美股期權個股詳情

GPRE241220P28000

- 10.80

- 0.000.00%

延時15分鐘行情收盤價 11/26 16:00 (美東)

0.00最高價0.00最低價

10.80今開10.80昨收0張成交量0張未平倉合約數28.00行權價0.00成交額280.20%引伸波幅-61.20%溢價2024/12/20到期日17.33内在价值100合約乘數23天距到期日0.00時間價值100合約規模美式期權類型-0.8425Delta0.0326Gamma0.60槓桿倍數-0.0362Theta-0.0119Rho-0.51有效槓桿0.0065Vega

綠色平原能源股票討論

News Highlights

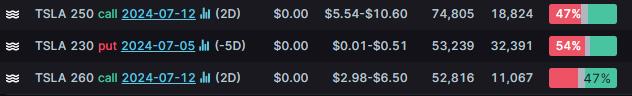

$特斯拉 (TSLA.US)$ ended 3.71% higher. Its options trading volume was 3.33 million. Call contracts account for 63.9% of the total trading volume. The $250 calls expiring July 12 were traded most actively.

Tesla's stock surged 3.7% on Tuesday, achieving its longest winning streak in over a year and closing at its highest level since October. The stock has risen for 10 consecutive sessions...

$特斯拉 (TSLA.US)$ ended 3.71% higher. Its options trading volume was 3.33 million. Call contracts account for 63.9% of the total trading volume. The $250 calls expiring July 12 were traded most actively.

Tesla's stock surged 3.7% on Tuesday, achieving its longest winning streak in over a year and closing at its highest level since October. The stock has risen for 10 consecutive sessions...

+3

40

3

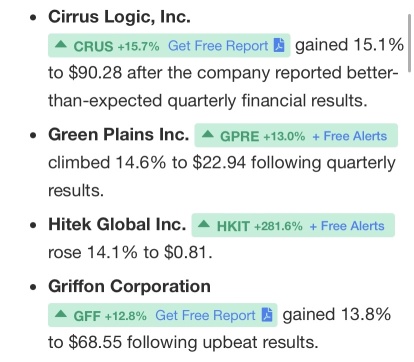

Analysts show less optimism post recent results, cutting revenue forecasts and significantly reducing earnings per share numbers. Despite this, price targets remain unchanged, indicating downgrades may not impact Green Plains' long-term valuation. However, the wide price target range from US$24.00 to US$55.00 per share suggests varied business scenarios.

Despite Green Plains' promising revenue outlook, its low P/S ratio indicates investor skepticism about its future growth. Major risk factors may be causing this, with investors expecting significant revenue volatility.

Green Plains is assessed as risky due to its debt, negative EBIT, and US$58m cash burn in the last year. Future profitability will decide if it can improve its balance sheet.

Despite a recent sell-off, long-term investors could potentially find an opportunity in Green Plains, owing to its trend towards profitability and a 10% annual gain over five years. The company's recent revenue growth could justify the gain in its share price.

$綠色平原能源 (GPRE.US)$

今天是 10-11-22 大家上升,你切下跌📉

今天是 10-11-22 大家上升,你切下跌📉

1

Gainers:

• $Nuvve (NVVE.US)$ +12.4% (selected as collaboration partner with Dept of Energy to accelerate V2G technology)

• $美國航空 (AAL.US)$ +10.9% (earnings results beat expectations)

• $聯合大陸航空 (UAL.US)$ +7.9% (earnings report)

• $特斯拉 (TSLA.US)$ +7.3% (Tesla posts record profit, Q1 sales jump 81% despite supply-chain disruptions)

• $遠藤製藥 (ENDP.US)$ +3.9% (court orders recusal of trial court judge and va...

• $Nuvve (NVVE.US)$ +12.4% (selected as collaboration partner with Dept of Energy to accelerate V2G technology)

• $美國航空 (AAL.US)$ +10.9% (earnings results beat expectations)

• $聯合大陸航空 (UAL.US)$ +7.9% (earnings report)

• $特斯拉 (TSLA.US)$ +7.3% (Tesla posts record profit, Q1 sales jump 81% despite supply-chain disruptions)

• $遠藤製藥 (ENDP.US)$ +3.9% (court orders recusal of trial court judge and va...

21

2

暫無評論

104327919 : 公平

Gina LaGarce : 阿們!

102357699 :