frankinglily

commented on

Hello everyone,

I'm Cow Moo-ney, an investor in my 30s who started with bonds in 2019 and stocks in 2021. I consider myself a risk-averse, slightly technical, and informed investor. My approach focuses on fundamental analysis, basic technical analysis, and staying updated on company news and macro environments.

Last year, I earned about $11K USD (approximately 15K SGD) using the options wheel strategy, on top of my stocks’ capital gains. ...

I'm Cow Moo-ney, an investor in my 30s who started with bonds in 2019 and stocks in 2021. I consider myself a risk-averse, slightly technical, and informed investor. My approach focuses on fundamental analysis, basic technical analysis, and staying updated on company news and macro environments.

Last year, I earned about $11K USD (approximately 15K SGD) using the options wheel strategy, on top of my stocks’ capital gains. ...

175

74

17

I came across this fantastic Moomoo ad at the subway station today! 🚇 It's all about embracing your trading journey and grabbing every chance that comes your way. Has anyone else spotted this gem in their daily commute? It's so refreshing to see such vibrant and motivating messages in public spaces! 🐄💪

6

frankinglily

commented on

frankinglily

commented on

Hello everyone,

I'm doctorpot1. My story is one of going from rags to riches![]() I grew up in a low-income family where money was always tight, and every dollar had to be stretched

I grew up in a low-income family where money was always tight, and every dollar had to be stretched ![]() Through hard work, determination and a lot of luck, I improved my financial situation

Through hard work, determination and a lot of luck, I improved my financial situation ![]() .

.

I realized early on that simply earning a paycheck wasn’t enough. I needed more streams of income. That’s when I started learning more about investi...

I'm doctorpot1. My story is one of going from rags to riches

I realized early on that simply earning a paycheck wasn’t enough. I needed more streams of income. That’s when I started learning more about investi...

172

111

39

Fantastic experience - I met moomoo in NYC!

It looks cool.

Bullish! To the moon!![]()

![]()

![]()

![]()

![]()

![]()

It looks cool.

Bullish! To the moon!

5

1

Upside:

$Apple (AAPL.US)$ break over 235.7, 240c Dec 20--to target: $237

$Costco (COST.US)$ Break over 975, 1000c Dec 6--to target: $980

$Upstart (UPST.US)$ break over 80.77, 85c Dec 20--to target: $83

$DraftKings (DKNG.US)$ break over 43.48, 45c Dec 20--to target: $44.5

Downside:

$NVIDIA (NVDA.US)$ Break under 135.5, 132p Dec 6--to target: $134

$Apple (AAPL.US)$ break over 235.7, 240c Dec 20--to target: $237

$Costco (COST.US)$ Break over 975, 1000c Dec 6--to target: $980

$Upstart (UPST.US)$ break over 80.77, 85c Dec 20--to target: $83

$DraftKings (DKNG.US)$ break over 43.48, 45c Dec 20--to target: $44.5

Downside:

$NVIDIA (NVDA.US)$ Break under 135.5, 132p Dec 6--to target: $134

7

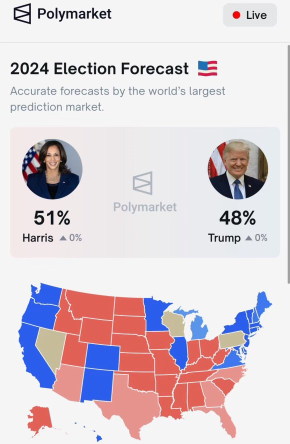

Prediction markets now show Kamala Harris with a 3 percentage point lead on Donald Trump, according to Polymarket's prediction app.

All signs point to an incredibly close race with the election now 5 weeks out.

$Trump Media & Technology (DJT.US)$ $Kamala Harris (LIST22990.US)$ $Donald Trump (LIST22962.US)$

All signs point to an incredibly close race with the election now 5 weeks out.

$Trump Media & Technology (DJT.US)$ $Kamala Harris (LIST22990.US)$ $Donald Trump (LIST22962.US)$

2

7

frankinglily

liked

$UBS Group (UBS.US)$

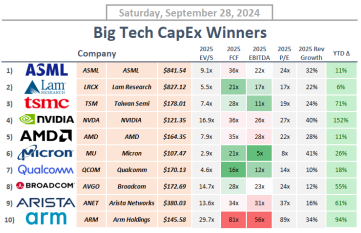

Here are 10 companies positioned to benefit from this anticipated rise in investment 🧐

1. $ASML Holding (ASML.US)$ is the exclusive provider of EUV lithography technology, which is critical for fabricating chips below the 7 nm process node. This technology enables the creation of smaller, more energy-efficient chip...

Here are 10 companies positioned to benefit from this anticipated rise in investment 🧐

1. $ASML Holding (ASML.US)$ is the exclusive provider of EUV lithography technology, which is critical for fabricating chips below the 7 nm process node. This technology enables the creation of smaller, more energy-efficient chip...

26

3

frankinglily

liked

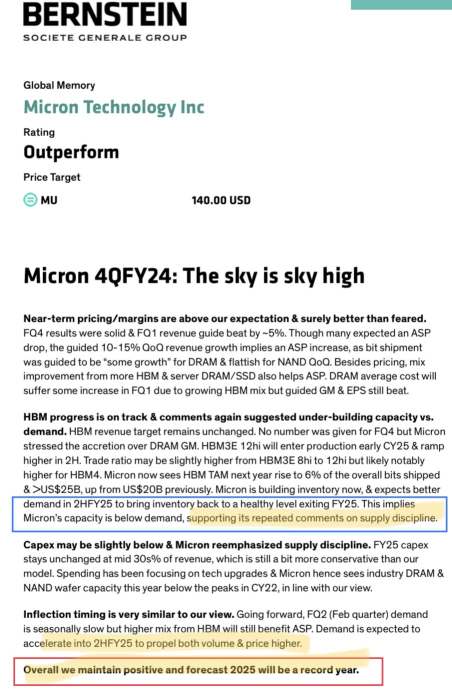

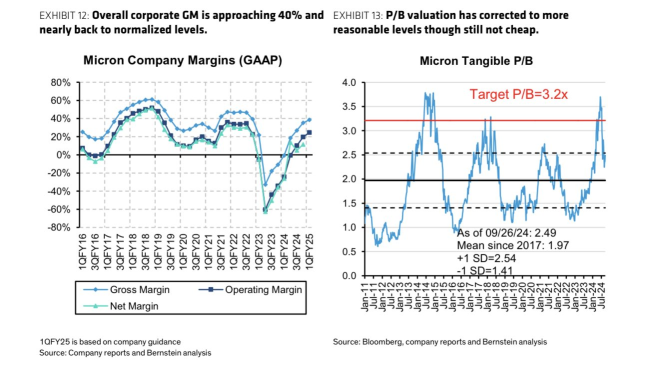

While I personally prefer buying $Micron Technology (MU.US)$ near book value (where it was merely a year ago), there are worse things than an oligopolistic growth cyclical delivering to an end-market in a boom phase

3

1

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)

frankinglily : The Options Wheel Strategy relies heavily on time decay for profit. However, during NVIDIA's earnings, fundamental factors like earnings reports and guidance can significantly impact stock price. How can I integrate fundamental analysis and perhaps even technical indicators into my strategy to create a more balanced approach, especially when facing potential earnings-related volatility?