Netflix Posts Solid Growth, Yet Stock Plummets – What's the Story?

On April 18th, Netflix released its Q1 earnings report after the market closed. The company delivered impressive results with Q1 revenue increasing by 14.8% YoY to $9.37 billion and net profit increasing by 79% YoY to $2.332 billion. In addition, Q1 saw the addition of 9.33 million new paid subscribers, far surpassing Bloomberg's consensus estimate of 4.84 million.

However, despite these strong numbers, the market was not impressed and Netflix's stock price fell more than 7% after the earnings release. Why did the stock price drop despite such impressive performance?

On the one hand, the market was concerned about Netflix's future growth prospects due to management's comments during the earnings call that "seasonality will lead to lower user growth in Q2" and that "the company's growth rate will slow in the second half of the year." Additionally, the company announced that it will no longer disclose key metrics such as membership numbers starting in Q1 2025, making it more difficult to assess the company's future prospects.

On the other hand, Netflix's stock price had already priced in much of the positive news, as the company's valuation was high and the market had high expectations for growth. Furthermore, recent hawkish comments from the US Federal Reserve and increased geopolitical risks in the Middle East have led to fragile market sentiment and decreased risk appetite.

Moving forward, we will further analyze Netflix's performance in this earnings report and delve into the company's future investment value.

I. The company's performance depends on growth in paid subscribers

As a purely streaming company, Netflix's revenue primarily comes from subscription fees paid by its members. Therefore, the growth in paid subscribers and average revenue per member (ARM) are the two core growth engines for the company. Therefore, when analyzing the company's financial reports, it is important to focus on changes in these two indicators.

1. The growth in the company's performance is still driven by growth in paid subscribers.

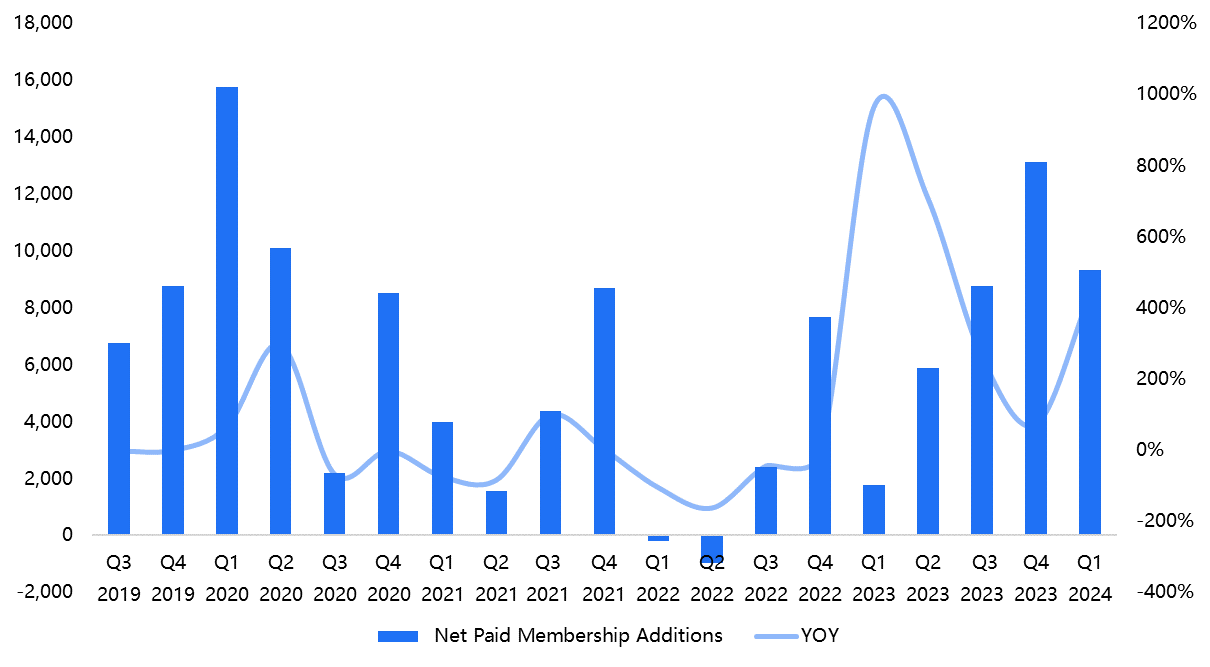

In Q1 2024, the company added 9.33 million new paid subscribers, almost double the market's expectations, while in the same period last year, only 1.75 million new paid subscribers were added. As of Q1 2024, Netflix's total subscriber count increased by 16% YoY to 269 million, and the explosive growth in subscriber numbers drove the company's revenue to increase by 14.8% YoY.

Image: Net subscriber additions from Q1 2020 to Q1 2024 (in thousands)

Why was the company able to gain so many new paid subscribers in the traditionally slow Q1 period?

(1) The slow season for content is not really that slow

Netflix's content performed well in Q1, with many titles achieving high viewership, including "Avatar: The Last Airbender," "The Crown," "Don't Look Up," "The Gentlemen," and "The Three-Body Problem" based on the sci-fi novel by Liu Cixin. In contrast to other streaming services that faced content delays due to strikes, Netflix's extensive content library continued to attract users with high user retention rates.

(2) The crackdown on password sharing is still effective

The company's crackdown on password sharing remains effective. Since announcing the crackdown in late 2022 and expanding its range in 2023, the company's subscriber base has seen a new growth curve. It is expected that most of the 29.53 million new subscribers added in 2023 came from converting shared accounts.

As of early 2023, the company estimated that there were over 100 million shared accounts (mostly in North America) with a monetization rate of around 50%. Assuming that around 20 million have already been converted, there is still conversion potential for around 30 million shared accounts in 2024-2025.

(3) Ad-supported plans are attractive to new users

Ad-supported plans have price advantages and are attractive to new users. According to the company's latest disclosed data, the number of monthly active users for ad-supported members exceeded 23 million in early 2024.

Looking at the sources of new user growth in this quarter, EMEA Europe and UCAN North America are the areas with the largest increase in the number of new users, indicating that other regions such as APAC and Latin America still face certain difficulties in localization of content, making it more difficult to attract new users.

Therefore, the company's user growth logic still relies on cracking down on password sharing. However, as the monetization rate of shared accounts gradually increases, user growth may again face bottlenecks in the future.

2. YoY ARM growth remained relatively flat, with limited contribution to performance

In Q1 2024, the company's average revenue per member (ARM) increased by only 1% YoY, showing little change. Although the company raised the prices of its base and premium plans by 11-22% in the US, France, and the UK in October of last year, and again increased prices in Q1 2024 in countries such as Singapore, New Zealand, Argentina, Chile, and Turkey, the impact of these small-scale price increases on the company's ARM was not significant, as more users are opting for lower-priced ad-supported plans.

Image: Netflix's AMR (average revenue per member) from 2017 to present.

Considering that the competition in the streaming market remains fierce, the company is unlikely to adopt overly aggressive price increase strategies. It is expected that the growth of the company's ARM will have to wait until the explosion of advertising revenue in 2025.

II. The profit margin for fiscal year 2024 is expected to reach a new high, but free cash flow is expected to decline significantly.

In Q1 2024, the company's gross profit margin reached a historic high of 46.89%; YoY operating profit grew by 53.59%, with an operating profit margin of 28.09%, also a historic high; net profit increased by 78.7% YoY to $2.332 billion, with a net profit margin of 24.89%.

Image: Operating and net profit margins from Q3 2017 to Q1 2024 (%).

The company's profit margin has reached a historic high, partly due to the reduction in content production costs resulting from last year's strike events, and partly due to further optimization of operating expenses. In the following quarters, as content spending gradually recovers and increases, the profit margin is expected to decline. The company expects an operating profit margin of 25% for the full year, a significant increase from the 20.62% in FY2023.

In terms of free cash flow, the company expects to generate approximately $6 billion for the full year, a significant decline from the $6.9 billion in FY2023, mainly due to increased content spending in FY2024.

Image: Free cash flow from Q3 2019 to Q1 2024 (in millions).

In Q1, the company repurchased $2 billion worth of shares, and currently has $6.4 billion remaining for buybacks. Assuming the entire buyback amount is used up in 2024, the shareholder return rate would be around 3.2%. However, considering that the company's free cash flow for FY2024 is around $6 billion, using up around $6 billion for buybacks and cancellations would be in line with expectations under stable performance, resulting in an estimated shareholder return rate of around 2.3%, which is less attractive compared to the current risk-free rate of 4.6%.

III.Post-earnings stock price decline, what is the market worried about?

Overall, the company's performance this quarter has been outstanding, but the post-earnings stock price has plummeted, and the market is worried about several factors:

1. Firstly, the company's current growth drivers are too single-minded. As mentioned earlier, the company's stock price rebound since H2 2022 has mainly benefited from the growth in user numbers resulting from the crackdown on shared accounts. However, with the gradual conversion of over 100 million shared accounts, it is foreseeable that user growth will face bottlenecks after 2025.

Therefore, the company is accelerating the expansion of its advertising subscription user base, hoping that when the growth of subscription users slows down in 2025, the growth of advertising revenue can drive an increase in ARM, becoming the second growth curve.

However, from current data, advertising revenue still faces significant uncertainty, and ARM performance is flat.

2. Secondly, the company's announcement that it will no longer disclose user growth and ARM data indicators after 2025 has exacerbated market concerns. Not disclosing these key indicators will increase the difficulty of analyzing the company's performance. At the same time, the opacity of the data indicators has made the market worried that the concerns about the slowdown in subscription user growth will become a reality, making it difficult to maintain the company's high-growth performance.

3. If the performance slows down, the company's current valuation may be difficult to sustain. The current PE (TTM) of the company is 50.75x. If the YoY growth rate of EPS in 2024 is as high as 45% (according to Bloomberg's consensus forecast), then the PE (forward) will still be high at 36x.

The current shareholder return rate of the company is around 2.3% to 3.2%, while the US risk-free rate under the background of interest rate hikes is around 4.6%. If the company's performance growth rate slows down, the current shareholder return rate is significantly less attractive, with a low safety margin.

Therefore, the company's current valuation is high and needs to maintain high-growth performance to sustain it. If the growth rate slows down slightly, the stock price will face a correction.

Therefore, we can see that the logic behind the post-earnings stock price decline is that the company's performance growth may slow down, the company's announcement confirms the market's concerns about the non-disclosure of key indicators, the current valuation is difficult to sustain, and the stock price will fall. Especially now that macroeconomic uncertainty risks have increased, with the Fed postponing interest rate cuts and geopolitical risks in the Middle East intensifying, market sentiment is more sensitive, resulting in more significant stock price fluctuations.

IV. How will the company's stock price evolve in the future?

We expect that in FY2024, the company's full-year paid user count will continue to maintain strong growth under the crackdown on shared accounts, while user growth rates will slow down significantly in FY2025 and FY2026. At the same time, ARM is expected to remain unchanged in FY2024 and will increase in FY2025 and FY2026 driven by advertising revenue growth. The positive impact of ARM growth may be difficult to offset the negative impact of the slowdown in user growth.

In summary, we expect revenue growth of 13%-15% in FY2024, gradually slowing down in FY2025 and FY2026. Considering the continuous optimization of the company's content costs and operating expenses, the profit margin is expected to continue to increase, and EPS is expected to grow at a high double-digit rate in FY2024, with a slowdown in FY2025 and FY2026.

Therefore, we can see that FY2024 will be the peak of the company's performance growth and the time of highest growth potential. After high growth becomes unsustainable, we should be more cautious in evaluating the company's long-term growth prospects.

Overall, we can combine the following assumptions to deduce the future changes in Netflix's stock price:

Scenario 1: Assuming that EPS will achieve high double-digit growth in FY2024, and growth rates in FY2025 and FY2026 will slow down, while shareholder returns are around 2.3%-3.2%. Then the current valuation of the company is too high. The stock price is expected to have a short-term correction risk and may fluctuate between $521 and $608. Therefore, holding shares, shareholders can use the covered call strategy to ensure profits while reducing losses.

Scenario 2: Assuming that the company's growth in paid users slows down significantly, and the competition landscape worsens, then the company will be priced based on "risk-free rate + equity operating risk," with a current shareholder return rate of around 2.3%-3.2%, compared with a risk-free rate of around 4.6%. The company will face significant downward valuation risks. Therefore, investors can buy puts to obtain investment returns while hedging risks.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment