September Curse Repeating? Analysts Warn of Downside Risks in U.S. Stocks

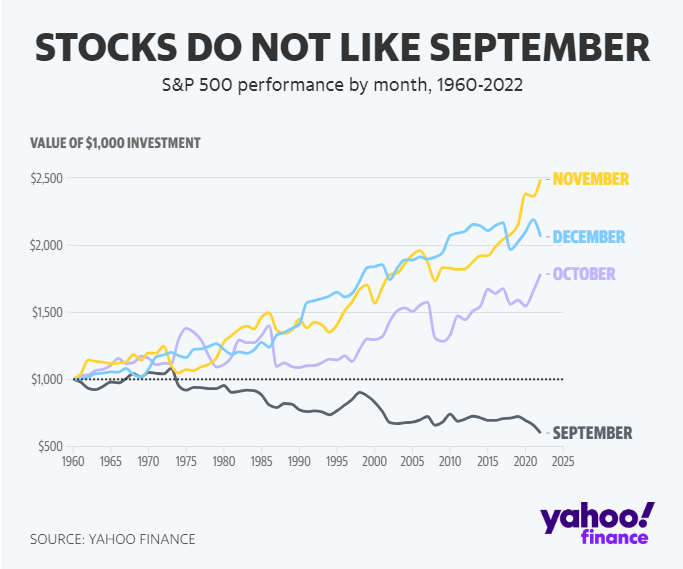

During the past month of August, the performance of U.S. stocks turned lackluster, as the $S&P 500 Index (.SPX.US)$ ended its five-month winning streak by closing down 1.77%. Historical trends reveal that September is typically a weak month for the U.S. stock market, leading some analysts to warn of the potential arrival of the so-called "September Curse." They also recommend some investment strategies to mitigate risks during this period.

1. U.S. Stocks Are Expensive Now

The $S&P 500 Index (.SPX.US)$ has rallied 17.61% this year, with companies within the index trading at approximately 19 times their next 12 months' estimated earnings. According to FactSet, this multiple is higher than the start-of-year figure of roughly 16.8x and the 10-year average of 17.7x. Furthermore, JPMorgan Strategists warned that U.S. stocks appear particularly expensive given the rising real interest rates as equity valuations have diverged from the higher real yields.

2. Lack of New Themes to Fuel the Market While AI's Market Boost Fades

Following the early-year surge led by AI and big tech stocks, U.S. equities are currently lacking a new theme to reignite market sentiment. At the same time, investor faith in AI appears to decline as they recognize that good news and results have already been priced in.

Morgan Stanley's Wilson recently stated, "Markets top on good news, and they bottom on bad news; I can't think of any better news than what we got from that company ( $NVIDIA (NVDA.US)$). The failed boost is another negative technical signal that the rally is exhausted.

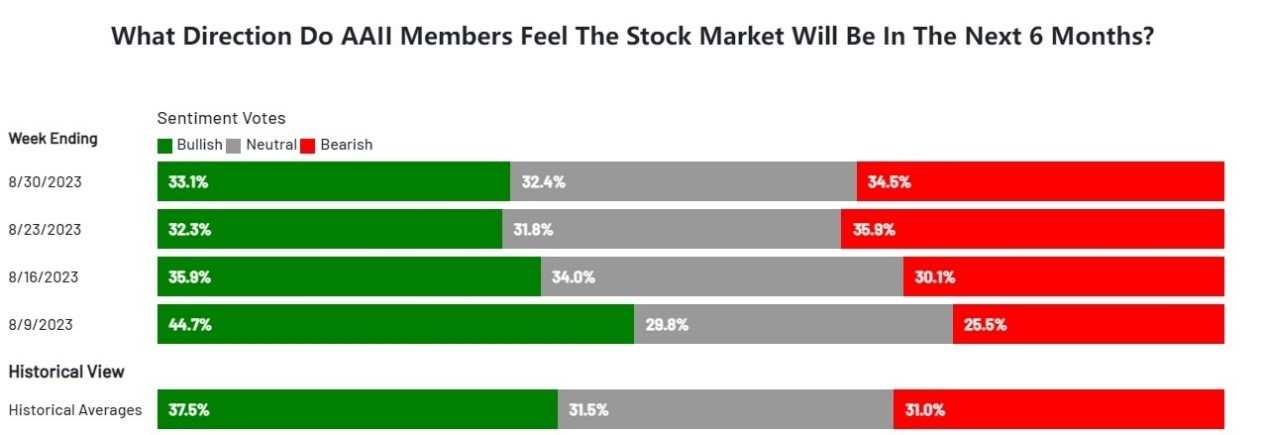

3. Market Anxiety Is Growing: Individual Investors Were More Cautious While Institutional Investors Began to Cash in on Their Gains.

According to the latest American Association of Individual Investors survey, bearish sentiment – indicating the anticipation of market decline over the next six months – rose to 34.5% for the week ending August 30th. This marks a second consecutive weekly increase after 11 weeks of readings below the historical average of 31%.

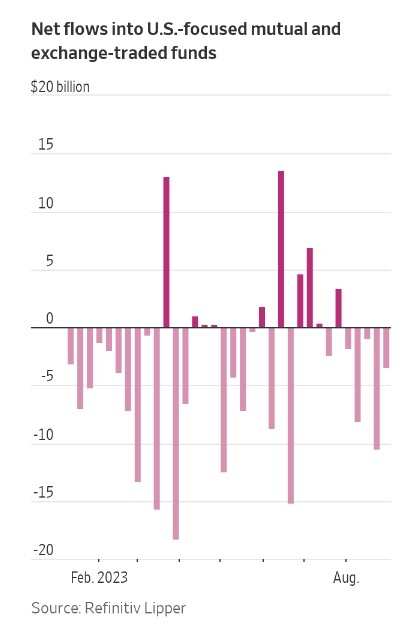

Additionally, Refinitiv Lipper Data reveals that institutional investors are taking profits by withdrawing funds from U.S.-focused equity mutual and exchange-traded funds for five consecutive weeks. This marks the longest outflow since the regional banking crisis in mid-March.

4. Uncertain Economic Outlook and Fed Policy

After a recent wave of economic data releases, an increasing number of economists anticipate a soft landing for the economy and believe that the urgency for the Fed to raise rates throughout the year has diminished. However, if these expectations are contradicted, non-negligible risks such as the negative impact of a recession on corporate earnings, and high interest rates' effect on the valuation of risky assets such as equities could pose significant threats to the market.

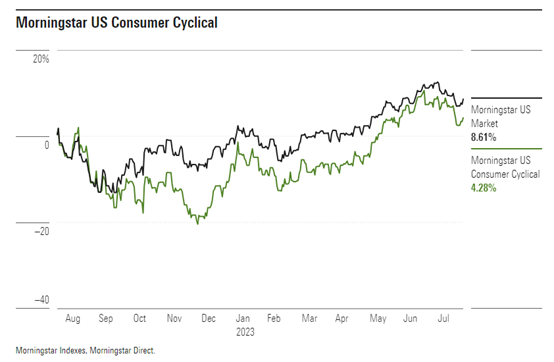

According to Morningstar's team of equity analysts, despite unfavorable macroeconomic conditions and near-term uncertainty, there are still ample investment opportunities in U.S. stocks, particularly in consumer cyclical stocks. As of August 24th, Morningstar's U.S. Consumer Cyclical Index had risen by 28.1% year-to-date, outperforming the Morningstar U.S. Market Index by 11.7%. Several fundamentally strong consumer stocks, including $Nike (NKE.US)$ , $Harley-Davidson (HOG.US)$ , $Polaris (PII.US)$ , $Etsy Inc (ETSY.US)$ , and others, are currently trading at very low valuations, indicating significant upside potential for these stocks.

Moreover, many institutional investors may also consider purchasing U.S. Treasuries to capitalize on attractive yields when interest rates are hovering at historically high levels.

As Jeff Rosenberg of BlackRock Inc. said, policy-sensitive 2-year Treasuries have become a "screaming buy."

Source: The Wall Street Journal, Bloomberg, Yahoo Finance, Morningstar

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

ccc7 : September Spell

Ishah : September is harvest time...you sow corruption all year long and engage in debauchery that summer... September you reap what you sown...

Ishah : You reap what you sow...