TSMC Earnings Preview | Are Q3 Results and Q4 Guidance Poised to Beat Expectations After September Sales Surprise?

$Taiwan Semiconductor (TSM.US)$, the world's leading semiconductor foundry, is set to release its 2024 Q3 earnings results on October 17th, ET. The sales report for September, released by the company last week, indicates that the Q3 sales exceeded expectations, with a year-on-year growth of 39% to TWD 759.69 billion ($23.59 billion), surpassing the top end of its guided range of $23.2 billion. Year-to-date, $Taiwan Semiconductor (TSM.US)$'s total sales have reached TWD 2025.85 billion, representing a 31.9% increase compared to the same period last year.

In line with its impressive sales performance, the company's stock price has soared by over 86% since the beginning of the year, with a cumulative increase of 10% in October alone. Over the past 9 trading days, the stock has risen for 8 consecutive days. As the new financial reporting season approaches, investors are closely watching to see if the company will provide better-than-expected guidance for Q4 and the full year, as well as updates on the progress of the 2025 advanced process node price hikes, global expansion plans, capital expenditure dynamics, and the impact of Taiwan's industrial electricity price hike on the company's gross margin.

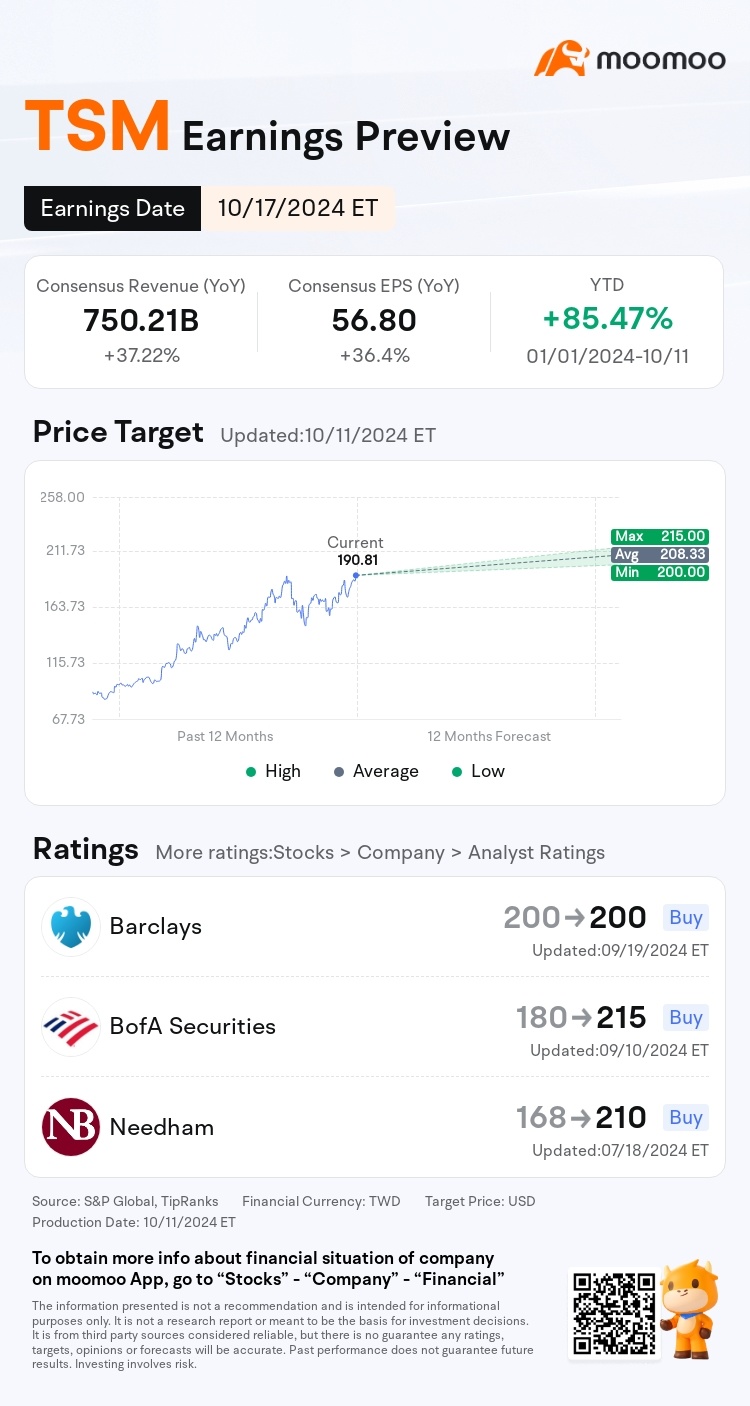

1. Analysts project that Taiwan Semiconductor is expected to achieve a revenue of TWD750.21 billion in the third quarter of 2024, showing a significant increase of 37.22% year over year.

2. Additionally, the estimated EPS are anticipated to reach TWD56.80, reflecting a YOY growth of 36.4%.

Despite the delivery delay of $NVIDIA (NVDA.US)$'s Blackwell chip, strong demand from Apple, Qualcomm, and MediaTek for Al chips and the new N3E process orders supported TSMC's outstanding sales performance in the third quarter of 2024. Analysts anticipate that the current demand for the N3 chips from the company will continue to outpace supply, with a utilization rate already exceeding 100%. JP Morgan predicts that the expansion of N3 production capacity will remain robust in 2025, and N3 revenue may reach $28 billion in 2025, accounting for 30% of TSMC's wafer revenue.

In addition, other important areas of focus for the company in 2024 include the outlook of earlier 2-nanometer (N2) node mass production, as well as the strategies to enhance its CoWoS advanced packaging capability by the year 2025.

JP Morgan analysts wrote in a report:

"We now believe that eventual N2+A16 capacity could reach 160-165k wfpm, well ahead of N3 (~140-150k wfpm), which should assure strong long-term growth for TSMC. Yield progress for N2 also appears to be tracking much better than initial N3, which should limit margin pressures in 2026/27."

TSMC is currently in the process of confirming with its clients the extent of price increases for its products in 2025. According to data from JP Morgan, the increase in advanced process nodes may be larger than expected, with N3 and N5 expected to see a price hike of 5-10%. As for CoWoS, a price increase of up to 10% may be observed. With strong demand, TSMC's leading technology and industry chain dominance will significantly support its gross profit margin growth in 2025, with the market anticipating a gross profit margin of over 55% for the year.

Amid business adjustments, Intel and Samsung are reported to be outsourcing some of their production capacity to TSMC this year. Investors are eagerly anticipating more details on how this move will impact their performance. According to research firm TrendForce, TSMC's global foundry revenue share is projected to increase from around 51% in 2019 to about 64% in 2024, while Samsung's share is expected to decrease from 16% in 2019 to approximately 10%.

According to Bloomberg's Jane Lanhee Lee and Annabelle Droulers, TSMC is planning to expand its global presence by establishing more factories in Europe, with a particular focus on the artificial intelligence chip market.

"They have started construction of the first fab in Dresden, they are already planning the next few fabs in the future for different market sectors as well," Taiwan's National Science and Technology Council Minister Wu Cheng-wen said.

Additionally, reports indicate that TSMC's project in Arizona "is progressing as planned and smoothly," with plans to commence production in Arizona in 2025, matching the output of its existing factories in Taiwan. Investors are particularly interested in the yield rates of TSMC's first advanced factory in the United States.

With the positive signals from the monthly sales data, analysts are particularly focused on whether TSMC will provide a consensus sequential-growth estimate exceeding 7%. Analysts at JP Morgan believe that TSMC may offer a revenue growth guidance of 10% due to the robust expansion in N3 (ongoing iPhone production and the ramp-up of new application processors from Mediatek and QCOM) and N4 (primarily for AI accelerators).

According to Bloomberg Intelligence:

"While Apple's A18 chip orders may decline due to soft demand for new iPhone 16s, robust orders from Nvidia and Intel are likely to offset any revenue shortfall."

Taiwan's new round of electricity prices will be implemented on October 16th, with an average increase of 12.5% in industrial electricity prices over the next six months. Major power consumers such as the semiconductor industry will be the first to bear the brunt, raising concerns in the market that the profits of leading chip contract manufacturer TSMC will also be affected. Analysts from Bloomberg Intelligence believe that the dilution of profits will be more moderate than expected due to the 12.5% increase being lower than the previously proposed 14%. Furthermore, looking at the aspect of cost pass-through, the team estimates that based on semiconductor shipments and electricity consumption over the past two years, TSMC's gross margin impact in the fourth quarter is expected to be below 30 basis points after passing on the electricity cost to its major customers.

Here are the latest analyst recommendations for TSMC since September 2024. Among them, Aletheia Capital has given the highest target price of 265, with nearly 40% upside potential.

Source: Bloomberg, JP Morgan, moomoo

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

Rene v Verdugo : great

105567159 : great

Elaine0519 : $台积电 (TSM.US)$ TSMC is the world's largest semiconductor foundry, serving major clients such as Apple, AMD, and NVIDIA. The company's future outlook is closely tied to technological advancements, global demand, and geopolitical factors.

In my opinion, TSMC's earnings prospects appear positive, driven by its leadership in advanced process technologies, strong customer base, and the ongoing growth in global semiconductor demand. However, TSMC faces challenges, including competitive pressure from rivals, geopolitical risks, and global economic uncertainties. Therefore, investors should pay attention to TSMC’s technological advancements, customer demand dynamics, and the potential impacts of global supply chain and policy changes.

Alen Kok : o

104024485 : K

Coach Donnie : The semiconductor sector is on fire! $Taiwan Semiconductor (TSM.US)$ and $NVIDIA (NVDA.US)$ have just hit new highs!

$Taiwan Semiconductor (TSM.US)$ and $NVIDIA (NVDA.US)$ have just hit new highs!

This is historic, Peoples! TSMC has become the first Asian tech company and the first non-U.S. tech company ever to surpass a $1 trillion market cap.

This is historic, Peoples! TSMC has become the first Asian tech company and the first non-U.S. tech company ever to surpass a $1 trillion market cap.

TSMC soared nearly 10%, closing at an all-time record high of $205 per share,with a total market cap of 1.07 trillion.