U.S. election enters final stretch: How could investors respond?

The highly-anticipated U.S. presidential election will officially kick off on November 5, potentially setting the stage for a whirlwind market environment. As the countdown begins, investors are bracing for heightened volatility. In this post, we explore the potential implications and strategies to consider.

The "Trump Trade" resurfaces

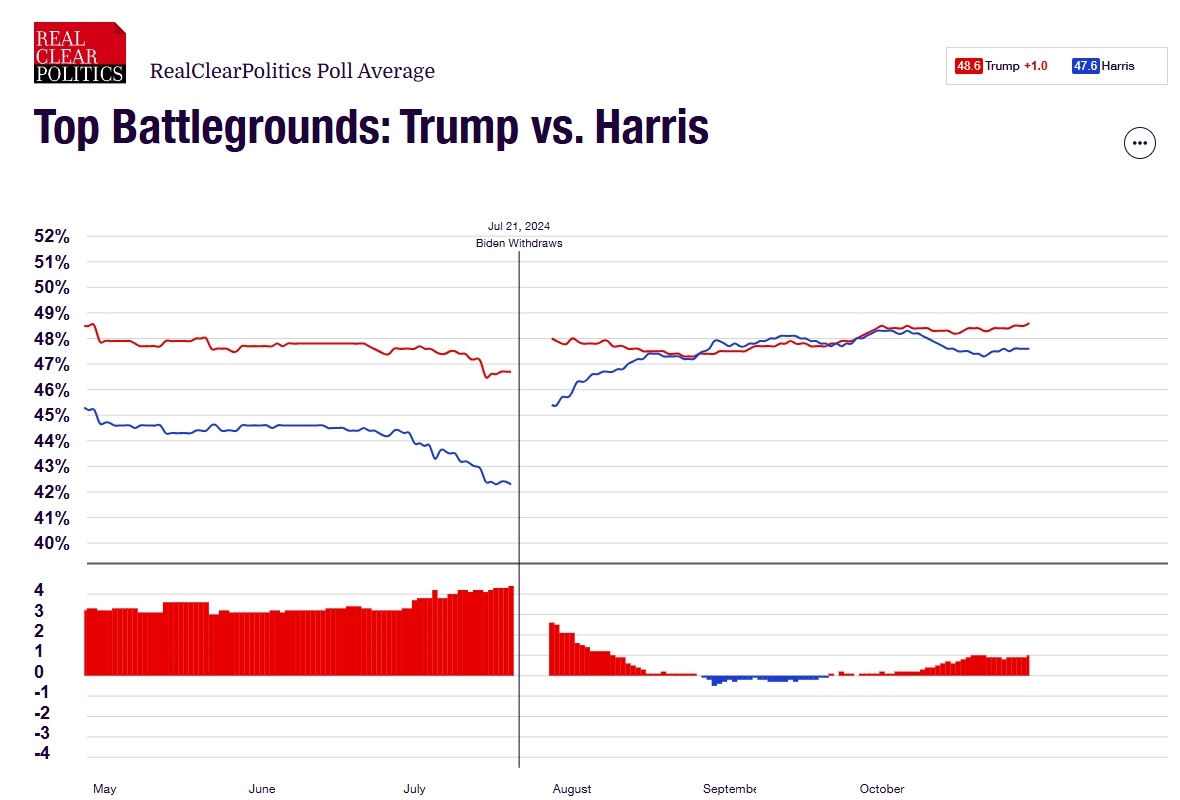

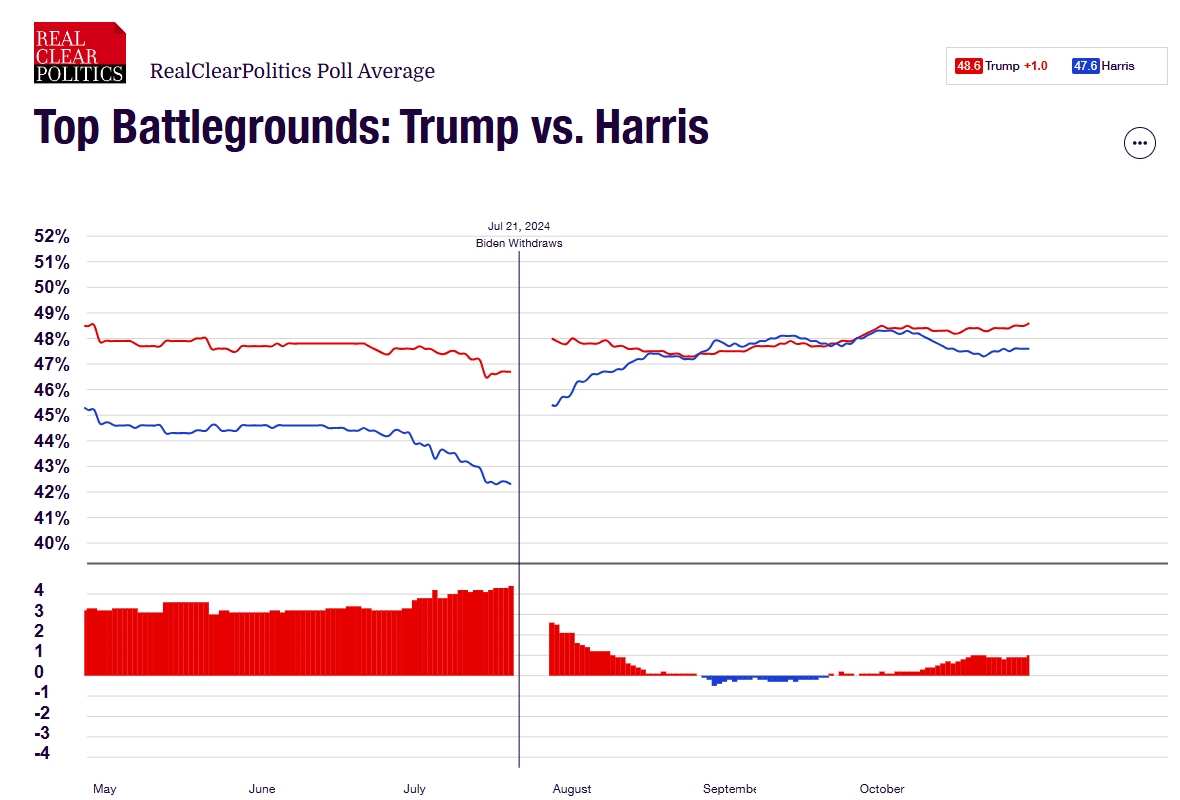

As October unfolded, Harris's lead in mainstream polls began to narrow, even disappearing in key swing states. Betting platforms like Polymarket have seen a surge in wagers on a Trump victory.

Since late September, $Trump Media & Technology (DJT.US)$, a core stock linked to the "Trump trade," has seen a remarkable rebound. Its stock price surged from under $12 to nearly $55, a gain of over 360%.

DJT is the parent company of Truth Social, and Trump retains a 57% stake, making it broadly seen as the quintessential Trump-related stock. Following the Capitol riots in early 2021, Trump was banned from mainstream media platforms and turned to Truth Social.

Other companies associated with Trump include $Rumble (RUM.US)$ and $Phunware (PHUN.US)$. Rumble is a social platform favored by conservatives, providing video hosting and streaming services for DJT. Additionally, Trump's running mate, Republican vice-presidential candidate J.D. Vance, is a shareholder at RUM. Phunware provided mobile app development and data analytics services for Trump's 2020 presidential campaign.

Beyond equities, a stronger dollar, rising U.S. Treasury yields, and Bitcoin's surge also appear to echo the "Trump trade". According to the Financial Times, this might reflect expectations of Trump's inflationary policies, such as aggressive tariffs and immigration crackdowns.

However, despite shifts in polling data, market expectations may already be priced in. Polymarket, as of October 30, shows Trump leading significantly (66.3% vs. 33.7%), while RCP's data indicates a tight race (48.6% vs. 47.6%). Bloomberg reports that 0.7% of Polymarket accounts contribute nearly half of the trading volume, raising questions about data accuracy and transparency.

On October 30, without significant changes in polling data, DJT experienced a sudden sell-off, plummeting over 20% in a single day.

Strategizing for the election

Trump's policy proposals emphasize a conservative stance, focusing on "America First," economic protectionism, strict immigration controls, tax cuts, deregulation, and a skeptical attitude towards clean energy development.

If Trump returns to the White House, sectors like infrastructure, traditional energy, finance, and pharmaceuticals could benefit.

Kamala Harris, on the other hand, embodies Democratic policies, such as promoting clean energy and electric vehicle industries, supporting international cooperation in foreign and trade policies, and advocating for the legalization of marijuana, allowing states to decide its legality.

While $Tesla (TSLA.US)$ is part of the renewable energy sector, Elon Musk's public endorsement has also made it a component of the "Trump trade." Both parties maintain an open stance on cryptocurrencies, and their commitments to increased government spending could further drive inflation, benefiting gold.

Some investors might also use options to strategize the election. Before major events, the implied volatility of target assets typically rises, then quickly recedes.

In a neutral risk scenario, lower implied volatility means lower premiums, theoretically favoring option buyers. If you anticipate rising volatility before the election, without a clear direction, consider constructing a long straddle or long strangle when volatility is low. Alternatively, you could leverage volatility crush by short straddle or strangle when volatility is high.

The volatility analysis tool on moomoo can help assess current volatility levels. Go to Stock Details > Options > Analysis > Volatility Analysis.

Implied volatility values alone don’t tell the whole story because asset characteristics vary. Using the volatility analysis tool can help you gauge the current volatility level, giving you a clearer picture of the target asset's overall volatility instead of just focusing on a single option.

For a better perspective, consider comparing the target's performance over the past year. IV Rank shows how the current implied volatility compares to past values, while IV Percentile indicates the percentage of trading days when implied volatility was lower. A smaller number suggests that current implied volatility is relatively low.

Does the election matter?

Who will win the election? How will the results affect my holdings? These are pressing questions for many investors. However, according to Morningstar, these questions might be misguided. Making investment decisions based on broad, sweeping predictions that can easily be wrong is unwise and dangerous.

Election trades typically unfold in three phases: pre-election shifts in perceived advantages, post-election surprises, and the impact of policy implementation on trade continuation or reversal. Each phase carries significant uncertainty, and factors like congressional election outcomes, policy agenda execution, and market expectations add complexity.

After Trump's 2016 victory, investors anticipated domestic-focused sectors would benefit from deregulation, tax cuts, and protectionism, leading to rallies in financials, basic materials, energy, and industrials. Meanwhile, Trump's perceived hostility towards Silicon Valley led to an initial tech sell-off. Yet, during Trump's presidency, tech stocks became the best-performing sector, highlighting the dominance of market forces.

Ultimately, fundamentals like earnings, cash flows, and valuations drive financial asset performance. While politics matter, their investment impact is hard to predict and often overstated. Schwab showed the $S&P 500 Index (.SPX.US)$ S&P 500 has only declined in four presidential election years since 1928, corresponding to the Great Depression, WWII, the dot-com bubble burst, and the 2008 financial crisis respectively, unrelated to elections.

According to J.P. Morgan Chase, after the election day, the $S&P 500 Index (.SPX.US)$ tends to rise as uncertainty fades. If this pattern continues, buying the underlying ETFs may be an option.

Some of the larger ETFs that track the S&P 500 are $Vanguard S&P 500 ETF (VOO.US)$ and $SPDR S&P 500 ETF (SPY.US)$ , both of which offer good liquidity and low expenses. VOO has exceeded $1 trillion in size, while SPY has more than $500 billion.

Morningstar analysts assert that while markets may perform better or worse under different presidents, the long-term trajectory is almost always positive. As a result, investors who remain calm and laser-focused on their goals will probably end up in a better place than those who attempt to shift their portfolios based on election headlines.

Options trading entails significant risk and is not appropriate for all customers. It is important that investors read Characteristics and Risks of Standardized Options (https://j.moomoo.com/017y9J) before engaging in any options trading strategies. Options transactions are often complex and may involve the potential of losing the entire investment in a relatively short period of time. Certain complex options strategies carry additional risk, including the potential for losses that may exceed the original investment amount. Supporting documentation for any claims, if applicable, will be furnished upon request.

Moomoo does not guarantee favorable investment outcomes. The past performance of a security or financial product does not guarantee future results or returns. Customers should consider their investment objectives and risks carefully before investing in options. Because of the importance of tax considerations to all options transactions, the customer considering options should consult their tax advisor as to how taxes affect the outcome of each options strategy.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

stefanita : This is wrong, biotech will suffer under Trump because of funding cuts.

Alice Lim choo : good

101802945 : Hope Harris will win

104871913 : Due to the US Presidential election this afternoon, the Federal Reserve's interest rate decision are expected to have a substantial impact on the price increase of save-haven assets.

AL MALIK PAIZA : trust me factors that not effective way

AL MALIK PAIZA : investor areas serious an risks challenge have been working on the global postage programme terms