Despite the fact that people may not be able to consistently beat the market, what is the main reason they still participate in day trading?

Capable traders acknowledge that the battle is not fought against the market, but within their own minds.

The mindset can be considered a primary predictive factor for trading success. Psychological factors play a crucial role in trading. Successful trading is primarily about understanding and managing one's emotions, biases, and decision-making processes, rather than outsmarting the market or possessing exceptional technical analysis skills.

This battle is the "internal struggle" that traders face in making decisions, where rational analysis conflicts with emotional reactions.

Fear, greed, and impatience can lead to hasty or irrational decisions that may undermine your success.

Recognizing that the real challenge lies within oneself highlights the importance of cultivating a disciplined and resilient trading mindset. This includes developing a habit of sticking to a clear trading plan even in the face of uncertainty or adversity.

Ensuring sufficient time and effort to understand and improve one's mental and emotional processes is an important part of trading strategy.

Although people may not be able to consistently beat the market, they still participate in day trading for several reasons:

1. The potential to earn huge profits: Although the overall market may be difficult to sustain outstanding performance, it is possible to obtain significant short-term profits through skilled intraday trading. Some traders are attracted to the possibility of earning huge returns in a short period of time.

2. Stimulation and excitement: Intraday trading can provide an exciting and engaging feeling, which some people find very appealing. The fast-paced nature of monitoring price movements and making quick decisions attracts traders who enjoy excitement.

3. Overconfidence and illusion of control: Some traders may overestimate their abilities and believe that they can beat the market through trading strategies and analysis. This overconfidence may lead them to believe that they can beat the market, even if statistical evidence suggests otherwise.

4. Lack of understanding of market dynamics: Many intraday traders may not fully appreciate the efficiency of the market and the difficulty of consistently outperforming it. They may not have a complete understanding of the factors driving market trends.

5. Availability of leverage trading: The ability to use leverage in intraday trading can amplify both profits and losses. Some traders are attracted to the potential for excessive returns, even though the risks are also magnified.

6. Seeking an advantage: Some traders believe they can discover new strategies or insights to gain an advantage in the broader market. This 'advantage' may be elusive, but pursuing it can drive continued intraday trading activity.

In the end, although it is very difficult to consistently beat the market statistically, the allure of substantial profits and the excitement of active trading continue to drive some individuals to pursue intraday trading strategies.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

103164496 : There's nothing you can do about Trump, be patient, I'll come

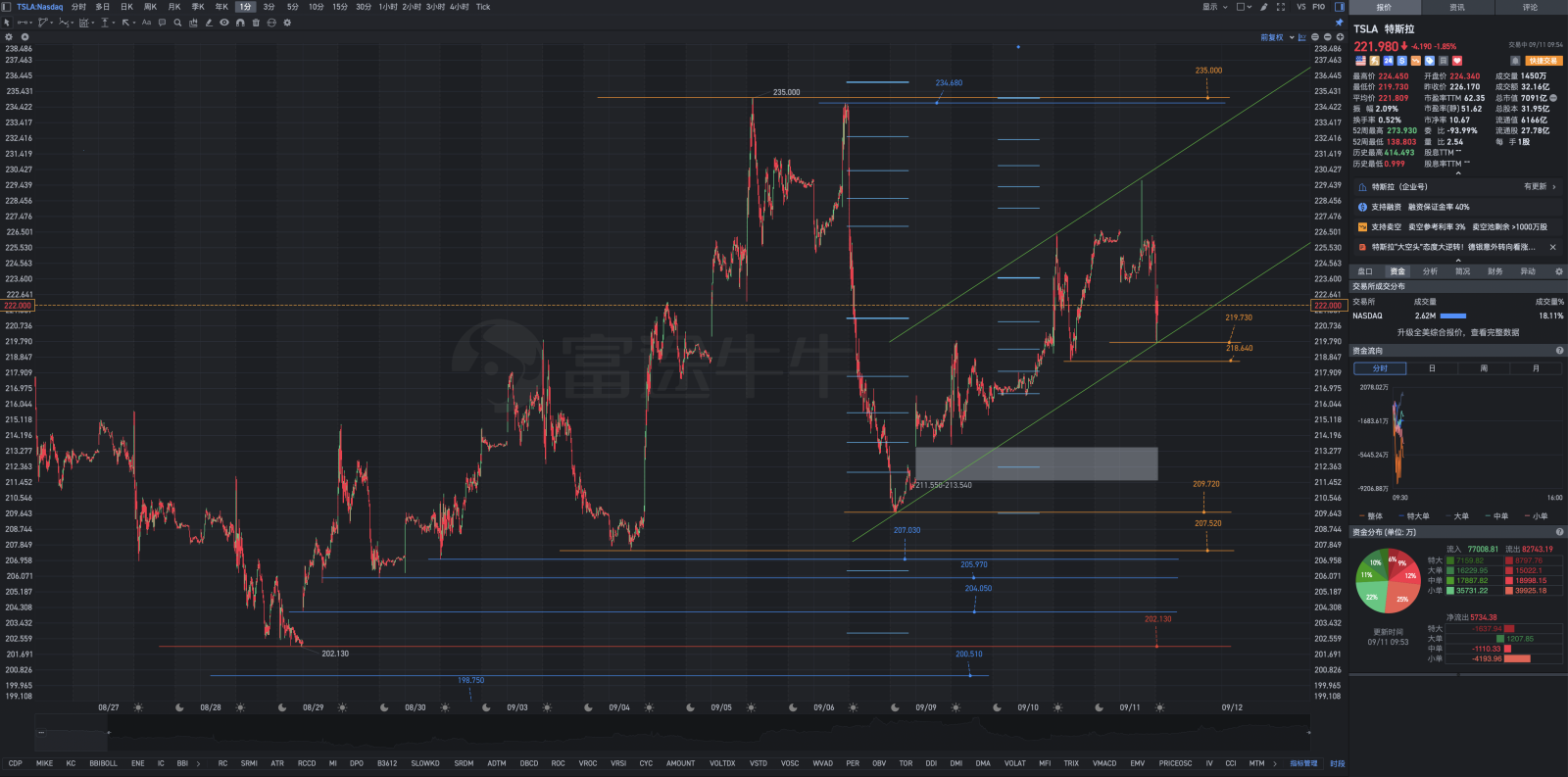

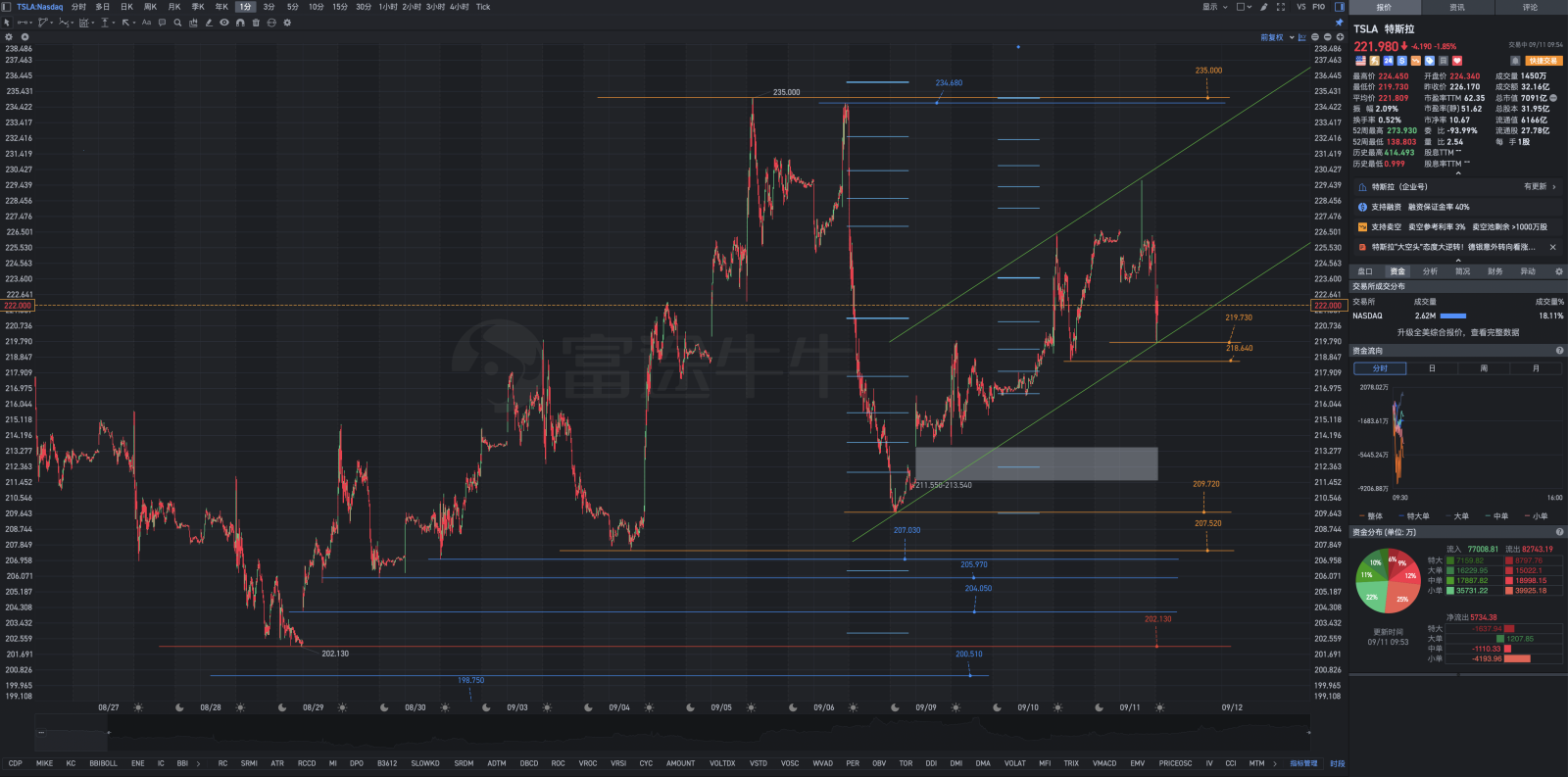

Elias Chen OP 103164496 : Core Tips: The principle of shareholding expansion: transitioning from an electric auto manufacturer to an Artificial Intelligence deep development application company + energy storage company + self-driving FSD + RoboTaxis (robot taxi) software company + Optimus (Prime) humanoid robot company.Artificial IntelligenceDeep development application company+Energy storage company+Self-driving carsFSD+RoboTaxis(Robot Taxi) software company+Optimus(Optimus Prime) humanoid robot company. This isElon Muskled byTeslaThe determination to change the world lies in the determination of the bulls that the world will be changed. You have the right to continue to believeElon Muskis to open a pie and cake shop for the purpose of making money. However,TeslaOnce self-driving is perfectedFSD+RoboTaxis(Siasun Robot&Automation) software, it will beTeslaThe beginning of a soaring stock price. When you cannot coexist with uncertainty, deny, and refuse emerging things that are still in the early stage, you also lose the future. If it doesn't go down, ignore it; if you don't fall, I won't buy.209.720-207.520For air identification zone;207.520-205.970-204.050-202.130To prevent the air defense firepower ambush circle;To start the special fund area of heavy repurchase after deep decline. Investors and traders can handle it according to their own situation.To initiate a special fund area for buying heavily in a deep dive. Investors and traders can handle it according to their own situation. LikeVanguard(Pioneer Navigation) Manage your individual retirement account (IRA) and investment trades for your stock account just like your financial account. Eventually, the consequences of liking rises and disliking falls, and chasing highs and chasing strength will all become apparent.IRAand401(KThe consequences of liking rises and disliking falls, and chasing highs and chasing strength will all eventually become apparent.TeslaAt2024The dynamic pe ratio for the fiscal year(TTM) has reached61.12,static pe ratio50.56,2024The fiscal year and2025The profit expectations for the fiscal year continue to decline slightly. It is not worrisome for the stock price to rise slightly above 60%s long position, it is a different matter and very unwise to go all out and defend. A person who does not have long-term planning and does not value the mental health of investment and trading will not go far, even ifTeslaHas the potential to make a breakthrough.271.000-299.290-314.800 range, even higher levels.Range, even higher levels.414.490-515.000 range, you can't even hold on to the floating profit chips in your hands.Range, you can't even hold on to the floating profit chips in your hands.

The principle of shareholding expansion: transitioning from an electric auto manufacturer to an Artificial Intelligence deep development application company + energy storage company + self-driving FSD + RoboTaxis (robot taxi) software company + Optimus (Prime) humanoid robot company.Artificial IntelligenceDeep development application company+Energy storage company+Self-driving carsFSD+RoboTaxis(Robot Taxi) software company+Optimus(Optimus Prime) humanoid robot company. This isElon Muskled byTeslaThe determination to change the world lies in the determination of the bulls that the world will be changed. You have the right to continue to believeElon Muskis to open a pie and cake shop for the purpose of making money. However,TeslaOnce self-driving is perfectedFSD+RoboTaxis(Siasun Robot&Automation) software, it will beTeslaThe beginning of a soaring stock price. When you cannot coexist with uncertainty, deny, and refuse emerging things that are still in the early stage, you also lose the future. If it doesn't go down, ignore it; if you don't fall, I won't buy.209.720-207.520For air identification zone;207.520-205.970-204.050-202.130To prevent the air defense firepower ambush circle;To start the special fund area of heavy repurchase after deep decline. Investors and traders can handle it according to their own situation.To initiate a special fund area for buying heavily in a deep dive. Investors and traders can handle it according to their own situation. LikeVanguard(Pioneer Navigation) Manage your individual retirement account (IRA) and investment trades for your stock account just like your financial account. Eventually, the consequences of liking rises and disliking falls, and chasing highs and chasing strength will all become apparent.IRAand401(KThe consequences of liking rises and disliking falls, and chasing highs and chasing strength will all eventually become apparent.TeslaAt2024The dynamic pe ratio for the fiscal year(TTM) has reached61.12,static pe ratio50.56,2024The fiscal year and2025The profit expectations for the fiscal year continue to decline slightly. It is not worrisome for the stock price to rise slightly above 60%s long position, it is a different matter and very unwise to go all out and defend. A person who does not have long-term planning and does not value the mental health of investment and trading will not go far, even ifTeslaHas the potential to make a breakthrough.271.000-299.290-314.800 range, even higher levels.Range, even higher levels.414.490-515.000 range, you can't even hold on to the floating profit chips in your hands.Range, you can't even hold on to the floating profit chips in your hands.