Options Market Statistics: A Downbeat Report From ASML Dragged Down Other AI Stocks

News Highlights

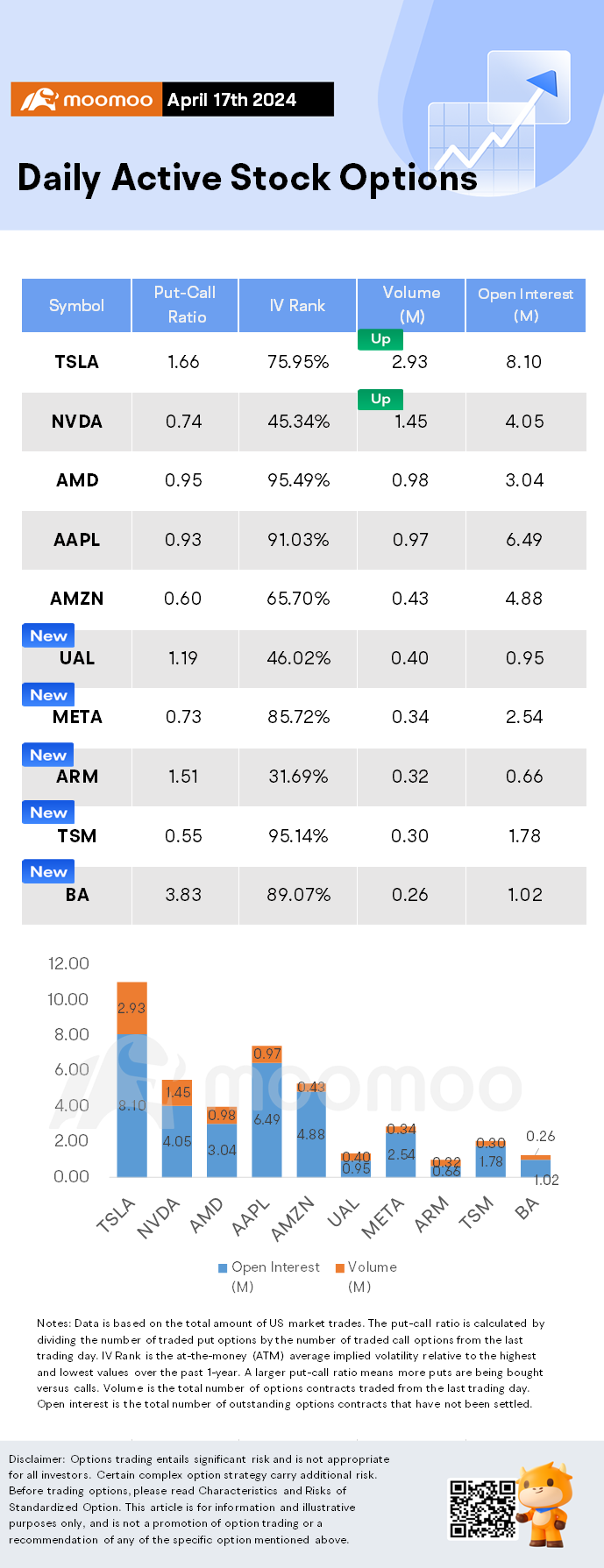

$NVIDIA (NVDA.US)$ shares fell by 3.87%, closing at $840.35. Its options trading volume was 1.45 million. Call contracts account for 57.5% of the total trading volume. The most traded calls are contracts of $900 strike price that expire on Apr. 19th. The total volume reaches 66,284 with an open interest of 20,475. The most traded puts are contracts of a $850 strike price that expires on Apr. 19th; the volume is 27,628 contracts with an open interest of 16,077.

Nvidia fell Wednesday but the stock is forming a flat base with a buy point at 974. A well formed base could lead to a clear breakout that would make Nvidia a buy again. But investors should also keep an eye on the Nasdaq, which has fared poorly in recent days.

Chief Executive Jensen Huang recently addressed students at his alma mater of Oregon State University and stated that "artificial intelligence is the technology industry's single greatest contribution to social elevation." Huang addressed faculty and students at a groundbreaking event for a new research building that seeks to advance the institute's presence in the semiconductor and high performance computing industries.

$Arm Holdings (ARM.US)$ shares fell by 11.99%, closing at $107.56. Its options trading volume was 0.32 million. Call contracts account for 39.8% of the total trading volume. The most traded calls are contracts of $130 strike price that expire on Apr. 19th. The total volume reaches 2,595 with an open interest of 10,941. The most traded puts are contracts of a $120 strike price that expires on Apr. 19th; the volume is 1,703 contracts with an open interest of 4,285.

Shares of Arm Holdings were taking it on the chin today after a disappointing earnings report from $ASML Holding (ASML.US)$ led to a broad-based sell-off in artificial intelligence (AI) stocks. Arm was the worst performer of the group as its shares finished the day down 12%, which was even worse than ASML's 7.1% drop.

$Taiwan Semiconductor (TSM.US)$ shares fell by 0.55%, closing at $139.03. Its options trading volume was 0.30 million. Call contracts account for 64.6% of the total trading volume. The most traded calls are contracts of $150 strike price that expire on Apr. 19th. The total volume reaches 7,302 with an open interest of 20,697. The most traded puts are contracts of a $138 strike price that expires on Apr. 19th; the volume is 3,260 contracts with an open interest of 1,256.

TSMC is set to report its first-quarter financial results before the market open Thursday and will host a conference call to discuss the results at 2:00 p.m. ET the same day.

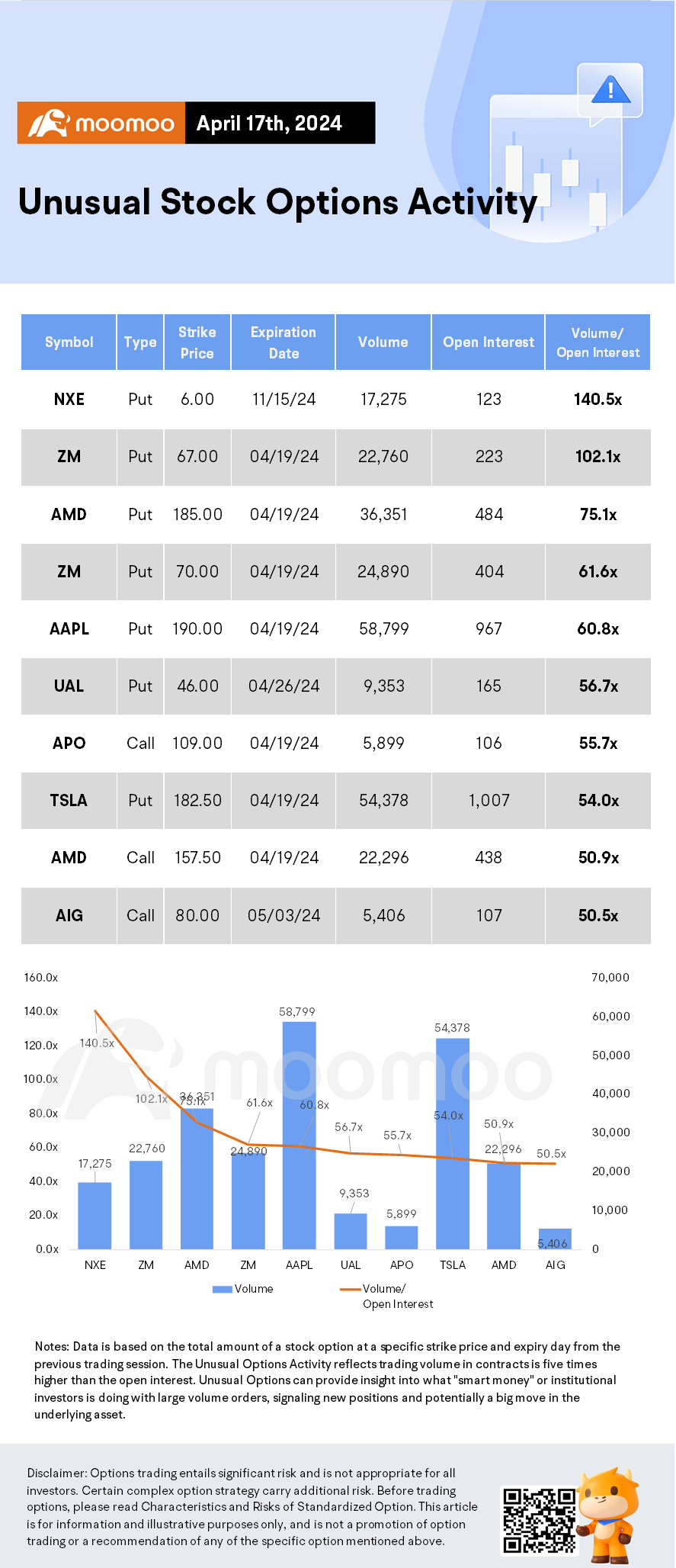

Unusual Stock Options Activity

Some notable put activity is being seen in $NexGen Energy (NXE.US)$, which is primarily being driven by activity on the Nov. 15 put. Volume on this contract is 17,275 versus open interest of 123.

