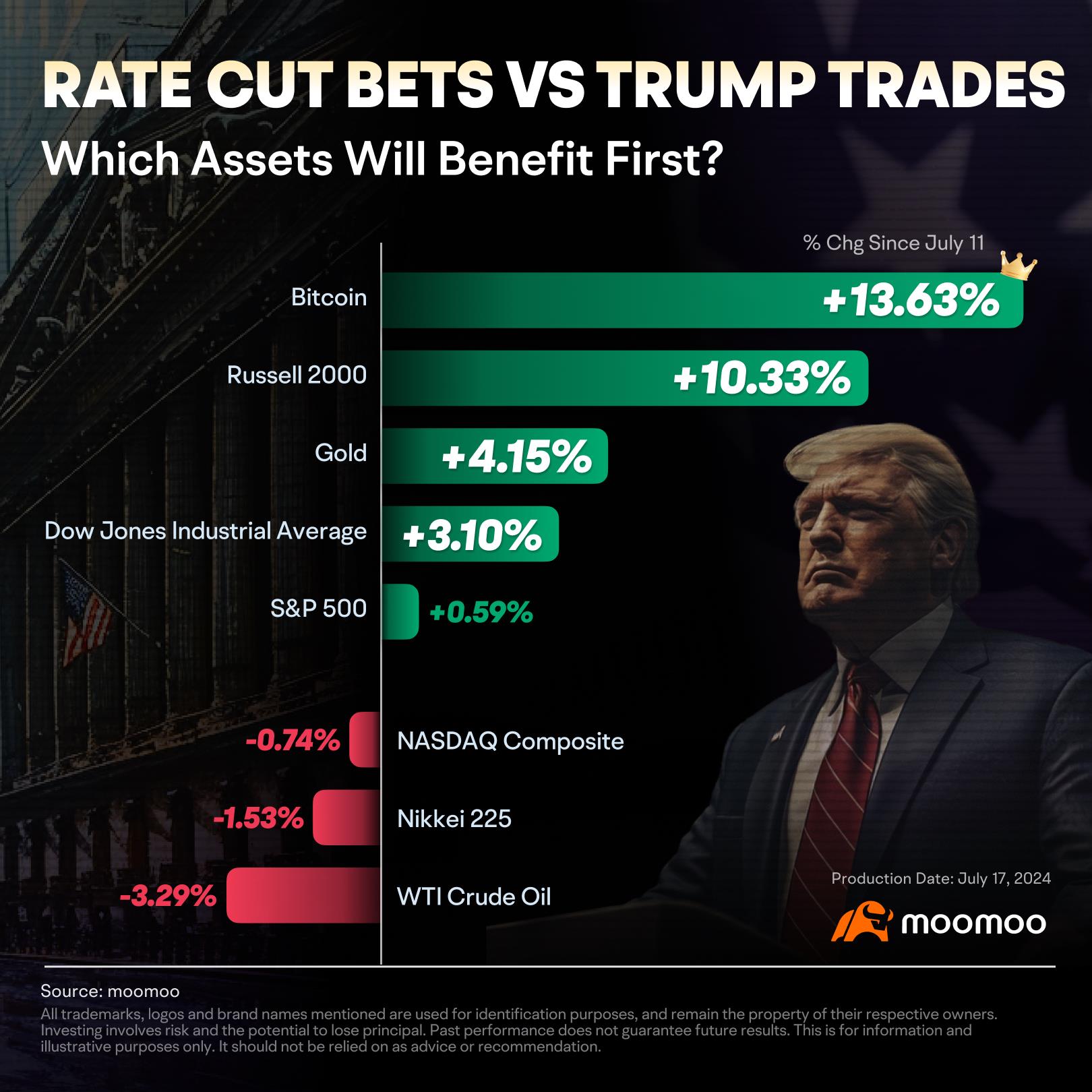

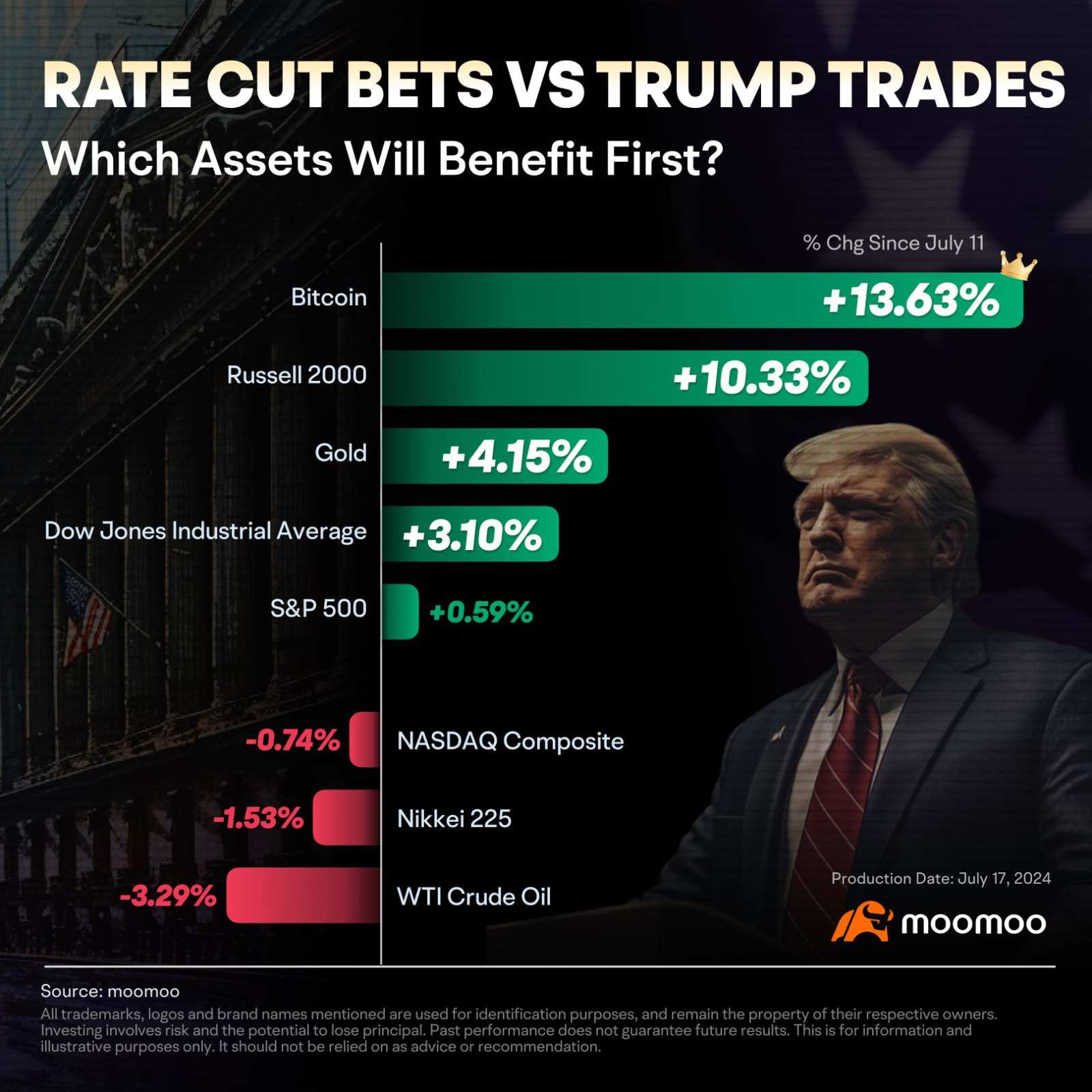

Rate Cut Bets vs. Trump Trades: Key Assets to Watch in the Hottest Trades Now

Following an unexpected cooling of US CPI data last week and recent dovish speeches by Fed officials, the market's anticipation of a rate cut has further intensified, with traders now pricing in a 100% chance of a Fed rate cut in September, according to CME Fedwatch tool. Furthermore, Trump's chances of winning the election have continued to lead after the first presidential debate and a shooting incident, with the latest probability being about 70%. Consequently, "rate cut trades" and "Trump trades" have emerged as the most popular trading themes currently.

Investors are closely monitoring which assets will be the first to benefit under these two trading themes and what opportunities are arising.

In Rate Cut Bets and Trump Trades, the market is betting on a broader rise and shifting its focus from large technology stocks to other previously lagging areas. Both the Dow Jones Industrial Average and Russell Small Cap stocks have risen for five consecutive days, with the Dow Jones reaching a new historical high on Tuesday, up more than 1.8%, and the Small Cap index jumping 3.5%, rising more than 1% for five consecutive days, with a cumulative increase of 11.5%, significantly outperforming the S&P 500 during the same period, marking the largest five-day gap between the two since 1986.

● Small-Cap Stocks Make a Strong Comeback:

The interest rate cut has boosted hopes for economic recovery, while Trump's tax cuts and "America First" policies further stimulate the profitability expectations of domestic businesses, especially small and medium-sized enterprises.

"U.S. Elections will trigger frequent rotation trades as Trump 2.0 potential policies are positive for the breadth trade," according to Société Générale's Kabra.

1)This shift in focus from certainty to flexibility has allowed small-cap stocks, which previously faced challenges in their operations, to exhibit greater elasticity in both profitability and valuation, as they are more sensitive to economic fluctuations and market sentiment.

2)The optimistic outlook for small-cap stocks is supported by Wall Street's upward revisions of their earnings, as RBC Capital Markets strategist Lori Calvasina notes that the $Russell 2000 Index (.RUT.US)$'s earnings and revenue growth forecasts are catching up with the $S&P 500 Index (.SPX.US)$.

3)Additionally, small-cap stocks have lagged behind large-cap stocks for a long time, which means they now have more attractive valuation levels.

4)On the other hand, the increase in short squeeze pressure resulting from the surge in rate cut expectations has added to the risk of short selling and short coveringby hedge funds and traders who held record short positions in small-cap stocks prior to the release of last week's CPI report.

5)Another positive signal is the surge in demand for Russell 2000-related call options in the options market.

Fundstrat's Tom Lee expects that the interest rate cut green light will sustain the small-cap stock rally for about 10 weeks, with a rebound strength that could reach 40%, even surpassing the 27% in the fourth quarter of last year, as institutional short positions are larger this time.

● The Dow also performed well:

When looking at interest rate cuts from a trading perspective,historically the $Dow Jones Industrial Average (.DJI.US)$ has had a higher likelihood of outperforming the $Nasdaq Composite Index (.IXIC.US)$ during rate cut cycles, with strong average performance. Out of the 13 previous rate cut cycles, the Dow Jones has outperformed the Nasdaq 8 times, with an average return of 13.5%, compared to the Nasdaq's 9.5%.

From the perspective of the "Trump trade 2.0 ", Trump's support for traditional energy and the repatriation of manufacturing to the United States, as well as his expansionary policy package, are favorable to traditional industries such as oil, natural gas, infrastructure and manufacturing, as well as finance. This also provides some logical support for the rise of the $Dow Jones Industrial Average (.DJI.US)$. In fact, looking back at the performance of the $Dow Jones Industrial Average (.DJI.US)$ relative to other major indices after Trump's victory in 2016, it was also impressive.

Moreover, the seesaw effect of the Dow and Nasdaq may also be a contributing factor, as funds that have taken profits from technology stocks are flowing into traditional value and cyclical stocks in search of opportunities.

● Real estate, industrial and other sectors performed outstandingly

In terms of sector performance, only Information Technology and Communication Services in the S&P 500 have fallen in the past week, while other sectors have shown an upward trend. Real Estate, Industrials, Financials, Materials, Energy, and Health Care have all risen by more than 3% in the past week.

It is worth noting that the regional banks, biotech, and real estate sectors have benefited significantly from the expectation of interest rate cuts, as they are sensitive to interest rates. These sectors have seen an impressive uptrend recently.

Meanwhile, the industrial sector surged over 2.5% on Tuesday, breaking out of several months of consolidation, as the expectation of manufacturing returning to the US has boosted this sector. This marks the largest single-day increase in the past year.

As the September rate cut approaches, the short-term US Treasury yields have significantly declined, with the $U.S. 2-Year Treasury Notes Yield (US2Y.BD)$, which are more sensitive to monetary policies, dropping nearly 30bps in July. Meanwhile, the market's expectation of higher US inflation and increased fiscal pressure due to Trump's policies, such as manufacturing repatriation, tax cuts, tariffs, and immigration tightening, has limited the extent of the decline in $U.S. 10-Year Treasury Notes Yield (US10Y.BD)$ . This has made the steepening trade (buying short-term bonds and selling long-term bonds) in the US Treasury yield curve a relatively certain direction for investors.

Indeed, as shown in the graph below, as Trump's election probability increased, the inverted yield curve of US Treasury yields became steeper, with the yield spread between the 2-year and 10-year bonds significantly narrowing.

Gold has become another area where "election trading" and "rate-cut trading" intersect. After a 2% increase in main gold futures on Wednesday, gold continued to rise today and reached a historical high of 2487.4.

In the short term, the interest rate cut has led to an increase in bullish expectations for gold by lowering the real interest rate. At the same time, the uncertainty of the US presidential election and geopolitical instability have significantly enhanced gold's safe-haven properties. According to a Reuters/Ipsos poll, concerns about political violence after the November 5th election have been increasing among US voters since Trump's attack, with about 84% of voters expressing fear that extremists will engage in violent behavior after the election.

Looking at a longer time frame, Trump's policy mix, including income tax cuts and increased fiscal spending, has raised concerns about a more serious US fiscal deficit and debt increase, which has put pressure on the US dollar credit system and also favored gold.

Citigroup expects gold prices to range between $2,700 and $3,000 per ounce by 2025, while Bank of America predicts that gold prices may reach $3,000 per ounce in the next 12 to 18 months.

The current logic behind Bitcoin's upward trend appears to be well-supported, whether it is due to the boost in valuation of risk assets from interest rate cuts, the digital gold's safe-haven properties, or Trump and his Vice Presidential candidate Vance's lenient attitude towards financial regulation and embrace of digital currencies. In the medium to long-term, Trump's fiscal stimulus policies are also favorable for Bitcoin's narrative of hedging against currency over-issuance and risk.

The Republican Party's latest campaign manifesto mentions that if Trump is elected, he will end the crackdown on cryptocurrencies. Furthermore, despite his recent injury, Trump plans to personally speak at a Bitcoin conference in Nashville later this month. His running mate, Vance, is also known for his support of digital currencies and related assets such as Bitcoin ETFs. All of these factors have boosted sentiment in the crypto market.

Since the beginning of the month, Bitcoin has rebounded strongly, quickly returning above $65,000 from its low point of $53,219 on July 5th.

Source: Bloomberg, moomoo, CNBC

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

KingNY-Life : Nice , Xiaobian worked hard

, Xiaobian worked hard

White_Shadow :

Goodjobguys : Just because that 1 person… create a major swift in the stock market and cause major losses for a lot of investors. And, that person might not even “win”!

只赚能力内的钱 Goodjobguys : We must take risks. Big tech stocks were originally high and needed to be adjusted, but now there is so much uncertainty, buying gold, BT, and Russell 2000.

Goodjobguys : All stocks are done, not just tech stocks!

101775147 AL alfijai : I want a lot of money. 99999999999.00

71252701 : if Trump wins expect $CoreCivic, Inc. (CXW.US)$ and $The GEO Group Inc (GEO.US)$ to gain substantially due to increased detentions.