Option Volatility | Market Sees Big Move Tesla, American Airlines Shares After Earnings

Stock prices may see larger-than-normal moves during earnings season, making it a potentially attractive time for options traders. For investors looking to trade against these moves, you should always keep track of how the options might shift after their earnings.

Approximately 14% of $S&P 500 Index(.SPX.US$ companies have released their earnings for the June quarter, and the blended earnings growth rate for the broader index remains robust. The upcoming week marks the official onset of the tech earnings season, which could significantly influence the market's direction following a sharp decline in the past week.

The tech earnings season began on a modest note last week with $ASML Holding(ASML.US$, a chip-equipment manufacturer, reporting its earnings. The company's stock plummeted around 16% due to a weak third-quarter outlook. Meanwhile, $Netflix(NFLX.US$ provided guidance that left investors underwhelmed, but despite this, sell-side analysts praised the results, preventing the stock from taking a significant hit.

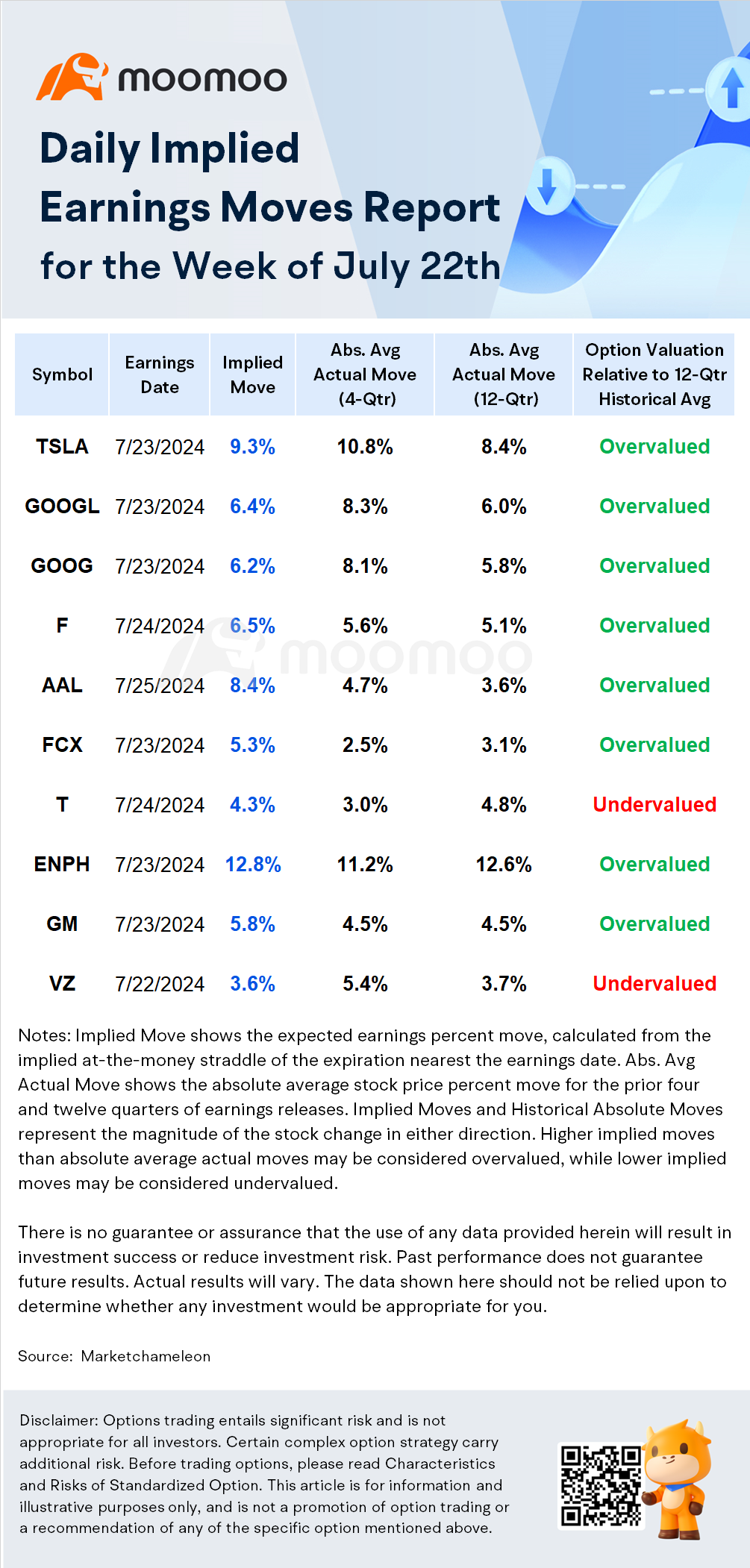

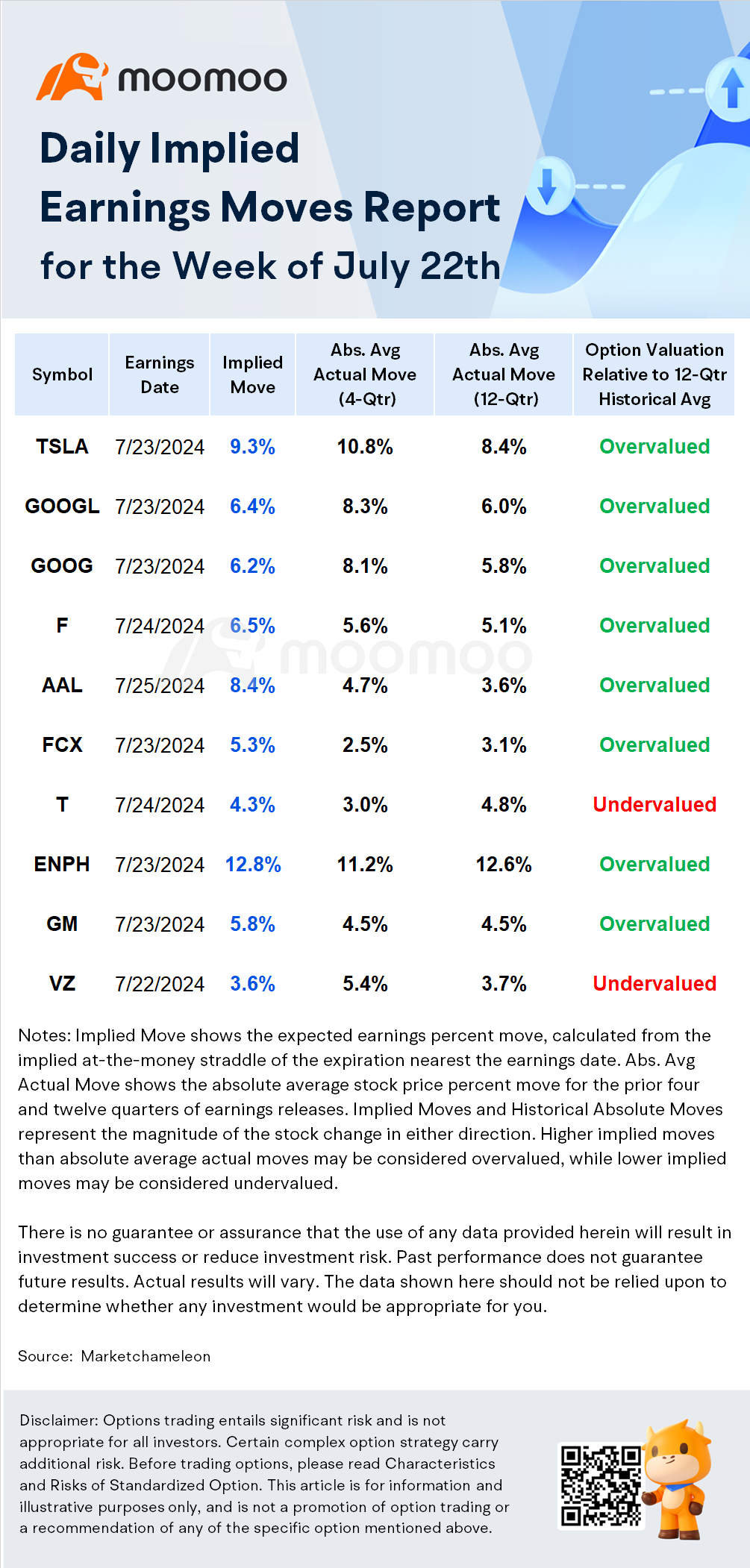

Here are the top earnings and volatility for the week:

-Earnings Release Date: Post-market on July 23

-Earnings Forecast: 2024 Q2 revenue of $24.70 billion, down 0.93% year-over-year; EPS of $0.49, down 37.18% year-over-year

Before Tesla announced its earnings, the market was prepared for the stock to potentially swing by an average of plus or minus 8.4%. However, the actual price movements were a bit more subdued, averaging around plus or minus 7.0%, which is 1.3% less than expected. The stock typically experienced significant initial moves at the market open, with gaps around plus or minus 5.9%, followed by additional average movements of plus or minus 3.5% throughout the rest of the trading day. The most substantial shifts saw Tesla's stock rocket up to 19.7% and tumble down to 14.8% after earnings were publicized.

