What to Expect in Friday's Report on the Fed's Preferred Inflation Gauge

The Federal Reserve's most closely monitored inflation metric, the Personal Consumption Expenditures Price Index (PCE), is set to release its November data on Friday. However, the results are expected to have minimal impact on the market, as this figure will be released after Wednesday's Fed meeting, which has increasingly shifted its focus toward the future trajectory of the PCE.

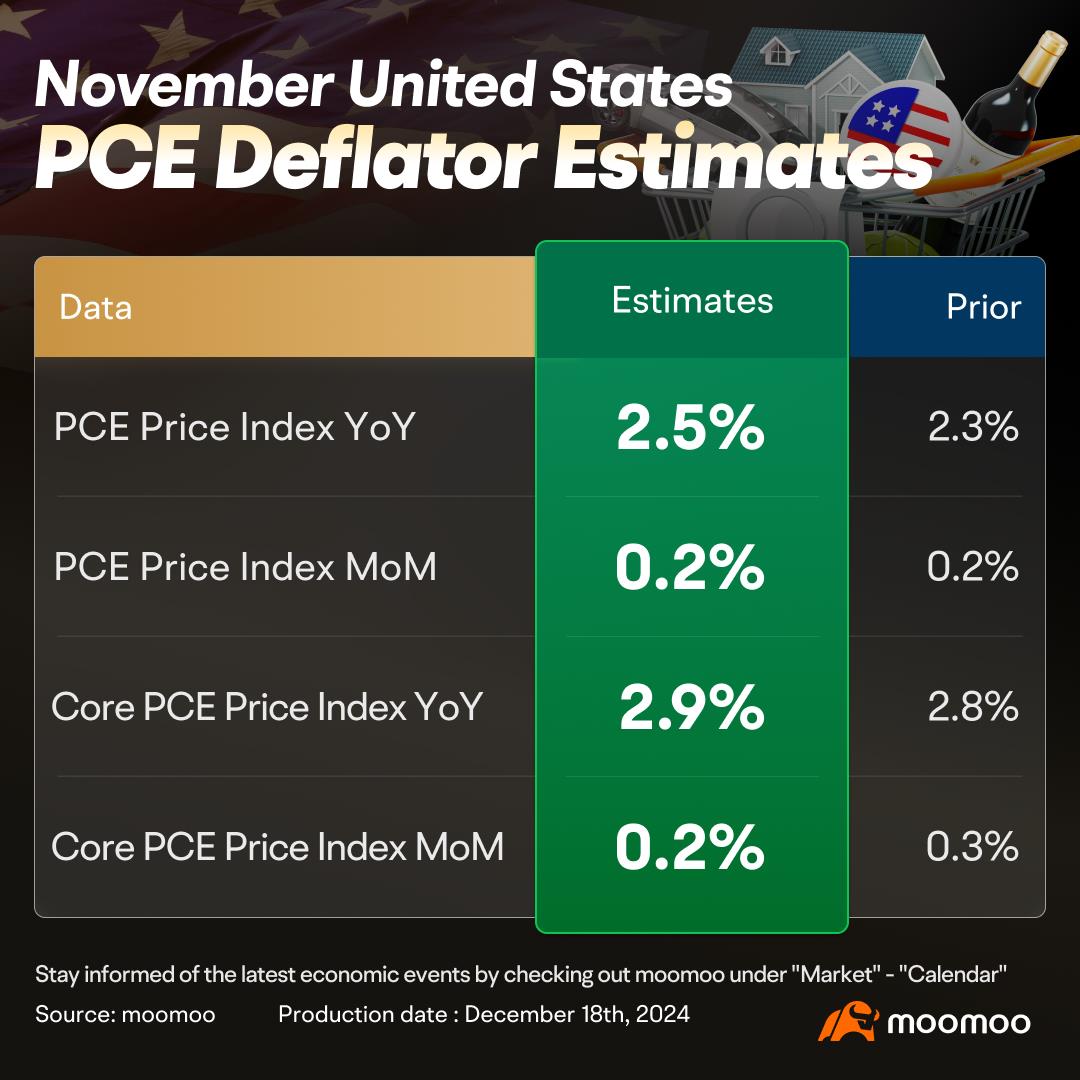

According to Bloomberg economists, the annual "core" PCE (which excludes the more volatile categories of food and energy) is projected to rise to 2.9% in November, up from 2.8% in October. However, on a month-over-month basis, core PCE is anticipated to increase by 0.2%, slightly below the 0.3% growth recorded in October.

Last week, readings from the Consumer Price Index (CPI) and Producer Price Index (PPI) indicated thatinflation is making no headway on the Fed's 2% target. The components of the CPI relevant to core PCE inflation showed mixed results. On the downside, inflation for regular rent and owners' equivalent rent (OER) decelerated unexpectedly, and apparel prices did not rebound as much as the market had anticipated. Conversely, lodging-away-from-home prices, along with new and used vehicle prices, rose significantly. Overall, inflation is moderating, but the process is still underway.

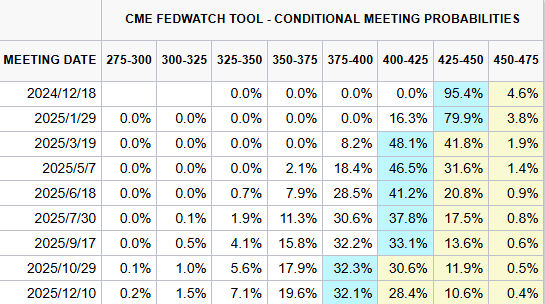

Given that the PCE data will be published after Wednesday's Fed meeting, its results are expected to have limited market impact, as the market has largely priced in a 25 basis point rate cut by the Fed. More importantly, discussions are shifting toward the future direction of inflation. Currently, market concerns are centering on the potential implications of Trump's tariff policies, which may hinder the Fed's efforts to bring inflation back to 2% next year. Additionally, there is growing anxiety that the December FOMC meeting may signal a more hawkish stance.

During his campaign, Mr. Trump pledged to implement both broad tariffs and levies of 60% or more on China. Earlier, he posted on Truth Social that on his first day in office, he would impose a 25% tariff on all goods from Canada and Mexico, along with an additional 10% tariff on products from China.

Economists at Deutsche Bank noted that the tariffs proposed by Trump on goods from Canada and Mexico could potentially push core PCE inflation above 3% by 2025. While it is challenging to predict precisely how these tariffs will influence inflation—given factors such as trade partner responses and adjustments in monetary policy—economists generally believe that tariffs are likely to lead to higher prices.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

friend688 : Meaning? Impact on the general market?

Brandon Jones198 : they don't know

Daily Investors : This is what I'm learning now, trading in the microsectors. I've been catching Bulz, but I'm at the point figuring what affects which one. like gold and oil, that's easy, but all the other microsectors it's dif, you have to say trade, can't sit. But they blow up when they run

104088143 : What happened?

103356238jenny tan : k

72441783 : good