Options Market Statistics: SoFi Stock Rallies Amid Speculation of Deregulation in a Second Trump Term; Options Pop

News Highlights

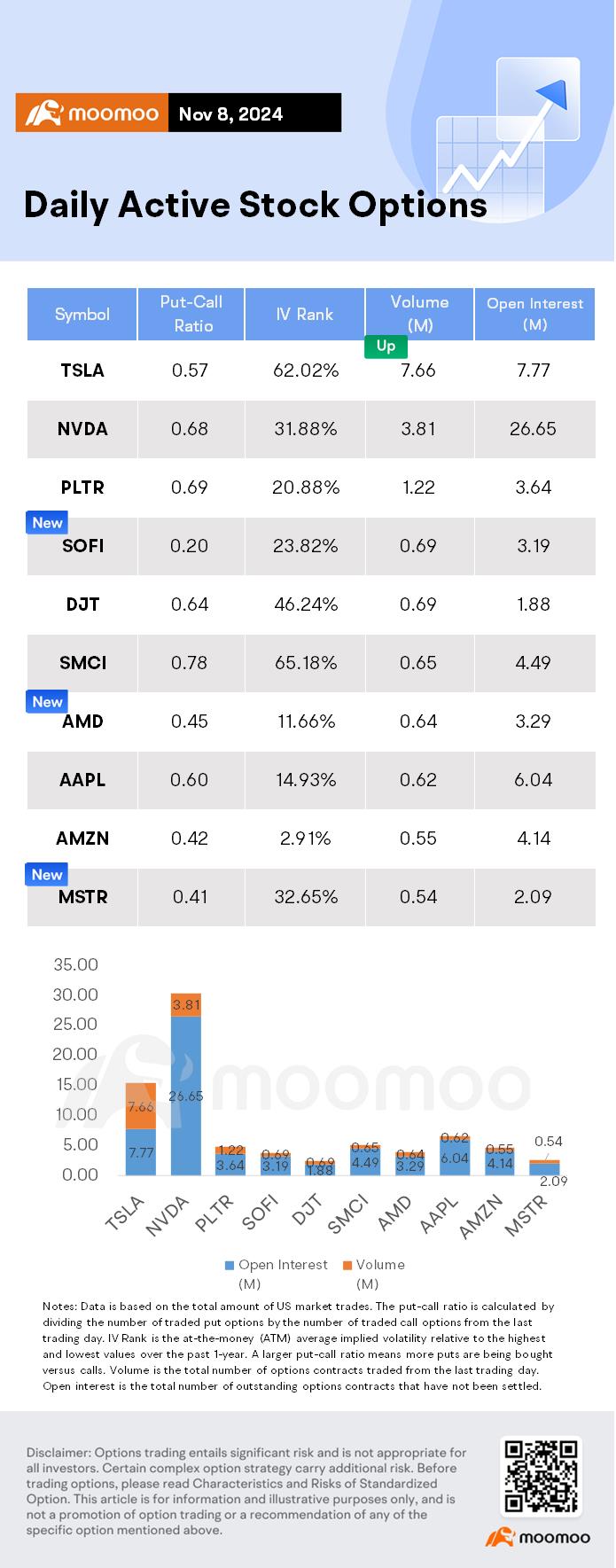

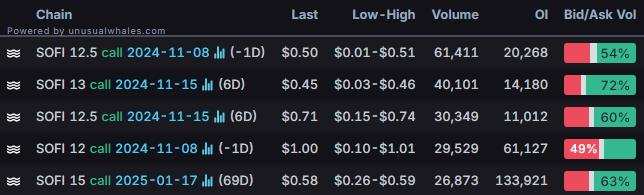

1. $SoFi Technologies (SOFI.US)$'s stock has soared 17% this week, fueled by investor optimism for potential deregulation with a possible second Trump administration. Trading volumes surged, closing the day with a robust gain of over 9%. The options market was notably active, with a volume of 689.57k contracts, where calls constituted 83.1% of the activity. The most traded calls are contracts of $12.5 strike price that expire on November 08. The total volume reaches 61,411 with an open interest of 20,268.

2. $Tesla (TSLA.US)$ shares continued their upward trajectory on Friday, climbing an additional 8.19% to close at $321.2. The trading session was marked by substantial options activity, with a volume of 7.66 million contracts, of which 63.8% were calls. The most actively traded options were the $320 calls set to expire on November 08.

Since Tuesday, Tesla's stock has climbed by 30%, pushing its market valuation beyond the $1 trillion mark. The significant uptick in Tesla shares occurred after Donald Trump secured the presidential election. Tesla's CEO, Elon Musk, frequently accompanied Trump during his campaign and is rumored to possibly secure a role in Trump's administration. Investors are optimistic about Trump's policies on electric vehicles (EVs) and tariffs, which are perceived to favor the U.S.-based electric vehicle leader by potentially curtailing competition.

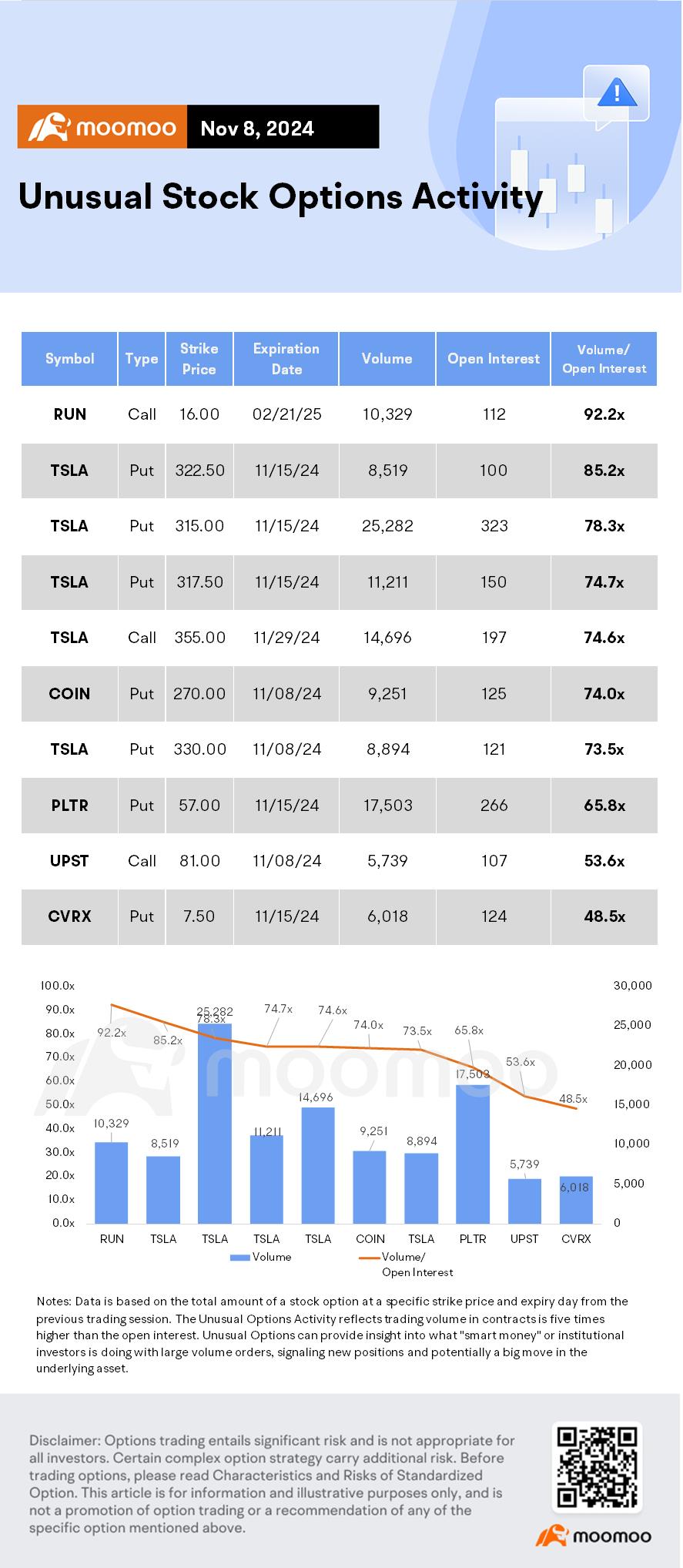

Unusual Stock Options Activity

There was a noteworthy activity in $Sunrun (RUN.US)$, with $16.00 calls topping the highest volume to open interest ranking. The highest volume over open interest ratio reaches 92.2x with 10,329 contracts.

Daily Active Index & Sector ETF Options

Source: Barchart, Unusual Whales, The Guardian, Bloomberg, MarketWatch

BloombergOption Volume: [Options Notes]Measuring liquidity: two key indicators to check

Call/Put Option: Trade Options: Quickstart Guide

Option Expiration: Trade Options: Quickstart Guide

Implied Volatility Rank: Volatility Analysis: IV, HV, IV Rank, IV Percentile

Disclaimer: Options trading entails significant risk and is not appropriate for all customers. It is important that investors read Characteristics and Risks of Standardized Optionsbefore engaging in any options trading strategies. Opening new options positions close to or on their expiration date comes with substantial risk of losses for reasons that include potential volatility of the underlying security and limited time to expiration. Options transactions are often complex and may involve the potential of losing the entire investment in a relatively short period of time. Certain complex options strategies carry additional risk, including i potential for losses that may exceed the original investment amount. Supporting documentation for any claims, if applicable, will be furnished upon request.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

NoDragonsPlz : Tesla will make the moon

AL MALIK PAIZA : Tesla a model for serious response treadmill isn't available support during close profits income

Edmond low : Ok

105417756 : good

Travy-AL : Good information here thanks

101550592 :

103677010 : noted

104247826 :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

54088 FROM MBS : 3299

103826785 : ok

View more comments...