Options Market Statistics: MicroStrategy's $42 Billion Bitcoin Investment Plan Triggers Drop in Stock, Options Pop

News Highlights

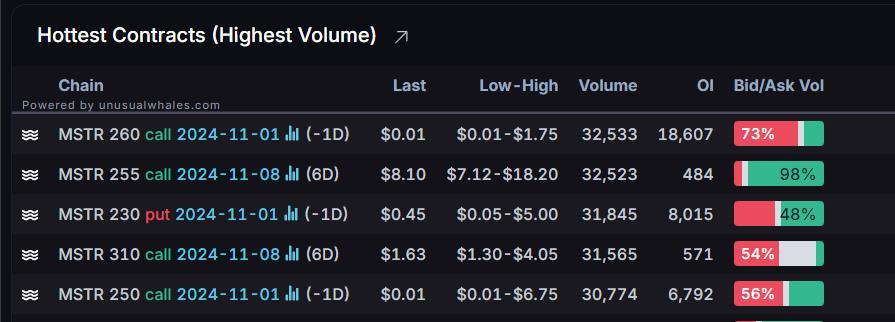

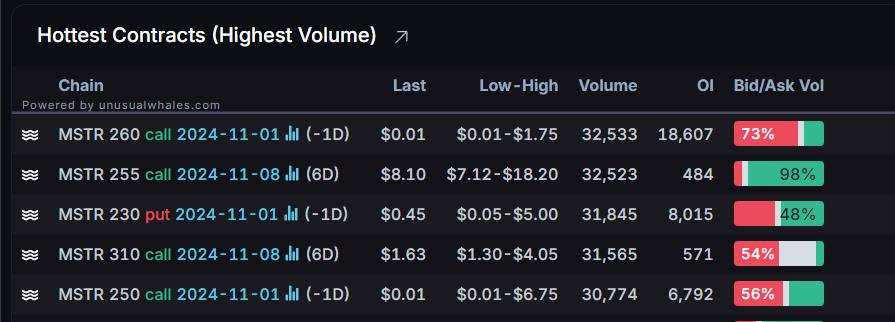

$MicroStrategy (MSTR.US)$ experienced a 6.05% drop in its stock price, closing at $229.71. Its options trading volume is 765K. Call contracts account for 58.8% of the whole trading volume.The most traded calls are contracts of $260 strike price that expire on November 1st.

MicroStrategy announced its third-quarter earnings on Wednesday, revealing a loss of $1.56 per share, falling short of the analyst consensus estimate of 14 cents. The company also reported quarterly sales of $116.071 million, which was 5.37 percent below the analyst consensus estimate of $122.66 million. This represents a 10.34 percent decline compared to sales of $129.462 million during the same period last year.

The company plans to increase its Bitcoin investments by funding additional acquisitions through equity and debt.

$Tesla (TSLA.US)$ Set to Lose Its BEV Crown as BYD Sales Surge in October. Chinese electric vehicle manufacturer BYD reported that its sales of electric vehicles surpassed 500,000 for the first time in October, continuing its impressive growth. As a result, BYD appears poised to reclaim the title of leading battery electric vehicle (BEV) manufacturer from Tesla in the fourth quarter, especially after surpassing Tesla's revenue for the first time in Q3.

Meanwhile, Ark Invest, led by Cathie Wood, made several significant trades, particularly concerning Tesla.

$Amazon (AMZN.US)$ 's stock closed 6% higher on Friday after the company reported third-quarter revenue and earnings per share that exceeded Wall Street's expectations.

On Thursday, Amazon projected its fourth-quarter revenue to be between $181.5 billion and $188.5 billion, while analysts had anticipated revenue of $186.36 billion for the same period. Arun Sundaram, a senior equity research analyst at CFRA, commented, "You've got the ingredients you needed for the stock to go up."

Unusual Stock Options Activity

There was a noteworthy activity in $Amazon (AMZN.US)$ , where $197.5 puts have topped volume to open interest ranking. The highest volume over open interest ratio reaches 115.3x with 16,954 contracts.

Daily Active Index & Sector ETF Options

Source: Barchart, Unusual Whales, The Guardian, Bloomberg

BloombergOption Volume:[Options Notes]Measuring liquidity: two key indicators to check

Call/Put Option:Trade Options: Quickstart Guide

Option Expiration:Trade Options: Quickstart Guide

Implied Volatility Rank:Volatility Analysis: IV, HV, IV Rank, IV Percentile

Disclaimer: Options trading entails significant risk and is not appropriate for all customers. It is important that investors readCharacteristics and Risks of Standardized Options before engaging in any options trading strategies. Opening new options positions close to or on their expiration date comes with substantial risk of losses for reasons that include potential volatility of the underlying security and limited time to expiration. Options transactions are often complex and may involve the potential of losing the entire investment in a relatively short period of time. Certain complex options strategies carry additional risk, including i potential for losses that may exceed the original investment amount. Supporting documentation for any claims, if applicable, will be furnished upon request.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

103827296 : hi I know run stop hey you no understand I don't know mine understand all money you take after you talk I hate bodo

Adrianlim90 : 1

ch LL : what does it mean?

super calls and puts ?

104247826 :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

SharkSouth7 : nice

Zoooi3 :

Laine Ford : billion stock market here

103677010 : noted