Will Trump's Debate Advantage Give Biotech and Healthcare Stocks a Lift?

As the dust settles on the latest presidential debate, market analysts are scrutinizing the implications of a potential shift in the political landscape. With former President Donald Trump's support rate increasing post-debate, the healthcare sector is witnessing a surge in certain stocks. Biotech investors are eyeing a favorable environment ahead.

The probability of Trump reclaiming the Oval Office is now pegged at around 60%, according to Andrew Lilley, chief interest rate strategist at Barrenjoey. Trump's odds have shot up by 5% since the debate with President Joe Biden on June 27th.

Health insurance stocks, particularly within the Medicare Advantage space, are rallying on the notion that Biden's poor debate performance could pave the way for Trump's second term. RBC analyst Ben Hendrix suggests that a Trump presidency would likely mitigate the regulatory and reimbursement challenges that have been plaguing managed care stocks.

Industry giants like UnitedHealth, Humana, and CVS Health experienced notable gains following the debate. $UnitedHealth(UNH.US$ shares saw an impressive surge of 4.69% on Friday after the debate, while $Humana(HUM.US$ reported a solid increase of 3.19%, and $CVS Health(CVS.US$ climbed 1.2% last Friday.

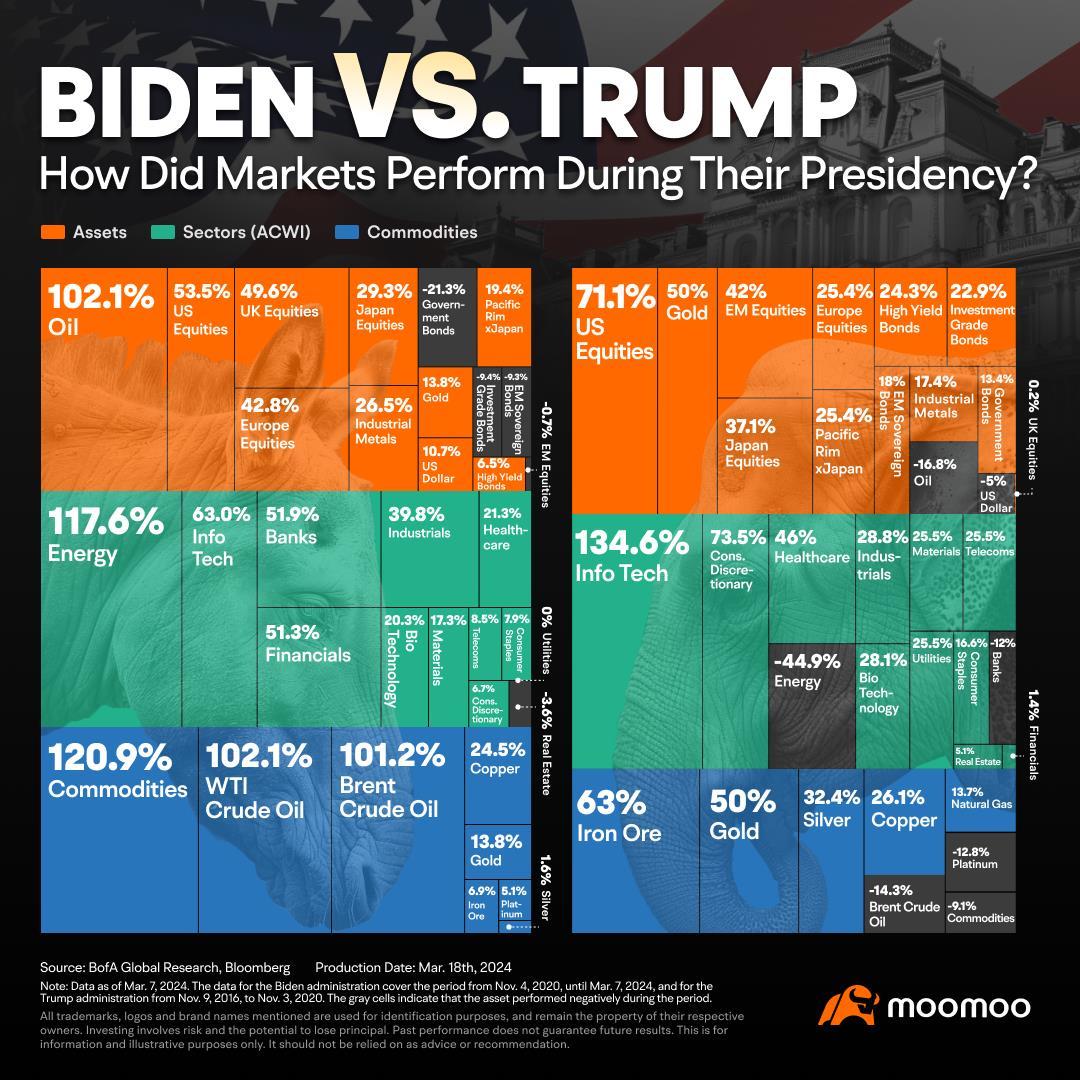

Contrasting the tenures of Presidents Trump and Biden, the healthcare sector surged 46% and 21.3% respectively, according to a report by Bank of America Global Research, reflecting a sectoral rotation influenced by differing policy and economic cycles.

The biotech sector also stands to gain during this period of political and economic transition. With a history of robust dealmaking and a recent uptick in stock performance, biotech companies are poised for further success. Rod Nathan, portfolio manager and partner at J. Goldman & Co., highlighted at STAT's Breakthrough Summit East that biotechs thrive on capital borrowing. A cut in interest rates, which becomes more likely under a Trump administration, would alleviate the pressure on these startups that have been struggling with high borrowing costs. This presents a tantalizing opportunity for investors to engage with public biotechnology firms that are now primed for growth.

Historical data from the previous four presidential elections (2004, 2008, 2012, and 2016) reveals a pattern of biotechnology stocks underperforming in the lead-up to election day. On average, the NYSE Arca Biotechnology Index posted a return of -6.4% during the two months preceding these elections. Market analysts often attribute this pre-election dip to the uncertainty surrounding healthcare policies and potential regulatory changes that a new administration might bring.

Source: MarketWatch, Bloomberg

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

smoothshoe : Also, Biden promised to raise the corporate tax rate and tax unrealized gains. Trump’s supply-side policies will be a catalyst for stocks across the board. I hate politics, but policies are extremely important.

1000proof : Be careful what you wish for. If u make the wrong choice we could end up drowning

TradeWithJames : $ARK Genomic Revolution ETF (ARKG.US)$ $Direxion Daily S&P Biotech Bull 3x Shares ETF (LABU.US)$ $iShares Biotechnology ETF (IBB.US)$ $SPDR S&P Biotech ETF (XBI.US)$ let’s go

股勇者 : Both Humana n UNH keep dropping...

73637910 smoothshoe : Tariffs make that unlikely. Consumption will be in for a big hit.

smoothshoe 73637910 : Tariffs make American companies more competitive and reduce tax burdens. They aren't a perfect solution, but they will help when implemented strategically.

73637910 smoothshoe : They make American companies more competitive by increasing costs to consumers. You can pay American wages for all of your products and afford less. The products will have retaliatory import duties in other nations, so their market is more limited. This also increases costs to consumers.

smoothshoe 73637910 : It's clear you never studied economics in depth, given your simplistic response. I'm not going to explain microeconomics to someone who doesn't even understand macroeconomics. Try running your answers through chat gtp. You might learn something.