Short-term technical indicators are overbought, and a pullback decline is imperative. If there is no pullback, how can I buy it?

[Core tips🔔: Fear God, be humble and cautious, and refrain from being arrogant. Look up at the starry sky and be down-to-earth. The wealth mountain in the financial market is guarded by two soldiers, and no one can completely overcome this limitation. That is, the unfathomable principle and spatial orientation disorder; at best, it can only be infinitely close. For high-quality high-tech stocks with long-term development prospects, we need to abandon excessive emphasis on short-term fluctuation gains and losses and speculative transactions, and base more on long-term investments. Tesla is the best quality stock we've been able to find so far, and has the best stock that surpasses any other listed company. It has a complete Artificial Intelligence industrial chain and ecological park. Some of the projects fall under the category of the Promising Quantum Science and Technology Revolution (Quantum Science and Technology Revolution) for the next 30-50 years. Historical big data shows that short-term speculation will never make much money; only medium- to long-term investments spanning time and years can achieve the grand blueprint vision. Being happy and tired of falling is a fatal injury for the vast majority of people. Once Tesla's transformation to Artificial Intelligence led by Elon Musk is implemented, surpassing Nvidia, Apple, Microsoft, etc. is no problem. He also has nine unlisted companies; Tesla is only one of the least technologically advanced companies. Big data on the history of human science and technology development shows that in the field of science and technology, the world simply has shortcuts to overtaking curves and changing lanes. They are fueled by Nobel Prize-level applications of science and technology and Fields-level mathematics applications. James Harris Simons (James Harris Simmons) quickly surpassed stock god Warren Edward Buffett (Warren Edward Buffett) for 27 consecutive years because he fell out with his executive boss and quickly soared to over 40 billion US dollars. If he wanted to, there was no problem surpassing Bill Gates, the original wealth benchmark. Why are they ambitious, spending 2 billion dollars on charitable causes, and the rest is invested in research at the Institute of Mathematics and Theoretical Physics he founded himself. On May 10, 2024, James Harris Simons rested and returned to his hometown in heaven.]

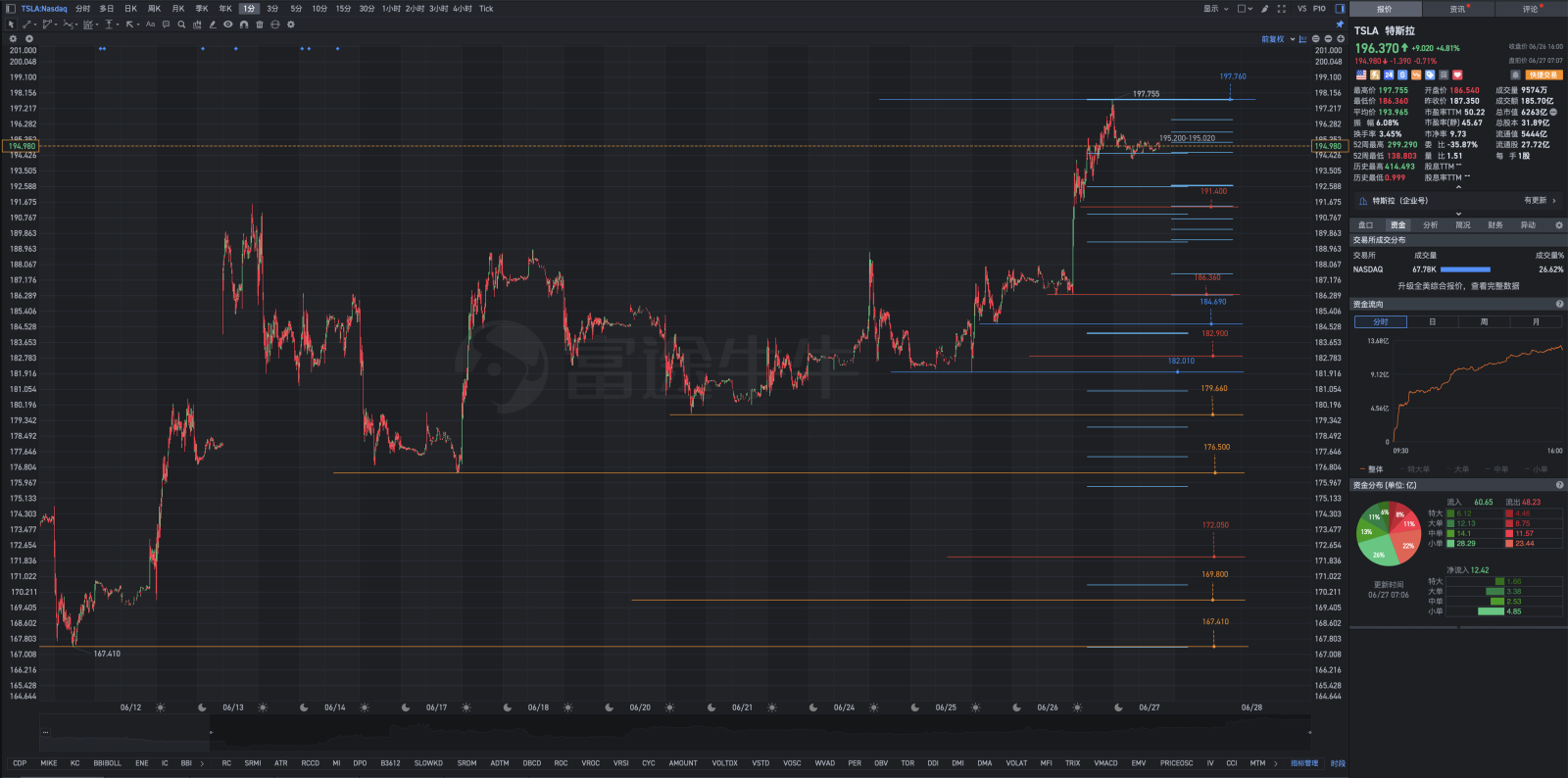

The current stock price fluctuations are generally in line with the results of the mathematical model and quantitative analysis we have established.

The general framework blueprint for Tesla's trend:

1. Tesla's stock price first crossed the 182.800-187.420 region. The prudent side set up positions in this region; the so-called “don't see rabbits” and don't throw hawks.

2. In the second step, Tesla's stock price crossed 187.420-191.300 and continued to rise.

3. Step 3: Tesla's stock price rises👆It floated out of the strong resistance zone of 198.870-205.600, opening the prelude to Tesla's spectacular gains. During the main trading session on Wednesday, June 26, EST, the stock price rose to 197.760 and then fell somewhat, and the main trading period closed at 196.370. After-market OTC trading and pre-market OTC trading on June 27 reached a low of 194.590, closing at 194.940 (stock price fluctuation,...)

4. In the fourth step, the stock price will effectively stand at 220.800, which will start the main upward trend.

5. Due to the vastness of these three regions, the rise in stock prices depends more on the gold pits made up of relatively low chips that appeared after the decline, so Tesla's strategic investors are willing to build up their overall positions. It is not until there is a major breakthrough in Tesla's fundamentals and signs of financial profit bookkeeping, that the situation of long-time stock price swings back and forth will evolve into a pattern of continuous rise.

Strategy:

1. Why arbitrage? There are already long positions; the only way to open positions is when there is a sharp decline or a deep decline.

2. Divide the funds in two: trading funds and deposit funds. This is the key to victory.

3. Split the position in two: hold 40-60% for a long time, not tempted by floating profits brought about by short-term fluctuations in stock prices. Unwavering for a long time.

4.60-40% is used to change positions during short-term arbitrage trading. Move less, look more, and change positions when it is best for you.

5. In principle: no return, no purchase; small back small purchase; big back big purchase. Flexibility is the best ability. Where did it fall? Where did the decline stop and stabilize? Frankly speaking, I don't know, and I can't measure it. The overall feeling isn't necessarily a deep drop; I don't know. However, I can respond by acting on an opportunistic basis, dividing gradients into batches, discrete random variables, and position opening layouts. Those who are actually involved in mathematics, who think that a very shallow wave theory can accurately predict points are deceiving themselves.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment