Shopify Joins Nvidia, Tesla in Top Options List as Bulls Pour Millions Into Calls

(This is a repeat of a column that was erroneously published only in the Canadian channel earlier Tuesday.)

$Shopify (SHOP.US)$ joined $NVIDIA (NVDA.US)$ and $Tesla (TSLA.US)$ in the list of the six most active stock options as bulls poured millions of dollars in call options.

Demand for call options that give holders the right to buy Shopify shares at a specific strike price are rising after the Canadian e-commerce company reported third quarter financial results that beat estimates and signaled a brighter outlook ahead.

Demand for call options that give holders the right to buy Shopify shares at a specific strike price are rising after the Canadian e-commerce company reported third quarter financial results that beat estimates and signaled a brighter outlook ahead.

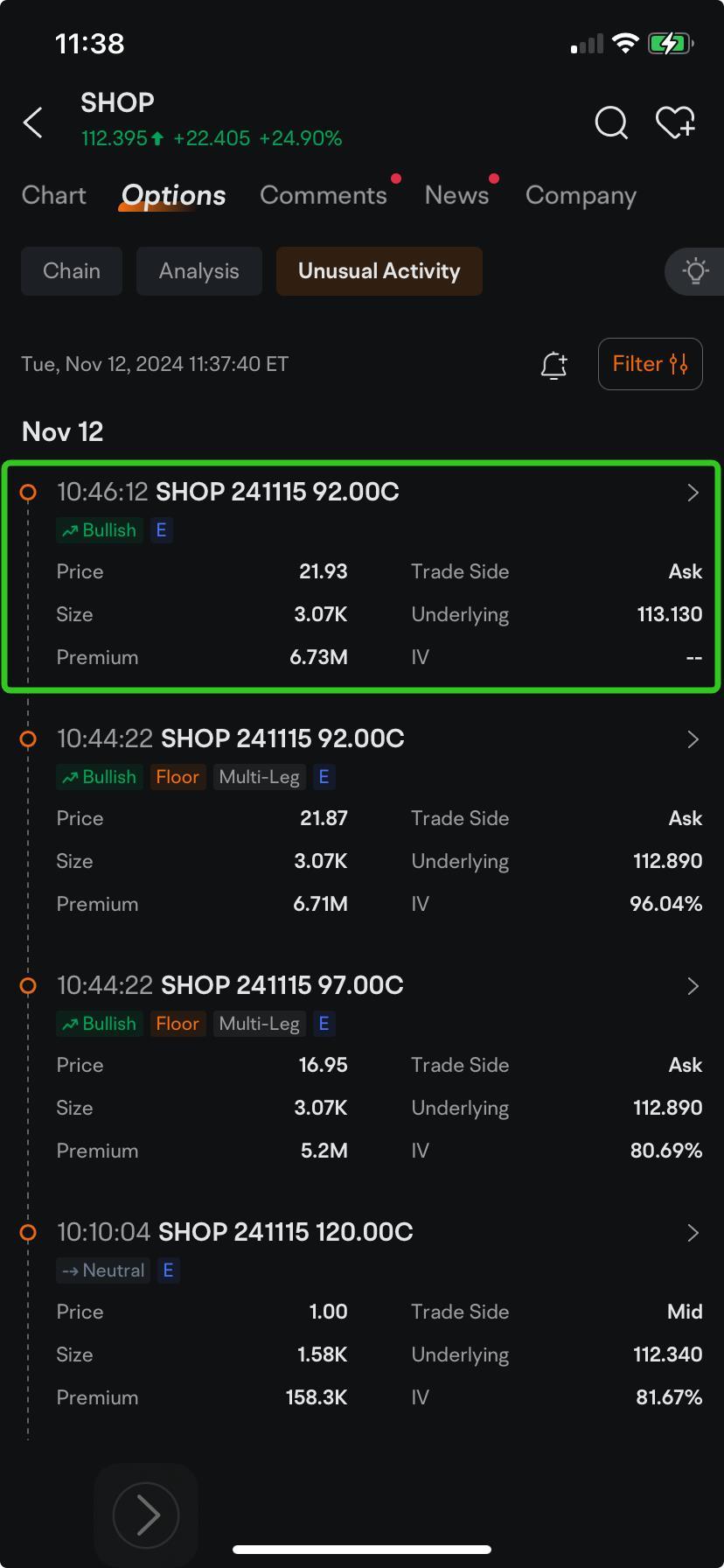

The biggest of those bullish trades involved an active buyer paying a premium of $6.73 million for call options that give the holders the right to buy 306,900 Shopify shares at $92 each in three days. The price of that contract climbed 235% to $19.10 as the stock headed for its highest close since early 2021.

Source: moomoo mobile app

(To see Shopify's options chain, click here. For the options ranking, click here.)

Shopify shares rose as much as 27% to $114.51 before paring gains to $111.24 at 1:39 p.m. in New York. The rally pushed many of its call options in-the-money, boosting their investment appeal. So far, more than 397,610 options changed hands across 15 expiration dates stretching through Jan. 15, 2027, exchange data tracked by moomoo showed.

That made Shopify the sixth most active stock option, behind $NVIDIA (NVDA.US)$, $Tesla (TSLA.US)$, $Meta Platforms (META.US)$, $Amazon (AMZN.US)$, and $Advanced Micro Devices (AMD.US)$. (To see Nvidia's options chain, click here. For Tesla's options chain, click here. Meta's options chain are found here.)

Demand for the Shopify call options rose after the company reported that its revenue climbed 26% to $2.16 billion in the third quarter ended Sept. 30, exceeding Bloomberg Consensus that called for $2.12 billion. That's the ninth straight quarterly revenue beat for the Ottawa-based company.

Source: moomoo mobile app

Shopify expects revenue in the fourth quarter to grow at a mid-to-high 20s percentage rate, according to its press release Tuesday morning. Gross profit is seen expanding at a similar pace as the third quarter, it said. Gross profit grew about 24% to $1.118 billion in the three months to Sept. 30.

More than 35,650 call options that give the holders the right to buy the stock at $120 in three days changed hands so far, almost nine times the open interest, exchange data tracked by moomoo showed. Those calls attracted the heaviest trading volume after the stock price climbed more than $21 to $111.24.

Source: moomoo desktop app

"We have grown free cash flow margin sequentially each quarter this year, consistent with what we delivered last year," Shopify Chief Financial Officer Jeff Hoffmeister. "These results demonstrate the durability of our business, our multiple avenues for growth and continued discipline of balancing both future growth investment and operational leverage."

The company's outlook signals the company could "finish the year strong," surpassing Wall Street expectations for revenue growth and operating margin, after its third quarter results confirmed Shopify's ecommerce leadership, Bloomberg News quoted TD Cowen analysts as saying.

Share your thoughts on Shopify, Nvidia, Tesla and Meta Platforms in the comments section. Can Shopify sustain the stock rally? And if you have a price forecast on the stock, please vote below.

Options trading entails significant risk and is not appropriate for all customers. It is important that investors read Characteristics and Risks of Standardized Options before engaging in any options trading strategies. Options transactions are often complex and may involve the potential of losing the entire investment in a relatively short period of time. Certain complex options strategies carry additional risk, including the potential for losses that may exceed the original investment amount. Supporting documentation for any claims, if applicable, will be furnished upon request. Moomoo does not guarantee favorable investment outcomes. The past performance of a security or financial product does not guarantee future results or returns. Customers should consider their investment objectives and risks carefully before investing in options. Because of the importance of tax considerations to all options transactions, the customer considering options should consult their tax advisor as to how taxes affect the outcome of each options strategy. All company analysis information is provided by third parties and not by Moomoo Financial Inc. Any illustrations, scenarios, or specific securities referenced herein are strictly for informational purposes and is not a recommendation. Past investment performance does not guarantee future results. Investing involves risk and the potential to lose principal. This content is also not a research report and is not intended to serve as the basis for any investment decision. The information contained in this article does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Furthermore, there is no guarantee that any statements, estimates, price targets, opinions or forecasts provided herein will prove to be correct.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

Space Dust : In a world of diversified portfolios.

SHOP and/or CART are 2 of the most interesting and on ALOT of watchlists.

104247826 :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

大马周瑜 : ok

Adrianlim90 : 1

70617193 : $Tesla (TSLA.US)$ Today's rise by 10%.![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)