ASML Holding (ASML) Implied Move Suggest Upside Post Earnings

$阿斯麥 (ASML.US)$ is expected to release earnings on 24 Jan before the market opens (BMO). ASML is Europe’s largest tech company which machines used to manufacture microchips.

Investors will be looking out for information by ASML which should offer some vital signal on the worldwide semiconductor industry, which are using ASML machines and systems.

One more item that will be on investors list is what is the impact caused by U.S. led efforts to block China from becoming a chip-making superpower on ASML result. These efforts have seen restrictions placed on the Dutch company’s abilities to export its machines.

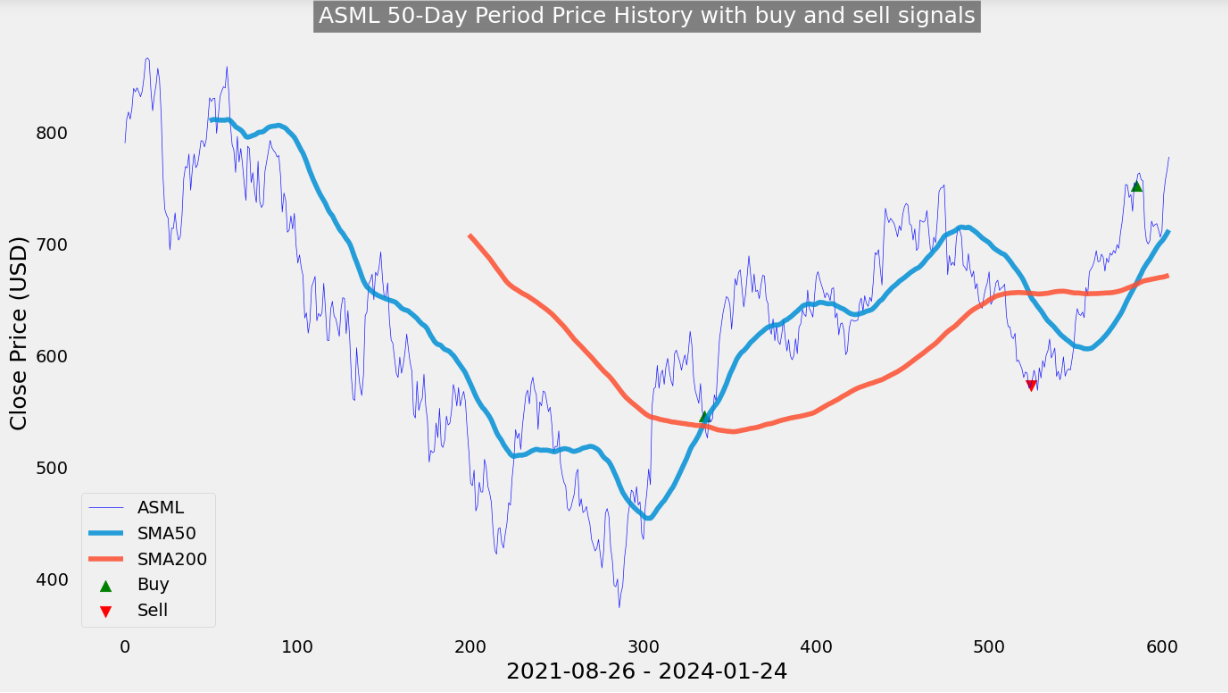

From the technical, we are seeing a very good Uptrend for ASML trading so far, but will it continue this upside? I will be looking out for ASML guidance announcement as well.

ASML Holding (ASML) Upcoming Earnings Guidance

ASML has issued earnings guidance for Q4 2023. Revenue estimate in the range of 7.08 B to 7.5 B, which would be a11% increase from the same period last year.Gross Margin estimate in the range of 50.0% to 51.0%.

ASML Holding (ASML) Last Earning Report

ASML last reported earnings on 18 Oct 23 before the market opened (BMO). ASML shares declined -4.2% the day following the earnings announcement to close at 580.71. Following its earnings release, 97 days ago, ASML stock has drifted +34.0% higher.

From the time it announced earnings, ASML traded in a range between 571.36 and 778.67. The last price (778.39) is closer to the higher end of range.

Estimated implied straddle for Q4 earnings is 4.5%. If we look at how ASML price effect have been related to Implied Straddle, we could be seeing a negative price effect.

This might be the case if the sales of machines to semiconductor industry have been impacted greatly by the U.S. restriction.

ASML Holding (ASML) Post Earnings Announcement Drift

ASML share price has drifted up 34.0% post earnings announcement. Using the last 12 quarters data, the average drift between earnings announcements is 5.8%. The current drift represents a positive 1.4 standard deviation move.

Current post earnings announcement drift: 34.0%

Historical average post earnings announcement drift: 5.8%

Historical post earnings drift standard deviation move: ±25.2%

ASML Holding (ASML) Post Earnings Movement

The options market overestimated ASML stocks earnings move 58% of the time in the last 12 quarters. The predicted move after earnings announcement was ±4.4% on average vs an average of the actual earnings moves of 3.7% (in absolute terms).

ASML Holding (ASML) Earnings Implied Volatility Crush

ASML's last earnings implied volatility (IV30) going into earnings was 33.3. The last time ASML released earnings, the implied volatility dropped to 32.2, resulting in an implied vol crush of 4%. 5 days after earnings, the 30 day IV was 34.8.

Average Implied Volatility Crush For ASML Earnings: 9%

Average 30 Day Implied Volatility 1 Day Before Earnings: 36.9

Average ASML 30 Day IV for the Day of Earnings: 34.2

Average 30 Day Implied Volatility 5 Days After Earnings: 36.3

ASML Holding (ASML) Implied Move

We could see a positive price movement if the implied move continue like the past 2 trading days. The possibility of less sales of machines might be minimal, as we can see that the order for chips have been increasing.

There might be new order of these machines as AMD and Nvidia are going to embark on their new chip development as announced.

Summary

If ASML post a positive result and its share price went up, this could help the other semiconductor shares to benefit from it as well.

Appreciate if you could share your thoughts in the comment section whether you think ASML would recover from the sales of the machines to chip maker and we can expect an upside from ASML.

Disclaimer: The analysis and result presented does not recommend or suggest any investing in the said stock. This is purely for Analysis.

免責聲明:社區由Moomoo Technologies Inc.提供,僅用於教育目的。

更多信息

評論

登錄發表評論