美股期權個股詳情

CRH241129C91000

- 0.00

- 0.000.00%

延時15分鐘行情收盤價 11/26 09:30 (美東)

0.00最高價0.00最低價

0.00今開0.00昨收0張成交量0張未平倉合約數91.00行權價0.00成交額96.75%引伸波幅-11.54%溢價2024/11/29到期日11.87内在价值100合約乘數2天距到期日0.00時間價值100合約規模美式期權類型0.9435Delta0.0139Gamma8.50槓桿倍數-0.1639Theta0.0057Rho8.02有效槓桿0.0096Vega

CRH水泥股票討論

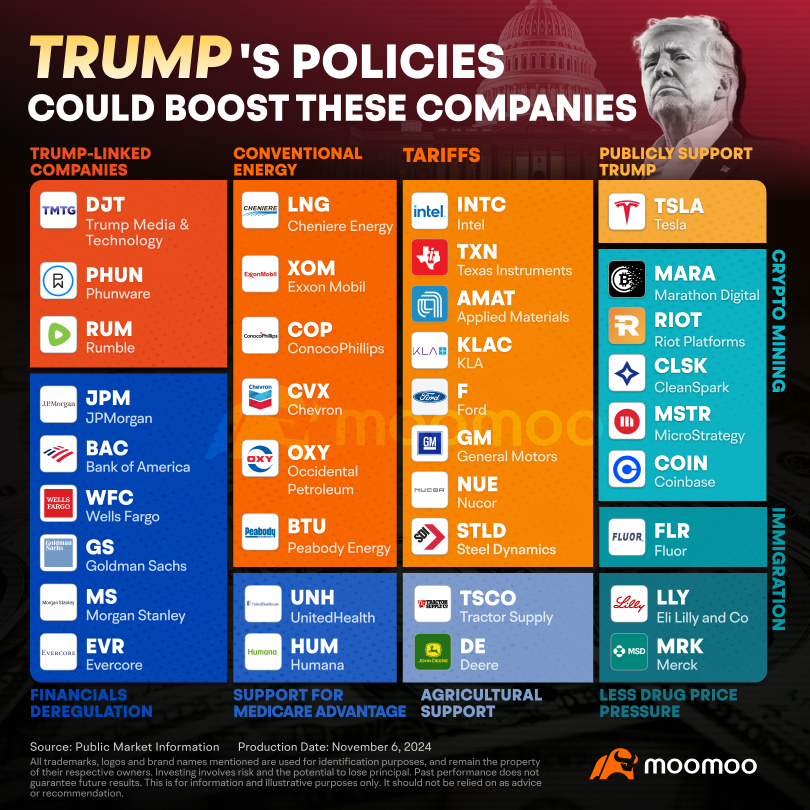

Donald Trump wins US presidency, igniting a "Trump Trade" surge in financial markets. $特朗普媒體科技集團 (DJT.US)$ was the most volatile, skyrocketing over 35% in pre-market trading on Wednesday. $特斯拉 (TSLA.US)$ shares climbed more than 15%, while $比特幣 (BTC.CC)$ briefly surpassed $75,000, reaching a record high.

Among major assets, the U.S. Dollar Index climbed as much as 1.6%, reaching its highest level in a year. U.S. Trea...

Among major assets, the U.S. Dollar Index climbed as much as 1.6%, reaching its highest level in a year. U.S. Trea...

105

12

Stocks to Watch

Oracle Corporation (ORCL US) $甲骨文 (ORCL.US)$

Daily Chart -[BULLISH ↗ **]ORCL US gapped higher and is consolidating sideways above 163.70 support. As long as price is holding above this support level, a further push higher towards 182.70 resistance then 205.70 resistance next, is expected. Technical indicators are advocating for a bullish scenario as well.

Alternatively: A daily candlest...

Oracle Corporation (ORCL US) $甲骨文 (ORCL.US)$

Daily Chart -[BULLISH ↗ **]ORCL US gapped higher and is consolidating sideways above 163.70 support. As long as price is holding above this support level, a further push higher towards 182.70 resistance then 205.70 resistance next, is expected. Technical indicators are advocating for a bullish scenario as well.

Alternatively: A daily candlest...

+3

15

2

$CRH水泥 (CRH.US)$World's fastest brick-laying construction robot lands on American shores

G'day, mooers! Check out the latest news on today's stock market!

• US major indexs fell

• ASX 200 rises by broad buying; ANZ sells stake in Malaysian bank

• Stocks to watch: Telix Pharmaceuticals, Adbri, Pro Medicus

Wall Street Summary

Indexs fell Thursday after harsh earnings reactions. Overall, there was more green than red out there, but by the numbers after the close, the $標普500指數 (.SPX.US)$ traded -0.60%,...

• US major indexs fell

• ASX 200 rises by broad buying; ANZ sells stake in Malaysian bank

• Stocks to watch: Telix Pharmaceuticals, Adbri, Pro Medicus

Wall Street Summary

Indexs fell Thursday after harsh earnings reactions. Overall, there was more green than red out there, but by the numbers after the close, the $標普500指數 (.SPX.US)$ traded -0.60%,...

3

CRH's dividend is seen as sustainable, backed by profit and cash flow. Its growing earnings and low payout ratios hint at a promising long-term dividend stock. The firm's consistent dividend and earnings growth show a commitment to rewarding shareholders.

1

Despite lower than expected Q4 numbers, investors are not worried due to the company's positive outlook for 2024, driven by significant infrastructure investment and re-industrialization activity across key markets in North America and Europe.

The strong EPS growth and insider buying at CRH indicate a positive outlook for the company. The growth rate and insider activity suggest that the company could be a good investment opportunity.

1

The market's view of CRH has improved over the last five years, likely due to consistent earnings growth. Recent insider buying and strong share price momentum suggest potential investment opportunities.

CRH's dividend is sustainable unless earnings drop sharply, as it's backed by profit and cash flow. A low payout ratio and quick earnings per share growth hint a focus on reinvestment. Over the past decade, dividends increased by around 5.2% annually, less than earnings per share growth. CRH's business growth prospects suggest enticing future dividends.

CRH plc is seen as undervalued, with its positive outlook and expected earnings growth hinting at a good time for shareholders to accumulate more holdings. The current share price may not fully mirror the promising future, presenting a potential buying opportunity for investors.

暫無評論

104476495 : h

Tiggerpepper : 恭喜

特朗普總統 2024-2028

特朗普總統 2024-2028

witty Pumpkin_2691 : 如預期,市場蓬勃發展。這讓人想起2016年至2020年的情形。

103827296 : 你寫我不不我問題,你問題你不聯絡我,你非常非常受歡迎。

104088143 : 怎樣呢

查看更多評論...