What to Expect From Amazon's Upcoming Earnings Report?

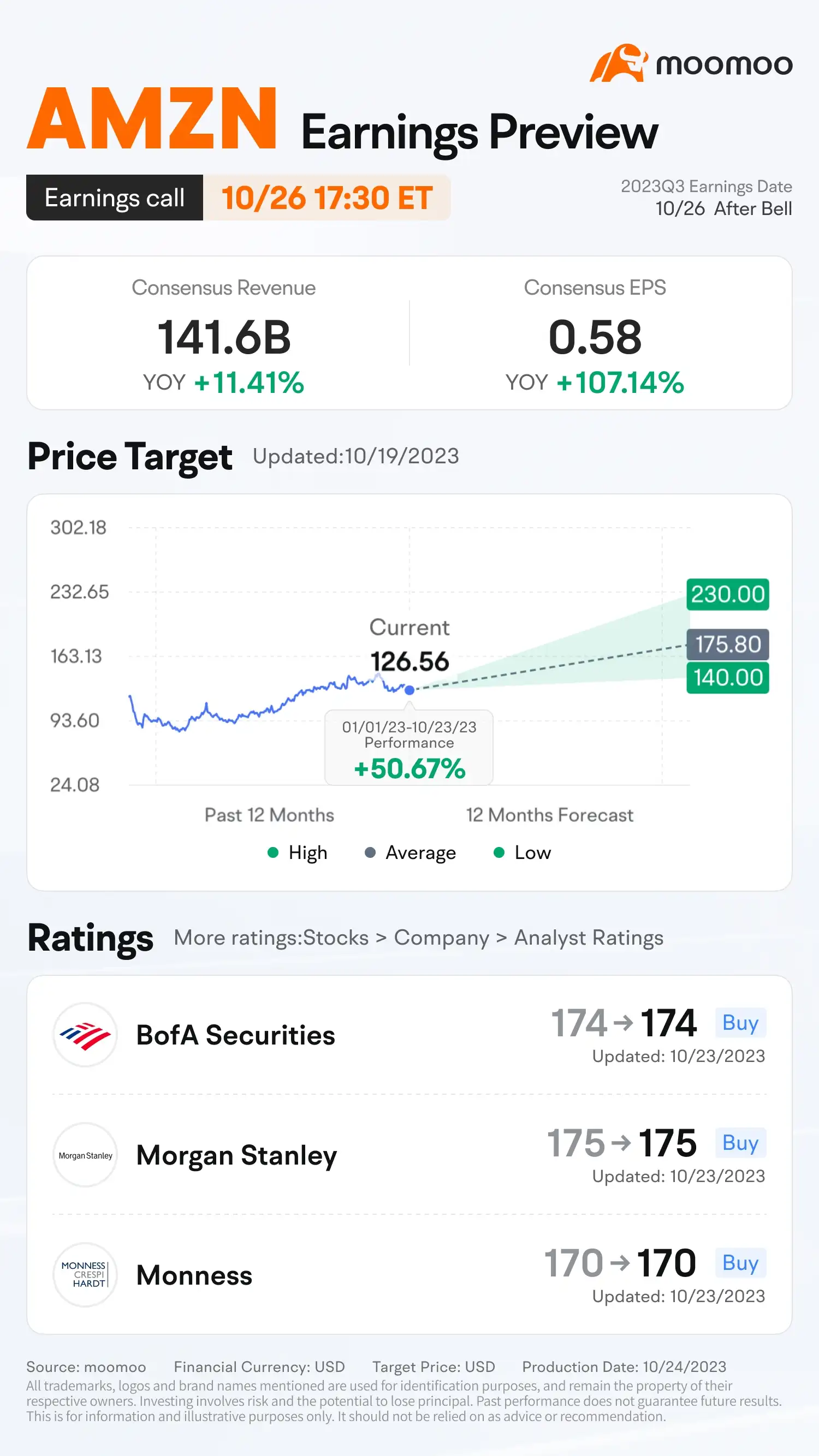

$Amazon (AMZN.US)$ is scheduled to release Q3 results for the period ending September 30th, 2023, after hours on Thursday, October 26th. Despite a 45% YTD rise in Amazon's stock, it dropped nearly 14% since September. The market has shown signs of instability in the second half of the year, and the outcome of Amazon's Q3 report can either halt the decline or exacerbate it.

Here are key expectations to watch:

Ahead of a busy week of Big Tech earnings, the $Nasdaq Composite Index (.IXIC.US)$ shed more than 3% last week. The pros discussed Amazon after $JPMorgan (JPM.US)$ said the e-commerce giant remains its "top internet pick." The firm rates Amazon overweight.

What History Shows

Over the last 8 quarters, Amazon has exceeded both EPS and revenue estimates on four occasions. While the range of revenue beat/miss has been relatively narrow, ranging from -0.13% to 2.35%, the EPS range has been wide and volatile due mainly to Amazon's investment in $Rivian Automotive (RIVN.US)$.

Additionally, Amazon's tendency to invest in undisclosed products and services has impacted its earnings per share over the years. Therefore, while it may be difficult to predict a beat or miss, it is reasonable to expect revenue to be closer to estimates than EPS.

Advertising and AWS

Amazon's advertising revenue is projected to reach $70.82 billion by 2027, despite a slowdown in growth from previous years (117% in 2018 and 58% in 2020). FY 2023 is expected to generate $44.35 billion in revenue, an almost 18% YoY increase. Amazon has already reported $20.1 billion in advertising revenue for FY 2023, requiring an average of $12.125 billion in Q3 and Q4 to meet the prediction. The projection predicts advertising revenue to surpass $11 billion in Q3 and exceed that number during Q4 due to expected holiday spending.

Despite continued growth, AWS has seen a slowdown in revenue expansion, reporting 16% YoY growth in Q1 2023 and 12% in Q2 2023. The H1 AWS revenue of $43.5 billion also puts the rumored FY 2023 target of $100 billion in jeopardy. Based on recent low double-digit growth rates, Q3 2023's AWS revenue is projected to reach $22.5 billion, adding pressure for Q4 to bring in $34 billion. However, it is unlikely to achieve the $100 billion projection. Amazon has shifted its attention towards Large Language Models (LLMs) to reinvigorate AWS' growth, and the upcoming AWS conference is expected to provide more insight into the company's AI efforts. Q3's report may also shed light on this, as it did in Q2 when Omnicom used AWS' generative AI.

Prime, Retail & Streaming Momentum

Amazon's online retail business is expected to have performed well in Q3, supported by the momentum of Prime benefits, strong customer loyalty, and a robust distribution network.

The company's performance during Prime Day earlier in the quarter is also expected to have driven sales. The Zacks Consensus Estimate for online store sales is projected at $57.16 billion, reflecting 6.9% YoY growth. Strengthening relationships with third-party sellers and increasing efforts in grocery retail are anticipated to have aided quarterly performance as well. The consensus mark for third-party seller sales is pegged at $33.43 billion, representing 16.6% YoY growth. The strength of Prime Video and subscription perks are likely to have contributed to Amazon's subscription revenue growth. The Zacks Consensus Estimate for subscription service sales is $10.12 billion, showing 13.6% YoY growth.

Source: Yahoo Finance, CNBC, Barron's, Seeking Alpha, Statista

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment