Starting Point for Business Recovery: CSL Company Outlook

Who is CSL Ltd? $CSL Ltd(CSL.AU$

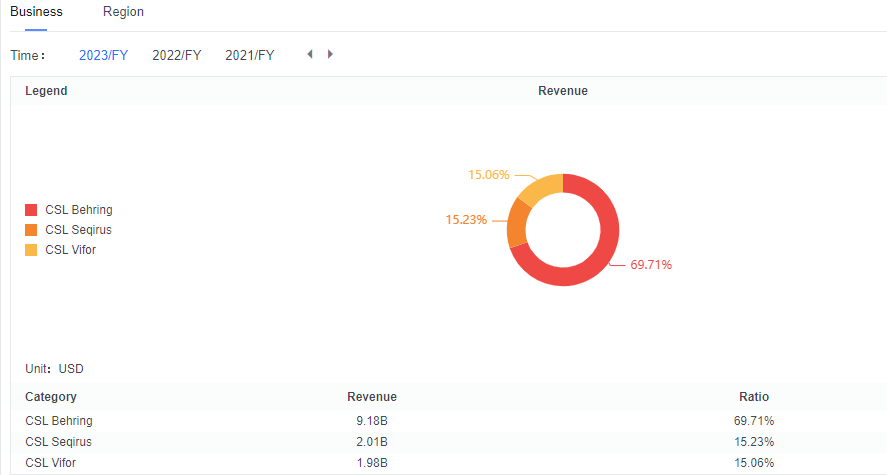

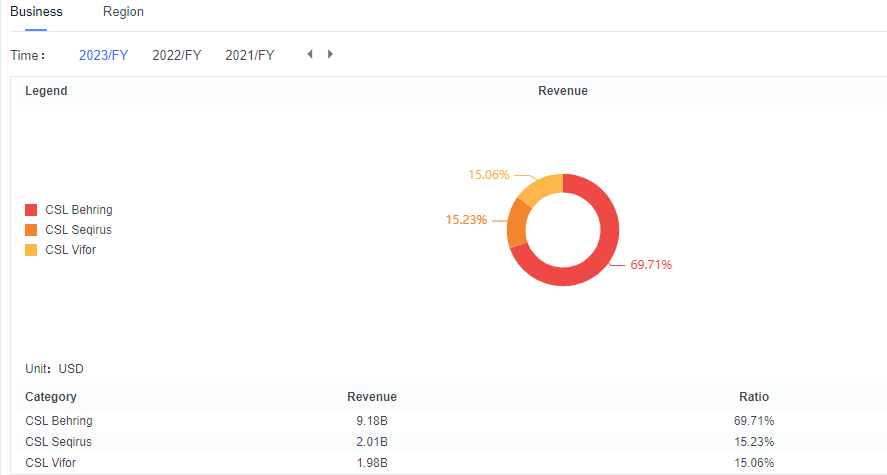

CSL is one of the world's largest biotechnology companies, and today CSL comprises three business units: CSL Behring, CSL Seqirus, and CSL Vifor.

1) CSL Behring uses plasma-derived proteins or recombinant proteins to treat diseases such as immunodeficiencies, bleeding disorders, and neurological indications.

2) Seqirus is now the world's second-largest influenza vaccine provider, acquired in the 2015 fiscal year.

3) CSL Vifor is a global leader in iron deficiency and iron deficiency anaemia therapies.

CSL has a strong track record in research and development. As the company continues to expand its scope, its products include drugs for treating hemophilia and immunodeficiencies, vaccines for preventing influenza, and medications for treating iron deficiency and kidney disease. Originally established as a state-owned entity in Australia, CSL now derives about half of its revenue from North America and a quarter of its revenue from Europe.

In February 2024, setbacks in the Australian healthcare sector and disappointment with the Phase III study results of CSL112 led to a drop in CSL's stock price. However, the company's latest financial report showcased strong profit growth and maintained stable dividend payments, with an interim dividend of $1.19 per share and a dividend yield of 1.22%.

Segment Operations Outlook

1.Immunoglobulins - CSL extended its lead

CSL achieved significant growth in immunoglobulin (Ig) sales in 2023, with an annual growth rate of 22%. This growth further increased to 24% in the December half-year report, outperforming the industry average. Looking ahead, the immunoglobulin market is expected to stabilize with continued growth. Plasma supply has been rising, with Grifols reporting a 10% increase in 2023 and Takeda forecasting a 10-20% rise by March 2024. This normalization positions companies for sustained growth and stability in the near future.

2.Albumin - CSL retained lead, but gave up share

CSL’s lead in albumin sales narrowed over the last year, as its growth of 5% lagged competitors’. Looking to 2024, CSL has reported strong demand from China, suggesting sales will pick up in 2024.

3.Hereditary angioedema (HAE) - Takeda leads as CSL sales stall

Takeda maintained its lead in HAE therapies, driven by the strong growth of Takhzyro, which saw a 14% sales increase. In contrast, CSL's Haegarda experienced flat to declining sales in 2023.

CSL is optimistic about its upcoming antibody, garadacimab, which was submitted for FDA approval in late 2023. Expected approval is mid- to late 2024, and its once-a-month dosing profile is anticipated to make it a strong competitor in the HAE segment.

4.Collection centre openings slow as recovery accelerates

CSL has slowed its center rollout as collections have recovered, adding 12 new centers in 2023, down from 20-30 in prior years. The focus now is on rolling out Terumo’s Rika plasmapheresis system.

Industry feedback indicates a decline in plasma prices on the spot market, suggesting the shortage has passed and some sector rationalization may be needed. However, the impact on finished goods markets is expected to be limited due to market concentration.

5.Influenza vaccines - CSL Seqirus continued to gain share in 2023

CSL’s influenza sales outperformed peers’ in the December half, growing 5% (excluding in-license, pandemic and other fees). Despite a backdrop of weaker demand, Seqirus gained market share thanks to its first-to-market deliveries and differentiated cell-based vaccines and adjuvanted offerings.

Margins bottomed, but price competition a risk

CSL’s gross margin dropped in 2023, but showed clear improvement in the December half. Overall gross margins across the sector are still well below pre-pandemic levels.

Looking to 2024, the company expect an industry-wide recovery from an ongoing drop in plasma costs as volumes recover and payment rates to donors continue to moderate. CSL also expect margins to be supported by other levers, such as efficiency programs within plasma collection centres and new plasmapharesis equipment to improve yields. In CSL’s case, this relates the rollout of Terumo’s Rika system, which is anticipated to complete by end-FY25.

Valuation and Investment Thesis

According to a report by J.P. Morgan, the Behring division is at the beginning of a multi-year recovery, benefiting from higher yields in collection and fractionation, as well as the anticipated sales of new high-margin therapies such as Hemgenix and Garadacimab. Additionally, through stringent cost control, particularly with the full integration of the Vifor business, the group's earnings will be further enhanced.

Based on the Discounted Cash Flow (DCF) method, a target price of $325 was set for CSL for June 2025. This valuation considers a terminal growth rate of 3.0%, a weighted average cost of capital (WACC) of 6.3%, and a beta value of 0.8, with a forecast period of five years.

Despite CSL showing a positive growth outlook, price competition remains a persistent risk in the industry. The company needs to continuously monitor market dynamics to address potential pricing pressures.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment