Options Market Statistics: Nvidia Stock Rebounds Strongly After Brief Dip, Options Pop

News Highlights

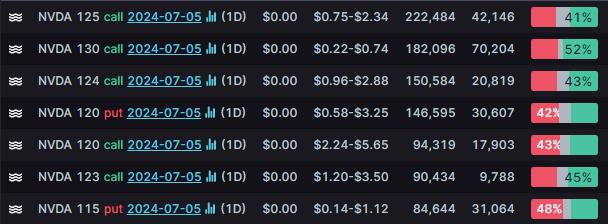

$NVIDIA (NVDA.US)$ ended 4.57% higher. Its options trading volume was 4.27 million. Call contracts account for 66.3% of the total trading volume. The $125 calls expiring July 5 were traded most actively.

Nvidia stock closed Wednesday's shortened session higher. Shares of the artificial intelligence company had shown signs of topping but appears to be getting back on its feet. Despite this, concerns about an AI bubble were raised by strategist Ed Yardeni, who cautioned that AI stocks might be overvalued. Separately, Ken Laudan of Buffalo Funds expressed skepticism about the speed of AI infrastructure development, trimming AI holdings in his fund.

$Tesla (TSLA.US)$ ended 6.54% higher. Its options trading volume was 4.14 million. Call contracts account for 62.4% of the total trading volume. The $200 puts expiring July 5 were traded most actively.

Tesla shares are approaching their highest price of the year as a rally for electric vehicle stocks extended into Wednesday, with several analysts raising price targets for the company after its second-quarter deliveries surpassed expectations.

Bank of America and Wedbush Securities analysts raised their price targets to $260 and $300, respectively, up from previous marks of $220 and $275. J.P. Morgan analysts, however, were less optimistic about the deliveries numbers, maintaining an "underweight" rating and price target of just $115.

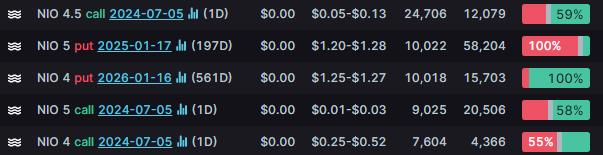

$NIO Inc (NIO.US)$ ended 7.51% higher. Its options trading volume was 0.23 million. Call contracts account for 78.4% of the total trading volume. The $4.5 calls expiring July 5 were traded most actively.

Unusual Stock Options Activity

There was a noteworthy activity in $Tesla (TSLA.US)$, where multiple puts have topped volume to open interest ranking. The highest volume over open interest ratio reaches 598.8x with 77,241 contracts.

Daily Active Index & Sector ETF Options

Source: Barchart, Unusual Whales, The Guardian, Bloomberg

Call/Put Option: Trade Options: Quickstart Guide

Option Expiration: Trade Options: Quickstart Guide

Implied Volatility Rank: Volatility Analysis: IV、HV、IV Rank、IV Percentile

Disclaimer: Options trading entails significant risk and is not appropriate for all investors. Certain complex option strategy carry additional risk.

Before trading options, please read Characteristics and Risks of Standardized Option. This article is for information and illustrative purposes only, and is not a promotion of option trading or a recommendation of any of the specific option mentioned above.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

n0drip : Tsla stole the show