The options market, which traders use to bet on or hedge against future stock price movements, has a history of overestimating Tesla's earnings-related stock volatility about one-third of the time over the past 12 quarters. On average, the options market anticipated a move of plus or minus 7.5% surrounding earnings announcements, but the actual average move turned out to be 8.4% when looking at absolute values. This indicates that Tesla's stock has, in fact, been more volatile than what traders predicted for its post-earnings reaction.

The implied volatility skew for Tesla currently shows the market's bias for pricing in volatility risk to the option premium of downside puts and upside calls. If the implied volatility for downside puts is increasing relative to upside calls, then that suggests the market is pricing in a larger fear to a downside move.

-Earnings Release Date: July 23

-Earnings Forecast: 2024 Q2 revenue of $84.27 billion, up 12.96% year-over-year; EPS of $1.85, up 28.23% year-over-year

In anticipation of Alphabet Inc.'s earnings reports, the market typically predicted a fluctuation of about plus or minus 5.0%. The actual stock movement came very close to these expectations, averaging a slight 0.1% less, at plus or minus 4.9%. When the market opened post-earnings, GOOGL shares saw an average gap of plus or minus 4.7%, with subsequent average movement, or "drift," of around plus or minus 1.6% during the rest of the trading session. The most notable price swings during regular trading hours post-earnings included a significant surge up to 16.8% and a drop to -9.9%, reflecting the stock's capacity for notable reactions to earnings news.

The options market, which essentially acts as a sentiment gauge and a hedge against stock price movements, had a tendency to overestimate the volatility of GOOGL's stock in relation to earnings 33% of the time over the last 12 quarters. While the expected move based on options was plus or minus 5.9%, the actual average movement was slightly higher at 6.0% in absolute terms. This suggests that GOOGL's stock often experienced more pronounced volatility than what traders had braced for based on their earnings predictions, indicating that the company's earnings results could bring surprises that exceed market expectations.

As the earnings season approaches, with the tech sector leading a strong market rally, Goldman Sachs analysts, including Arun Prakash, CFA, have issued a warning regarding the semiconductor space. Despite the broader market's positive momentum, they advise investors to be wary of potential setbacks within this specific sector. The analysts point to several risk factors that chipmakers are currently facing: significant investor crowding within the industry, rising geopolitical concerns, and impending earnings announcements. Additionally, the relatively low cost of protective put options signals an opportune moment for investors to secure a defense against potential share price declines. This conservative outlook from Goldman Sachs is partly driven by the recent unease over possible new export limits to China, suggesting that investors should consider hedging their positions to safeguard against the prospect of a market downturn.

-Earnings Release Date: Pre-market on July 25

-Earnings Forecast: 2024 Q2 revenue of $14.37 billion, up 2.26% year-over-year; EPS of $0.98, down 48.14% year-over-year

In the last three years, the options market has consistently overestimated the volatility of American Airlines' stock in response to earnings releases. In 75% of instances over the past 12 quarters, the options market predicted an average move of plus or minus 5.5% following the airline's earnings announcements. However, the actual average movement of the stock was notably less, at just plus or minus 3.6% in absolute terms, indicating a trend of overestimation by the options market.

In the lead-up to American Airlines' earnings reports, the expected stock price fluctuation was around plus or minus 5.2%. Yet, the reality was a more modest average change of plus or minus 4.0%, which is 1.2% lower than anticipated. At the opening bell, the stock typically showed gaps averaging plus or minus 2.8%, with further average movements of plus or minus 3.2% as the trading day progressed. Notably, the stock experienced significant volatility within regular trading hours after earnings were made public, with the most dramatic surge reaching up to 31.5% and the steepest decline hitting -10.8%, highlighting the potential for substantial price swings post-earnings.

Souce: Market Chameleon, Dow Jones

Disclaimer: Options trading entails significant risk and is not appropriate for all customers. It is important that investors read Characteristics and Risks of Standardized Options before engaging in any options trading strategies. Opening new options positions close to or on their expiration date comes with substantial risk of losses for reasons that include potential volatility of the underlying security and limited time to expiration. Options transactions are often complex and may involve the potential of losing the entire investment in a relatively short period of time. Certain complex options strategies carry additional risk, including the potential for losses that may exceed the original investment amount. Supporting documentation for any claims, if applicable, will be furnished upon request.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment