Under the expectation of rate cuts: how to invest in gold?

Since March, the gold market has been on a strong upward trend. On March 6th, the gold price hit a new all-time high. From April to July, gold prices stabilized within the $2,300 to $2,400 range. However, by the end of July, gold prices surged again and broke through the critical $2,500 mark in early August, attracting widespread attention from global investors.

Driven by expectations of a Federal Reserve rate cut, the potentiality of gold has become increasingly significant, leading many investors to reassess their portfolios and consider increasing their allocation to gold. For many investors, purchasing physical gold, such as gold bars, ingots, or coins, is the first choice for entering the gold market. However, as investment needs diversify, more and more investors are seeking alternatives to physical gold. ETFs (Exchange-Traded Funds) have emerged as a popular alternative.

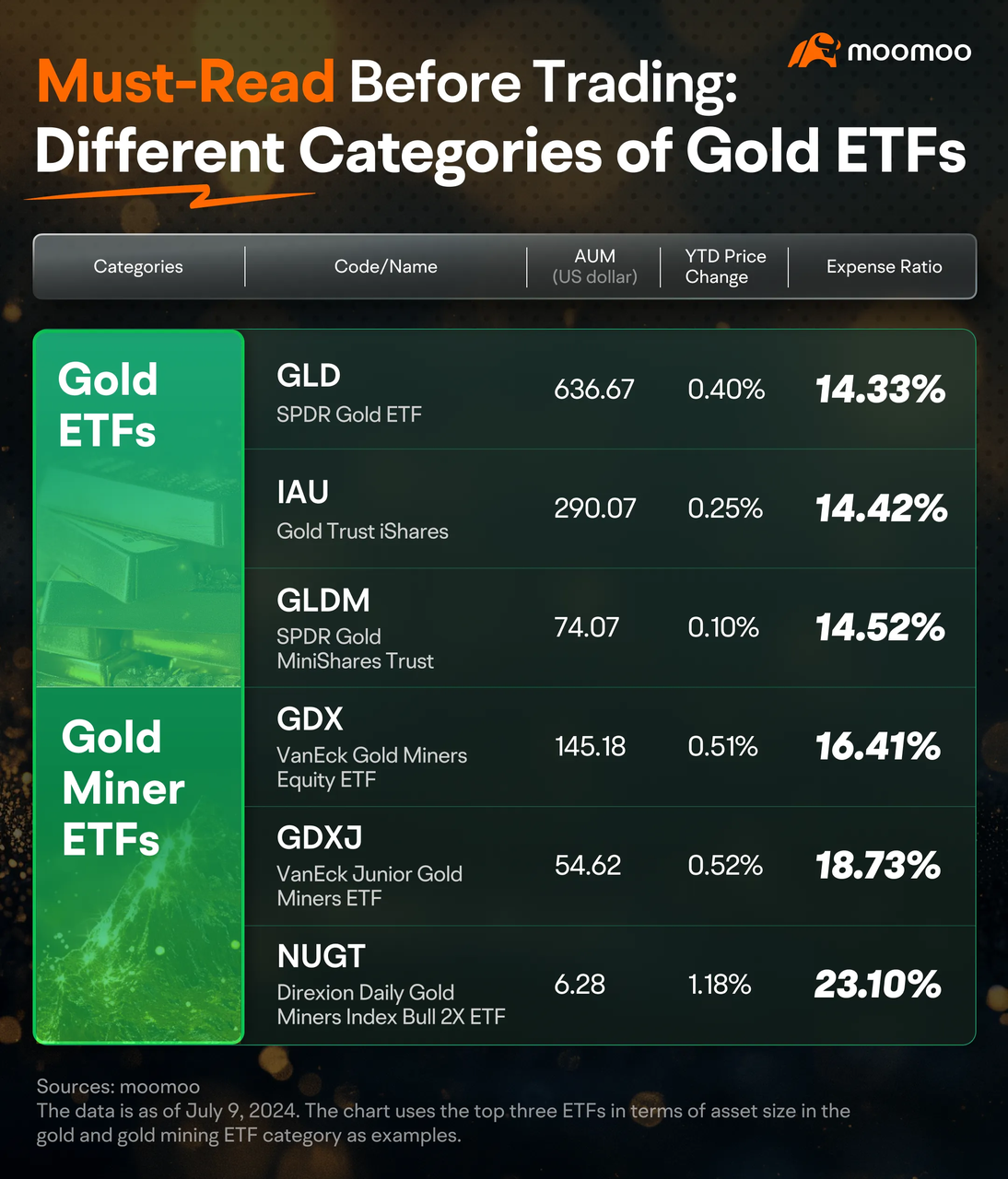

Gold-related ETFs typically refer to exchange-traded funds that have gold as their underlying asset. They aim to provide investors with a different way to invest in the gold market. Based on their tracking goals and underlying assets, gold investment ETFs can be categorized into two types: gold ETFs and gold mining stock ETFs.

A gold ETF is a financial product traded on a stock exchange that aims to track the performance of gold prices. Gold ETFs typically hold physical gold as their underlying asset or invest in gold-related financial derivatives, such as gold futures contracts. When the price of gold rises, the price of the gold ETF also increases, allowing investors to profit from the price difference without actually owning physical gold bars.

A gold mining stock ETF is an exchange-traded fund that specifically invests in the stocks of gold mining companies. This type of ETF provides an alternative way for investors to gain exposure to multiple gold mining companies through a single investment tool, thereby diversifying risk and capitalizing on the growth potential of the gold mining industry. This ETF is suitable for investors who are optimistic about the long-term value growth of gold and wish to invest in the gold mining sector.

– Advantages of Gold-related ETFs:

◦ Convenience: Gold ETFs are traded on stock exchanges, allowing investors to easily buy and sell through their brokerage accounts.

◦ Liquidity: Gold ETFs typically have high liquidity and can be traded on the market at any time.

◦ Low Cost: Compared to purchasing and storing physical gold, gold ETFs usually have lower management fees.

◦ No Storage Needed: Investors do not need to worry about the storage and insurance of physical gold.

◦ Risk Diversification: Gold ETFs allow investors to easily achieve portfolio diversification.

◦ Transparency: The price and holdings information of gold ETFs are publicly transparent.

– Advantages of Physical Gold:

◦ Physical Ownership: Investors actually own the gold, which can serve as a long-term store of value.

◦ No Trading Fees: Once purchased, holding gold incurs no additional trading fees.

◦ Tax Advantages: Some countries may have more favorable tax policies for physical gold.

◦ Protection During Market Turmoil: In extreme market conditions, physical gold can serve as a hard currency.

– Gold-related ETFs:

◦ May have tracking errors, meaning the ETF price may not completely sync with the gold price.

◦ Affected by market volatility, the price may fluctuate with the stock market.

◦ Need to consider the credit risk of the ETF provider.

– Physical Gold:

◦ Storing and insuring physical gold may involve additional costs.

◦ Liquidity may be limited, especially when quick liquidation is needed.

◦ Buying and selling physical gold may involve premiums and discounts.

1. Regular Investment: Adopt a systematic investment plan to reduce the impact of market volatility.

2. Risk Management: Allocate a reasonable proportion of gold investment in your portfolio based on your risk tolerance.

3. Market Research: Pay attention to macroeconomic factors and market dynamics that affect gold prices.

When faced with the decision to invest in ETFs or physical gold, your own investment goals are key factors. If you are inclined to hedge against global financial market risks, plan to hold long-term, or consider asset inheritance, Physical gold could be an option to be considered. On the other hand, if your goal is to diversify your asset allocation or seek an investment tool that can quickly respond to stock market fluctuations, ETFs are the ones you can explore further due to their flexibility and convenience.

You can find gold ETFs on the moomoo platform: Markets-> ETFs-> Thematic ETFs-> Gold ETF

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

Gastly : In the image of gold ETFs, the last two columns was wrongly swapped. You can’t expect an expense ration of 15%![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)