PDD Sees Bulls Pour Millions of Dollars Into Call Options After Tepper Boosts Stake

$PDD Holdings (PDD.US)$ saw bulls pour millions of dollars into call options after billionaire David Tepper's Appaloosa Management boosted its stake in the parent company of online retailer Temu.

Appaloosa added 3.36 million PDD American depositary receipts to its portfolio, taking its stake in the company to 456.7 million ADRs as of Sept. 30, according to Bloomberg data from the investment firm's 13F filing with the Securities and Exchange Commission. That position was valued at $714.5 million.

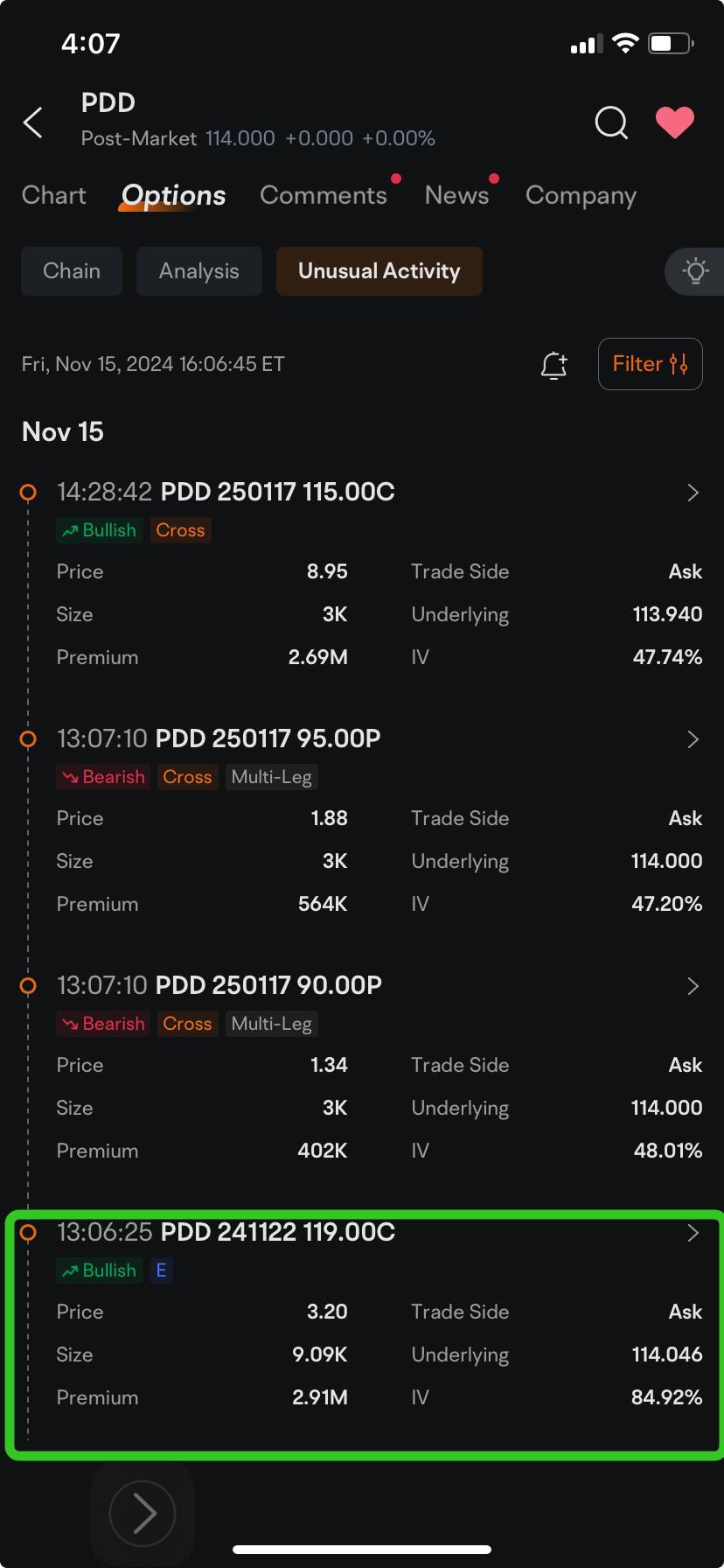

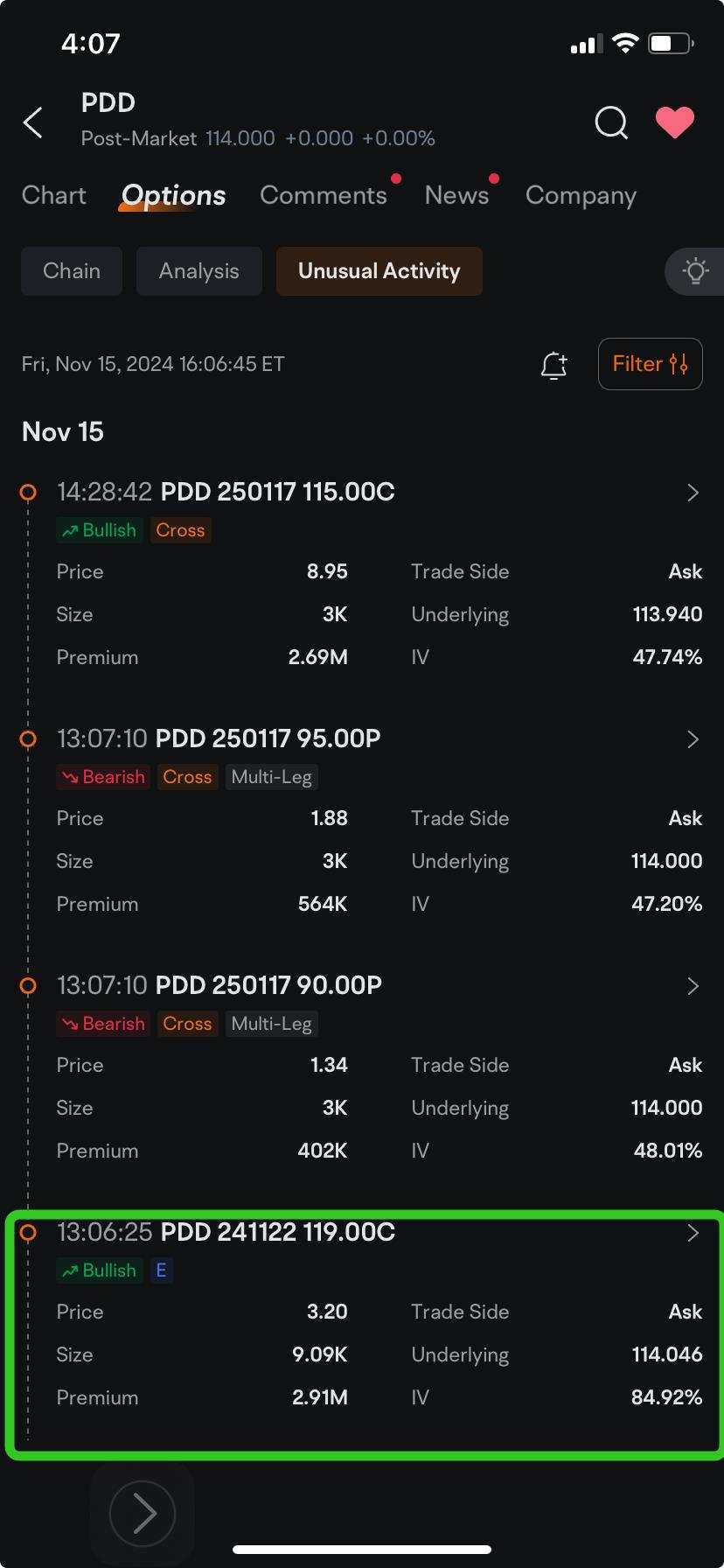

On Friday afternoon an active buyer paid a $2.91 million premium for call options that gives the holders the right to buy 909,400 PDD ADRs at $119 each by the end of next week. That's the biggest, unusual options trade posted that day.

In early May, PDD climbed to the highest since 2021 on optimism that China's stimulus could help accelerate the Asian country's economic recovery. That rally fizzled amid investor worries that the measures won't be enough to bolster growth.

On Friday, the ADRs rose 1.7% after government data showed China retail sales grew 4.8% in October, fueling optimism that the stimulus are starting to boost consumer confidence. That's the fastest pace of growth in retail sales in eight months, surpassing all the forecasts of economists, according to Bloomberg.

Even technical indicators tracked by moomoo are leaning positive on PDD. Eleven of 15 technical indicators tracked by moomoo are signaling that the stock is still oversold and the trend could be turning bullish.

Another unusual trade posted Friday afternoon was for $2.69 million in premium paid for call options that gives the holders the right to buy 300,000 PDD ADRs at $115 by Jan. 15, 2025, exchange data tracked by moomoo showed.

The positive sentiment seen in the ADR's price contrasts with the latest capital trend data tracked by moomoo. Outflows outpaced inflows by $25 million, the latest exchange data show.

Even Bloomberg's aggregated data on positions held by hedge funds, pension funds, sovereign wealth funds and other institutional investors showed a net reduction in their combined holdings in PDD by 9.16 million ADRs.

The total was based on 7,402 13F filings submitted to the Securities and Exchange Commission and tallied by Bloomberg as of 3:46 p.m. Friday. Still, their combined holdings stood at 525 million PDD ADRs, valued as of Sept. 30 at $50.2 billion.

Still, the institutional investors that hold the biggest stake in the company continued to boost their holdings, data showed.

Share your thoughts on PDD and other Chinese stocks in the comments section. And if you have a price forecast, please vote below.

Options trading entails significant risk and is not appropriate for all customers. It is important that investors read Characteristics and Risks of Standardized Options before engaging in any options trading strategies. Options transactions are often complex and may involve the potential of losing the entire investment in a relatively short period of time. Certain complex options strategies carry additional risk, including the potential for losses that may exceed the original investment amount. Supporting documentation for any claims, if applicable, will be furnished upon request. Moomoo does not guarantee favorable investment outcomes. The past performance of a security or financial product does not guarantee future results or returns. Customers should consider their investment objectives and risks carefully before investing in options. Because of the importance of tax considerations to all options transactions, the customer considering options should consult their tax advisor as to how taxes affect the outcome of each options strategy. All company analysis information is provided by third parties and not by Moomoo Financial Inc. Any illustrations, scenarios, or specific securities referenced herein are strictly for informational purposes and is not a recommendation. Past investment performance does not guarantee future results. Investing involves risk and the potential to lose principal. This content is also not a research report and is not intended to serve as the basis for any investment decision. The information contained in this article does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Furthermore, there is no guarantee that any statements, estimates, price targets, opinions or forecasts provided herein will prove to be correct.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

Daily Investors : Tommorow im taking the whole day for my research. Ill check this out, and Ill send you a msg on what I get. We all have our tricks, but sometimes I have eyes to where there are none.

sunwu79 :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

103677010 : noted

Adrianlim90 : 1

104476495 : h

88KTI : Maintained as it where is![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

54088 FROM MBS : 3299

Foodie Investor Daily Investors : Pls share your findings on moomoo

103356238jenny tan :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

104028868 : Mark

View more comments...