Top Winners of Rate Cuts? Homebuilder Stocks Surge to All-Time Highs

Fueled by expectations of the upcoming interest rate cuts and hopes for a soft landing, shares of homebuilders are soaring to new record levels. The S&P Homebuilders Select Industry Index has impressively surged by 37% since its October low, surpassing all three major stock indices.

Notably, the homebuilders favored by Warren Buffett - $D.R. Horton (DHI.US)$, $Lennar Corp (LEN.US)$, and $NVR Inc (NVR.US)$ - have also achieved historic highs.

Based on data compiled by moomoo, $Meritage Homes (MTH.US)$ has experienced a significant rebound of over 60% from its October lows, leading the gains in the homebuilder sector. Among the three major U.S. homebuilders that were accurately invested by Buffett's $Berkshire Hathaway-A (BRK.A.US)$ in the second quarter of this year, $D.R. Horton (DHI.US)$ and $Lennar Corp (LEN.US)$ have soared by approximately 50%, while $NVR Inc (NVR.US)$ has achieved a gain of almost 30%.

1.Seven Consecutive Weeks of Declining Borrowing Costs Boost Real Estate Demand Recovery

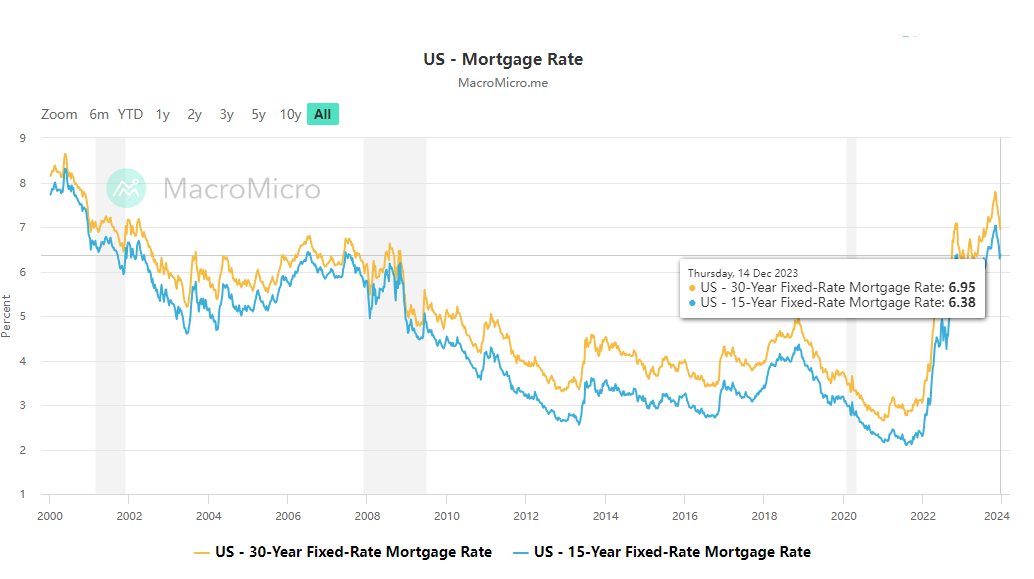

As of December 14th, the US 30-year mortgage rate fell below the 7% threshold, hitting 6.95%. This marks a four-month low and represents a notable decrease from October's rate of 7.79%, plummeting by 84 basis points.

During the December Fed Meeting, Powell acknowledged the easing of inflation and suggested that an interest rate cut is currently under discussion. This means the Fed has met market expectations for an interest rate cut, further creating more room for reduced loan costs. The ongoing decline in borrowing expenses will reduce financial burdens on potential homebuyers, making properties more affordable and increasing their willingness to purchase. This, in turn, will accelerate buyers' return to the market. According to the MBA Mortgage Market Index, which is widely considered a leading indicator of the real estate market, there has been a continuous increase in residential mortgage loan applications for seven consecutive weeks now. This trend signifies that the market is on the path to recovery.

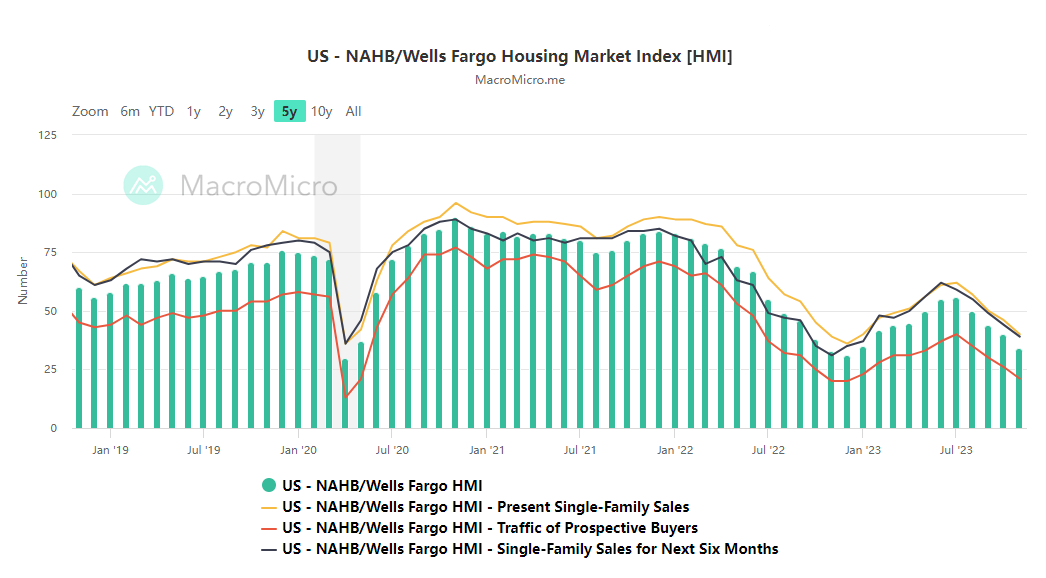

Despite a more substantial than anticipated decline in U.S. homebuilder confidence in November, reaching its nadir this year, the Chief Economist of the National Association of Home Builders, Robert Dietz, remains optimistic about the future prospects of the housing market. "Recent macroeconomic data point to improving conditions for home construction in the coming months; Given the lack of existing home inventory, somewhat lower mortgage rates will price-in housing demand and likely set the stage for improved builder views of market conditions in December," said NAHB Chief Economist Robert Dietz.

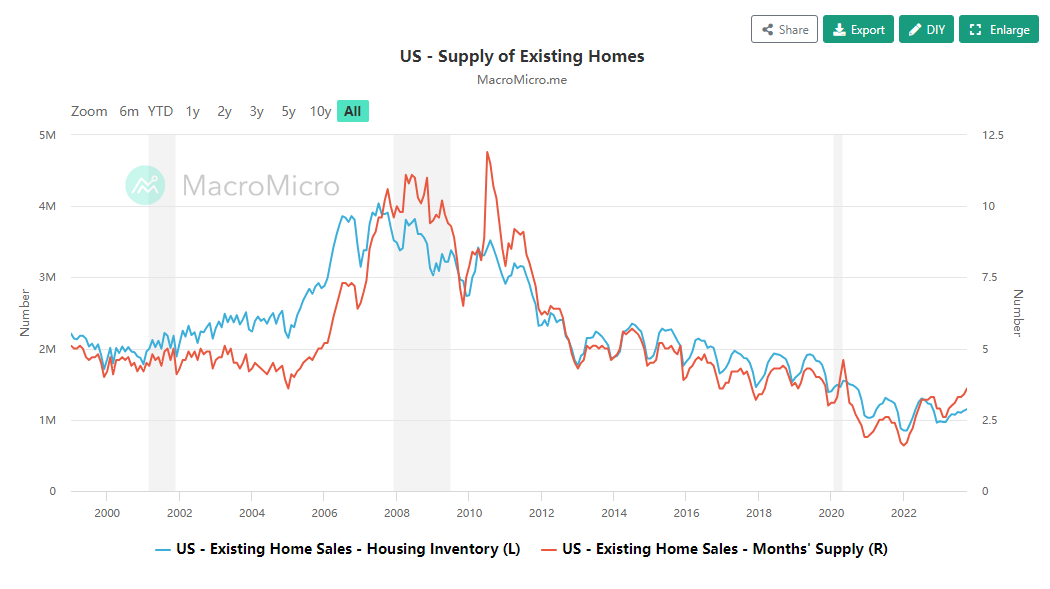

2.Insufficient Supply of Existing Homes is Another Strong Driver for Future Home Builder Sales

The impact of falling interest rates on the supply side is more limited in terms of speed and extent, primarily due to reluctance among preexisting homeowners who acquired financing at lower rates in the initial stage, to list their properties for sale. Consequently, there is a paucity of pre-owned homes available, which upholds the high housing prices. Additionally, the dearth of existing homes implies a greater shift in new demand towards newly built constructions, thereby positively impacting the sales price and volume for home builders. Recent data indicates that the inventory of pre-owned homes in the United States is hovering at historically low levels.

As Greg McBride, chief financial analyst at Bankrate.com pointed out,“A decline below the 7% threshold may trigger some additional demand among prospective home buyers; But it won’t move the needle on supply — at least not right away — so the frustrations about high home prices and limited selection will persist.”

3.With the Industry on the Path to Recovery, Home Builders' Profit Margins are Anticipated to Rise

In a high-interest-rate environment, numerous homebuilders have resorted to price reductions and promotions to fuel sales, which has resulted in compromised profit margins. However, as interest rates decrease and the demand for home purchases rebounds, this aspect of the company's predicament will be effectively mitigated. Furthermore, declining interest rates have also led to reduced financing costs for future investments by real estate developers, thereby contributing to an improved profitability outlook.

Source: MacroMicro, Yahoo Finance, moomoo

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

BenKan : ok

103124762 : so how about this week? all my friend ok?