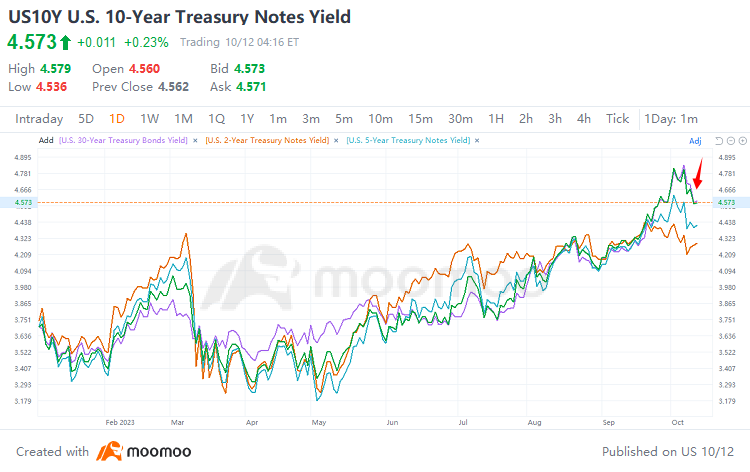

US Treasury Yields Topped Out? What Factors Indicate an Impending Turnaround?

In early October, a confluence of factors, including rising term premiums, speculation regarding higher neutral interest rates, and expectations of the Fed maintaining higher interest rates for longer, triggered a surge in US Treasury yields across multiple maturities, particularly longer-term ones.

This unexpected move caught global financial markets off guard. However, this week has seen a significant decline in US Treasury yields, prompting discussions on whether they have peaked.

As of October 12th, there was a substantial drop in $U.S. 10-Year Treasury Notes Yield (US10Y.BD)$ and $U.S. 30-Year Treasury Bonds Yield (US30Y.BD)$ by 35 and 32 basis points, respectively, compared to last week's highs. Additionally, the $U.S. 2-Year Treasury Notes Yield (US2Y.BD)$ and $U.S. 5-Year Treasury Notes Yield (US5Y.BD)$ retreated by 18 and 29 basis points respectively.

1. Market Sentiment Shifts as Fed Issues Dovish Comments, Easing Expectations for Rate Hikes

Previously, a strong non-farm payroll report fueled expectations of interest rate hikes, resulting in a surge in short-term U.S. Treasury yields. However, market sentiment has recently shifted following dovish speeches by several Federal Reserve officials, as well as the release of September FOMC meeting minutes that were more dovish compared to July.

Fed Officials' Remarks:

Dallas Fed President Lorie Logan said Monday that if long-term interest rates remain elevated due to rising term premiums, then the need to raise the federal funds rate may be less.

On the same day, Fed Vice Chairman Philip Jefferson stated the need for the Fed to balance the risk of not having tightened enough against the risk of policy being too restrictive. He further emphasized that the central bank should proceed with caution in any future increases in the benchmark federal funds rate.

Additionally, Atlanta Fed President Raphael Bostic reiterated on Tuesday, "I think our policy rate is restrictive enough to bring inflation back down to 2%. I actually don't think we need to keep raising rates anymore."

FOMC Meeting Minutes:

Based on the September FOMC meeting minutes, while the policymakers agreed that interest rates should remain at a restrictive level for some time, they acknowledged that the economic outlook is highly uncertain. In light of the current monetary policy stance, there was a consensus among FOMC members to proceed with caution in order to balance the risks of over-tightening and under-tightening the economy.

WSJ's Nick Timiraos, known as the “Fed whisperer” recently commented on the continued rise in U.S. Treasury yields since the September meeting. He suggested that rising yields may serve as a substitute for the Fed to complete its final objective of raising interest rates. Consequently, the need for the Fed to pursue further rate hikes may be relatively weakened.

Andrew Ticehurst, a rates strategist at Nomura in Sydney, believes that US 10-year Treasury yields are unlikely to reach new highs given that the Fed's rate hiking cycle may be approaching its end. He notes that the tone of recent statements by Fed officials has softened considerably, as they acknowledge that rising Treasury yields and tighter financial conditions will impact their views on the Federal funds rate.

2. Term Premiums May Decrease as Supply-Demand Imbalances Ease

Previously, the imbalance between supply and demand in the U.S. Treasury market was exacerbated by factors such as large-scale debt issuance by the U.S. Treasury, selling by overseas central banks, and tapering by the Fed. This led to a rise in term premiums, which became the primary driver of long-term U.S. Treasury yields. After the debt-ceiling crisis, the Treasury Department continued to issue a significant amount of debt over several months. Recent data shows that as of October 10th, the size of the U.S. TGA account fund has sharply risen from its historic low of $48.512 billion on May 31st to $743.996 billion, surpassing levels seen before COVID-19.

Looking ahead, it seems that the peak of U.S. Treasury issuance may have already passed in Q4. Recent data from the U.S. Treasury Department show that planned net issuance of U.S. debt in Q4 has decreased to pre-COVID-19 levels, with the pace of issuance stabilizing.

Additionally, when excluding U.S. Treasury maturing within one year and floating coupons, which have less impact on the market, U.S. bonds maturing in Q4 of 2023 represent less than 5% of the total stock, relieving some of the pressure on maturity renewals. As such, supply-demand imbalances in long-term U.S. Treasuries are beginning to ease, potentially resulting in a decrease in term premiums and yields.

3. Technical Indicators Suggest U.S. Treasury Market is Oversold

Furthermore, BofA Global Investment Strategy's research indicates that technical indicators suggest current U.S. Treasury prices have fallen below their 200-day average and are once again oversold, which typically signals a rebound after an excessive sell-off.

1. Reduced pressure on the valuation of risk assets such as equities: Recently, the fall in U.S. Treasury yields has led to strong rebounds of three major U.S. stock indexes. Notably, the tech-heavy $Nasdaq Composite Index (.IXIC.US)$ gained 1.70% this week, while the $S&P 500 Index (.SPX.US)$ and the $Dow Jones Industrial Average (.DJI.US)$ rallied 1.59% and 1.19%, respectively.

2. The U.S. dollar has recently topped out: Following the recent peak in U.S. Treasury yields, the $USD (USDindex.FX)$ has experienced a significant decline, dropping from its highs of 107.354 to 105.67 as of October 12th.

3. The suppression of commodities has eased: Higher U.S. Treasury yields had previously led to a weakened performance for commodities such as gold and copper. However, these commodities have started to rebound from their recent lows due to the decline in yields. For example, $Gold Futures(FEB5) (GCmain.US)$ have bounced back from Friday's low of 1823.5 to 1892.9, while $Silver Futures(MAR5) (SImain.US)$ and $Copper Futures(MAR5) (HGmain.US)$ have also experienced some level of recovery.

Source: MacroMicro, Guotai Junan International

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment