Options Market Statistics: Alphabet's Stocks Close at Highest Level Since Early 2022, Options Pop

News Highlights

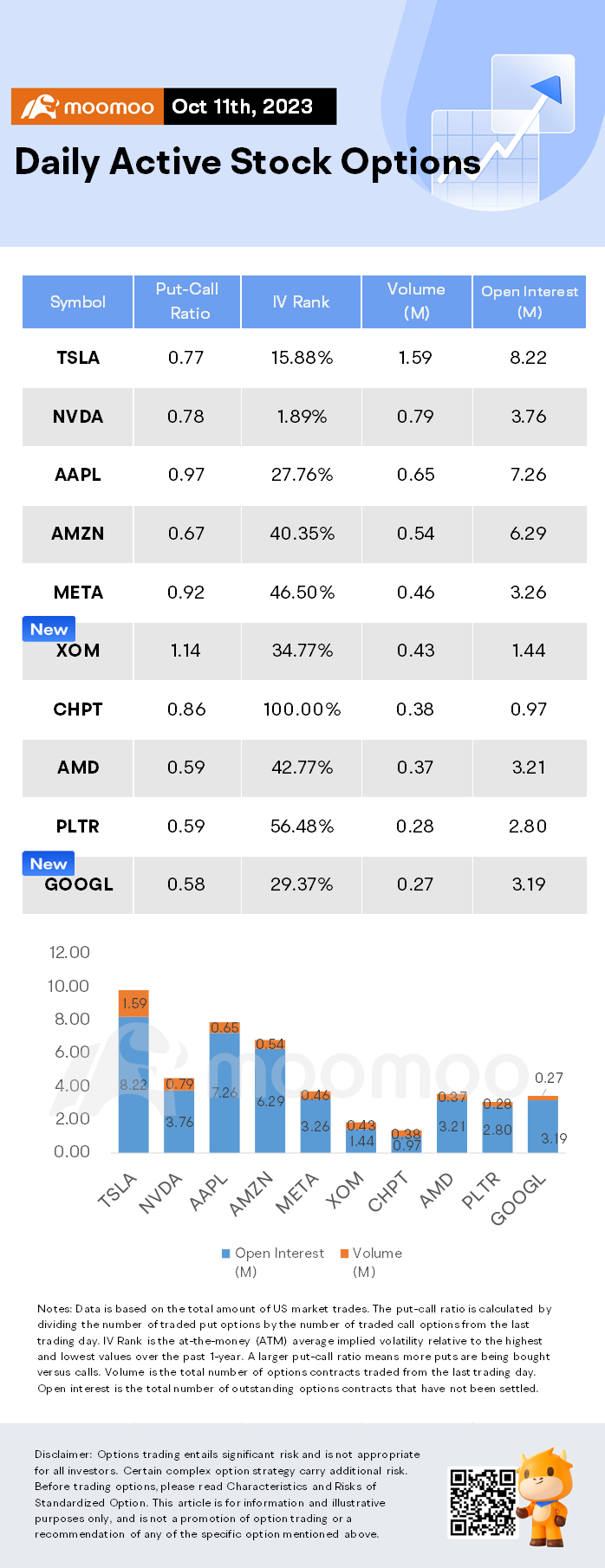

$Tesla (TSLA.US)$ shares fell by 0.24%, closing at $262.99. Its options trading volume is 1.59 million. Call contracts account for 56.5% of the whole trading volume. The most traded calls are contracts of $260 strike price that expire on October 13th. The total volume reaches 85,133 with an open interest of 14,216. The most traded puts are contracts of a $250 strike price that expires on October 13th; the volume is 47,903 contracts with an open interest of 10,843.

Earlier this year, Tesla dove into the world of advertising using Google Ads in the United States and the United Kingdom. The company is now targeting another country with an advertising strategy spotted by a user on Twitter, now known as X. The user showed a video of a video ad from Tesla at the Tokyo Haneda International Airport in Japan. In the video ad, the company's Model Y vehicle is shown along with features like Superchargers, Camp Mode and the Autopilot system, as shared by Teslarati.

After shying away from advertisements, Tesla CEO Elon Musk has shared that the company plans to do "a little advertising," a strategy that generated positive reaction from some analysts and experts who have been suggesting it for years. Japan has a low market share of electric vehicle sales, but it has grown in recent years, including 2022, which saw EV sales triple year-over-year. The Haneda International Airport is one of two that service the Tokyo market and among the top 20 airports by annual passenger traffic. Advertisements in Japan could help grow brand name recognition in the region that has many domestic automakers with a strong market share. The advertisements could also be part of Tesla's overall advertising strategy to expand beyond its loyal fan base in attempts to grow annual sales by 50% going forward.

$Exxon Mobil (XOM.US)$ shares fell by 3.59%, closing at $106.49. Its options trading volume is 0.43 million. Call contracts account for 46.8% of the whole trading volume. The most traded calls are contracts of $115 strike price that expire on October 20th. The total volume reaches 11,899 with an open interest of 22,464. The most traded puts are contracts of a $105 strike price that expires on October 20th; the volume is 7,186 contracts with an open interest of 35,047.

In recent news, Exxon Mobil Corp. is said to be in the midst of finalizing a takeover deal with Pioneer $Pioneer Natural Resources (PXD.US)$. The speculated transaction could see shares of Pioneer being purchased for more than $250 each.

As reported by Bloomberg, the all-stock deal is expected to be announced as early as Wednesday. The deal, if it goes through, would value Pioneer at not less than $58 billion, considering the number of outstanding shares. The Bloomberg source added a note of caution, stating that the final agreement is yet to be finalized and the terms may change or the talks could end without a deal.

$Alphabet-A (GOOGL.US)$ shares rose by 1.80%, closing at $140.55. Its options trading volume is 0.27 million. Call contracts account for 63.3% of the whole trading volume. The most traded calls are contracts of $139 strike price that expire on October 13th. The total volume reaches 9,518 with an open interest of 4,952. The most traded puts are contracts of a $136 strike price that expires on October 13th; the volume is 3,597 contracts with an open interest of 1,456.

Internet stocks Alphabet Inc. logged its highest closes in more than a year as it continued its October rally.

From an industry perspective, we would highlight that [third-quarter] 2023 digital ad trends continue a pattern of improving growth trends that has been a hallmark of the progression [through] 2023," Goldman Sachs's Eric Sheridan said in a note to clients earlier this month. He added that companies generally should see easier comparisons and "steady sequential improvement in brand advertising," among other positive drivers.

As for Alphabet, Piper Sandler analyst Thomas Champion thinks the stock's move will depend on management's commentary on the core search business and progress on cost cuts.

Unusual Stock Options Activity

Some notable put activity is being seen in $Meta Platforms (META.US)$, which is primarily being driven by activity on the October 13th 327.50 put. Volume on this contract is 12,615 versus open interest of 161, so it's likely that nearly all of the volume represents fresh positioning.

Daily Active Index & Sector ETF Options

Source: Benzinga, Dow Jones, CNBC

Disclaimer: Options trading entails significant risk and is not appropriate for all investors. Certain complex option strategy carry additional risk. Before trading options, please read Characteristics and Risks of Standardized Option. This article is for information and illustrative purposes only, and is not a promotion of option trading or a recommendation of any of the specific option mentioned above.

Source: Benzinga, WSJ

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment