Options Market Statistics: Salesforce Stock Tanks On Weak Guidance, Options Pop

News Highlights

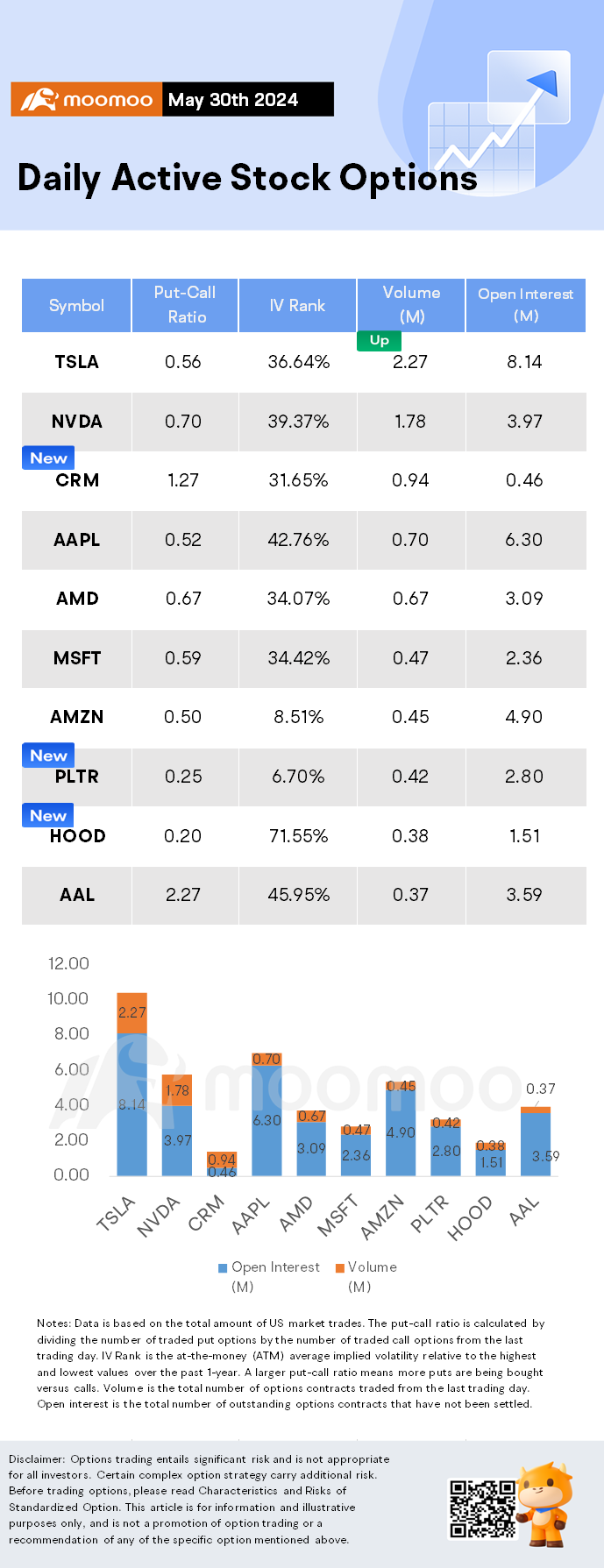

$Tesla (TSLA.US)$ shares ended 1.48% higher. Its options trading volume was 2.27 million. Call contracts account for 64% of the total trading volume. The $180 calls expiring May 31 were traded most actively.

Tesla wrote a detailed letter to shareholders on Wednesday, responding to a report by proxy advisory firm Glass Lewis on Musk's 2018 pay package, which remains under dispute six years after it was originally agreed on. The investor group on Saturday released a report saying Musk's pay deal is "excessive" and cited the "dilutive impact" on current shareholders. Glass Lewis also opposed Tesla's proposal to reincorporate in Texas from Delaware.

$Salesforce (CRM.US)$ shares ended 19.74% lower. Its options trading volume was 0.94 million. Call contracts account for 44% of the total trading volume. The $280 calls expiring May 31 were traded most actively.

With software stocks already struggling, Salesforce reported first-quarter earnings that topped estimates while revenue missed. July-quarter revenue guidance for Salesforce stock came in well below expectations. Shares plunged as investors await a boost from artificial intelligence products.

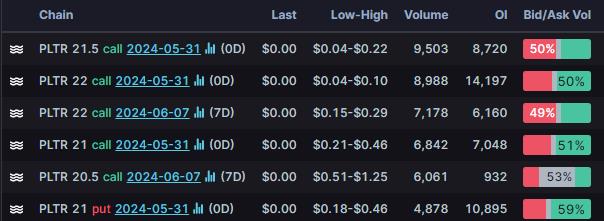

$Palantir (PLTR.US)$ shares ended 3.77% higher. Its options trading volume was 0.42 million. Call contracts account for 80% of the total trading volume. The $21.5 calls expiring May 31 were traded most actively.

Unusual Stock Options Activity

There was a noteworthy activity in $Salesforce (CRM.US)$, where multiple puts have topped volume to open interest ranking. The highest volume over open interest ratio reaches 129.8x with nearly 33,624 contracts.

For all the mooers in Singapore, you can now lower your options commssions with our new campaign. Come check the link: US Stock Option.

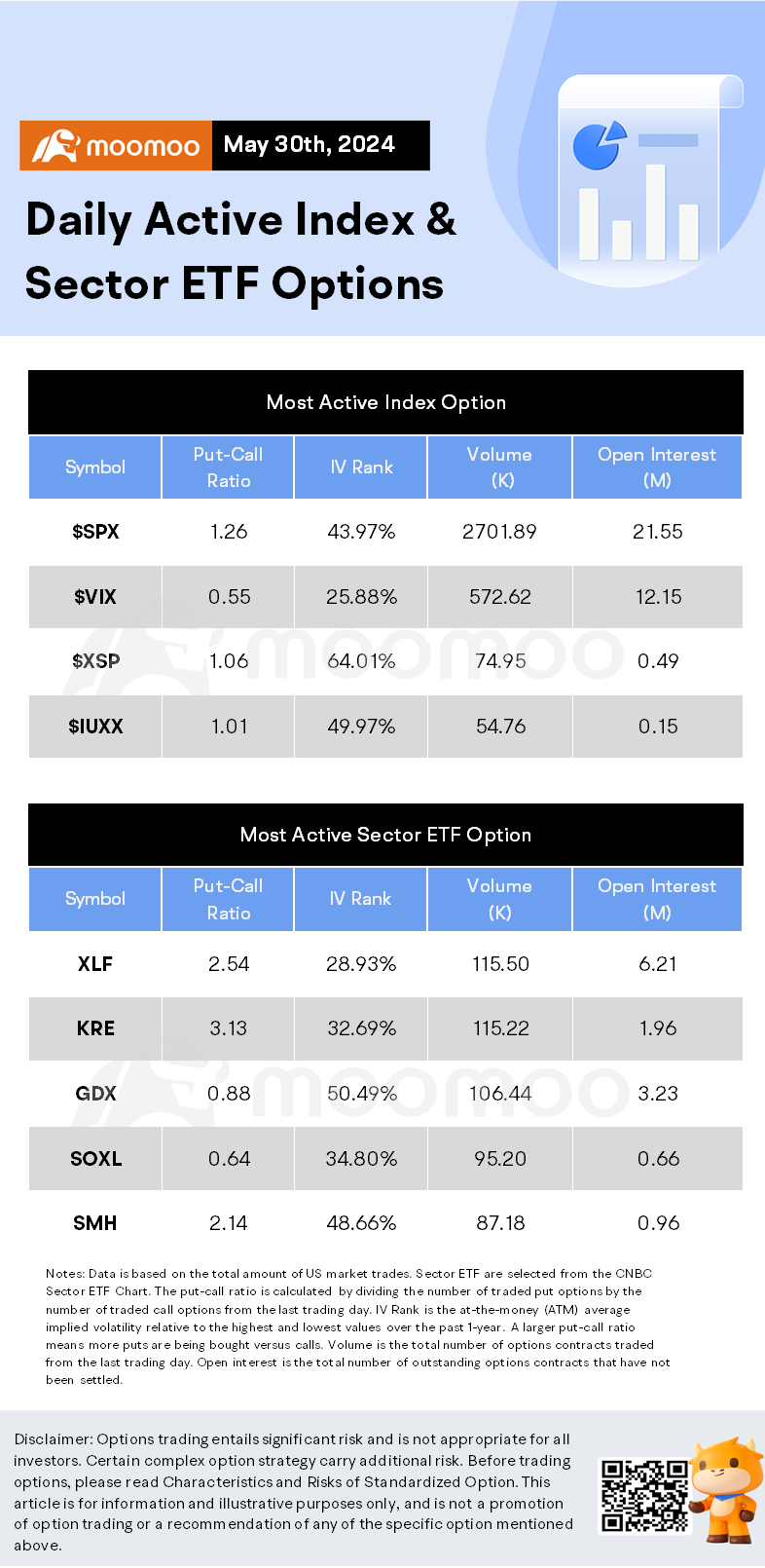

Daily Active Index & Sector ETF Options

Source: Barchart, Unusual Whales, The Guardian, Bloomberg

Having trouble understanding the concepts of options trading? Check out these beginner-friendly guides:

Call/Put Option: Trade Options: Quickstart Guide

Option Expiration: Trade Options: Quickstart Guide

Implied Volatility Rank: Volatility Analysis: IV、HV、IV Rank、IV Percentile

Disclaimer: Options trading entails significant risk and is not appropriate for all investors. Certain complex option strategy carry additional risk. Before trading options, please read Characteristics and Risks of Standardized Option. This article is for information and illustrative purposes only, and is not a promotion of option trading or a recommendation of any of the specific option mentioned above.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

money maker 666 :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

josh168 :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

ianxue : Crm options discussion

HouJr :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

ianxue HouJr : I![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

ianxue : Cool option discussion