Will AI End Up the Same Way That the Internet Bubble Stocks Did?

The demand for generative AI has been fueled by the release of OpenAI's ChatGPT tool last year, as it has the potential to disrupt industries ranging from banking to education to film-making. According to $Citigroup (C.US)$ strategists, the impacts of AI will be seen across various businesses in as little as two years, making it the stock market's "new growth thing." This excitement has led to a search for early winners, with chipmaker $NVIDIA (NVDA.US)$ being considered as the flag-bearer for the group, as its shares have risen by 212% this year.

However, The artificial intelligence hype cycle may have finally crested. Shares of $C3.ai (AI.US)$ have fallen by as much as 26.14% last month, and shares of $Palantir (PLTR.US)$ have slumped by 24.5% last month. The enterprise AI providers reported weak growth and huge losses, prompting investors to sell the stocks.

Additionally, China's expansion of a ban on $Apple (AAPL.US)$'s iPhone landed just as bond yields nudged higher, underlining a market-valuation picture that some see an outright bubble. Coming off its best week since June, the Nasdaq slumped, with Apple and rally champion Nvidia Corp. both notching their second-worst falls of the year.

Factor-investing legend Rob Arnott labeled Nvidia "a great company priced beyond perfection."

The whole market is a potential casualty," said the founder of Research Affiliates LLC, "when investors wake up to my view that the AI powerhouse isn't 'too big to fail,' but 'too big to succeed.'"

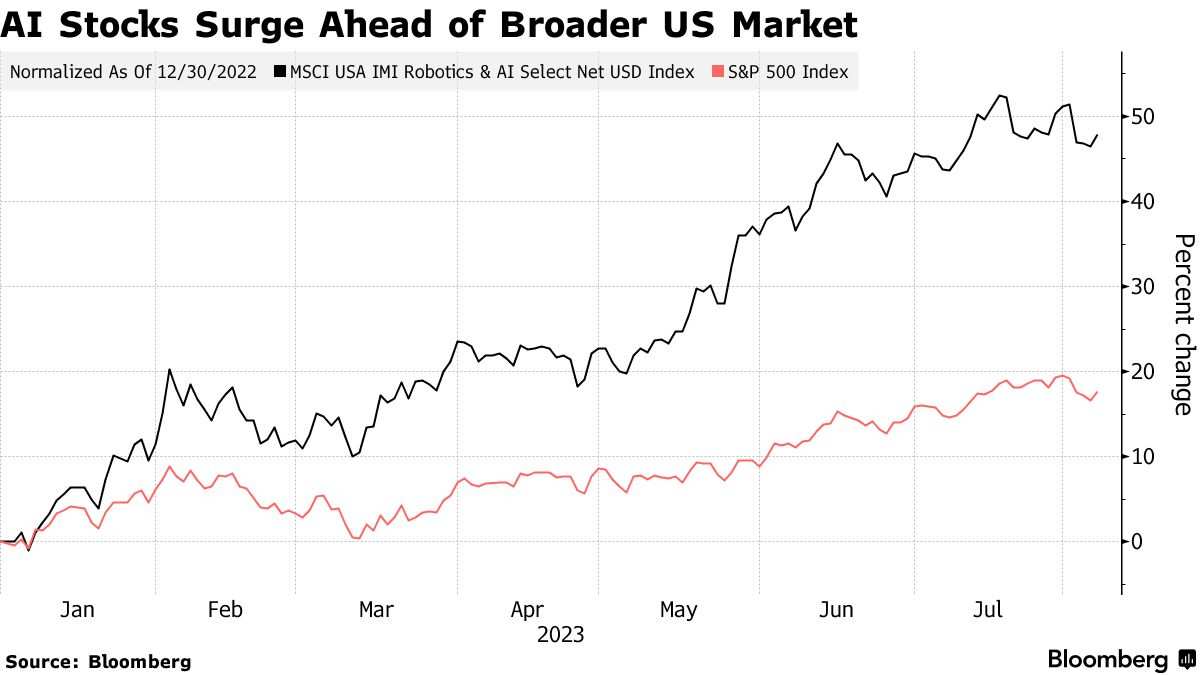

$Goldman Sachs (GS.US)$ strategists have refuted concerns about a bubble forming in artificial intelligence, stating that the early winners in this field have strong fundamentals and less extreme valuations as compared to stocks seen in previous periods of exuberance. According to a note titled "Why AI Is Not a Bubble," led by Peter Oppenheimer, the Goldman strategists believe that we are still in the relatively early stages of a new technology cycle that will likely lead to further outperformance. The stocks leading the AI rally trade at significantly lower levels than the major firms during past tech bubbles, and today's companies are profitable and generate cash.

Mizuho Securities upgraded $Adobe (ADBE.US)$ to Buy from Neutral and raised its price target to $630.00 from $520.00 ahead of the Q3 results this Thursday. Wall Street has been growing optimistic about Adobe, enthused by the potential growth that might come from artificial intelligence. Adobe released generative AI software Firefly in March, intended to translate simple text into images, audio, illustrations, videos and 3-D images. Firefly is part of Adobe's portfolio of AI software tools for businesses and creators, which also includes Sensei GenAI, a program designed for marketers.

There is a lot of faith that the prospects for AI are real and will not end up the same way that the internet bubble stocks did," said Peter van Dooijeweert at Man Solutions. "Even modest news flow has led to larger moves to the downside in several specific technology stocks suggesting vulnerability may be more than perceived."

Goldman's optimism flies in the face of a more cautious approach taken by fellow investment banks. $Bank of America (BAC.US)$ strategists have warned that AI won't save technology stocks from the impact of higher-for-longer interest rates, while $Morgan Stanley (MS.US)$ has said that the bubble is nearing a peak.

Speaking about how to manage the coming 'techstorm' and the fast pace of technological advancement, Bergman, an adviser to the European Innovation Council (EIC) since 2020, said: "You have to embrace new things and be curious. You do not have to jump all in, but you have to be curious about new things."

Source: Bloomberg, Citywire, The Motley Fool

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

心随花开 : Temporary Panic ~ AI Will Develop Greatly

smoothshoe : If you make sure the AI stocks you invest in, have a solid balance sheet, you can avoid bubble stocks. I know seasoned investors learned from the .com era. AI startups need a long runway of cash to burn, combined with growing revenues, in order to become successful.

Follow the smart money (investment firms and Walstreet whales). Some AI stocks will go bust. However, it won't be a blood bath like the .coms.

Derpy Trades smoothshoe : If it IS a bubble, even the winning companies will likely suffer from "sympathy" loss for a while.