What to look out for this week, plus an update on latest Chinese economic stats

– This morning at 10AM: China released economic numbers related to November retail sales, industrial output, fixed asset investment and jobless rate.

– While November's industrial production rose in line with expectations (+5.4% year on year), and the jobless rate of 5% remained steady, retail sales for November rose only 3% compared to the 5% expectation. The latest retail sales stats validate the Chinese government's need to boost consumption as announced last week, although the market may be hung up over the lack of clarity on any policy

– Tuesday night: the US will publish their own November retail sales, which will offer insights into consumer spending for the month and help shape expectations for 4th quarter real GDP growth. Consensus estimates predict a month on month increase to 0.5%, up from the previous 0.4%.

– Wednesday night: the FOMC will annouce their target rate, where markets are expecting the interest rates to be cut by 25 bps. Given the recent stalling in inflation progress and mixed signals from the labor market, the communication is likely to emphasize that future rate cuts will be data-dependent. The dot plot is likely to shift in a hawkish direction relative to the 100 bps of easing in 2025 that was indicated in September. Addtionally, the US will publish their November housing starts and building permits, which is projected to remain relatively unchanged.

– Thursday: the Bank of Japan will announce their target rates. Expectations are for rates to remain unchanged, although the market is also pricing a low chance of a hike. The BoJ has unexpectedly scheduled a speech for Deputy Governor Himino on 14 January 2025 before the next BoJ meeting on 24 January - to potentially prime the market for a potential hike.

– Friday: Japan announces its national core Consumer Price Index for November, while the US will announce their Core PCE Price Index and Real Personal spending on Friday night.

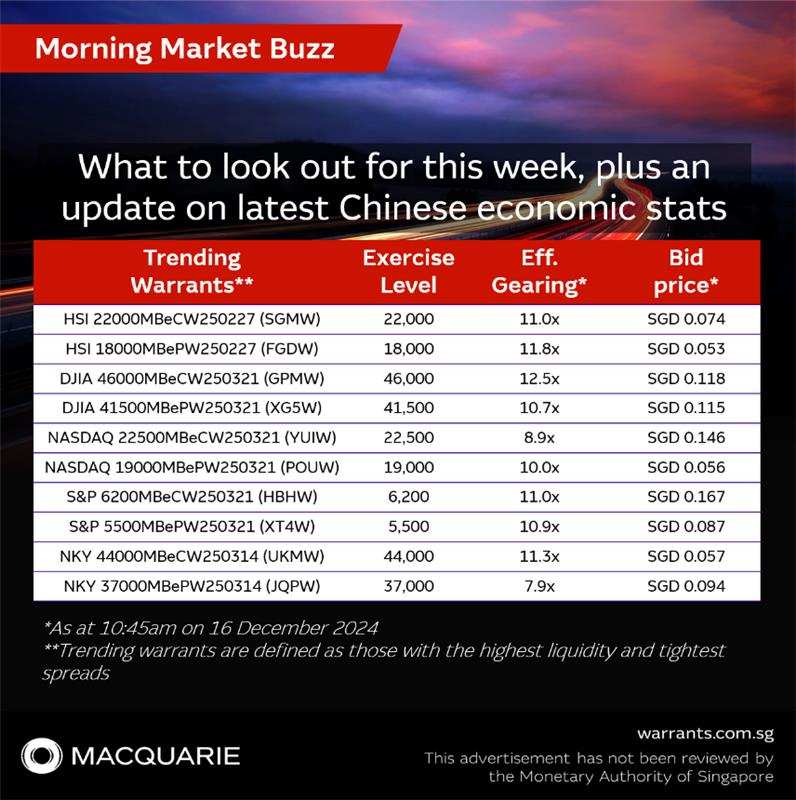

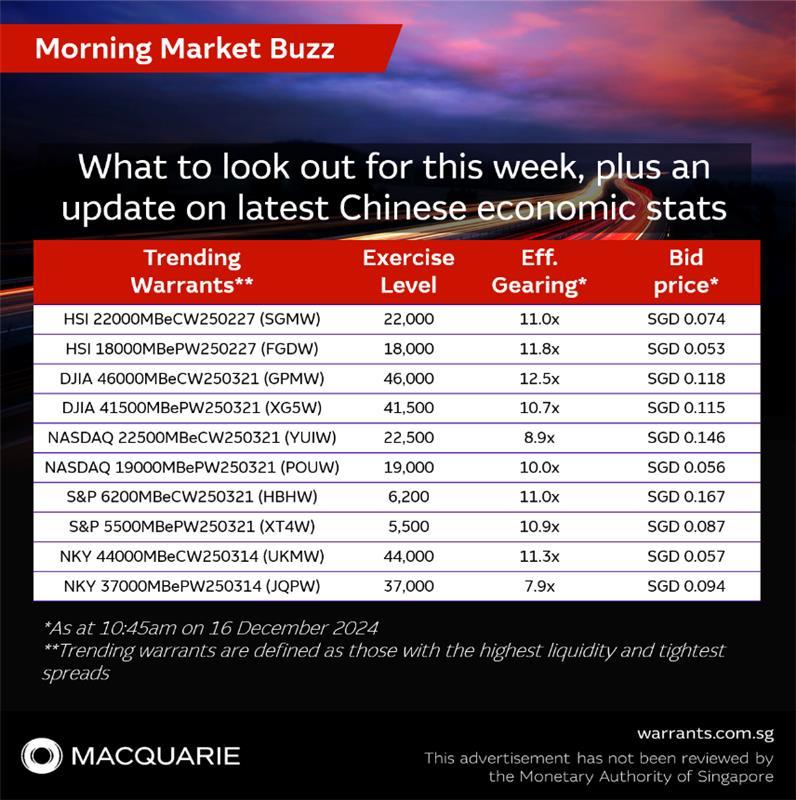

– Investors keen to trade potential moves in the China-related HSI, the US indices or the Nikkei225 during Singapore trading hours may wish to consider Macquarie's HSI, S&P500, Dow Jones, Nasdaq-100 and Nikkei225 warrants. Find out more about our index warrants here: Singapore Warrants | Trading Stocks and Index Warrants | Macquarie

To see how each of the above warrants moves alongside their respectively index futures, click into their Live Matrix pages below!

HSI call $HSI 22000MBeCW250227 (SGMW.SG)$ https://warrants.com.sg/tools//SGMW

HSI put: $HSI 18000MBePW250227 (FGDW.SG)$: Singapore Warrants | Trading Stocks and Index Warrants | Macquarie

Nikkei call $NKY 44000MBeCW250314 (UKMW.SG)$: https://warrants.com.sg/tools/livematrix/UKMW

Nikkei put $NKY 37000MBePW250314 (JQPW.SG)$: https://warrants.com.sg/tools/livematrix/JQPW

S&P call $S&P 6200MBeCW250321 (HBHW.SG)$: https://www.warrants.com.sg/tools/livematrix/HBHW

S&P put: $S&P 5500MBePW250321 (XT4W.SG)$

See how the warrant moves alongside S&P futures: https://www.warrants.com.sg/tools/livematrix/XT4W

Nasdaq call $NASDAQ 22500MBeCW250321 (YUIW.SG)$: https://www.warrants.com.sg/tools/livematrix/YUIW

Nasdaq put $NASDAQ 19000MBePW250321 (POUW.SG)$: https://www.warrants.com.sg/tools/livematrix/POUW

HSI call $HSI 22000MBeCW250227 (SGMW.SG)$ https://warrants.com.sg/tools//SGMW

HSI put: $HSI 18000MBePW250227 (FGDW.SG)$: Singapore Warrants | Trading Stocks and Index Warrants | Macquarie

Nikkei call $NKY 44000MBeCW250314 (UKMW.SG)$: https://warrants.com.sg/tools/livematrix/UKMW

Nikkei put $NKY 37000MBePW250314 (JQPW.SG)$: https://warrants.com.sg/tools/livematrix/JQPW

S&P call $S&P 6200MBeCW250321 (HBHW.SG)$: https://www.warrants.com.sg/tools/livematrix/HBHW

S&P put: $S&P 5500MBePW250321 (XT4W.SG)$

See how the warrant moves alongside S&P futures: https://www.warrants.com.sg/tools/livematrix/XT4W

Nasdaq call $NASDAQ 22500MBeCW250321 (YUIW.SG)$: https://www.warrants.com.sg/tools/livematrix/YUIW

Nasdaq put $NASDAQ 19000MBePW250321 (POUW.SG)$: https://www.warrants.com.sg/tools/livematrix/POUW

Dow Jones call : https://www.warrants.com.sg/tools/livematrix/GPMW

Dow Jones put $DJIA 41500MBePW250321 (XG5W.SG)$: https://www.warrants.com.sg/tools/livematrix/XGSW

Dow Jones put $DJIA 41500MBePW250321 (XG5W.SG)$: https://www.warrants.com.sg/tools/livematrix/XGSW

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment