What is the dark side of stock trading? It's like holding a hot potato!

Follow the big trend (main trend and medium to long-term trend), counter technology (unexpected moves, attack the unprepared), go against human nature (break free from the control of greed and fear). If Tesla experiences another significant decline, it would be more fun and exciting to absorb chips at low levels, ensuring a sufficient quantity of low-cost chips in hand, optimizing the portfolio structure, and reducing average holdings are more important than short-term arbitrage.

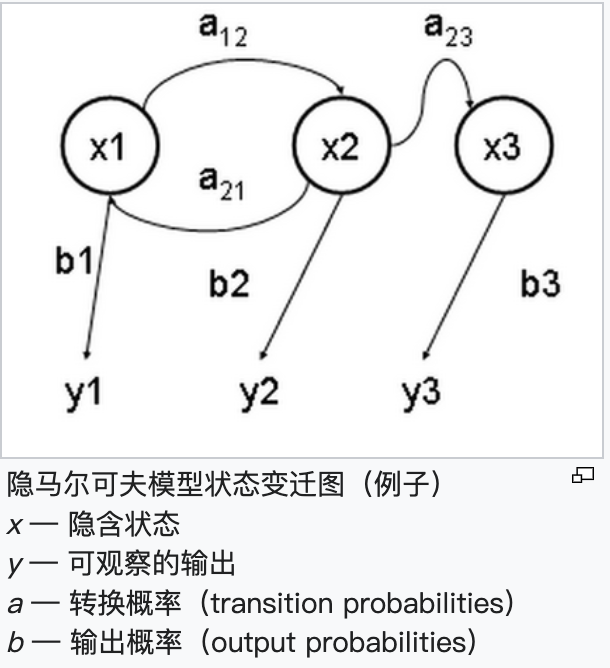

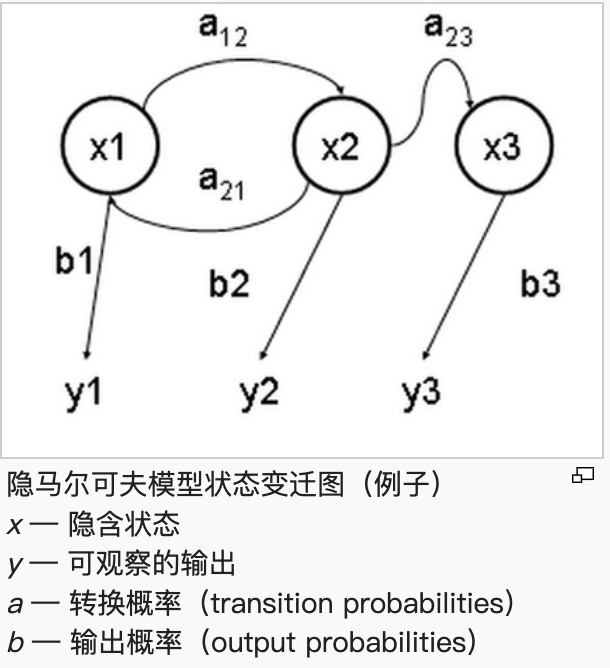

People simply do not like theoretical physics and applied mathematics at all, so it is simply impossible to have a deep understanding of the path of quantification and calculation models in the financial market (at best, it is just Elliott Wave Theory + selling so-called software that tracks the movement of block orders. Is it really that easy to track the movements of block orders? Strictly speaking, it is already lagging behind). Ignorant and inherently greedy, they love rising and hate falling.

Distinguish between secondary trends and primary trends, short-term trends and medium to long-term trends. Do not doubt the stocks you hold, do not invest in doubtful stocks. Do not let the tumultuous and epic primary uptrend of Tesla cause you to mistake the retracements of secondary trends and short-term trends as a decline in Tesla's primary trend and medium to long-term trend, missing out on the historic opportunity to change your financial destiny. The ascending channels and retracement nature of the downtrends within them in various time period charts have clearly explained everything. Charts say it all, interpreting charts correctly is crucial.

Fearless heroes face the decline with a happy and open mindset, breaking free from the curse of enjoying rises and resenting falls. Cherish declines, study declines, and utilize declines. When the short-term secondary downward trend sharply conflicts with the medium to long-term main trend, it is wise to let go of the head and middle trends of the decline. In the foreseeable final stage of the decline, buy on dips and buy on declines, in a planned and step-by-step manner, in gradient batches, discrete random variables, precise surgical and relatively accurate framework for opening positions.

Operate your stock account like Vanguard manages individual retirement accounts (IRAs) and 401(k) fund accounts for investments. Ultimately, the consequences of enjoying rises and resenting falls and chasing highs and strengths (refusing to buy on dips and declines, buying in a planned and step-by-step manner, in gradient batches, with discrete random variables, setting up positions, waiting for the main uptrend to appear, only then chasing highs and strengths, otherwise it would be a failure. Short selling puts is suicidal behavior). Having slightly over 60% long positions, there is no need to worry about stock price increases. Going all in or all out is a completely different matter, and not very wise. A person without long-term planning and who neglects the psychological health of investment transactions won't go far, even if Tesla has the potential to surge between the 271,000-299,290-314,800 range, or even higher levels like the 414,490-515,000 range, intermittently jumping into Tesla's historical peak values or even setting new records highs, you still won't be able to handle the unrealized profits in your hands.

Investment trades are always a regretful profession. 5 years ago, Masayoshi Son sold $4 billion worth of NVIDIA stocks, which are now worth $160 billion. This is equivalent to selling the stocks for $4 per share, which later rose to $160 per share, missing out on a 40-fold bull stock......

The current market is an epic primary uptrend market, characterized by a profit chip ratio that has never been below 70%, always fluctuating in the 70-100% range.

Ronald Stephen Baron, the founder of Baron Capital, the twelfth largest institutional shareholder of Tesla, holds over 6 million shares of Tesla stocks in total (with a holding cost of only $42.88 per share. People should seriously rethink why their holding cost is so low?), an American billionaire and investor, has already earned 6 billion US dollars on this stock (People should seriously rethink why they can earn so much? Are you manipulating recklessly and cunningly?), ready to hold for another ten years.

When you are in a "focused state" during trading, it means you are approaching the center.

You have found a place of emotional stability where you are neither too high nor too low emotionally.

When you can find this center point, it allows you to make clear, concise decisions.

You will not be influenced by fear or greed.

On the contrary, you can assess the market situation calmly and rationally.

This enables you to enter and exit trades precisely and with discipline.

When you trade in this area, you have found a place of power and control.

From this space, you can confidently utilize market opportunities and achieve prosperity.

The reality of stock trading.

- Day traders should have the title of risk managers. Essentially, you are willing to take risks in areas where you have an advantage. The rest of the time, you just have to wait. Essentially, you are waiting to wait. This is the exact opposite of doing something. Patience. This is the hardest thing to master. One embarks on a journey to truly see all their flaws in trading.

- It's okay to lose. Trading is more of a game of 'am I following the plan' rather than win or lose. If you can see losses as part of the plan, then those losses are good losses. The losses you try to eliminate are FOMO losses.

- You will be wrong. You may have done everything perfectly in your analysis, but still end up losing, this will happen. On the days you can win in the market, you must win with discipline, keep losses small, so that your next winning trade will be more valuable.

- You can't catch every move. There will always be another trade. You don't need to try catching every move. It's a saying to be a sniper rather than a machine gunner. Quality over quantity.

- You will always leave money on the table. No matter how well or poorly you do, you will always think you could have held longer, or made another trade, or earned more money. That's greed. The market operates on it. It's crucial to pay yourself at the levels explicitly defined in your trading plan. At moments dominated by emotions, the plan must be followed.

– The process is more important than money. Money comes from following a system you can repeat. If you can't repeat it every day, then you are gambling, not trading. Understand the difference. If you are still trading without a proper plan, it's time to develop one that suits you. Other people's plans may not necessarily meet your needs, even if someone provides a plan for you, you should make your own plan that feels natural.

– Every advantage is profitable. This has been proven. It's the discipline that truly sets you apart. You can do it.

Core Tips🔔The principle of increasing shareholding and expanding shares: transitioning from an electric car manufacturer to an Artificial Intelligence deep development application company + energy storage company + self-driving FSD + RoboTaxis (robot taxis) software company + Optimus (Optimus Prime) humanoid robot company. This is the determination of Tesla led by Elon Musk to change the world, and also the belief of the bulls that the world will be changed. You have the right to continue to believe that Elon Musk is making empty promises to raise money.

However, once Tesla perfects the self-driving FSD + RoboTaxis (robot taxi) software, it will mark the skyrocketing start of Tesla's stock price. When you cannot coexist with uncertainty, deny, and reject emerging things that are still in a vague stage, you also lose the future. Investors can handle and respond according to their own situations.

James Harris Simons, the late world-renowned mathematician (James Harris Simons, from a young age, was exceptionally intelligent, renowned among mathematicians for his adeptness in intricate and lengthy calculations; the wave theory pales in comparison to Leonard Baum's mathematical computational model). He led Renaissance Technologies LLC and Medallion Fund, utilizing an enhanced and expanded Leonard Baum mathematical computational model. Such modified computational models, which most professionals do not understand or know how to apply in practical trading in financial markets (require significant adjustments to adapt to the market conditions).

The explosive force and speed of the rise in Tesla's stock price can be seen from the large-scale upward channel in the chart and another steeper ascending channel within that channel. Don't be dissatisfied.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment