Star-Studded Canadian Stocks Tour: BCE, Telecom Giant Trapped in Competition

Yesterday, we brought you an analysis of Enbridge: Star-Studded Canadian Stocks Tour:Enbridge, Oil Pipeline Giant

Today, we will be analyzing another star stock in the Canadian market - BCE Inc.

Who is BCE Inc?

BCE Inc. is one of Canada's largest telecommunications service companies with a long history dating back to 1880. The company is listed in both Canada and the United States with the stock codes: $BCE Inc(BCE.US$ $BCE Inc(BCE.CA$

As a leader in the Canadian telecommunications industry, BCE Inc. provides a wide range of communication services including fixed-line and mobile phones, broadband, TV services, and a range of business communication solutions. Its services cover the entire country of Canada and it is one of the three major wireless operators in Canada, occupying over 30% of the market share.

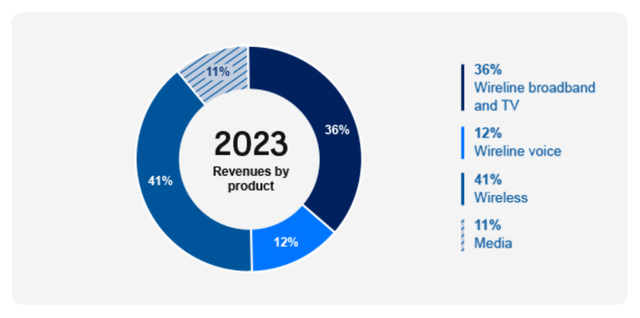

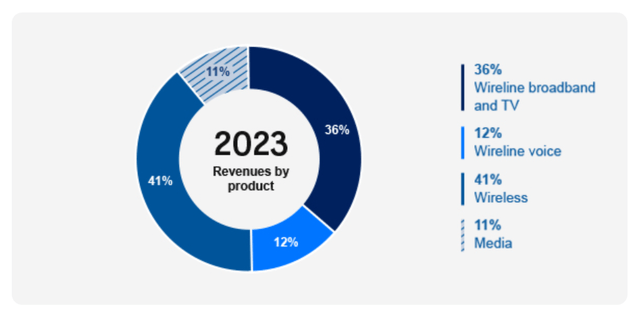

Currently, the company is divided into three key sectors, namely Bell Wireless, Bell Wireline, and Bell Media. Each sector focuses on specific service areas such as wireless communication, wireline broadband and TV services, and the production and distribution of media content. As of 2023, BCE's revenue has predominantly come from communication services (including wireline and wireless), accounting for approximately 88% of total revenue, while the media sector has a relatively small revenue share, accounting for only 11% of total revenue.

According to the company's latest financial report, BCE Inc.'s EBITDA for Q1 2024 was approximately CAD 1.9 billion, representing a YoY growth of 1.33%. There was a slight increase in postpaid phone revenue and internet users driven by fiber sales. In a competitive pricing environment, BCE's average revenue per user (ARPU) for Q1 2024 was CAD 43.11, representing a YoY increase of 0.25%.

However, due to increasingly fierce market competition, the growth of service revenue is under pressure. BCE's total operating revenue for Q1 2024 was CAD 4.456 billion, representing a YoY decrease of 0.45%. The churn rate also increased to varying degrees, with a churn rate of 5.74% for prepaid users, representing a YoY increase of 8.71%, and a churn rate of 1.21% for postpaid users, representing a YoY increase of 34.44%. For BCE, the biggest challenge currently is how to stand out in the competition and maintain revenue while reducing prices to attract customers.

As shown in Q1 2023 performance, BCE performed well in postpaid mobile and internet user growth, but the increase in churn rate reflects the intensity of price competition in the market. The Canadian telecommunications market has long been dominated by three major operators - Bell Canada, Rogers Communications, and TELUS - forming an oligopoly. Competition between these companies is extremely fierce and they are constantly fighting for market share through price wars, marketing strategies, and service innovation.

In fact, over the past few years, wireless network prices in Canada have been on a downward trend. According to Statistics Canada, in Q1 2024, Canadian cellular network costs were only half of what they were in 2017, which is rare during inflation.

Faced with the low-price market situation brought about by competition, after a sluggish Q1, BCE plans to adopt a convergence bundling strategy by bundling wireless networks with features such as caller ID and call waiting for sale, in order to increase its average revenue per user (ARPU) and drive user growth in the future. At the same time, the company has invested in fiber, 5G, and cloud services/security in the hopes of achieving growth in the future and benefiting from opportunities in the Internet of Things (IoT) and multi-access edge computing (MEC).

As it stands, BCE is facing increasing risks, particularly in the wireless services field. Although the company is working hard to maintain user growth through promotional activities and package sales, high user churn rates and reliance on new users may put pressure on profit margins. Therefore, BCE needs to continue to focus on cost control and operational efficiency to cope with competitive pressure and maintain profitability.

It is worth noting that BCE has always been known for paying high dividends, and with this year's sharp drop in stock prices due to competition, as of June 4th, BCE's dividend yield was as high as 8.32%, making it a high dividend product in the Canadian market. In the latest financial report, BCE also increased its dividend by 3.1% to CAD 3.99 per share, and its stable free cash flow and generous dividend returns have added a lot of attractiveness to the company.

With such a high dividend yield, coupled with recent expectations for interest rate cuts in Canada, it is expected that BCE's performance in the future will be even more promising.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment