$TENCENT(00700.HK$

Hong Kong stocks are rampant again after major fluctuations. They often take four or five days to move back in direction. They are more rampant towards the end of the year. At this time last year, they consolidated in a narrow range for five consecutive days. Although there is a year-end at the end of the year, the intensity has declined a lot, and the transaction has already been reflected. So-called favorable headlines went viral this morning, but the market reaction was lackluster. It was no different from a few days ago, and it has yet to rise above this week's high of 17800. Institutions don't come forward, retail investors are no longer active, and market confidence is really poor. Should the Hang Seng Index see 18,000 today? If 17,800 liters remain unbroken, Hong Kong stocks are too weak. Excessive optimism is not prudent. Cautious optimism is aggressive. Currently, there is only 500 points of fluctuation this Thursday, which is rare in recent months, and is less than normal one-day fluctuation. It is difficult to move upward, and there is some support in the downward 17200 mood. The double buyout at the beginning of this week has shrunk by more than half. Fortunately, after the option premium was hedged, it cost less than 100 points and was only 1/4 of the position. Even if the premium was cut this period, it did not exceed the profit to loss ratio limit. It's also scary when the cost is limited and quantified. Yesterday, it was Futubull Community Quan live broadcast. Trading is still difficult to win, and since wins are limited, the profit to loss ratio is not good; the higher the cost, the more passive. This is why cyclical options are more advantageous than monthly options. Buy both tickets at the end of the week. Today's price is reasonable, but the fluctuation is difficult to say. Whether this week's narrow range will continue. Take a small note of joy. Looking forward to Black Friday morning and bad laughs. The 11/25 p.m. cycle ticket is not easy to use. $Hang Seng Index Current Month futures (HSICurrent.hk) $...

Hong Kong stocks are rampant again after major fluctuations. They often take four or five days to move back in direction. They are more rampant towards the end of the year. At this time last year, they consolidated in a narrow range for five consecutive days. Although there is a year-end at the end of the year, the intensity has declined a lot, and the transaction has already been reflected. So-called favorable headlines went viral this morning, but the market reaction was lackluster. It was no different from a few days ago, and it has yet to rise above this week's high of 17800. Institutions don't come forward, retail investors are no longer active, and market confidence is really poor. Should the Hang Seng Index see 18,000 today? If 17,800 liters remain unbroken, Hong Kong stocks are too weak. Excessive optimism is not prudent. Cautious optimism is aggressive. Currently, there is only 500 points of fluctuation this Thursday, which is rare in recent months, and is less than normal one-day fluctuation. It is difficult to move upward, and there is some support in the downward 17200 mood. The double buyout at the beginning of this week has shrunk by more than half. Fortunately, after the option premium was hedged, it cost less than 100 points and was only 1/4 of the position. Even if the premium was cut this period, it did not exceed the profit to loss ratio limit. It's also scary when the cost is limited and quantified. Yesterday, it was Futubull Community Quan live broadcast. Trading is still difficult to win, and since wins are limited, the profit to loss ratio is not good; the higher the cost, the more passive. This is why cyclical options are more advantageous than monthly options. Buy both tickets at the end of the week. Today's price is reasonable, but the fluctuation is difficult to say. Whether this week's narrow range will continue. Take a small note of joy. Looking forward to Black Friday morning and bad laughs. The 11/25 p.m. cycle ticket is not easy to use. $Hang Seng Index Current Month futures (HSICurrent.hk) $...

Translated

$Alibaba(BABA.US$

Opinion Network On November 17, at a time when people's attention to “Double Eleven,” which has just come to an end, has not declined, Alibaba revealed its results for the second quarter of fiscal year 2023 and held a conference call.

The conference call was attended by Chairman of the Board and CEO Zhang Yong, Executive Vice Chairman Cai Chongxin, and Chief Financial Officer Xu Hong.

According to financial data, in the second quarter of fiscal year 2023, Alibaba Group's revenue was 207.176 billion yuan, up 3% year on year; operating profit was 25.137 billion yuan, up 68% year on year; and adjusted EBITA (profit before interest, tax, depreciation and amortization) was 36.164 billion yuan, up 29% year on year.

Before it was released on the list, the majority of the market was optimistic that it was expected to resume positive growth after four consecutive seasons of decline in earnings. The financial data after publication also lived up to expectations and was better than market expectations.

Ali people are also full of confidence in themselves and the future. As Zhang Yong said in his speech, “Regardless of the ebb and flow, we are always full of confidence in ourselves, and even more so in the future.”

Focus on “Double Eleven”

In the conference call, this year's special “Double Eleven” was mentioned many times. Since hosting the event in 2009, it is also the first time that major platforms have not disclosed final transaction data.

Although Ali said that the scale of Tmall's “Double Eleven” transaction was the same as last year (GMV in 2021 was 540.3 billion yuan, an increase of 8 percent over the same period in 2020...

Opinion Network On November 17, at a time when people's attention to “Double Eleven,” which has just come to an end, has not declined, Alibaba revealed its results for the second quarter of fiscal year 2023 and held a conference call.

The conference call was attended by Chairman of the Board and CEO Zhang Yong, Executive Vice Chairman Cai Chongxin, and Chief Financial Officer Xu Hong.

According to financial data, in the second quarter of fiscal year 2023, Alibaba Group's revenue was 207.176 billion yuan, up 3% year on year; operating profit was 25.137 billion yuan, up 68% year on year; and adjusted EBITA (profit before interest, tax, depreciation and amortization) was 36.164 billion yuan, up 29% year on year.

Before it was released on the list, the majority of the market was optimistic that it was expected to resume positive growth after four consecutive seasons of decline in earnings. The financial data after publication also lived up to expectations and was better than market expectations.

Ali people are also full of confidence in themselves and the future. As Zhang Yong said in his speech, “Regardless of the ebb and flow, we are always full of confidence in ourselves, and even more so in the future.”

Focus on “Double Eleven”

In the conference call, this year's special “Double Eleven” was mentioned many times. Since hosting the event in 2009, it is also the first time that major platforms have not disclosed final transaction data.

Although Ali said that the scale of Tmall's “Double Eleven” transaction was the same as last year (GMV in 2021 was 540.3 billion yuan, an increase of 8 percent over the same period in 2020...

Translated

$Tesla(TSLA.US$

Because the price reduction had little effect on Tesla... Tesla dropped once last month. The price reduction range was between 14,000 yuan and 37,000 yuan, mainly Model Y and Model 3. The price reduction was only about 50,000 orders, and the effect was really average... (As pointed out by mooer, this may be a rumor; there is no clear data)

Let's take another look at Tesla's flag at the beginning of the year. It says it will sell around 1.5 million units this year, but Tesla's cumulative production in the first three quarters of this year was 930,000 units, and almost 600,000 cars will have to be sold in the fourth quarter...

Please, don't keep staring at Twitter, check out Tesla, this is your money bag! Look, the BYD next door has all gone up in price. I'm not worried about the subsidy being lifted next year... but BYD's stock price isn't going anywhere good (BYD's brothers don't mind, they just hate iron and not steel) $BYD (002594.SZ) $

Because the price reduction had little effect on Tesla... Tesla dropped once last month. The price reduction range was between 14,000 yuan and 37,000 yuan, mainly Model Y and Model 3. The price reduction was only about 50,000 orders, and the effect was really average... (As pointed out by mooer, this may be a rumor; there is no clear data)

Let's take another look at Tesla's flag at the beginning of the year. It says it will sell around 1.5 million units this year, but Tesla's cumulative production in the first three quarters of this year was 930,000 units, and almost 600,000 cars will have to be sold in the fourth quarter...

Please, don't keep staring at Twitter, check out Tesla, this is your money bag! Look, the BYD next door has all gone up in price. I'm not worried about the subsidy being lifted next year... but BYD's stock price isn't going anywhere good (BYD's brothers don't mind, they just hate iron and not steel) $BYD (002594.SZ) $

Translated

2

$Tesla(TSLA.US$

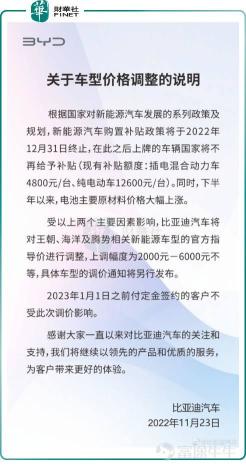

On November 23, BYD Auto announced on Weibo that the official guide prices for new energy models related to Dynasty, Ocean, and Tension will be adjusted. The increase will range from 2,000 yuan to 16,000 yuan. Price adjustment notices for specific models will be posted separately. However, customers who paid a deposit before January 1, 2023 will not be affected by this price adjustment.

After the news was released, there was constant buzz in the market, and it even hit the headlines for a while.

You need to know that since late October, under the leadership of $TSLA.US (TSLA.US) $, $Cyrus (601127.SH) $, $Zero Sports Car (09863.HK) $, Xiaopeng (09868.HK), and Ford MustungMach-e have all participated in promotions through terminal discounts or official price reductions to boost sales.

Today, BYD is going the other way around. The price of new energy vehicles is rising instead of falling. What is the reason behind this?

01. What is the driving force behind BYD's price increase?

According to the announcement, there are two reasons why BYD announced price increases for some new energy vehicles.

First, it is affected by the imminent withdrawal of state subsidies. According to the country's series of policies and plans for the development of new energy vehicles, the NEV purchase subsidy policy will end on December 31, 2022, and the countries that license vehicles after that will no longer be subsidized (current subsidy amounts: 4,800 yuan/unit for plug-in hybrids, 12,600 yuan/unit for pure electric vehicles).

Second, since the second half of the year...

On November 23, BYD Auto announced on Weibo that the official guide prices for new energy models related to Dynasty, Ocean, and Tension will be adjusted. The increase will range from 2,000 yuan to 16,000 yuan. Price adjustment notices for specific models will be posted separately. However, customers who paid a deposit before January 1, 2023 will not be affected by this price adjustment.

After the news was released, there was constant buzz in the market, and it even hit the headlines for a while.

You need to know that since late October, under the leadership of $TSLA.US (TSLA.US) $, $Cyrus (601127.SH) $, $Zero Sports Car (09863.HK) $, Xiaopeng (09868.HK), and Ford MustungMach-e have all participated in promotions through terminal discounts or official price reductions to boost sales.

Today, BYD is going the other way around. The price of new energy vehicles is rising instead of falling. What is the reason behind this?

01. What is the driving force behind BYD's price increase?

According to the announcement, there are two reasons why BYD announced price increases for some new energy vehicles.

First, it is affected by the imminent withdrawal of state subsidies. According to the country's series of policies and plans for the development of new energy vehicles, the NEV purchase subsidy policy will end on December 31, 2022, and the countries that license vehicles after that will no longer be subsidized (current subsidy amounts: 4,800 yuan/unit for plug-in hybrids, 12,600 yuan/unit for pure electric vehicles).

Second, since the second half of the year...

Translated

+1

不如归去

voted

Hey mooers,

Welcome back to Mooers' insights, where we share knowledge and thoughts.

Last week, we discussed "Why did you start investing?" in Weekly Buzz. Let's see what mooers talk about!

The longer I invest before I retire, the more time my money has to grow.

@KT88

I started investing with the intention of not only generating a second source of revenue but may also assist me in curating inflation-beating returns. Aside from that, making regular ...

Welcome back to Mooers' insights, where we share knowledge and thoughts.

Last week, we discussed "Why did you start investing?" in Weekly Buzz. Let's see what mooers talk about!

The longer I invest before I retire, the more time my money has to grow.

@KT88

I started investing with the intention of not only generating a second source of revenue but may also assist me in curating inflation-beating returns. Aside from that, making regular ...

+1

25

5

不如归去

voted

Twitter pre-musk:

What do you think of Twitter in the current situation?

$Tesla(TSLA.US$ $Twitter (Delisted)(TWTR.US$ $NIO Inc(NIO.US$ $XPeng(XPEV.US$

What do you think of Twitter in the current situation?

$Tesla(TSLA.US$ $Twitter (Delisted)(TWTR.US$ $NIO Inc(NIO.US$ $XPeng(XPEV.US$

不如归去

voted

iPhone 14 Pro availability continues to wane as the holiday shopping season enters full swing. Now, Apple partner Best Buy is warning that it is seeing strong demand for the flagship iPhone 14 Pro and iPhone 14 Pro Max devices, and it doesn’t have the supply to be able to keep up with that demand.

As reported by Reuters, Best Buy CEO Corie Barry acknowledged this demand pressure in a call with the media this week. One of...

As reported by Reuters, Best Buy CEO Corie Barry acknowledged this demand pressure in a call with the media this week. One of...

1

2

$Hang Seng Index(800000.HK$

$Hang Seng Index (800000.HK) $ Hang Seng Index had a straight angle fake yesterday that had not been seen for a long time: $Hang Seng Index Futures (2211) (HSImain.HK) $ Hang Seng Index futures experienced three rapid bull and bear transitions in a single day. After the failure to break through the key support level to 19750, it immediately plummeted to 17350, but then rebounded from this position. This rebound is likely to create a short-term Xiong Jun trap, because there is a possibility of a short-term backlash. An obvious range-bound trend has begun: 17720-17450. As long as there is any real breakthrough within the next two days, it is very careful that a new one-sided period will occur until the futures index settlement is completed

$Hang Seng Index (800000.HK) $ Hang Seng Index had a straight angle fake yesterday that had not been seen for a long time: $Hang Seng Index Futures (2211) (HSImain.HK) $ Hang Seng Index futures experienced three rapid bull and bear transitions in a single day. After the failure to break through the key support level to 19750, it immediately plummeted to 17350, but then rebounded from this position. This rebound is likely to create a short-term Xiong Jun trap, because there is a possibility of a short-term backlash. An obvious range-bound trend has begun: 17720-17450. As long as there is any real breakthrough within the next two days, it is very careful that a new one-sided period will occur until the futures index settlement is completed

Translated

不如归去

liked

I started trading a few months ago and was so excited to make money day trading but to my disappointment I would mostly loose until the $1,000 I started with disappeared , so I decided to trade only one stock and buy the dip , Im now getting confidence and making profit , MOO MOO app has definitely help me grow into a better invester.

Thankyou

Thankyou

9

3

不如归去

commented on

$MEITUAN-W(03690.HK$ The Hang Seng Index is rising more and more. Is there any possibility that a bull market is coming and that it will rise infinitely? 10W points will be the end point [laugh and cry]. There has always been no shortage of market drummers. The Hang Seng Index rebounded by nearly 4,000 points this month. I have never seen such a big rebound in a single month. In 2007, it rebounded 10,000 points in February. Although the world's major financial markets have performed the worst, it is normal for them to fall deep and fall to death; they are already far behind. As for reversing the bull market, there has been no improvement in fundamentals; the year was more decent with the news. Tencent's performance should not be impressive, and stock positions will not stop being replenished. There are reservations about the further increase in the Hang Seng Index, and the reaction to derivatives is different. It is rare for the Hang Seng Index Bull and Bear Index ratio (number of shares) to lose 0.4% (24) bears 99.6% (6,791). Yesterday, the Hang Seng Index cyclical subscription of 18200call had quite a few intraday transactions. Today, they all settled on the same day without spending the night. Using yesterday's market, it's impossible to sell orders. Bull and bear securities have now peaked, and Hang Seng Index options are only intraday institutional operations. The price of premium options is higher in the middle of the month than at the beginning of the month, and is no longer attractive. Most of the cycle options are fresh, and unclosed contracts are visible. Today, Wednesday, the option premium will return to Monday's price, and the settlement date is two more days away. The Hang Seng Index rose, the panic index rose, and the rise was uneasy. derivatives and spot goods were on the same page. It wasn't easy to double buy the Hang Seng Index this week; on Monday and Tuesday, only the latter made a profit. There must be a reason why options trading is weak. It's hard for mature traders to win. Beginners and conservatives don't look bad; they don't lose when they earn less. At this point, they both buy value...

Translated

1

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)