For all the mooers in Singapore, you can now lower your options commssions with our new campaign. Come check the link: US Stock Option.

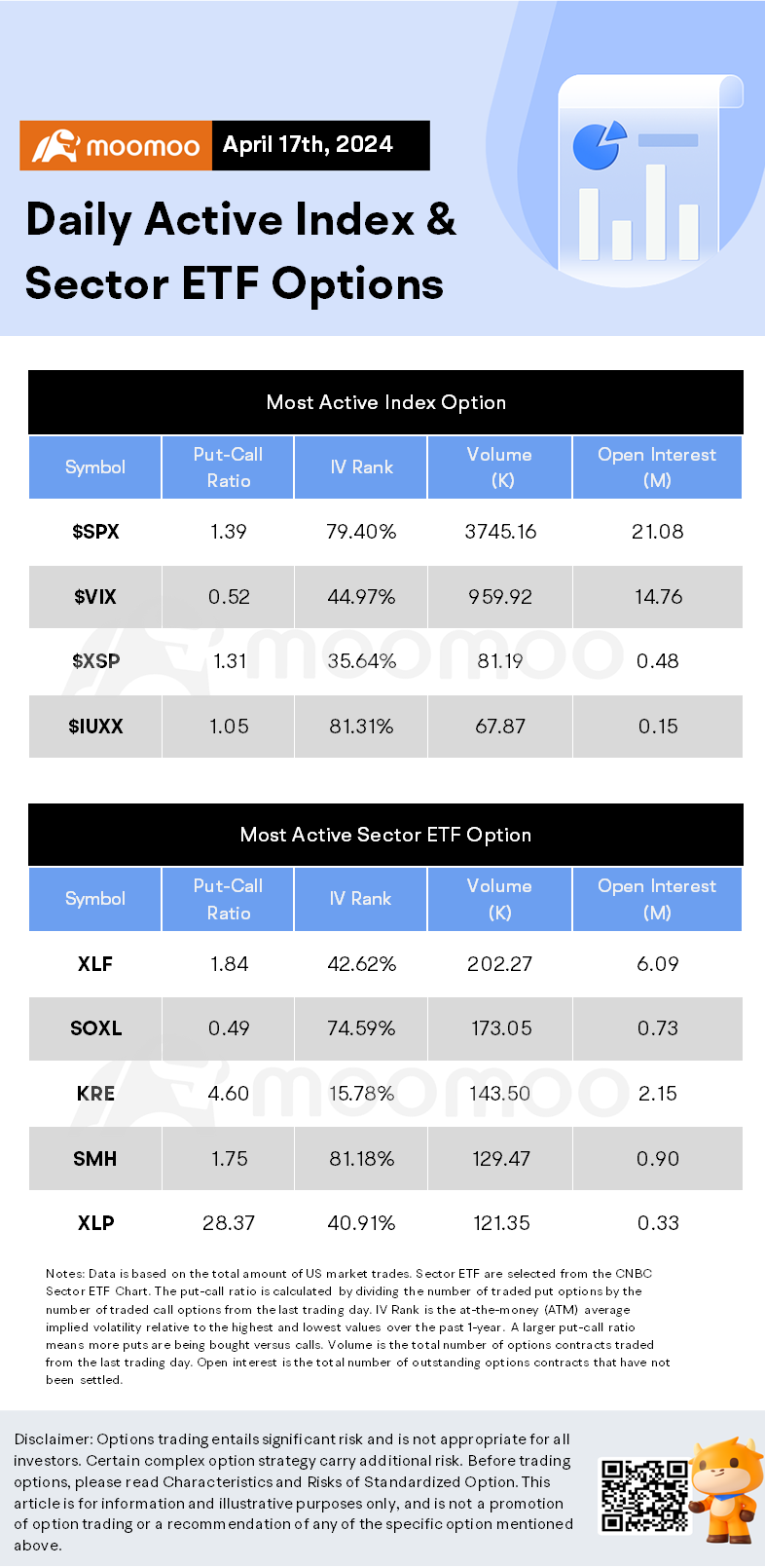

Daily Active Index & Sector ETF Options

Source: Barchart, Unusual Whales, WSJ, Reuters

Disclaimer: Options trading entails significant risk and is not appropriate for all investors. Certain complex option strategy carry additional risk. Before trading options, please read Characteristics and Risks of Standardized Option. This article is for information and illustrative purposes only, and is not a promotion of option trading or a recommendation of any of the specific option mentioned above.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

_Max_ : @Oomarr

ET Rodriguez : wow