Options Market Statistics: Tilray Brands Stock Jumps on DEA Reclassification News, Options Pop

News Highlights

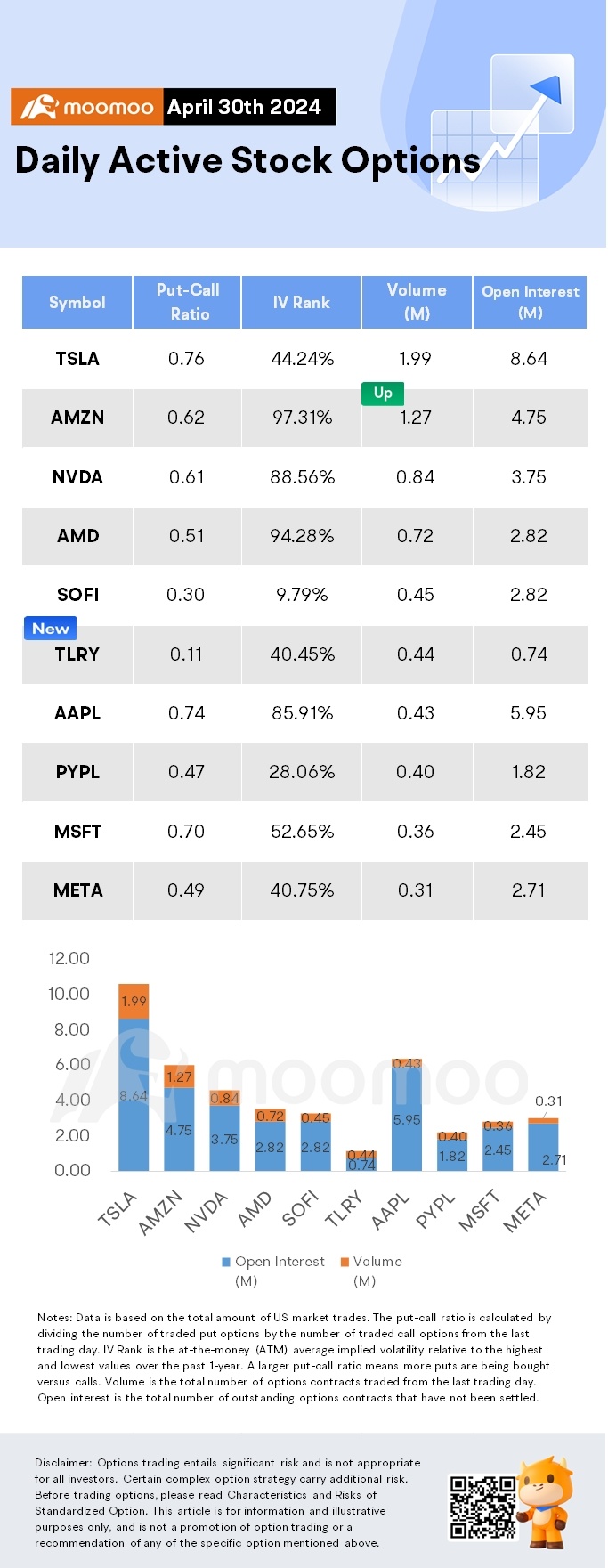

$Amazon (AMZN.US)$ shares fell by 3.29%, closing at $175. Its options trading volume was 1.27 million. Call contracts account for 61.9% of the total trading volume. The most traded calls are contracts of $200 strike price that expire on May 3rd. The total volume reaches 51,932 with an open interest of 21,091. The most traded puts are contracts of a $160 strike price that expires on May 3rd; the volume is 39,574 contracts with an open interest of 8,432.

Amazon's first-quarter revenue rose to $143.3 billion, a 13% increase from the prior year, exceeding analyst predictions. The company's net income soared to $15 billion, more than triple the $3.17 billion reported in the same quarter of 2023.

Amazon Web Services (AWS) experienced a growth spurt with a 17% revenue increase to $25 billion, contributing 62% to Amazon's total operating profit, attributed to a strategic focus on AI, as stated by CEO Andy Jassy. Additionally, Amazon's advertising sales grew by 24% to $11.8 billion, bolstered by expanded advertising efforts, including new ads on Prime Video.

$Tilray Brands (TLRY.US)$ shares surged by 39.55%, closing at $2.47. Its options trading volume was 0.44 million. Call contracts account for 90.1% of the total trading volume. The most traded calls are contracts of $2 strike price that expire on May 3rd. The total volume reaches 71,892 with an open interest of 18,489. The most traded puts are contracts of a $2 strike price that expires on May 3rd; the volume is 8,449 contracts with an open interest of 1,876.

Tilray Brands' stock surged on Tuesday following the announcement by the US Drug Enforcement Administration (DEA) that it is considering downgrading marijuana to a lower drug danger category, marking a potentially groundbreaking development for the cannabis industry.

The investment community has been anticipating the DEA's decision to reassess marijuana's classification, which currently places it alongside substances such as LSD and heroin. A reclassification could eliminate the extra taxes levied on cannabis businesses, which has been a significant financial burden for the sector. The DEA has been evaluating marijuana's status since September, prompted by the Biden administration.

A change in classification is expected not only to reduce taxation on cannabis businesses and improve their cash flows but also to potentially attract more institutional investors to the market, according to Jefferies analyst Owen Bennett in a note on Tuesday.

Unusual Stock Options Activity

There was a noteworthy activity in $Cameco (CCJ.US)$, which is primarily being driven by activity on the Dec 20 Call. The highest volume over open interest ratio reaches 170.4x with nearly 23,174 contracts.

For all the mooers in Singapore, you can now lower your options commssions with our new campaign. Come check the link: US Stock Option.

Daily Active Index & Sector ETF Options

Source: Barchart, Unusual Whales, The Guardian, Bloomberg

Disclaimer: Options trading entails significant risk and is not appropriate for all investors. Certain complex option strategy carry additional risk. Before trading options, please read Characteristics and Risks of Standardized Option. This article is for information and illustrative purposes only, and is not a promotion of option trading or a recommendation of any of the specific option mentioned above.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment