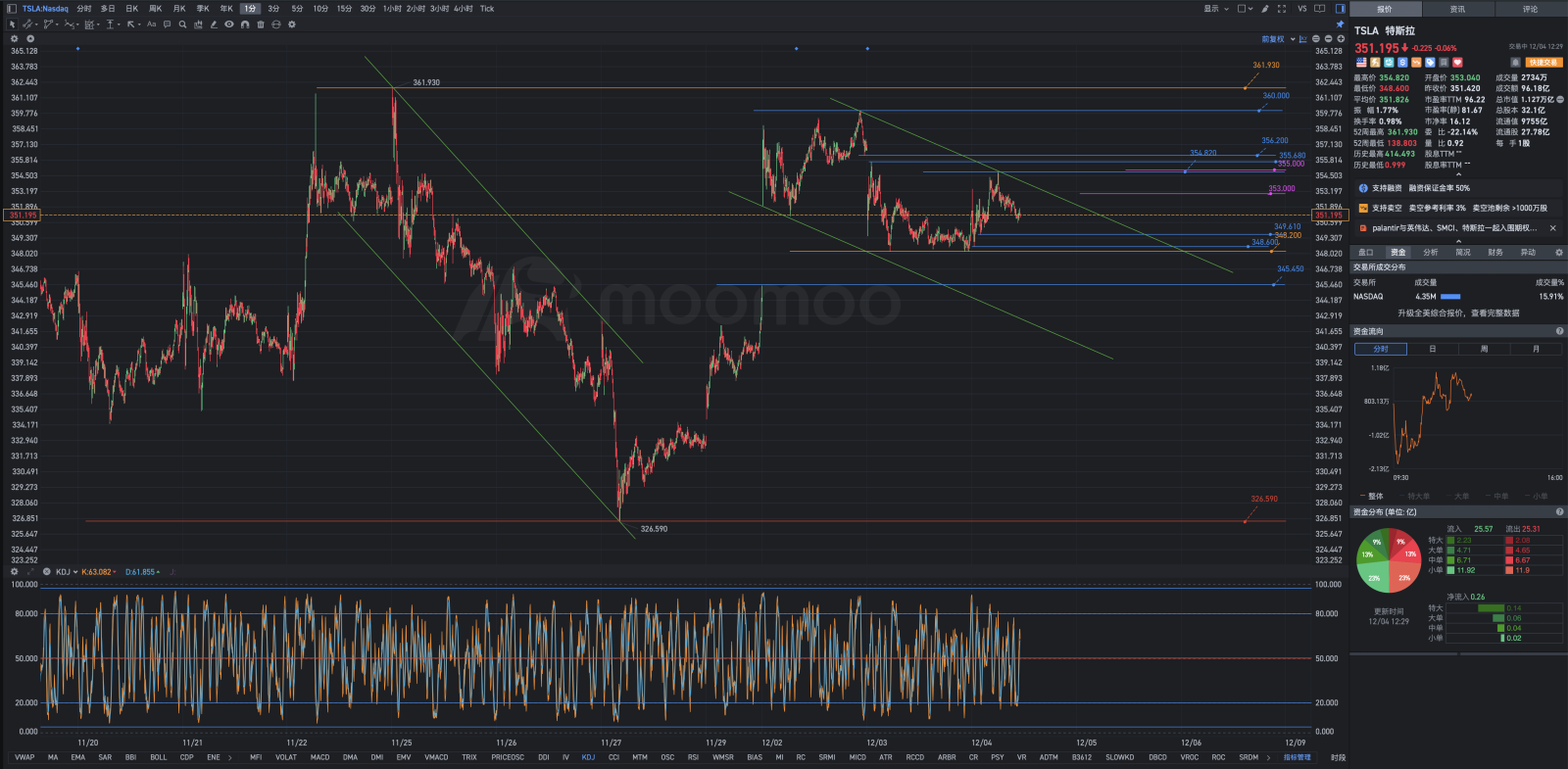

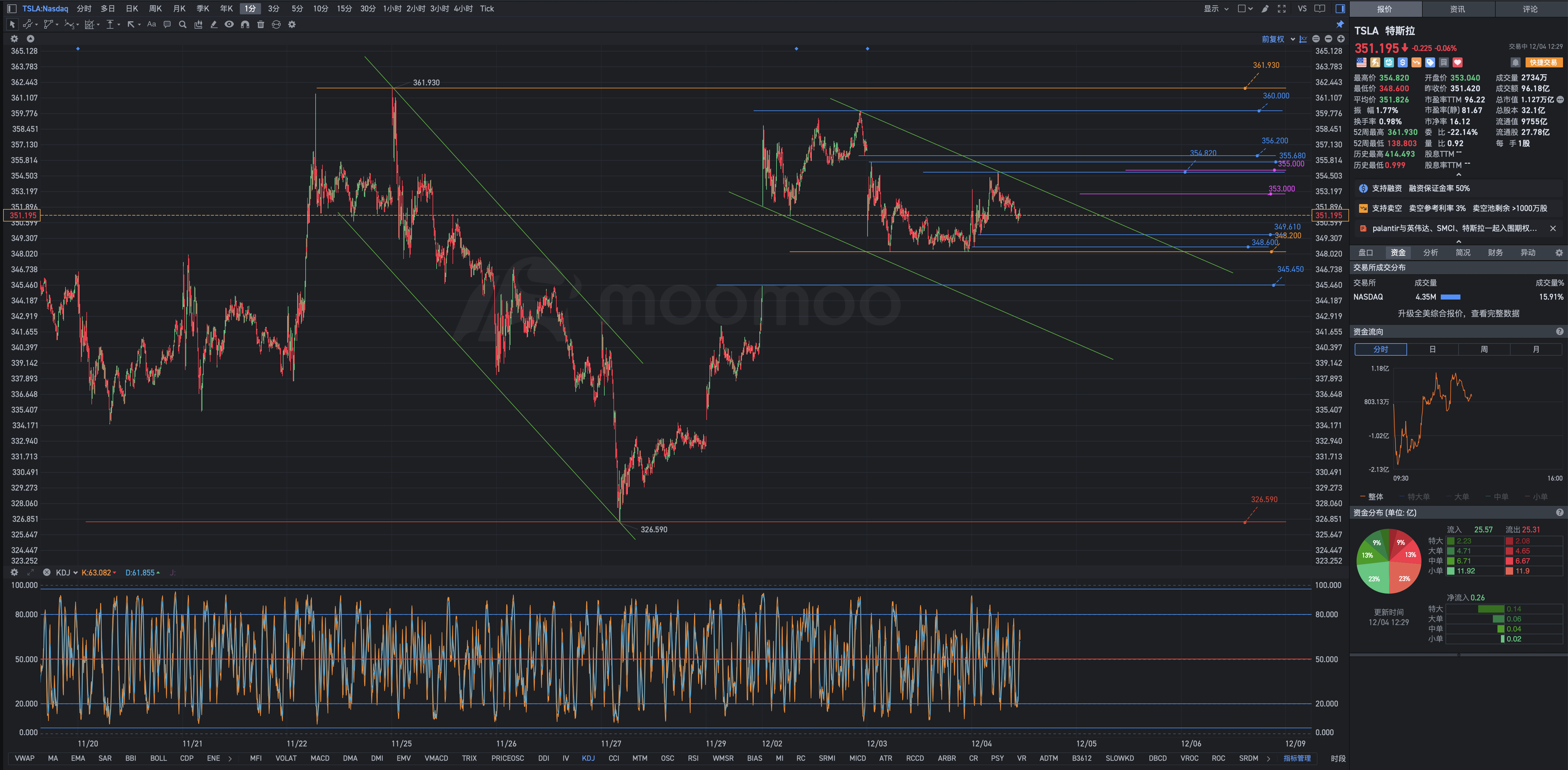

Tesla's early trading review charts geometric analysis; patience is also needed to establish new long positions.

Stock prices fall briefly, causing frowns, but capturing the mind? Enjoying rises and hating falls? Spike directly, making money with each buy and sell? Is that so satisfying?

Embrace the downtrend, utilize it: When the secondary trend sharply opposes the primary uptrend, it is wise to intelligently let go of the top and middle of the downtrend, buy low during the tail-end of the downtrend, with a planned and systematic approach, in gradients and batches, discrete random variables, framework-based position layout.

Spatial disorientation caused by long and short adjustments in financial transactions.

What is Spatial Disorientation? Also known as spatial disorientation, spatial disorientation. Originally referred to the inability of pilots to determine angles, altitudes, and speeds during flight. In nighttime or severe weather conditions, when the horizon is not clearly visible, the inability to determine angles, altitudes, and speeds is particularly severe because human orientation primarily depends on visual perception.

In financial transactions, when there is a sustained asymmetric wide-ranging oscillation in the market, traders need to frequently change their original views and positions to adapt to market changes, which can lead to the occurrence of spatial disorientation (spatial orientation disorder, spatial disorientation).

Once a trader experiences spatial disorientation, it will have catastrophic consequences for market analysis and financial investment trading.

On Wall Street, large financial institutions generally engage in very few short sell trades with mutual funds, while hedge funds do so more frequently. When conducting put short sell trades, there is often a group of individuals dedicated to this task who must cooperate closely with traders responsible for call buy trades at low levels in order to complete the put short sell arbitrage task.

There is asymmetry between call long and put short sell trades. In put short sell trades, if there is a misjudgment, including correctly analyzing the market but mistiming the rhythm, theoretically the risk is unlimited, which is significantly different from the former. It cannot be denied that once put short sell trades are correctly anticipated, they can achieve rapid arbitrage. This is also a fundamental reason why many traders are keen on utilizing the mature market's bidirectional mechanism to attempt long and short repairs, and some specifically engage in put short sell trades.

Put short sell trades have positive implications for hedging long positions in mature financial markets, hedging risks, and active market trading.

An important characteristic of the US stock market is the bull goes long and the bear goes short, short in rallies and long in declines. Therefore, The Oracle of Omaha, stock god Warren Edward Buffett, warns the world: never short sell USA stock indexes and US stocks. It is profound and worthy of deep consideration.

Have you experienced Spatial disorientation (spatial orientation barriers, spatial disorientation, spatial disorientation)?

Are you sure that you are definitely skilled enough to achieve long and short repairs?

A once-in-a-lifetime opportunity will make all animals dare to take risks.

When there is nothing difficult for oneself, always try to leave others a sense of warmth.

The new cycle will inevitably go through four stages: invisible, disdain, incomprehensible, and finally too late.

Fortune is like squatting before jumping, so the difficulties you are experiencing now are accumulating strength for your takeoff.

******

It is not easy to systematically bottom out. Realize a small part of the floating profit to reward yourself.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment