U.S. CPI Preview: Inflation for July is Expected to Mark the First Increase in 13 Months

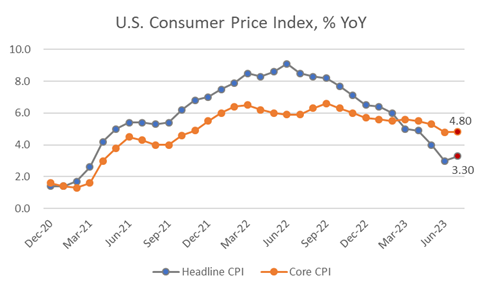

The upcoming release of the U.S. Consumer Price Index (CPI) on August 10th at 8:30 am ET is drawing considerable attention from investors. According to Bloomberg, headline CPI inflation is projected to increase to 3.3%, up from June's 3%, while core CPI inflation, which excludes volatile food and oil prices, is expected to remain steady at 4.8%. Both Headline and Core CPI are anticipated to register a 0.2% month-on-month growth rate.

1. Headline Inflation is expected to move slightly higher in July, marking the first increase in 13 months.

Economists surveyed by Bloomberg anticipate the year-on-year July CPI to range from 3.10% to 3.50%, with the majority projecting it at 3.30%, marking the first gain in 13 months. This rise can be attributed to two main factors: 1) unfavorable base effects resulting from the measure beginning to ease from a peak of 9.1% in July of last year, and 2) higher gas prices, which are driving up the energy component.

Credit Suisse:“Unfavorable base effects and modestly higher gas prices are likely to lead headline inflation higher to 3.3% YoY. A reading in-line with our expectations would represent the second consecutive month that monthly core inflation has been broadly in-line with the Fed's target.”

Here are the forecasts for July CPI from various institutions.

2. Core CPI may record the smallest back-to-back gains since early 2021.

Economists and Fed officials consider the core CPI to be a more reliable indicator of underlying inflation. It is projected to rise by 4.8% YoY and 0.2% MoM in July, which is likely to indicate moderate price growth that the Federal Reserve seeks to sustain. Although similar to June, this figure is expected to soften in the forthcoming months due to core inflation acceleration during August and September of the previous year.

ANZ:“Falling used car prices are again expected to see a decline in core goods prices. Some one-off factors are expected to keep core services ex-rent subdued, while rent inflation should continue to cool from a heady pace. Our diffusion and dispersion indices suggest inflation pressures are abating and normalizing.”

NBF:“The advance in core prices could have been more subdued in July thanks in part to a decline in the price of used vehicles.”

3. A gain in average hourly earnings remain upward pressure for inflation.

In the July jobs report, the unemployment rate dipped to 3.5% and hourly earnings climbed more than expected with a 4.4% YoY growth and 0.4% MoM increase, suggesting inflation could see a rebound.

Former Treasury Secretary Larry Summers warned that the jobs data indicate "an underlying inflation rate in 3.5% range — and it may not be decelerating. If you look at wage inflation, it was faster for the month than for the quarter, faster for the quarter than for the year. That's not consistent with 2% underlying inflation or close."

4. Some economists suggest that progress in curbing inflation is expected to be slower and more gradual in the upcoming months.

Wells Fargo:“Through the monthly noise, inflation appears set on a downward path. However, progress in the coming months is likely to be slower and noisier than June’s print alone would suggest. We expect monthly gains in core inflation to pick up slightly in Q4 as the disinflationary momentum from waning goods prices fades and health insurance prices rebound toward the end of the year .”

The five-year, five-year forward inflation expected rate reached over 2.5% this week, coming close to the nine-year high achieved last year. This indicates that, according to numerous investors, U.S. inflation is anticipated to persist for a longer period than previously projected. Bringing inflation back down to its 2% target is predicted to be a difficult task.

If core inflation remains at 0.2% as anticipated, it will be largely in line with the Federal Reserve's inflation target of 2%. Moreover, given that higher headline inflation growth is partly a result of an unfavorable base effect, economists tend to believe that the Federal Reserve is unlikely to raise interest rates in September. According to the CME FedWatch Tool, traders anticipate an 86.5% likelihood of no rate hike at the Fed's September policy meeting.

Commerzbank:“The headline inflation rate is also likely to be 0.2%. As this would be largely in line with the Fed's inflation target of 2%, such a result would support our view that the Fed is unlikely to raise rates again.

Patrick Harker, the Philadelphia Fed President also stated that if no new alarming data emerges before the September meeting, the Federal Reserve could have the opportunity to exercise patience and allow its current measures to take effect. He also emphasized that, in such a scenario, interest rates would likely need to remain at their current levels for an extended period, as there are no foreseeable developments that would require immediate easing.

Here is S&P 500's performance subsequent to CPI data releases dating back to 2022.

Source: Bloomberg, Moomoo, Fxstreet

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment