in maximum assets, restricting its expansion.

- Earnings Release Date: July 11th

- Earnings Forecast: 2024 Q2 revenue of $15.70 billion, up 0.81% year-over-year; earnings per share of $2.35, down 17.1% year-over-year.

- Delta Air Lines's current implied move is ±6.3%, indicating the options market is expecting a post-earnings one-day move of 6.3%, with current option prices much overvalued compared to the past 12 earnings actual moves.

Prior to DAL earnings releases, the average expected earnings move was ±4.7%. The actual move averaged ±2.8%, which is 1.8% below the average predicted move. The opening gaps averaged ±2.7% while the stock drift after the open tended to move ±2.2%.

During regular trading hours after the earnings was released, the biggest move to the high price was +7.5%, and the largest move to the low price was -9.2%.

DAL shares have moved lower after 9 out of 12 previous reports. On average the stock moved down -1.5% in the first day of trading after the company reported earnings.

Open interest in Delta Airlines is evenly distributed around the current stock price, with a significant concentration of call options at $50 and put options at $44. This suggests that option traders are anticipating a relatively stable week for the stock.

Don't Get Crushed by Earnings. Here are things you should know before considering a trade.

Knowing the IV Crush

Before significant corporate events such as earnings announcements, product launches, or clinical trial results, implied volatility tends to increase. However, after the news has been released, the implied volatility can drop significantly due to the sudden clarity in the market and the stock price reaction to the news. This phenomenon is referred to as IV crush.

IV Crush And Option Prices

IV crush can lead to a decrease in option prices because the Implied volatility is lowered dramatically. This decrease in option prices due to IV crush can be a risk for options traders who have purchased options at a higher price with the expectation of making a profit from a significant move in the underlying stock price. Conversely, IV crush may not be as prevalent if the option is undervalued and the stock price moves drastically, which can pose a risk for option sellers. It's important for traders to be aware of IV crush and factor it into their trading strategy when considering options trades around significant corporate events.

Not all options are affected equally by an IV crush. IV crush affects short-term option prices more than long-term option prices.

Nonetheless, it's important to note that trading options always involve risks, and investors should consult with a financial advisor before making any trades.

Source: Dow Jones, Market Chameleon, Bloomberg

Disclaimer:

Options trading entails significant risk and is not appropriate for all customers. It is important that investors read Characteristics and Risks of Standardized Options before engaging in any options trading strategies. Options transactions are often complex and may involve the potential of losing the entire investment in a relatively short period of time. Certain complex options strategies carry additional risk, including the potential for losses that may exceed the original investment amount. Supporting documentation for any claims, if applicable, will be furnished upon request. Moomoo does not guarantee favorable investment outcomes. The past performance of a security or financial product does not guarantee future results or returns. Customers should consider their investment objectives and risks carefully before investing in options. Because of the importance of tax considerations to all options transactions, the customer considering options should consult their tax advisor as to how taxes affect the outcome of each options strategy.

The data and information provided has been obtained from sources considered to be reliable, but Moomoo Financial and its affiliates do not guarantee that the foregoing material is accurate or complete. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment