Upside:

$Apple (AAPL.US)$ break over 235.7, 240c Dec 20--to target: $237

$Costco (COST.US)$ Break over 975, 1000c Dec 6--to target: $980

$Upstart (UPST.US)$ break over 80.77, 85c Dec 20--to target: $83

$DraftKings (DKNG.US)$ break over 43.48, 45c Dec 20--to target: $44.5

Downside:

$NVIDIA (NVDA.US)$ Break under 135.5, 132p Dec 6--to target: $134

$Apple (AAPL.US)$ break over 235.7, 240c Dec 20--to target: $237

$Costco (COST.US)$ Break over 975, 1000c Dec 6--to target: $980

$Upstart (UPST.US)$ break over 80.77, 85c Dec 20--to target: $83

$DraftKings (DKNG.US)$ break over 43.48, 45c Dec 20--to target: $44.5

Downside:

$NVIDIA (NVDA.US)$ Break under 135.5, 132p Dec 6--to target: $134

7

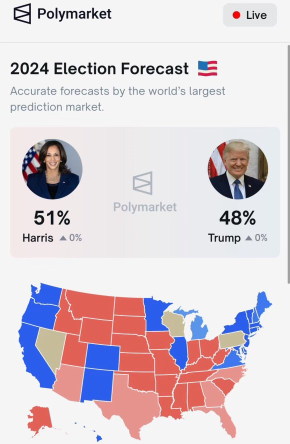

Prediction markets now show Kamala Harris with a 3 percentage point lead on Donald Trump, according to Polymarket's prediction app.

All signs point to an incredibly close race with the election now 5 weeks out.

$Trump Media & Technology (DJT.US)$ $Kamala Harris (LIST22990.US)$ $Donald Trump (LIST22962.US)$

All signs point to an incredibly close race with the election now 5 weeks out.

$Trump Media & Technology (DJT.US)$ $Kamala Harris (LIST22990.US)$ $Donald Trump (LIST22962.US)$

2

7

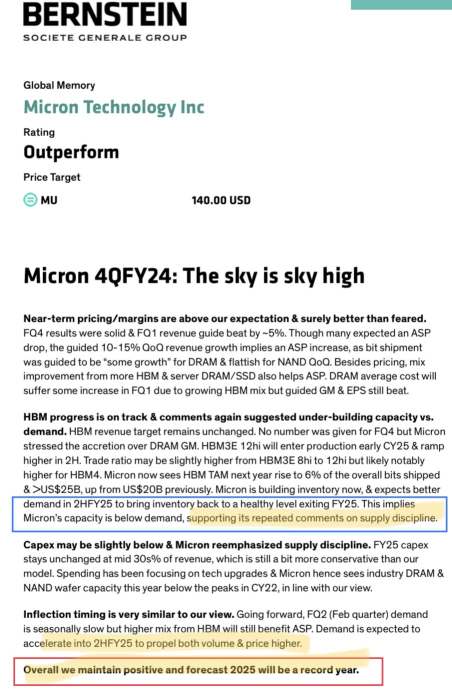

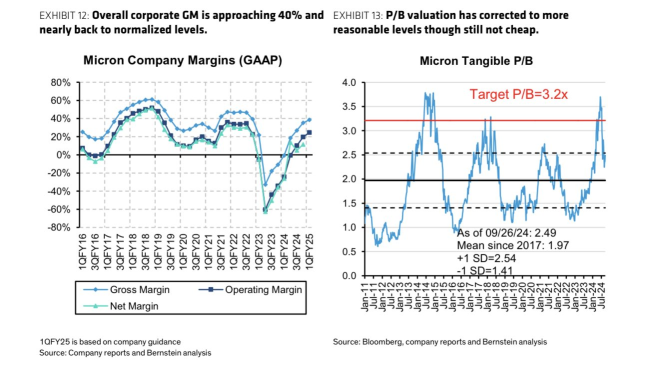

While I personally prefer buying $Micron Technology (MU.US)$ near book value (where it was merely a year ago), there are worse things than an oligopolistic growth cyclical delivering to an end-market in a boom phase

3

1

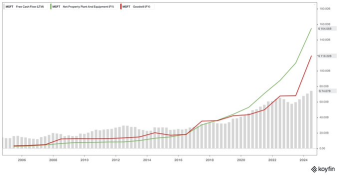

The chart below displays some (but not all) of the key components used in calculating return on capital including the free cash flow (grey bars), property plant & equipment (green line) and goodwill (red line).

We are focusing only on these three because I would like to highlight a key question: will all of the recent capital investment pay off?

During the early 2000s, FCF regularly exceeded PPE an...

We are focusing only on these three because I would like to highlight a key question: will all of the recent capital investment pay off?

During the early 2000s, FCF regularly exceeded PPE an...

12

Charlie Kawwas head of $Broadcom (AVGO.US)$ semis business was even more explicit and detailed on this today at GS, segmenting the AI accelerator mkt into three parts:

- Internet scale customers ( $Meta Platforms (META.US)$ $Alphabet-C (GOOG.US)$ Bytedance Tencent): significant logic and value for these companies spending $10s of Bns all on internal infra to customize ASICs for own environments. AVGO can bring new XPUs to mkt in a year. Sees most of this mkt going to custom silicon in 5yrs.

- Hyperscale...

- Internet scale customers ( $Meta Platforms (META.US)$ $Alphabet-C (GOOG.US)$ Bytedance Tencent): significant logic and value for these companies spending $10s of Bns all on internal infra to customize ASICs for own environments. AVGO can bring new XPUs to mkt in a year. Sees most of this mkt going to custom silicon in 5yrs.

- Hyperscale...

3

3

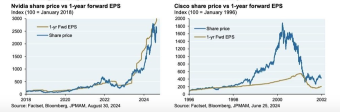

$NVIDIA (NVDA.US)$ REPORTS ON WEDNESDAY

ARE WE BULLISH OR BULLISH

....or bearish

I think they beat the $28B guide and raise. The big question here is on the raise because of the Blackwell delay but given $Super Micro Computer (SMCI.US)$ guidance and $Taiwan Semiconductor (TSM.US)$ monthly metrics, I don't think that will have the largest impact for Q3.

All eyes on Jensen.

ARE WE BULLISH OR BULLISH

....or bearish

I think they beat the $28B guide and raise. The big question here is on the raise because of the Blackwell delay but given $Super Micro Computer (SMCI.US)$ guidance and $Taiwan Semiconductor (TSM.US)$ monthly metrics, I don't think that will have the largest impact for Q3.

All eyes on Jensen.

5

1

Argument:

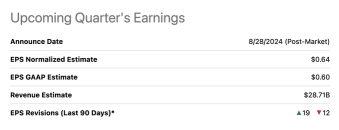

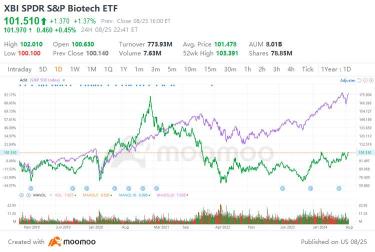

The upcoming interest rate cuts are poised to benefit the biotech stock industry, setting the stage for strong performance in the coming quarters.

Reasons:

Cheaper Funding: Lower interest rates make it easier for biotech companies to access capital for research and development, accelerating their progress and growth potential.

Attractive Valuations: Biotech stocks are currently trading at attractive levels, offering investors an opportunity to capitalize on the sector's long-term pot...

The upcoming interest rate cuts are poised to benefit the biotech stock industry, setting the stage for strong performance in the coming quarters.

Reasons:

Cheaper Funding: Lower interest rates make it easier for biotech companies to access capital for research and development, accelerating their progress and growth potential.

Attractive Valuations: Biotech stocks are currently trading at attractive levels, offering investors an opportunity to capitalize on the sector's long-term pot...

5

1

1

$NVIDIA (NVDA.US)$ reclaimed the 10-week/50-day lines on a strong rebound. It gained 18.93% for the week and closed near the highs of the week after the prior week's undercut and rally off the prior base. It may be forming the right side of a new base (36% deep, 140.76 std pivot, 136.15 early pivot). See if it can follow-through next week and clear the descending trend line of its base. EPS on 8/28, AMC.

6

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)